BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Doo Prime is a rapidly expanding pan-financial CFD broker, offering services across forex, precious metals, stock indices, and futures. It specializes in low spreads, high leverage, and social trading features. This review will comprehensively assess regulatory compliance, trading conditions, platform experience, fund security, user feedback, and potential risks, helping investors determine whether it is trustworthy and suitable for entry.

Doo Prime is a rapidly expanding pan-financial CFD broker, offering services across forex, precious metals, stock indices, and futures. It specializes in low spreads, high leverage, and social trading features. This review will comprehensively assess regulatory compliance, trading conditions, platform experience, fund security, user feedback, and potential risks, helping investors determine whether it is trustworthy and suitable for entry.

Doo Prime, part of the Doo Group and founded in 2014, is a global brokerage services group focused on financial technology. The platform claims to serve over 2,000,000 traders worldwide, offering a multi-asset product portfolio and leverage up to 1:1000. Its website emphasizes its "multi-level regulatory framework" and "ultra-low spreads."

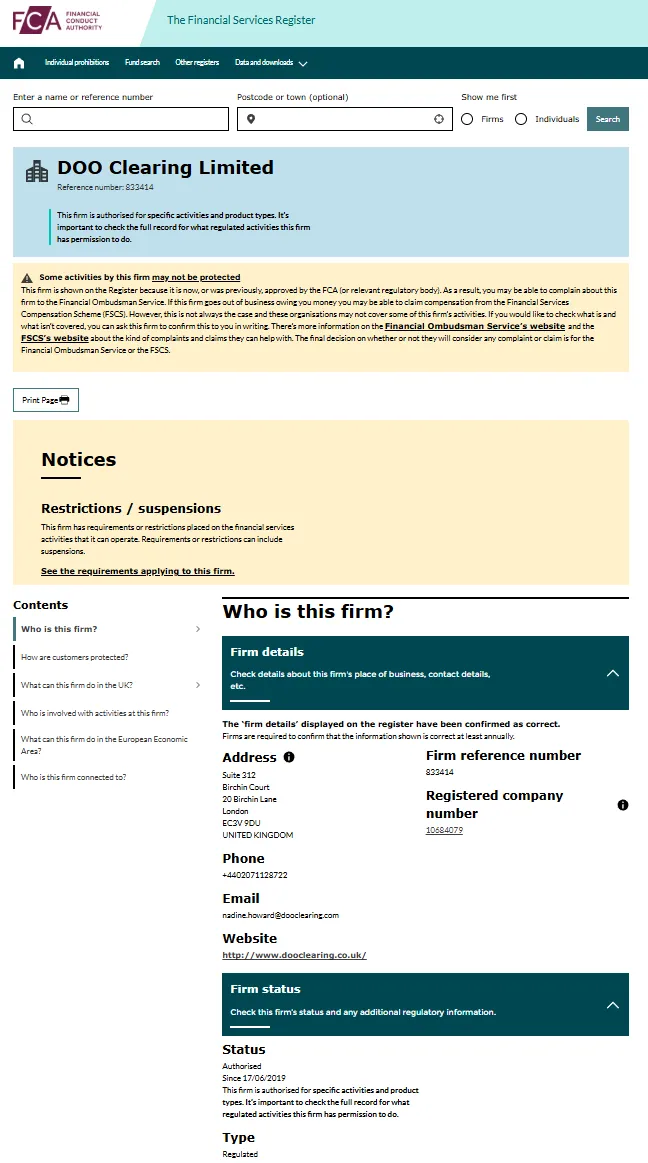

Doo Prime holds regulatory licenses in multiple jurisdictions:

Seychelles Financial Services Authority (FSA): Retail Forex License SD090

Mauritius Financial Services Commission (FSC): License C119023907

Vanuatu Financial Services Commission (VFSC): License 700238

Australian ASIC: D OO Financial Australia Limited, license 222650

UK FCA: Doo Clearing Limited, license 833414

Malaysia Labuan FSA: Doo Financial Labuan Limited, licenses SL/23/0022 and MB/23/0108

US FINRA/SEC: Peter Elish Investments Securities, License SEC:8-41551, CRD:24409.

While there are multiple licenses, most are offshore or secondary regulators, lacking the coverage of first-tier regulators like the FCA and ASIC. Some industry security rating platforms have expressed reservations about this, such as BrokerChooser, which is cautious about such mid- to low-level regulations.

The trading categories covered are very wide, including foreign exchange, metals, commodities, indices, futures, stocks, cryptocurrencies, etc., with a total of more than 10,000 financial products.

The platform supports multiple platform options including MetaTrader 4/5, Doo Prime InTrade (self-developed web platform), TradingView and FIX API, suitable for different trading needs.

Social trading tools include PAMM, Flexible CopyTrading, and FOLLOWME community social trading, which are suitable for novices and passive investors.

