BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:The Stock Exchange of Thailand (SET) is the core platform of Thailand's capital market, with a market capitalization of approximately 6.7 trillion baht. It offers a diverse range of products, including stocks, bonds, and ETFs. This article provides an unbiased assessment of the SET's regulatory compliance, market size, product diversity, internationalization, and growth potential, answering questions like "Is the SET reliable?" and "Is the Thai stock market a worthwhile investment?", providing comprehensive reference for investors.

The Stock Exchange of Thailand ( SET ), established in 1975 , is the core hub of Thailand's capital market. Its predecessor dates back to the privately-owned Bangkok Stock Exchange in the 1960s, which was later unified under government guidance and ultimately developed into Thailand's national exchange. Headquartered in Bangkok, SET has played a key role in Thailand's economic modernization and is a key capital market in the ASEAN region.

By 2025, SET will have approximately 600 listed companies with a market capitalization of approximately 5.5 trillion baht (approximately US$160 billion) , ranking among the largest in Southeast Asia. Its core index, the SET Index, reflects the overall performance of Thailand's capital market and serves as a key reference for regional investors.

The SET market structure utilizes a quote-driven model, slightly different from the matching models used in Singapore and Indonesia. Investors access the market through local and international brokerages in Thailand, with lower minimum account opening requirements, making it more accessible to small and medium-sized investors.

| Market Segment | Features | Type of listed company |

|---|---|---|

| SET Motherboard | Strict financial requirements | Large and medium-sized enterprises |

| mai (Market for Alternative Investment) | More relaxed conditions | Small, medium and innovative enterprises |

| Bond and ETF markets | By the Thai Bond Traders Association in collaboration with SET | Government bonds, corporate bonds, ETFs, REITs |

The SET is regulated by the Securities and Exchange Commission of Thailand (SEC Thailand) , ensuring market transparency and compliance. The SEC has comprehensive systems for IPO approval, listed company information disclosure, and investor protection, and is actively introducing ESG reporting standards to attract international capital.

Regulator : Securities and Exchange Commission, Thailand

Legal framework : Securities and Exchange Act and related derivative regulations

Investor protection mechanism : An investor compensation fund is set up to support the rights and interests of small and medium-sized investors

SET offers a wide range of financial products, including:

Stocks : Traditional Industries + High-Growth Technology Companies

Bonds : government bonds, corporate bonds, convertible bonds

Derivatives (through TFEX, Thailand Futures Exchange): index futures, gold futures, interest rate futures

ETFs and REITs : Gradually becoming the main tools for foreign investment in the Thai market

SET completed a comprehensive upgrade of its electronic trading system in the late 2000s and currently utilizes the SET CONNECT platform, which supports high-frequency trading and cross-border access. Its average order matching time is less than 50 milliseconds, demonstrating high stability.

Clearing and Settlement : Responsible by the Thailand Clearing House (TCH), with delivery on T+2

Digital transformation : Launching the SET App and API trading interface to support real-time trading on mobile devices

Thai investors can deposit funds through local bank accounts, while foreign institutions typically access funds through international brokerages and custodian banks. Settlement is in Thai Baht (THB) , so some foreign investors may need to consider foreign exchange risk.

SET provides extensive investor education and financial literacy training , and operates the SET Digital Library , which provides public access to financial data, market research reports, and ESG disclosures. Customer service is available in Thai and English, with support gradually expanding to Chinese and Japanese.

WikiFX : SET is rated as a "high compliance, low risk" market in the region, suitable for long-term investors.

FX110 : points out that SET is still slightly behind Singapore and Hong Kong in terms of internationalization, but has growth potential in the ASEAN region.

Bangkok Post : Highlights SET’s progress in digital transformation, especially the popularization of apps for young investors.

Investing.com : It is believed that the Thai market is highly volatile, closely related to politics and foreign capital flows, and attention should be paid to risk management.

