Philippine Stock Exchange (PSE) In-Depth Review | How is the PSE? A Complete Analysis of Regulatory Compliance, Market Size, International Comparisons, and Investment Risks

Summary:An in-depth review of the Philippine Stock Exchange (PSE): As the Philippines' sole stock exchange, how does the PSE fare? Is its regulatory compliance reliable? A comprehensive analysis of its market size, index system, internationalization, and growth potential reveals whether the PSE is a worthwhile investment, as well as its risks and long-term opportunities.

1. Brand Background and Development History

The Philippine Stock Exchange (PSE) is the sole stock exchange in the Philippines, with a history dating back to the Manila Stock Exchange and the Makati Stock Exchange in 1927. In 1992, the two merged to form the PSE, creating a unified national capital market.

Headquartered in Bonifacio Global City (BGC), Manila, its offices and trading floor are located in One Bonifacio High Street Tower , symbolizing its efforts in modernization, reform and market opening.

By the end of 2023 :

Number of listed companies: approximately 285

Total market capitalization: Approximately ₱16.74 trillion (USD 302 billion)

Share of Philippine GDP: Over 150%

Number of investor accounts: approximately 1.2 million (still relatively small compared to Indonesia's 17 million)

These data show that the PSE is a medium-sized exchange in Southeast Asia, but plays a core role in the Philippines' domestic financial system.

II. Trading System and Technological Reform

Trading hours : Monday to Friday, 9:30 am to 3:00 pm, continuous auction.

Clearing system : Managed by the Securities Clearing Corporation of the Philippines (SCCP), ensuring the security of transaction settlement.

Index system : The most representative one is PSEi (PSE Composite Index) , which consists of 30 blue-chip stocks.

Digital Transformation : The PSE has launched an online trading platform and will launch an electronic IPO system in 2022, allowing retail investors to participate in initial public offerings through mobile applications, thereby increasing market accessibility.

III. Supervision and Compliance

The PSE is jointly supervised by the Securities and Exchange Commission of the Philippines (SEC Philippines) and the Bangko Sentral ng Pilipinas (BSP) :

Corporate Governance : Publicly listed companies must comply with the Philippine Corporate Governance Code and disclose regular financial reports.

Investor protection : The Philippine Deposit Insurance Corporation (PDIC) provides a certain level of protection, but capital market investments still lack a strong compensation mechanism like Singapore's MAS.

Foreign investment restrictions : In most industries, foreign shareholdings may not exceed 40%, which is relatively strict in the Southeast Asian capital market and limits the enthusiasm of multinational institutions.

International rating agencies S&P and Moody’s both pointed out that the regulatory environment in the Philippines has gradually improved, but transparency and enforcement still need to be enhanced.

IV. Market Size and Product Structure

Stocks : Major sectors include banking, real estate, energy, and consumer goods.

ETFs : The number of ETFs listed on PSE is limited (less than 10), much lower than that on SGX and IDX.

REITs : Since the implementation of the REIT Act in 2020, many large real estate groups have launched REIT products, bringing new capital inflows into the market.

Bond market : Mainly completed on the Philippine Bond Exchange (PDEx), which is relatively independent of the PSE.

Derivatives market : Still in its infancy, lacking futures and options trading, and lagging significantly behind regional derivatives centers such as CME and SGX.

contrast:

Singapore Exchange (SGX): A global leader in derivatives and commodities trading.

Indonesia Stock Exchange (IDX): There are nearly 1,000 listed companies and the number of investors is growing rapidly.

Philippine Stock Exchange (PSE): Lack of product diversity and high market concentration, with the top 30 companies accounting for over 70% of the market capitalization.

V. Internationalization and Regional Competitiveness

PSE has limited internationalization:

Foreign investment participation rate : approximately 20%–25%, lower than Indonesia (30%+) and Thailand (40%+).

Regional influence : Failed to become a regional financing center like SGX.

Limiting factors : Foreign shareholding limit, insufficient market depth, and low trading liquidity.

