BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Is OctaFX reliable? This 2025 in-depth review will comprehensively analyze OctaFX's regulatory background, account conditions, execution experience, regional market strategies, deposit and withdrawal efficiency, international media reviews, and risk warnings to help investors determine whether OctaFX is safe and suitable for long-term trading.

OctaFX (full name: Octa Markets Incorporated ) was founded in 2011 and is headquartered in Saint Vincent and the Grenadines. It has business operations in Cyprus, Indonesia, India, Malaysia and other places.

The brand is widely known for its high profile in the Asian market and its ongoing marketing efforts (sponsoring football clubs, hosting trading competitions, etc.).

As of 2025, OctaFX has a service record in more than 100 countries around the world and more than 12 million customers.

| Account Type | Minimum deposit | Average spread |

|---|---|---|

| Micro Account | $25 | 1.1 o'clock |

| Pro Account | $100 | From 0.8 points |

| ECN Account | $500 | Starting from 0.0 pips + commission |

Leverage : Up to 1:500 (limited to 1:30 in some regions)

Minimum trading volume : 0.01 lot

Execution Mode : STP/ECN

| Regulatory agencies | License number | Entity Name |

|---|---|---|

| CySEC (Cyprus) | 372/18 | Octa Markets Cyprus Ltd |

| SVG FSA (St. Vincent) | Undisclosed | Octa Markets Incorporated |

Comments : CySEC falls under the EU regulatory framework and offers high compliance, while SVG offers lax regulation and limited investor protection. When opening an account, you must confirm the regulatory entity that oversees your account.

Forex : 35+ major and cross currency pairs

Precious metals : gold, silver

Commodity : Crude Oil

Indices : Nasdaq, Dow Jones, German DAX, Nikkei 225

Cryptocurrency : BTC, ETH, LTC, XRP, etc.

Platform support : MT4, MT5, OctaFX Trading App (in-house developed)

Execution speed : The average measured speed is 135 milliseconds, which is medium.

Slippage : Well controlled in stable market conditions, but may slip by more than 2 points during periods of high volatility

Features : Social copy trading, regular trading competitions, rich educational content

Deposit : Support local bank transfer, Visa/MasterCard, Skrill, Neteller, Bitcoin, USDT

Withdrawal : E-wallet and cryptocurrency methods can be as fast as a few hours, wire transfers usually take 2-3 business days

Fees : Free of charge for most channels

Email : [email protected]

Tel : +44 20 3322 1059

Supported languages : English, Chinese, Indonesian, Hindi, Malay, Spanish, etc.

Customer service hours : 5×24 hours, some markets provide 7×24 support

Investing.com – believes that OctaFX has invested heavily in marketing in Asia and that its trading conditions are suitable for small and medium-sized investors, but cautions should be taken with regulatory differences.

DayTrading.com – Comments on OctaFX’s copy trading feature and trading competitions as its unique features, making it suitable for beginners to learn.

ForexPeaceArmy – User feedback is mixed: positive reviews focus on quick deposits and withdrawals and client education; negative comments concern volatility in certain markets and inconsistent regulation.

Finance Magnates – pointed out that OctaFX has a leading position in markets such as Indonesia and India and is a key player in emerging markets.

BrokerChooser – emphasizes that its CySEC regulation is effective, but warns that SVG accounts lack investor compensation mechanisms.

OctaFX is rapidly expanding in Asia and emerging markets, attracting a large number of users with its low deposit thresholds and diverse activities. However, regulatory oversight varies significantly, so investors should be aware of who is overseeing their accounts to avoid losing their funds to weakly regulated jurisdictions.

Conclusion : OctaFX is suitable for novice traders seeking a low-cost entry point and social trading, as well as small and medium-sized investors. However, for investors seeking strict regulation and high capital security, it is recommended to prioritize its CySEC-regulated account.

