Kabu.com Review | Is Kabu.com Securities Legit and Safe? Regulation, Trading Conditions & User Feedback

Summary:How is Kabu.com (au Kabu.com Securities)? As a licensed Japanese brokerage firm under Mitsubishi UFJ Financial Group, it's strictly regulated by the Financial Services Agency (JFSA) and offers a diverse range of products, including stocks, futures, foreign exchange (OTC-FX), and ETFs. Its platforms include KabuStation, MT4/MT5, and segregated funds, protected by an investor compensation fund. User reviews praise its system stability and security, but it's not user-friendly for non-Japanese users, and its maximum forex leverage is only 1:25. With an overall rating of 9.0/10, it's suitable for conservative investors with long-term investment options.

1. Company Background and Group Strength

Full legal name : au Kabucom Securities Co., Ltd. (Japanese name: auカブコム証券株式会社).

Parent company : Affiliated with Mitsubishi UFJ Financial Group (MUFG) , one of the top five banking groups in the world by market capitalization, with total assets exceeding US$1.5 trillion and an investment-grade credit rating (Moody's A1, S&P A+).

Strategic Positioning : Kabu.com is MUFG's flagship subsidiary for retail securities and online trading in Japan. In 2019, it partnered with KDDI (a Japanese telecommunications operator) and changed its name to au Kabucom , strengthening its integrated financial services model of "banking + securities + telecommunications."

Establishment : Started in 1999, listed on the Tokyo Stock Exchange in 2001, and later fully integrated into the MUFG Group.

Authoritative conclusion : Kabu.com has a banking group background and is a core part of the Japanese financial market, with extremely high guarantees in terms of legal compliance and financial stability.

II. Regulatory and Compliance Framework

Regulator : Strictly regulated by the Japan Financial Services Agency (JFSA). The license number can be found in the Financial Instruments Introducing Operators Directory .

Compliance requirements : Must comply with the Financial Instruments and Exchange Act and the Securities and Exchange Act, isolate and deposit customer funds, and submit financial and business reports regularly.

Investor Protection : As a member of the Japan Securities Dealers Association (JSDA), Kabu.com customers can receive compensation from the Investor Protection Fund in the event of company bankruptcy, with each investor receiving up to 10 million yen in compensation.

Transparent Disclosure : Financial reports, capital adequacy ratios, and system compliance statements are regularly disclosed on the official website, reflecting the high level of transparency that is unique to Japanese securities firms.

3. Trading Platform and Technical Strength

Independent research and development platform :

KabuStation® - Professional-grade PC-based trading tool supporting stocks, futures, options and FX, with high-performance charting and conditional order system.

Kabu Smart App - a mobile application that integrates AI alerts, asset analysis tools, and ETF investment assistant.

MT4/MT5 Support : The FX section can be accessed through MT4 to meet the needs of quantitative trading and EA strategies.

Innovative Technology : In recent years, we have introduced AI (news sentiment analysis) and VR/AR trading interfaces , and collaborated with KDDI to promote 5G financial services experiments to enhance user experience.

Stability : It is one of the most stable brokerage firms in the Japanese market, with very few downtimes.

IV. Product and Market Coverage

Securities products : Japanese stocks (TOPIX 1/2, JASDAQ, Mothers), US stocks, and selected overseas ETFs.

Derivatives : Nikkei 225 futures, TOPIX futures, index options.

Foreign Exchange (OTC-FX) : Kabu FX offers major currency pairs (USD/JPY, EUR/JPY, etc.) with fixed and transparent spreads, suitable for intraday trading.

Contract for Difference (CFD) : Access to selected international indices and commodities through partner markets.

Investment Trusts and Retirement Accounts : Supports Japanese NISA and iDeCo accounts, integrating long-term investment tools.

5. Account Types and Fund Management

Account Type :

Ordinary securities account

NISA (Tax-Free Savings Investment Account)

Forex Account (Kabu FX)

Investment Trust Account

Funds in and out : MUFG internal instant transfers are supported (no handling fee), and external bank transfers usually arrive within 1 business day.

Fund security : All client funds are segregated and stored in trust accounts and are regulated by the Japanese Financial Services Agency.

Leverage restrictions : Japan has strict regulations, with the upper limit of foreign exchange leverage being 1:25 , which is much lower than the 1:500 of offshore brokerages, but it offers higher compliance and security.

6. Customer Service and Educational Resources

Customer service language : Mainly Japanese, providing telephone, email and online customer service, some pages have English support.

Service hours : 24/5 full-time support on trading days.

Educational content : Provides daily market commentary, technical analysis lectures, ETF and investment trust financial management courses, and video tutorials.

User Group : Mainly for local Japanese investors, the entry threshold for international users is relatively high (must understand Japanese and Japanese account opening conditions).

7. User Reputation and Market Position

Market Position : Kabu.com is one of the top three retail forex brokers in Japan's OTC-FX market, alongside GMO and DMM.com.

Media Recognition : Received numerous awards from the Nikkei and financial media for "high customer satisfaction" and "excellent system stability."

User feedback :

Positives: Transparent spreads, fund security, endorsed by parent company MUFG, suitable for long-term investment.

Negatives: Unfriendly to non-Japanese users, limited international expansion; low leverage limit, may not attract high-frequency speculators.

