BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:How is Monex Securities? Monex, affiliated with Monex Group, a Tokyo-listed company, is strictly regulated by Japan's Financial Services Agency (JFSA). It maintains segregated funds and includes an investor protection fund (with a maximum compensation of 10 million yen). It offers a diverse range of products, including stocks, ETFs, forex (with a maximum leverage of 1:25), futures and options, and is powered by TradeStation technology. With an overall rating of 9.0/10, it's considered safe and stable, making it suitable for long-term investment.

Official website : Monex Group official website

Founded in 1999 , Monex Securities (マネックス証券株式会社) is one of Japan's earliest online securities brokers. It is affiliated with Monex Group, Inc. and is listed on the Tokyo Stock Exchange's Main Board (stock code: 8698). The group's businesses include securities, foreign exchange, investment trusts, derivatives, and international markets.

Shareholders and Strength : Monex Group fully controls Monex Securities and holds numerous global subsidiaries, including the renowned US trading platform TradeStation and Japan's major cryptocurrency exchange Coincheck . This makes Monex not only a major player in Japan's domestic retail market, but also a financial group with an international presence.

Monex Securities is officially authorized by the Japan Financial Services Agency (JFSA) as a "Type 1 Financial Instruments Dealer." As a JFSA-regulated brokerage firm, it must meet the following requirements:

Segregated management of client funds - investor funds are held in separate custody and cannot be misappropriated.

Capital adequacy requirements - regularly disclose financial reports and maintain healthy capital levels.

Compliance and Risk Disclosure - Submit regular reports to JFSA and accept on-site inspections.

Investor Protection : Monex is a member of the Japan Securities Dealers Association (JSDA) and the Japan Investor Protection Fund (JIPF) . If a customer's assets cannot be returned due to company bankruptcy, they can receive compensation of up to 10 million yen .

Conclusion : The regulatory intensity is one of the highest in the world, protecting the rights and interests of investors.

🔗Japan Financial Services Agency (JFSA) regulatory information

The technology stack provided by Monex covers multiple levels of users:

Monex Securities Platform : Used for trading local assets such as stocks, ETFs, funds, and futures. It has a simple interface suitable for Japanese investors.

Monex FX Platform : Focuses on foreign exchange trading, supporting major currency pairs such as USD/JPY and EUR/JPY, with transparent spreads.

MetaTrader 4 (MT4) : Provides quantitative and EA strategy support for traders accustomed to international standards.

TradeStation : A US subsidiary of Monex Group, it is known for its powerful chart analysis, backtesting tools and quantitative interfaces to meet the needs of professional strategy traders.

This means that Monex can not only meet the needs of traditional stock/fund investment users, but also provide world-leading tools for quantitative and programmatic traders.

Monex Securities offers a wide range of financial products:

Stocks and ETFs : Tokyo Stock Exchange stocks, US stocks (via international accounts), and some Hong Kong stocks.

Foreign Exchange (OTC-FX) : Leverage limit of 1:25, stable spreads, suitable for hedging and conservative traders.

Futures and options : including Nikkei 225 futures, TOPIX futures, and index options trading.

Funds and retirement accounts : NISA and iDeCo tax-free investment accounts support long-term investments.

Digital asset layout : Through the group subsidiary Coincheck, it has entered the cryptocurrency ecosystem.

Differentiating features : Compared to Japanese brokerages like Rakuten and Kabu.com, Monex is more international, especially in its support for US stock trading and the TradeStation platform.

Client funds isolation : fully comply with JFSA requirements, and funds are independently managed.

Compensation coverage : JIPF covers up to 10 million yen.

Deposits and withdrawals : Supports multiple Japanese banks (including Rakuten Bank and MUFG), with fast transfers and low fees.

Leverage control : The maximum leverage for foreign exchange is 1:25, and strict margin rules reduce the risk of liquidation.

Positive reviews :

The security of funds is extremely high;

The platform is stable and executed without major glitches;

TradeStation enhances international competitiveness.

Negative reviews :

Not friendly enough to international users, with limited English support;

Foreign exchange leverage is low and is not suitable for high-leverage speculative investors.

Media and industry recognition : Monex has been repeatedly mentioned by Nikkei and international investment research institutions as "one of Japan's top three online brokerages," demonstrating its high brand credibility.

