BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:CME Group Inc. (official website: https://www.cmegroup.com) is the world's largest derivatives marketplace, headquartered in Chicago, USA. The Group comprises four core exchanges: the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBOT), the New York Mercantile Exchange (NYMEX), and the Comex. Its product offerings cover a full range of derivatives, including interest rates, stock indices, foreign exchange, energy, agricultural products, and metals. As a financial giant listed on Nasdaq (ticker: CME), CME Group is strictly regulated by the U.S. Commodity Futures Trading Commission (CFTC) and provides leading global risk management and clearing services through its clearinghouse, CME Clearing. Its average daily trading volume exceeds 20 million contracts, connecting investors and financial institutions in over 150 countries and regions. CME Group not only holds a core position in the global derivatives market but also actively promotes innovation in electronic trading, data services, and financial technology. It is widely recognized as a key hub for price discovery and risk hedging in the international market.

CME Group Inc. (NASDAQ: CME), headquartered in Chicago, Illinois, USA, is the world's largest and most influential derivatives exchange group.

History : Founded in 1898 (originally as the Chicago Butter and Egg Exchange), it merged with the Chicago Board of Trade (CBOT) in 2007, subsequently absorbing the New York Mercantile Exchange (NYMEX) and the Kansas City Board of Trade (KCBOT) to form the current CME Group.

Market position : Currently the center of global derivatives trading, covering interest rates, foreign exchange, stock indices, commodities, energy, agricultural products and other categories.

Scale advantage : CME's average daily trading volume in 2024 exceeded 23 million contracts , with the world's largest total notional value.

CME does not open accounts directly for retail investors, but rather through its members, clearing houses, and brokers. Its core product features are:

| Product Type | Typical Contract | Minimum price change | Margin Requirements (Example) |

|---|---|---|---|

| Interest Rate Futures | Fed Funds, SOFR, Treasury futures | 0.0025 | Approximately US$1,500 – US$3,500 |

| Foreign exchange futures | Euro/US Dollar (EUR/USD) | 0.00005 | About $2,200 |

| Stock Index Futures | E-mini S&P 500 | 0.25 index points | About $12,000 |

| commodities | WTI crude oil futures | $0.01 per barrel | About $7,500 |

As a core financial infrastructure in the United States, CME Group is subject to multiple regulations:

| Regulatory agencies | Jurisdiction | status |

|---|---|---|

| CFTC (U.S. Commodity Futures Trading Commission) | Futures and derivatives trading | First-level federal regulation |

| NFA (National Futures Association) | Membership and compliance supervision | Industry self-regulatory organizations |

| SEC (U.S. Securities and Exchange Commission) | Stock index derivatives | Federal regulation |

CME's business scope is extremely broad, covering major global financial markets:

Interest rate products : SOFR, Treasury bond futures, global hedging and pricing benchmarks.

Forex : Covers 40+ major currency pairs, futures and options.

Stock index derivatives : E-mini series (S&P 500, NASDAQ-100, Dow Jones).

Energy and Commodities : WTI crude oil, natural gas, gold, silver, corn, soybeans.

Crypto asset derivatives : Bitcoin futures, Ethereum futures (approved by the CFTC).

CME Globex : An electronic trading platform with 24-hour continuous trading and access by investors from over 150 countries worldwide.

Latency performance : The core matching latency is less than 1 millisecond, which is recognized as one of the fastest markets in the world.

Clearing mechanism : CME Clearing provides central counterparty clearing, reducing counterparty risk and ensuring market stability.

Risk Management : SPAN Margin Model (global derivatives industry standard).

CME does not directly provide retail funding access, but members and Futures Commission Merchants (FCMs) support:

Wire Transfer

Clearing member margin account

International banking channels

Fund security is guaranteed by CME Clearing and regulation.

Multi-language coverage : English, Chinese, Japanese, Spanish, German, etc.

Customer Support : Provided through members, brokers, and CME offices worldwide.

Research & Tools : Daily market analysis, volatility tools, FedWatch Tool (predicting the probability of a Fed rate hike, cited by global financial media).

Bloomberg – CME, as the pricing center of the global futures market, is highly authoritative, especially in terms of Federal Reserve policy expectations.

Reuters – CME Bitcoin futures are at the heart of global compliant digital asset derivatives.

Financial Times – CME has a rigorous regulatory structure and is a critical infrastructure for financial stability.

✅Authoritativeness : The world's first derivatives market with the highest compliance.

✅Market size : Ranked first in the world in terms of trading volume and clearing volume.

✅ Uniqueness : Exclusive benchmark products such as FedWatch Tool and Bitcoin futures.

⚠️Restrictions : Not for direct retail investors. Small investors must access through brokers.

