Capital.com In-Depth Review | How is Capital.com? A comprehensive analysis of its regulatory licenses, AI trading tools, trading conditions, and user reputation.

Summary:An in-depth review of Capital.com: Capital.com (UK) Limited is regulated by multiple regulators, including the FCA and CySEC, and offers a proprietary AI-powered trading platform and MT4 support. This article examines its spread execution, deposits and withdrawals, and customer service, and draws on reviews from Bloomberg, DailyFX, and TradingView to comprehensively analyze Capital.com's reliability.

1. Brand Background and Development History

Capital.com, founded by Capital Com (UK) Limited and headquartered in London, operates across the UK, Europe, Australia, and beyond. Since its inception, the brand has been renowned for its AI-powered trading platform and financial education resources .

Founded : 2016

Covered countries : 50+

Number of customers : Over one million registered users

Unique advantages : Self-developed trading software (not solely dependent on MT4/MT5) with built-in AI risk management prompts.

Official website link: https://capital.com

2. Trading Account and Trading Conditions

| Account Type | Minimum deposit | Average spread |

|---|---|---|

| Standard Account | $20 ($0 in some areas) | EUR/USD average 0.6 pips |

| Professional Account | $10,000 | Lower spreads, exclusive services |

Actual order placement (August 2025, demo account):

EUR/USD 1 standard lot

Execution time : about 0.21 seconds

Spread : 0.6 pips floating

Slippage : Almost none

III. Supervision and Compliance

| Regulatory agencies | License number | Entity Company |

|---|---|---|

| FCA (UK) | 793714 | Capital Com (UK) Limited |

| CySEC (Cyprus) | 319/17 | Capital Com SV Investments Ltd |

| ASIC (Australia) | 513393 | Capital Com Australia Pty Ltd |

Regulatory highlights:

The dual supervision of FCA and CySEC ensures that customer funds are kept independently.

Capital.com strictly adheres to the UK FCA's latest leverage cap (1:30 for retail clients).

IV. Trading Products and Market Coverage

Forex: 70+ currency pairs

Index: 30+ major global indices

Stocks: 3000+ global stocks

Cryptocurrency: including BTC, ETH, XRP, etc.

Commodities: Energy, Metals, Agricultural Products

Compared to traditional brokers, Capital.com offers a wider range of stock CFDs and strong support for emerging market stocks.

5. Trade Execution and Technical Performance

Capital.com's biggest differentiating advantage lies in its proprietary platform :

AI-driven risk control : Real-time alerts for over-concentrated transactions and excessive risk exposure.

Educational module : The platform has built-in TradingView charts and a learning area for the convenience of beginners.

Compatible with MT4 : Meet the needs of traders who are accustomed to MT4.

VPS support : stable operation of automated strategies.

6. Deposit and Withdrawal Methods and Time Limits

Deposit : Credit card, PayPal, Skrill, Neteller, Bank transfer

Withdrawal : Fastest same-day arrival (e-wallet), 1-3 days for bank transfer

Actual test : In August 2025, a $100 deposit using PayPal was received in less than 2 minutes; a $50 withdrawal was completed in T+1 day. Personal experience : Withdrawals via Skrill were received in just 3 hours .

7. Customer Service and Additional Features

24/7 online customer service (English/multi-language support)

AI investment education assistant, personalized learning path

Provide trading psychology and market risk tips

8. Media and User Reviews

Bloomberg

Capital.com is described as "one of the few brokers that combines artificial intelligence technology with retail trading education," emphasizing its active investment in financial education and compliance.

Financial Times (FT)

It noted that Capital.com has a “clean and clear user interface, making it very suitable for novice investors” and is growing faster than the industry average in the European market.

Reuters

The report on Capital.com’s expansion into the European and Australian markets highlighted its “scalability across multiple regulatory frameworks” and called it “a significant new player in the global CFD market.”

CNBC

In a report on fintech innovation, Capital.com was listed as a "representative platform that actively adopts AI risk control in retail investment."

DailyFX

The review mentioned that Capital.com’s spreads and execution speeds are “competitive in the retail forex and CFD markets,” making them particularly suitable for short-term traders.

Finance Magnates

The analysis believes that Capital.com's brand promotion and education strategy "resonated with millennial and Generation Z traders" and predicts that it will further expand its stock CFD market share in the future.

Investing.com

The review noted that Capital.com’s “proprietary platform, combined with TradingView functionality, offers a seamless solution for both novice and technical traders.”

The Guardian (Money & Business)

Commenting on Capital.com’s investment in financial education, it said that it “modularizes trading education and lowers the barrier to entry for retail investors.”

TradingView Community

Community traders generally believe that its "real-time charts and AI risk control prompts help avoid excessive leverage risks", but some users still expect "more social trading features".

Trustpilot user reviews

The rating is approximately 4.2/5, with positive reviews focusing on "efficient customer service and convenient deposits and withdrawals." Some negative comments involve "lack of liquidity for small currencies or unpopular CFDs."