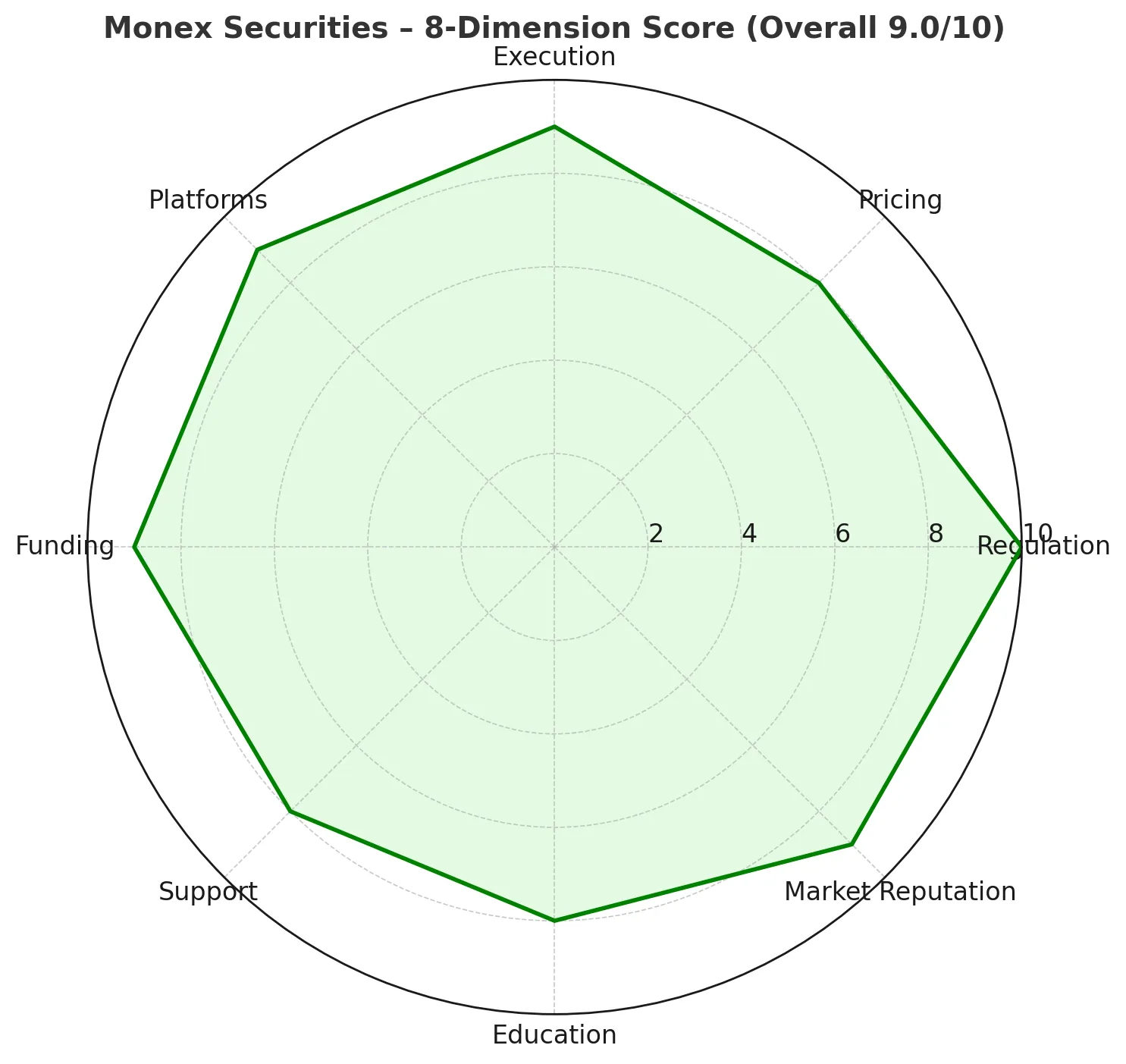

| Dimensions | Fraction | illustrate |

|---|---|---|

| Regulatory compliance | 10 | JFSA supervision, top protection |

| Platform and Technology | 9 | Self-developed platform + MT4 + TradeStation |

| Product Coverage | 9 | Stocks, US stocks, foreign exchange, ETFs, futures, and funds are all available |

| Costs and Spreads | 8 | Reasonable stock rates and transparent forex spreads |

| Deposit and withdrawal efficiency | 9 | Fast bank channels and safe funds |

| Customer Service and Education | 8 | Mainly Japanese, limited English |

| Market reputation | 9 | Japan's mainstream securities firms, high transparency |

| Risk Control | 10 | Client Funds Isolation + JIPF Compensation + Leverage Limitation |

📊 Overall rating: 9.0/10

Monex Securities is a stable, secure, and transparent top-tier Japanese brokerage firm, ideal for long-term investments and those pursuing compliant investment strategies.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.