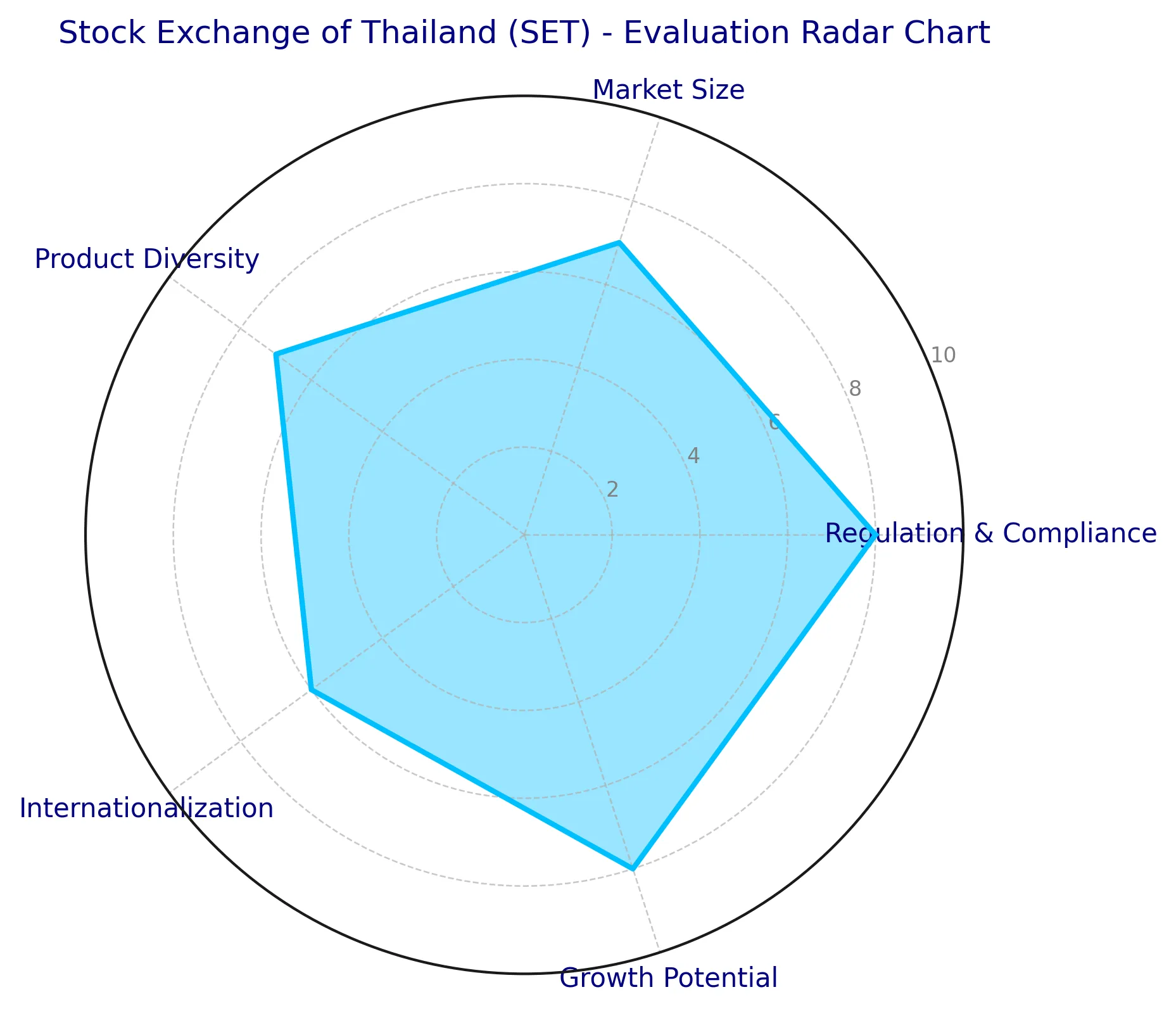

Regulation and Compliance : 8 / 10

Market size : 7/10

Product diversity : 7/10

Internationalization : 6/10

Growth Potential : 8/10

Overall rating: 7.2/10

illustrate:

Under the strict supervision of the Securities and Futures Commission of Thailand (SEC Thailand), the Stock Exchange of Thailand (SET) demonstrates high compliance and security, creating a relatively stable overall environment. While its market size and number of listed companies have grown annually, its product mix remains primarily equity-based, with relatively limited offerings in derivatives and other categories. While its internationalization remains moderate, foreign investment participation needs to be enhanced, recent reforms have provided positive market signals. As a major economy in the ASEAN region, Thailand's capital market possesses considerable growth potential, contributing to the SET's overall score of 7.2 .

The Stock Exchange of Thailand (SET) plays a key role in the ASEAN capital market, particularly in SME financing and regional investment. While its regulatory framework is robust and its product offerings are increasingly diverse, the SET remains limited for global investors due to its internationalization and the volatility of the Thai baht.

Overall, SET is a regional growth market suitable for investors seeking exposure to ASEAN, but this requires a diversified allocation and risk management strategy.

Company Name:Stock Exchange of Thailand

Website:

https://www.set.or.th/th/home

7.15

Business Rating

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.