BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:How is the TMGM platform? This in-depth review examines its ASIC regulation, DMA execution, MT5 account structure, deposit and withdrawal efficiency, and user reputation, helping you comprehensively assess its legitimacy and security.

Full brand name : Trademax Global Markets Pty Ltd

Official website : https://www.tmgm.com

Founded in 2013 and headquartered in Sydney, Australia, TMGM (Trademax Global Markets) specializes in providing institutional-grade liquidity and execution to clients worldwide. The platform accesses Tier 1 liquidity providers via Direct Market Access (DMA) and is one of the few multi-platform brokers in the Asia-Pacific region to support both MT4, MT5, and IRESS DMA systems.

Compared with traditional market maker platforms, TMGM emphasizes transaction transparency and deep market access , and is suitable for professional traders who pursue real quotes and ultra-low slippage environment.

| Account Type | Minimum deposit | EUR/USD Spread | commission | Platform support | Applicable trader types |

|---|---|---|---|---|---|

| Classic | $100 | 1.0 pip and up | none | MT4 / MT5 | New or ordinary traders |

| Edge (Raw) | $100 | Starting from 0.0 pip | $3.5/hand/side | MT4 / MT5 | High Frequency/Scalping/EA Users |

| IRESS DMA | $5,000 | Real-time market spreads | Floating based on trading volume | IRESS | Professional investors/stock traders |

Leverage Description :

ASIC regulation: up to 1:30

VFSC regulation: up to 1:500

| Regulatory agencies | License plate number | Company Entity | state |

|---|---|---|---|

| ASIC (Australia) | 436416 | Trademax Australia Pty Ltd | efficient |

| VFSC (Vanuatu) | 40356 | Trademax Global Limited | efficient |

| FMA (New Zealand) | FSP569807 | TMGM NZ Limited (Registered Financial Services Provider) | efficient |

The platform deposits client funds in NAB Bank segregated accounts and provides additional protection through Australian PI insurance , with an annual compensation limit of A$25 million.

✅ DMA+MT5 mode hybrid structure : STP and DMA can be switched freely, and both use the same account system.

✅ The IRESS system is connected to the ASX, HKEX, and NYSE markets , making it suitable for users with heavy stock CFD positions.

