BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Is TopFX reliable? This article comprehensively analyzes TopFX Ltd.'s regulatory status (CySEC 209/13), its institutional liquidity business, and its retail forex services. It covers the MT4/cTrader platforms, account types (Raw/Zero), spreads, and commission structures. It also assesses its execution speed, deposit and withdrawal security, and customer service. Furthermore, it incorporates user and media reviews to help investors comprehensively assess TopFX's safety and suitability for investors.

1. Brand Background and Development History

Full company name : TopFX Ltd.

Founded : 2010

Headquarters : Limassol, Cyprus

Regulatory license : CySEC 209/13

Business Positioning : Initially a Prime Brokerage (liquidity provider) , serving other brokers and institutions, and later expanded into the retail foreign exchange business.

2010–2015 : Provided Prime services as a liquidity provider (B2B) to small and medium-sized brokers and asset management companies.

2016–2018 : Expanded retail business line and launched ECN retail accounts.

2019 : Added support for the cTrader platform , competing with cTrader-focused brokerages such as IC Markets and Pepperstone.

2020–2023 : Expand marketing efforts in Asia and the Middle East, and participate in multiple financial expos.

TopFX's core advantage lies in its dual identity : it is both a liquidity provider and a retail trading service provider, with both B2B and B2C models.

TopFX offers two core accounts:

| Account Type | Minimum deposit | Spread | commission | Platform support | Applicable people |

|---|---|---|---|---|---|

| Raw Account | $100 | From 0.0 pips | $2.75/side/lot | MT4 / cTrader | Professional traders, high-frequency users |

| Zero Account | $100 | From 1.0 pips | No commission | MT4 / cTrader | Novice and small capital traders |

Trading Conditions Highlights :

The Raw account is similar to IC Markets and Pepperstone, with very low spreads + commission model.

The Zero account is a commission-free account with higher spreads, making it more suitable for beginners.

Leverage : Up to 1:500 (limited to 1:30 for EU retail clients).

Minimum trading lot size : 0.01 lots.

| entity | Place of registration | Regulatory agencies | License plate number | Remark |

|---|---|---|---|---|

| TopFX Ltd. | Cyprus | CySEC | 209/13 | Main regulatory entities |

| TopFX Seychelles | Seychelles | FSA | SD037 | Offshore entity serving non-EU clients |

Compliance Analysis :

CySEC: EU regulated, subject to the MiFID II framework, and provides €20,000 investor compensation guarantee.

Seychelles FSA: loosely regulated, mainly used to provide high leverage and flexible services.

Conclusion: TopFX has both strong regulation (CySEC) and flexible offshore (FSA) to cover different types of customers.

Forex : 80+ currency pairs.

Commodities : crude oil, natural gas.

Metals : Gold, Silver, Platinum.

Index CFD : S&P500, Nasdaq100, DAX40 and other mainstream indices.

Stock CFD : Global popular stock CFD.

Cryptocurrency CFDs : BTC, ETH, LTC, etc.

The product coverage is wide, and it is particularly competitive in foreign exchange and index CFDs.

Supported platforms : MT4 and cTrader.

Execution mode : STP/ECN, no market maker.

Latency performance : The average measured latency for a Raw account is 40–70ms.

Slippage control : Slippage is less than 0.2 pips in normal market conditions, and there is still negative slippage during high volatility.

Tool support : EA automated trading, social trading, FIX API (for institutions).

Comparative advantages :

Compared to other cTrader providers, TopFX is positioned closer to IC Markets / Pepperstone , but its execution depth is slightly inferior to LMAX.

Deposit methods : Wire transfer, credit/debit card, Skrill, Neteller, cryptocurrency.

Withdrawal methods : Wire transfer, e-wallet, cryptocurrency withdrawals are fastest.

Time for funds to arrive : 1–3 business days for wire transfers and a few hours for e-wallets.

Fees : TopFX does not charge internal fees, but bank transfer fees are borne by the client.

Fund security : Deposited in segregated accounts, protected by CySEC client funds rules.

Channels : Email, Live Chat, Phone.

Languages : English, Chinese, Arabic, Russian, Spanish.

Service hours : 5×24 hours.

IB Cooperation : TopFX provides high rebate plans and backend systems to IB partners.

Educational resources : Basic forex learning articles and video courses.

Market analysis : daily market briefing.

Disadvantages : Less in-depth research and more oriented towards retail customers.