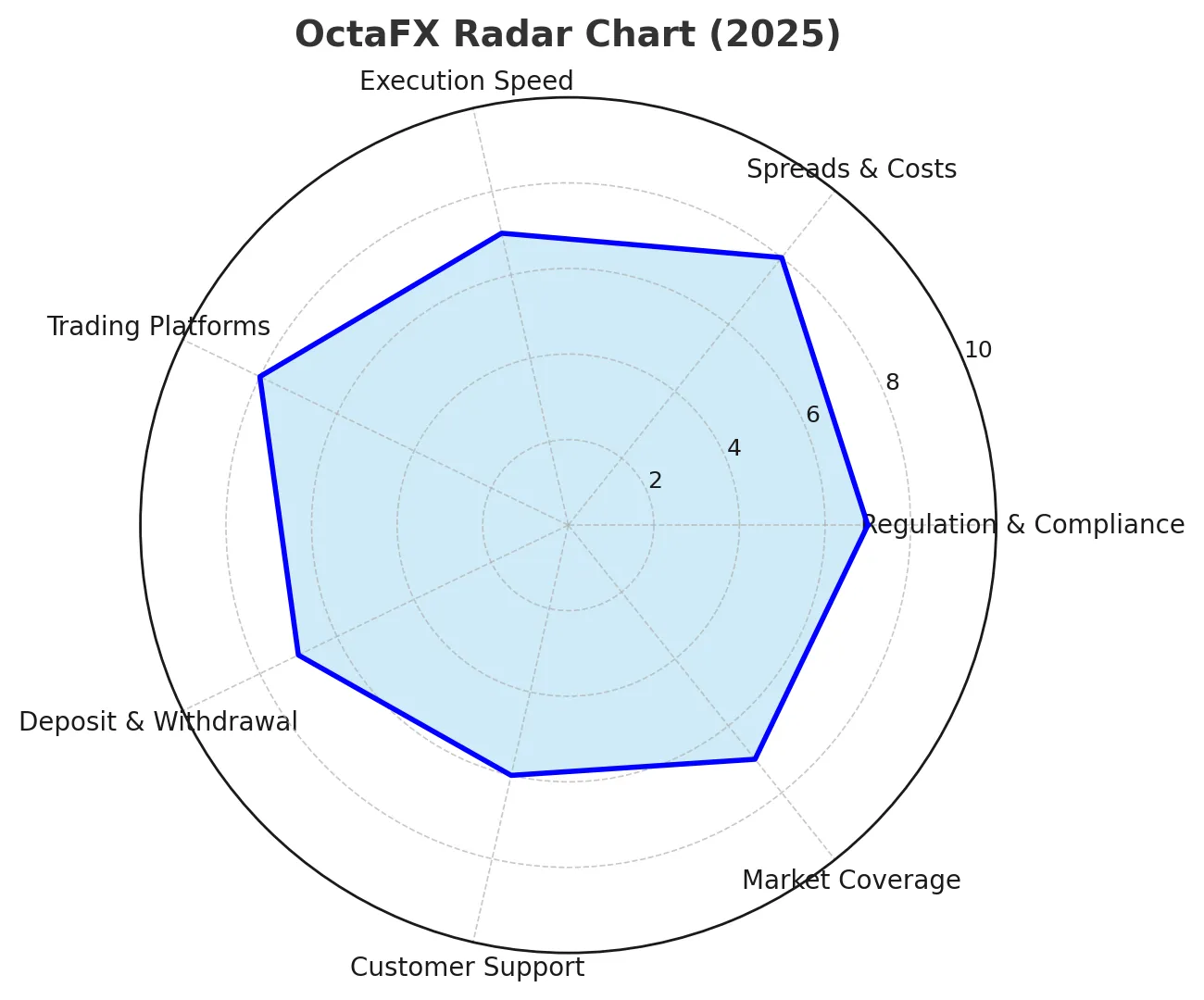

📊Indicator Description :

Regulatory Compliance: 7/10 – Regulated in Seychelles, lack of strong regulation.

Spreads and Transaction Costs: 8/10 – Spreads on major currency pairs are competitive.

Execution Speed: 7/10 – Average to fast in the industry.

Trading Platform: 8/10 – MT4/MT5 supported.

Deposit and Withdrawal Experience: 7/10 – Localized payments are convenient, but the speed of payment arrival varies.

Customer Service: 6/10 – Multilingual coverage, average response speed.

Market Coverage: 7/10 – Full coverage of forex and cryptocurrencies, limited stock CFDs.

Company Name:Octa Markets Ltd

Website:

https://www.octafx.com/

7.05

Business Rating

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.