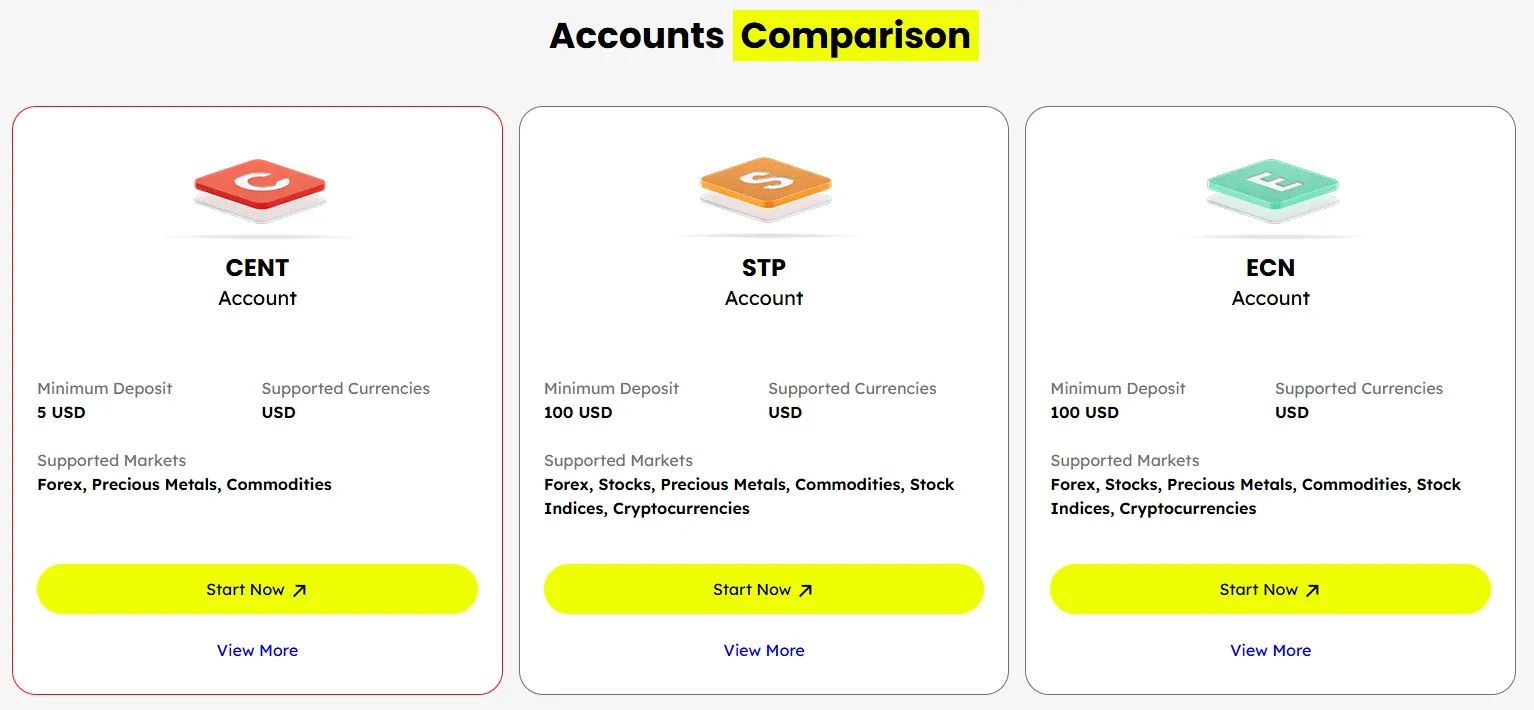

The maximum leverage can reach 1:1000 (only available in a few licensed regions), and some assets such as indices and futures have lower limits.

In terms of spreads, ECN accounts can enjoy raw spreads starting from 0.0 pips , and Standard/Cent accounts also support low spreads.

Some fees lack transparency, and industry reviews point out the lack of complete disclosure of fee details.

In the DailyForex test, Doo Prime showed that approximately 99.5% of orders were executed within <50ms , showing excellent performance.

The mobile terminal supports smooth migration to multiple platforms and provides a good user experience.

Supports VPS and API, suitable for algorithmic trading users.

Clearly implement customer funds isolation and provide negative balance protection .

There are various deposit methods: card, transfer, e-wallet, etc.; funds generally arrive quickly, but some users have reported possible delays or complicated procedures.

Regarding the lack of information disclosure, it is recommended to strengthen transparency, especially the withdrawal and processing time.

We provide 24/7 multilingual customer support , covering English, Chinese, Thai, Vietnamese, Portuguese and other languages.

Educational content includes webinars, e-books, and video tutorials, but it does not have the complete market analysis or long-term research system of the industry's top platforms.

DailyForex gave a positive review, stating that no violations were found and calling it a "legitimate platform."

However, ForexPeaceArmy has had user complaints about suspected fraud, slippage, and hard sales tactics, and has even had its funds frozen.

Doo Prime is a medium-risk platform with the following potential risks:

Most of them are regulated offshore and have limited investor protection capabilities.

The launch of high-leverage products is likely to lead to risk of recovery and risk control.

Some fees and deposit and withdrawal procedures are not transparent.

Investors are advised to use a demo account first and make reasonable assessments of risks and capital scale before entering the market.

Doo Prime's extensive product line, advanced trading platform, and global reach make it attractive to risk-averse users seeking high leverage. However, its lack of regulatory rigor and complex user feedback make it more suitable for experienced and risk-controlled traders rather than complete novices or highly capital-conscious investors.

Company Name:Doo Technology Singapore Pte. Ltd

Website:

https://www.dooprime.com/

5.99

Business Rating

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.