However, as ASEAN Capital Market Integration progresses, PSE is expected to strengthen its linkage with regional markets through the FTSE ASEAN Index Series .

VI. Growth Potential and Risk Analysis

Potential : The Philippines' GDP growth rate is stable at 5-6%, its population is young (average age 25), and its consumption and digital economy are developing rapidly, which is conducive to long-term stock market expansion.

risk :

The average daily market turnover is low, about ₱6–8 billion in 2023, only a quarter of Indonesia’s.

Regulatory transparency still needs to be improved, and information disclosure is not as complete as SGX.

Political and macroeconomic risks (inflation, peso depreciation) have a greater impact on the market.

7. Media and User Reviews

FXEye : PSE is listed as a national authoritative exchange in the Philippines, and its compliance is unquestionable, but insufficient liquidity is its biggest flaw.

FX110 : Emphasizes PSE's domestic market influence, but also points out its lack of international appeal.

Bloomberg : Calls PSE a "typical emerging market" that still has room for improvement within the region.

Investing.com : We believe that the investment value of PSE lies in its long-term potential rather than short-term trading opportunities.

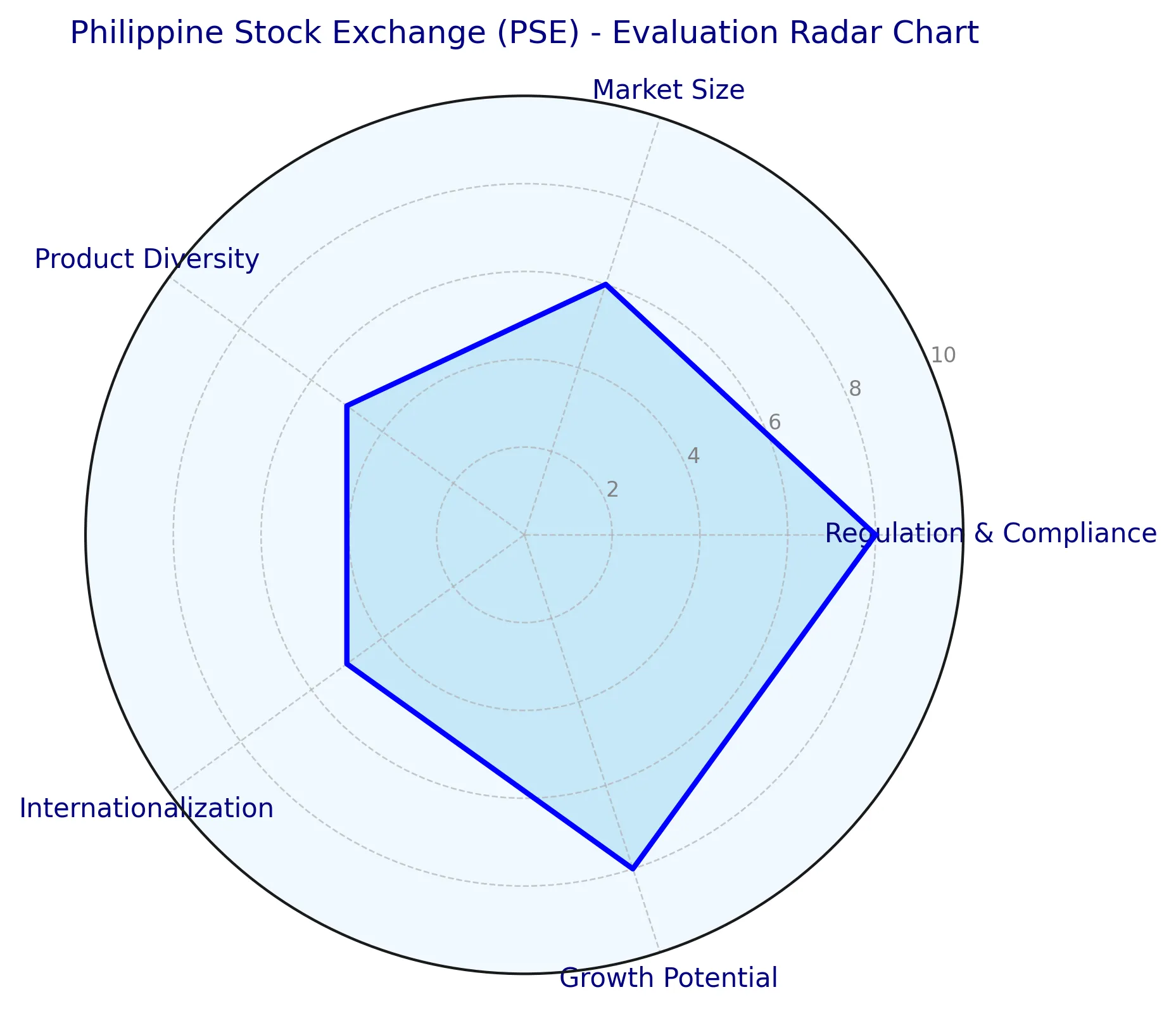

8. Authoritative Rating (out of 10 points)

Regulation and Compliance: 8 / 10

The PSE is fully regulated by the Philippine Securities and Exchange Commission (SEC) . Its regulatory framework is based on international practices, with stringent disclosure requirements. Listed companies are required to adhere to transparent accounting and financial reporting standards and submit regular compliance documents. While enforcement efficiency lags behind that of Singapore and other emerging international financial centers, the PSE maintains a relatively high level of compliance and investor protection, mitigating investment risks.Market size: 6/10

As of 2023, the PSE's total market capitalization is approximately ₱16.7 trillion (approximately US$302 billion) , with 285 listed companies. Its scale ranks mid-range within the ASEAN capital market, significantly lagging behind the Indonesia Stock Exchange (IDX) and the Singapore Exchange (SGX). The market's average daily trading volume is limited, and liquidity is low. This creates significant entry and exit costs, especially for large trades and institutional investors.Product diversity: 5/10