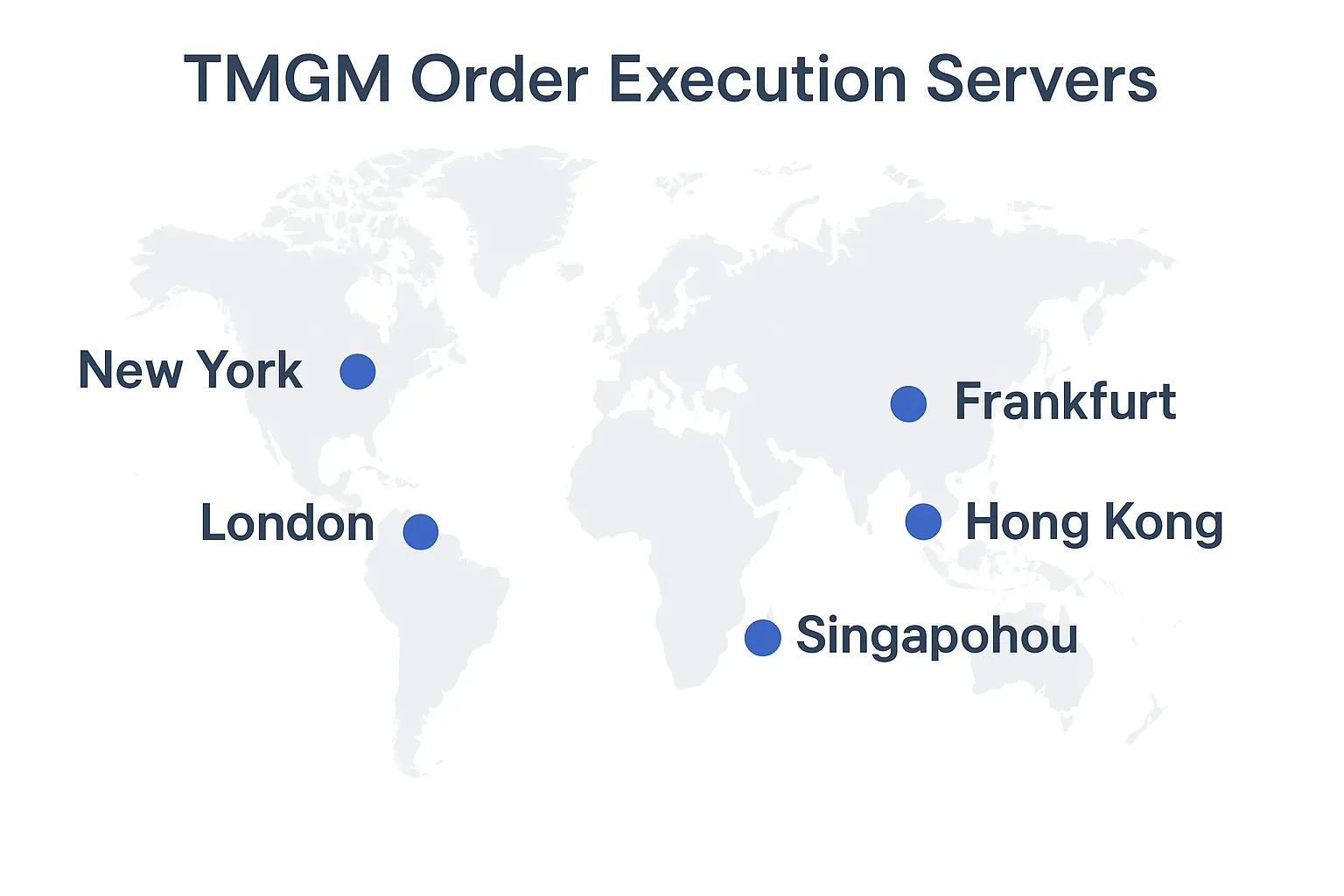

✅Trading servers are spread across 7 locations on 6 continents : Hong Kong, Tokyo, London, New York, etc., all directly connected to Equinix data centers.

✅ Trader Tools plug-in system : supports market depth chart (DOM), take-profit and stop-loss track analysis, and EA management panel.

✅Multilingual customer support : covering 20+ languages including Chinese, Vietnamese, Thai, Arabic, etc.

Foreign exchange currency pairs : 60+ mainstream/cross pairs (supports offshore RMB)

Crypto assets : Support 7 major currencies (BTC, ETH, XRP, LTC, DOGE, etc.)

Stock index : covering Australia 200, Hang Seng Index, Dow Jones, S&P 500, German DAX, etc.

Stock CFD : Provides real market share transactions through the IRESS system

Precious metals and crude oil : Gold, Silver, WTI, Brent with a micro-transaction threshold of 0.01 lots