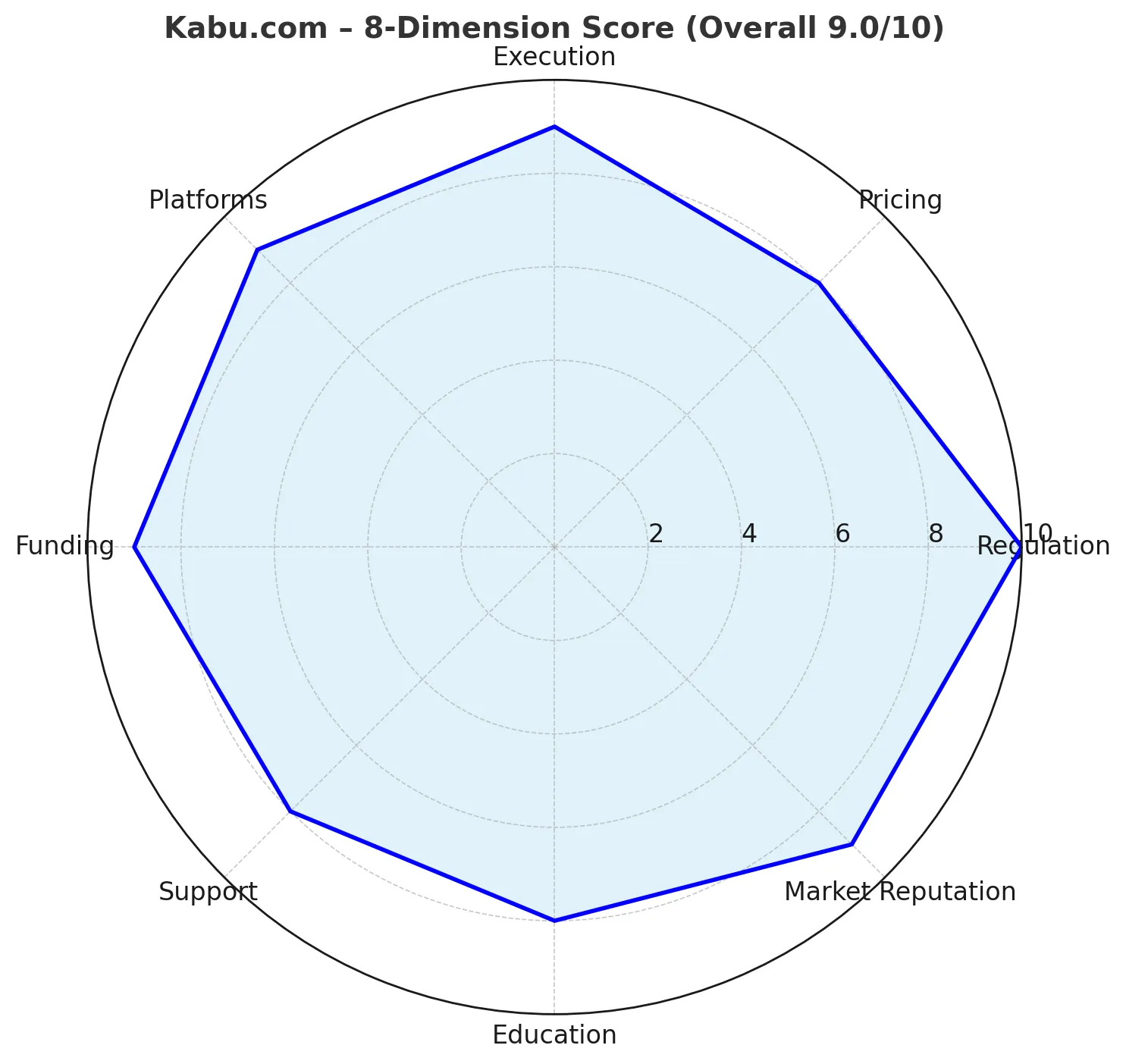

8. Overall score (0–10)

| Dimensions | Fraction | illustrate |

|---|---|---|

| Regulatory compliance | 10 | Strictly regulated by JFSA, endorsed by MUFG, and guaranteed by top-tier security |

| Platform and Technology | 9 | Powerful self-developed platform, AI/VR innovation, and high stability |

| Product Coverage | 9 | Full coverage of stocks + futures + foreign exchange + trusts |

| Costs and Spreads | 8 | Low fees, transparent FX spreads, but limited leverage |

| Deposit and withdrawal | 9 | MUFG internal instant transfers, safe and efficient |

| Customer Service and Education | 8 | Complete Japanese service, rich educational resources, limited English |

| Market reputation | 9 | High domestic user satisfaction and recognition from authoritative media |

| Risk prevention and control | 10 | Client funds isolation + compensation fund + low leverage risk control |

Overall score: 9.0/10 — A highly secure and authoritative mainstream Japanese securities/forex broker.

IX. Risk Warning

For international users: Account opening restrictions are strict and must comply with Japanese regulations and identity requirements.

For high-leverage traders: Japanese law only allows 1:25 leverage, which is not suitable for speculative strategies.

Recommendation: Conservative investors and users of the Japanese market can give priority to it. Global users who seek high leverage can evaluate other FCA/ASIC regulated platforms.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.