BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:How is eToro? This article will comprehensively evaluate eToro Group Ltd. from multiple perspectives, including regulatory compliance, live account trading experience, trading conditions, CopyTrading social features, deposit and withdrawal efficiency, and user reputation, revealing its true competitiveness as a leading global social trading platform.

Founded in 2007 and headquartered in Tel Aviv, Israel, eToro Group Ltd. is one of the world's first social trading (CopyTrading) platforms. As a fintech pioneer dedicated to socializing and digitizing investing, eToro has attracted over 30 million registered users worldwide.

✅ Founded: 2007 ✅ Listing Status: Planned IPO on Nasdaq, currently privately held ✅ User Coverage: Tens of millions of investors in over 140 countries ✅ Unique Features: CopyTrading, Smart Portfolios

✅ Official website: https://www.etoro.com

Frequently Asked Questions:

Is eToro safe? ✔ Regulated by multiple international regulators

Does eToro offer cryptocurrency trading? ✔ Provides complete cryptocurrency investment channels (including its own wallet, eToro Money)

Is it suitable for beginners? ✔ Yes, the social copy trading function makes it easier to get started

eToro adopts a single account model, allowing investors to trade multiple assets through one account, reducing the complexity of account switching.

Account Features:

Minimum deposit : $50 (starting from $10 in some areas)

Spread : The average spread for EUR/USD is about 1.0 pip

Commission structure : 0 commission on stock investments (applicable to some markets), CFD and cryptocurrency trading includes spread fees

Leverage : Up to 1:30 for European clients (subject to ESMA regulations), up to 1:400 for international clients

Features Highlights:

CopyTrading Copy the portfolios of successful traders

Smart Portfolios offer diversified thematic portfolios (e.g. technology, green energy, cryptocurrency baskets)

Provide zero-commission investment in stocks and ETFs

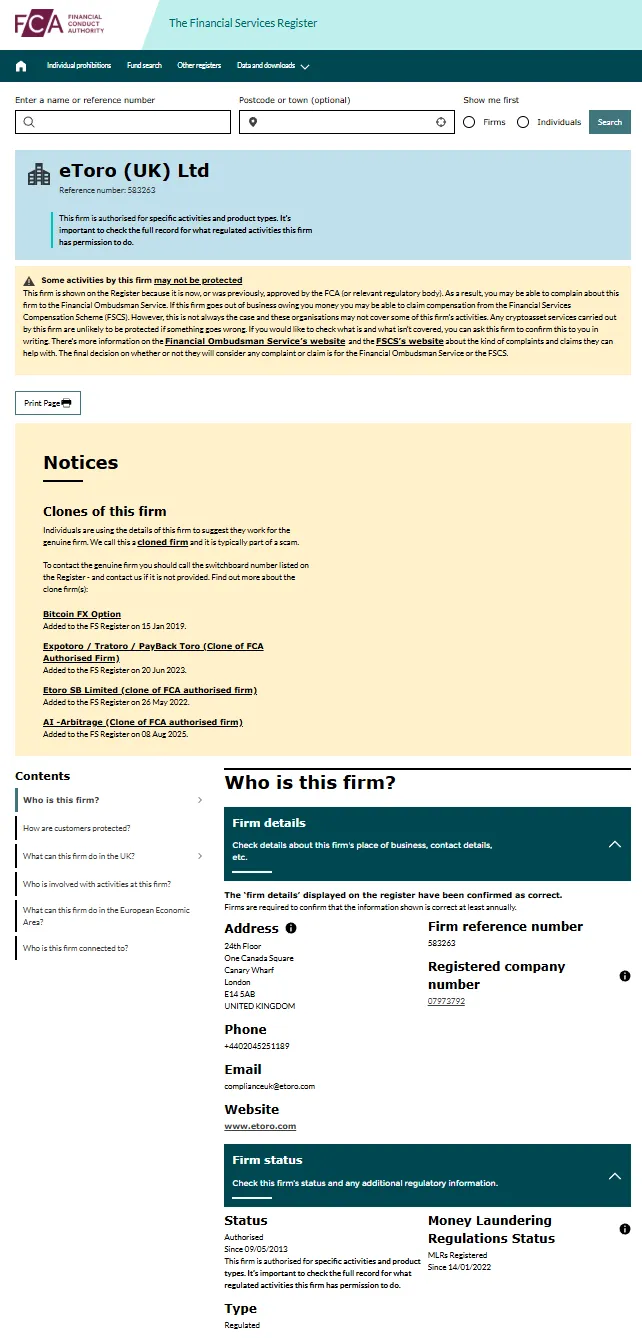

| Regulatory agencies | Registered Entity | License number |

|---|---|---|

| UK Financial Conduct Authority (FCA) | eToro (UK) Ltd | 583263 |

| Cyprus Securities and Exchange Commission (CySEC) | eToro (Europe) Ltd | 109/10 |