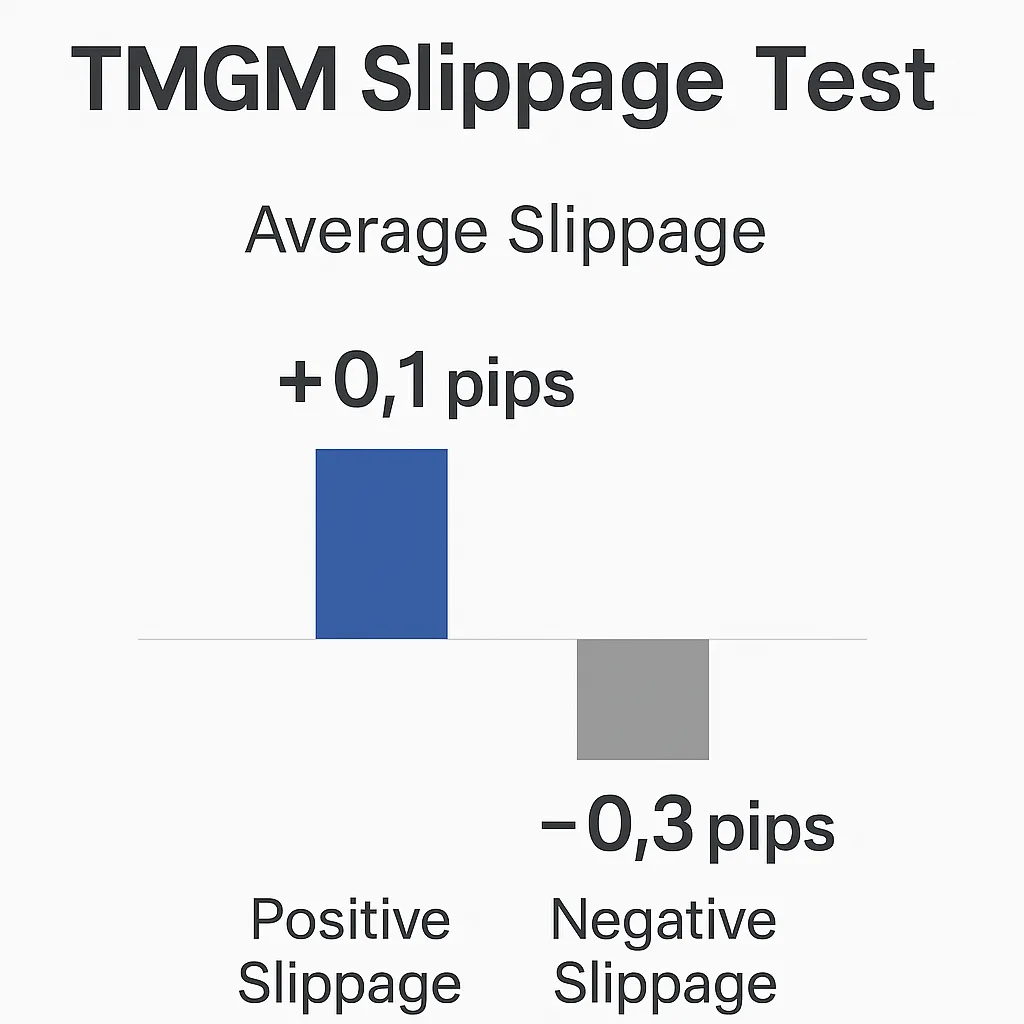

Execution speed : Measured average < 30ms, with excellent slippage control (especially during high volatility periods such as non-farm payrolls)

Supported methods : UnionPay, Visa, MasterCard, Skrill, Neteller, USDT (ERC20/TRC20)

Deposit : Most methods are immediate

Withdrawal : Processed within 24 hours (According to UnionPay, it arrives within 48 hours)

Fee policy : No handling fee for withdrawals, but management fees may be charged for excess withdrawals within a month

Emphasis on comprehensive supervision and good liquidity

Low user likes spread and fast customer service response

Many reviews believe that "TMGM DMA order execution is close to professional exchange level"

Mentioned its server deployment strategy "optimized for the Asian market"

Positive reviews focus on slippage control and real quotes

User feedback: "Customer service supports Chinese, and there is no threshold for deposits and withdrawals"

Although the IRESS account provides real DMA market information, the minimum deposit is relatively high and is only suitable for experienced CFD investors.

Leverage should be used prudently in conjunction with regulatory policies to avoid margin calls.

Cryptocurrency CFDs are highly volatile and should not be held overnight. They are suitable for high-frequency traders.

TMGM is an international brokerage firm that offers DMA execution, a flexible account system, and stable spreads, making it ideal for:

✅ Traders who value real market quotes and hate false slippage

✅ Professional players who are concerned about server latency and EA deployment effects

✅ Those who have stock CFD needs and hope to use the DMA system to achieve "real exchange matching"

✅ Users who pursue regulatory compliance and require high leverage flexibility (flexible switching between Australian and offshore regulations)

Company Name:tmgm

Website:

https://www.tmgm-invest.com/zh-hans-cn?campaign_code=traderknows24cn

6.10

Business Rating

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.