Currently, the PSE primarily focuses on stock trading , with its ETF, bond, and derivatives markets still in their infancy. The limited selection of investment instruments makes it difficult for institutional and cross-border investors to build complex or hedged portfolios through the PSE. In recent years, the exchange has attempted to promote the listing of more ETFs and REITs, but product innovation and coverage still lag behind regional competitors.Internationalization: 5/10

Foreign investors face numerous restrictions entering the Philippine market, with some sectors still subject to foreign ownership caps. Overall international capital participation remains low. While some PSE blue-chip stocks have garnered international attention through inclusion in the MSCI Emerging Markets Index, their global influence and appeal are limited. Regionally, the PSE lags behind the SGX and IDX in terms of internationalization.Growth Potential: 8/10

The Philippines is one of the most populous countries in Southeast Asia, with a total population exceeding 110 million , a demographic that is aging rapidly, and a growing middle class. With the widespread adoption of digital finance and enhanced investor education , the number of retail investors continues to grow, significantly increasing participation in the financial market. Coupled with the gradual shift toward service and technology industries in its economic structure, the PSE's medium- and long-term growth potential is widely optimistic.

Overall rating: 6.4/10

Overall, the PSE's strengths lie in its stable regulatory system and substantial demographic dividend , along with strong potential for growth. However, its weaknesses lie in its limited market size, insufficient liquidity, limited product offerings, and limited internationalization . For local investors, the PSE remains a core channel for accessing the capital market; for global investors, indirect investment through regional funds, ETFs, or index products linked to the Philippines is more suitable.

IX. Conclusion

As the Philippines' sole securities exchange, the Philippine Stock Exchange (PSE) boasts national status and a robust compliance system, offering significant long-term potential. However, its limited scale, low liquidity, and lack of internationalization hinder its competitiveness in Southeast Asian capital markets.

It is suitable for long-term investors who are optimistic about the Philippine economic development , but the PSE has limited appeal to international investors seeking liquidity and diversified products.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.