| Australian Securities and Investments Commission (ASIC) | eToro AUS Capital Ltd | 491139 |

| Financial Industry Regulatory Authority (FINRA) | eToro USA LLC | Registered |

Fund security:

Client funds are segregated and stored in top banks

Comply with EU MiFID II and UK FCA fund protection standards

Investor compensation scheme available (up to €20,000/£85,000, depending on jurisdiction)

eToro offers a wide range of financial products, covering both traditional and emerging assets:

Foreign Exchange (Forex) : 40+ major currency pairs

Equities : 3,000+ global stocks (US, European, and Hong Kong)

ETFs : Hundreds of global ETF products

Cryptocurrency : 80+ digital assets (BTC, ETH, SOL, DOGE, etc.)

Indices : S&P 500, Nasdaq 100, DAX, etc.

Commodities : gold, silver, crude oil, natural gas, etc.

Platform technology highlights:

Independently developed trading platform (eToro Platform) : supports web version and mobile terminal (iOS/Android)

CopyTrading : Users can copy top traders’ strategies with one click

Smart Portfolios : Long-term investment portfolio, automatic rebalancing management

Order execution speed : Industry average (approximately 0.4–0.6 seconds)

Stability : Cloud servers, multi-region accelerated access

eToro offers a variety of flexible and convenient deposit and withdrawal methods:

| Way | Deposit arrival time | Withdrawal Time |

|---|---|---|

| Credit/Debit Card | Instant payment | 1–2 business days |

| PayPal, Skrill, Neteller | Instant payment | 1–2 business days |

| Bank Wire Transfer | 3–5 business days | 3–7 business days |

| Cryptocurrency (eToro Money Wallet) | The funds will be credited after the block is confirmed | Processed within 24 hours |

Withdrawal fee: A flat $5 withdrawal fee is charged , and exchange rate conversion fees may also apply.

Customer support : 24/5 online ticketing and multi-language support (including Chinese)

Educational resources : eToro Academy offers trading basics courses, market analysis

Social features : users can share their views and follow popular investors on the platform

Demo Account : Provides $100,000 in demo funds, supporting unlimited practice

Trustpilot ⭐️ 4.3/5 (18,000+ reviews)

Common comments: The platform has a user-friendly interface and is suitable for beginners, but the withdrawal fees and spreads are relatively high.

WikiFX 7.95/10

Comment: The supervision is real, but the leverage restrictions are relatively strict.

BrokerChooser

Pros: Unique social trading, strong regulation, and a rich product line. Cons: Doesn't support MT4/MT5, and has a slightly higher withdrawal fee.

Test Account: Standard Account Deposit Method: PayPal $500

Trading experience:

EUR/USD spread: approximately 1.1–1.3 pips

Stock trading: zero commission, transaction price is consistent with market price

Withdrawal: within 48 hours (PayPal)

Platform experience: CopyTrading is easy to operate and has an intuitive interface, but advanced technical indicators are limited

| Dimensions | Rating (10 points) |

|---|---|

| Regulatory compliance | 9.5 |

| Trading Conditions | 8.6 |

| Technical Performance | 8.8 |

| Deposit and Withdrawal Experience | 8.2 |

| Customer Service | 8.0 |

| User reputation | 8.4 |

| Media reviews | 8.6 |

| Real-person test | 8.7 |

Conclusion: Who should use eToro?

As the world's leading social investing platform, eToro is ideal for:

New investors who want to quickly get started with copy trading

Investors who enjoy social interaction and following investment strategies

Diversified investors who want to allocate assets across stocks, ETFs, and cryptocurrencies

Users who prefer a simple platform over complex technical analysis tools

If you value regulatory compliance, global investment channels and a unique social trading model, eToro is an investment platform worth considering .

Company Name:eToro Group Ltd.

Website:

https://www.etoro.com

7.66

Business Rating

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.