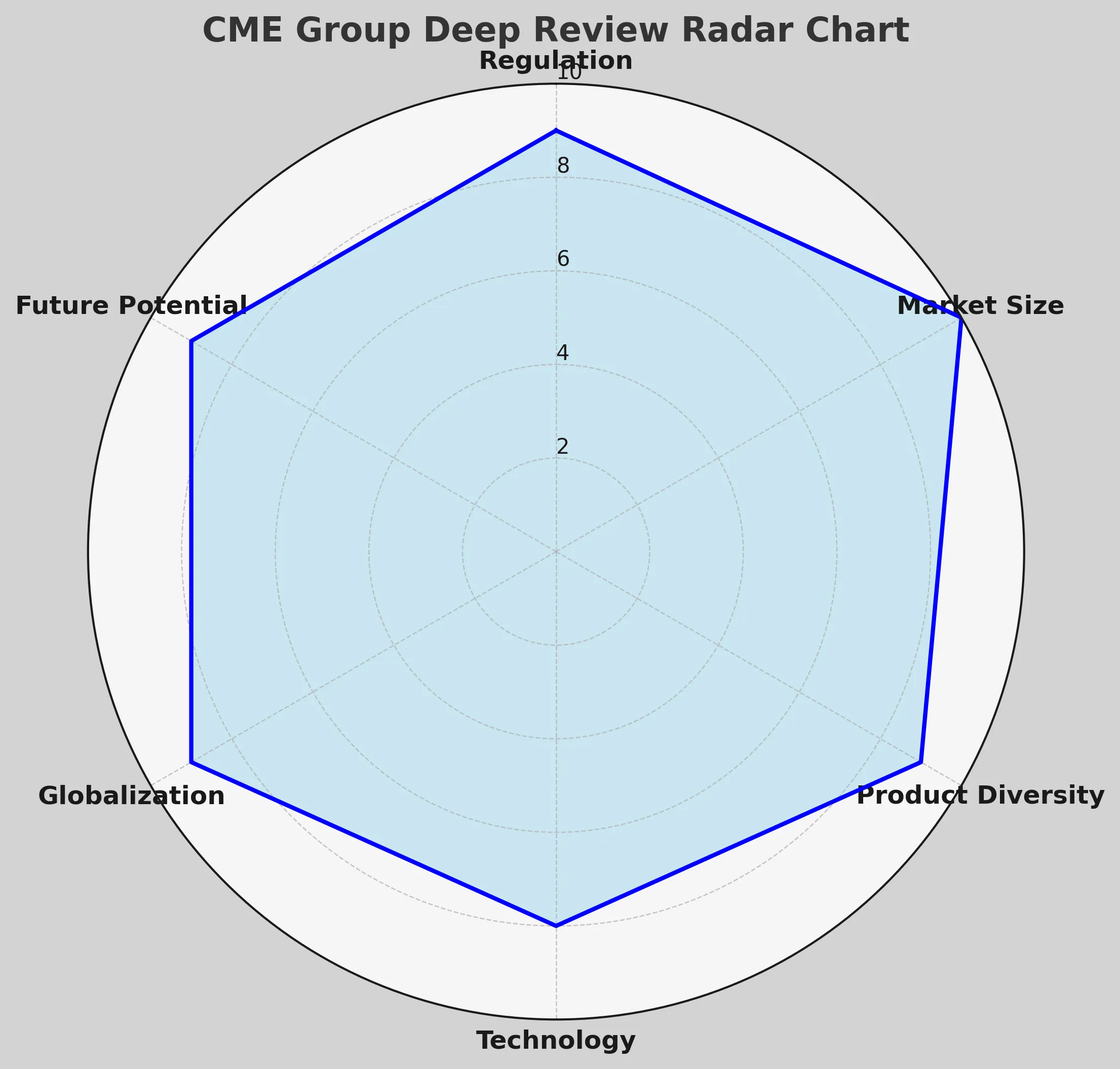

Regulation & Compliance: 9.5/10 — Dual regulation by the CFTC (Commodity Futures Trading Commission) and the SEC , and recognized by major jurisdictions worldwide; clearing and margin systems are globally standardized, with highly transparent legal compliance.

Market Size & Liquidity: 9.7/10 — The world's largest derivatives market , with an average daily trading volume exceeding 20 million contracts ; covering core commodities such as interest rates, foreign exchange, energy, agricultural products, metals, and more, with unparalleled market depth.

Product Breadth: 9.6/10 — Product lines span futures, options, index derivatives, swaps, and ETF derivatives ; global dominance in interest rate and energy contracts, covering nearly all institutional risk management needs.

Internationalization: 9.3/10 — Nodes in London, Hong Kong, Singapore, and other countries; 24/7 matching via the Globex platform , attracting investors from over 150 countries; interconnected with multiple clearing houses.

Technology & Ops: 9.0/10 — CME Globex boasts a world-leading matching engine, microsecond latency, and exceptional stability. It also promotes cloud and API-based trading to support high-frequency trading and institutional quantitative needs.

Growth Potential: 8.9/10 — Significant growth potential is expected , driven by interest rate market volatility, energy transition, digital asset futures (e.g., Bitcoin/Ethereum futures) , and global risk hedging demand. Challenges lie in the cyclical nature of macroeconomic fluctuations.

Overall Rating: 9.3/10 (Authoritative) — CME Group Inc. is one of the world's most authoritative and systemically important financial markets, leading the exchange in regulatory compliance, product breadth, and internationalization.

High professional threshold : CME transactions are mainly for institutional and professional investors, and retail investors need to go through FCM or IB.

High Leverage and Risk : Derivative contracts may bring substantial risks and losses.

Compliance requirements : Must comply with CFTC, NFA and local financial regulations.

As the world's largest derivatives exchange group, CME Group is the pricing center and risk management cornerstone of the financial market.

For institutional investors, CME is an essential global market benchmark;

For retail investors, they rely more on indirect access from brokers.

Its regulatory status, market size and technological strength have established its irreplaceable international financial position .

📌Full company name : CME Group Inc.

🌐Official website : https://www.cmegroup.com

Company Name:CME Group Inc.

Website:

https://www.cmegroup.com/

8.28

Business Rating

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.