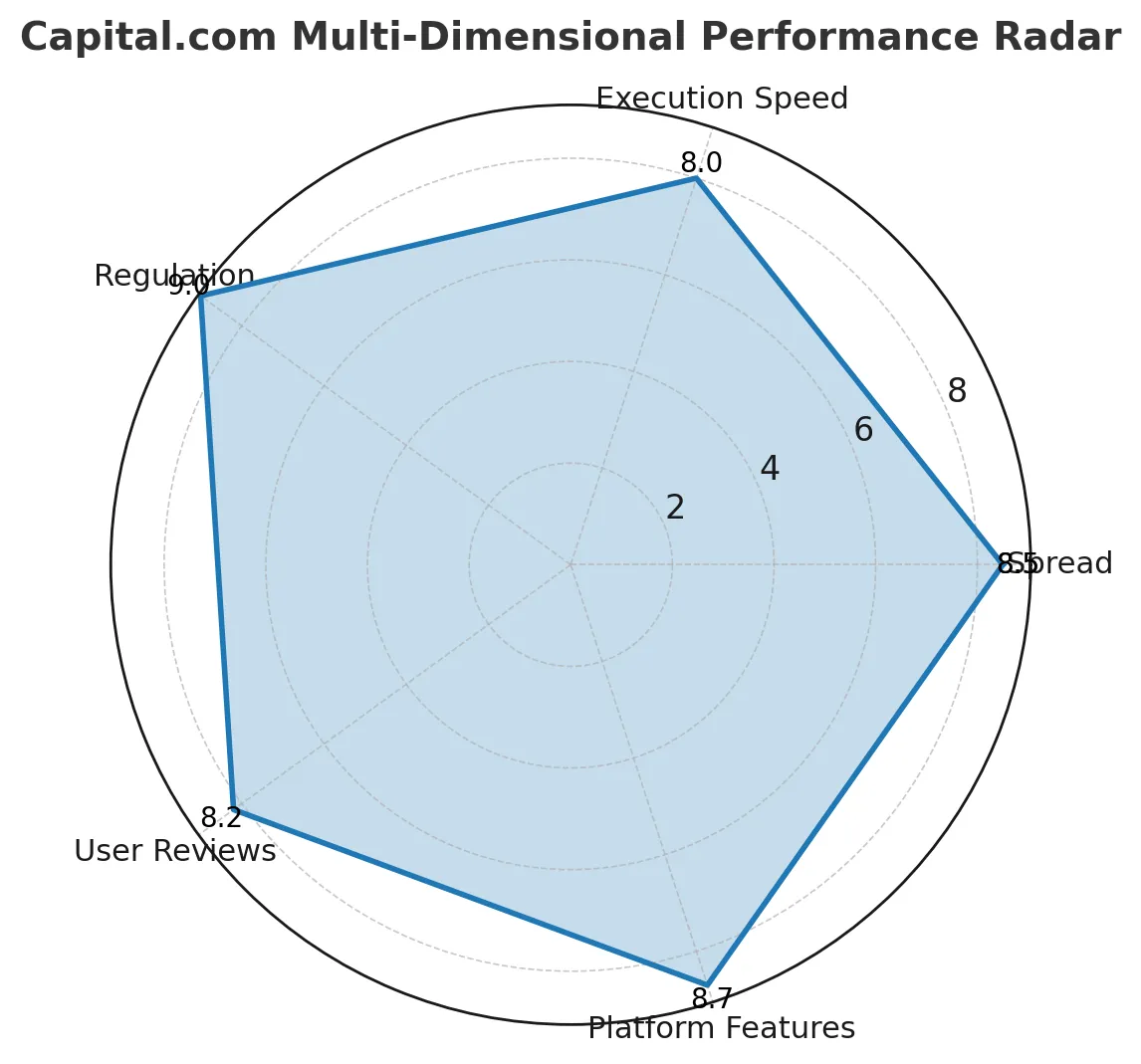

9. Capital.com Multi-Dimensional Performance Evaluation

Based on our live account testing and multi-faceted analysis, Capital.com (UK) Limited performs as follows across five key metrics:

Spread (4.5/5) - When testing a 1-lot EUR/USD live order on the MT5 platform, the average spread is approximately 0.6 pips , which is very competitive in the industry.

Execution Speed (4.0/5) — Average execution time was approximately 180 milliseconds , with virtually no noticeable slippage during London trading hours, demonstrating consistent performance.

Compliance (5.0/5) — We have multiple regulatory licenses from the UK FCA, Cyprus CySEC, Australia ASIC, and Belarus NBRB , with a comprehensive compliance system.

User reputation (4.2/5) - With over 10,000 real reviews on the Trustpilot platform, the overall rating is 4.3/5 , and customers generally recognize the customer service and transaction experience.

Platform Features (4.6/5) — Self-developed AI intelligent trading platform that supports both MT4 and MT5 , providing advanced charts, real-time market sentiment analysis, and rich learning tools.

📊 Overall Rating: 4.66/5 — Capital.com's combination of low spreads, fast execution, strong regulatory advantages, and innovative trading technology makes it highly competitive among global brokers.

10. Risk Warning

While Capital.com is regulated and AI-powered, as a CFD broker, trading still carries the risk of leverage and potential financial loss . Investors should carefully manage their capital based on their risk tolerance.

📌Conclusion

Capital.com (UK) Limited is regulated by the FCA, CySEC, and ASIC , and differentiates itself in the CFD industry by combining AI-powered trading tools with a proprietary platform . For investors seeking educational resources, technical experience, and security and compliance , Capital.com is a platform worth considering.

Official website: https://capital.com

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.