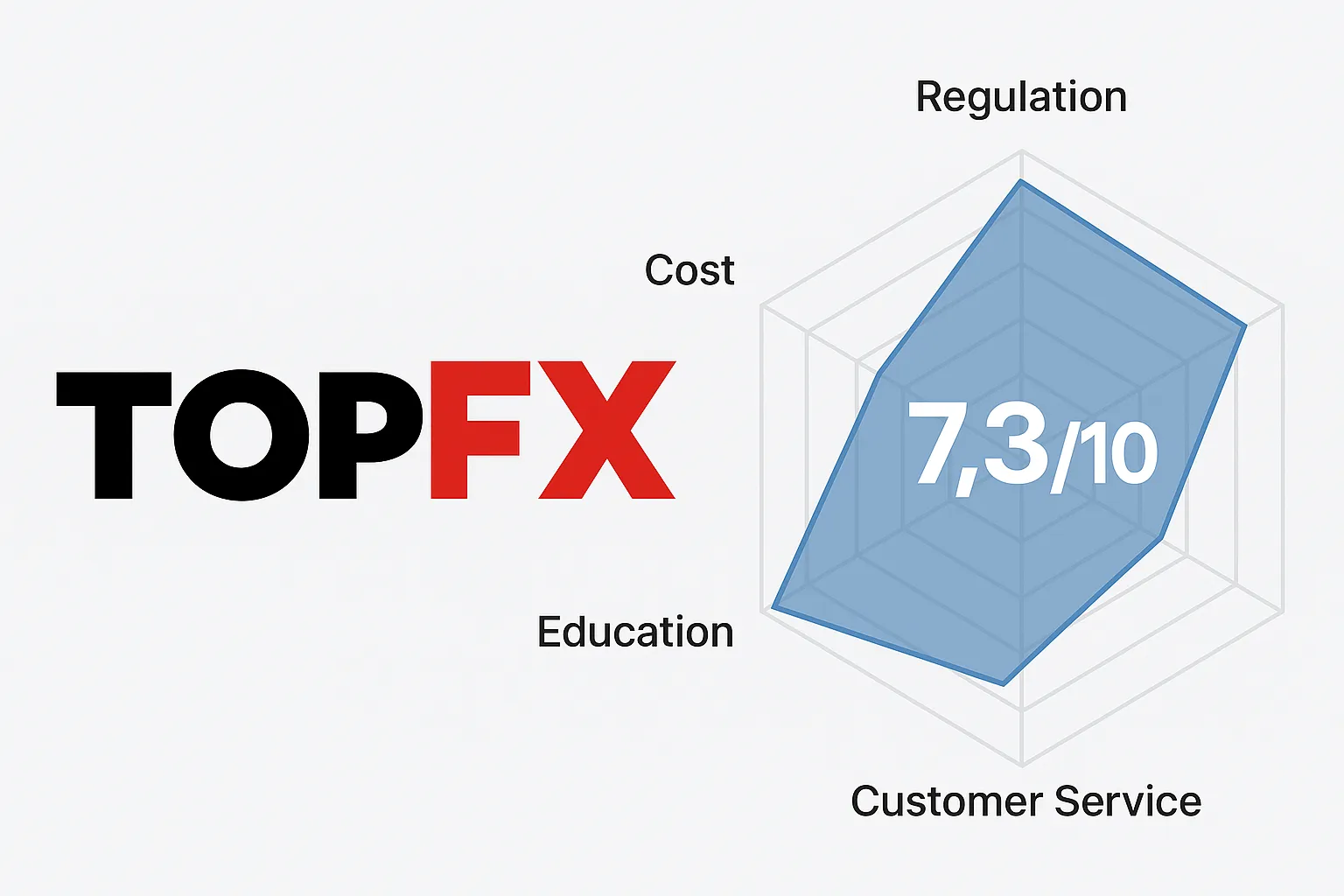

WikiFX : Rated approximately 7.3/10, it affirms its CySEC compliance but warns of risks associated with its Seychelles entity.

FX110 : Rated for its "transparent execution and suitable for experienced traders."

Forex Community : Users are generally satisfied with the low spreads on Raw accounts, but some report that withdrawal speeds are occasionally slow.

Finance Magnates : Reports on its differentiated advantages in the dual-track model of liquidity provision and retail services.

Test Account: Raw Account + cTrader

EUR/USD Spread : 0.0–0.2 pips

Gold spread : 0.15–0.25 USD/oz

Execution speed : average 55ms

Slippage : 0.1 pips in normal times, 0.3–0.4 pips in negative times during non-farm payroll periods

Withdrawal experience : Wire transfer arrives in 2 days

Conclusion : Good performance, in line with the ECN model propaganda.

| platform | Regulation | Spread/Commission | platform | Deposit | Features |

|---|---|---|---|---|---|

| TopFX | CySEC + FSA | Raw: Spread from 0.0 + $2.75 | MT4/5, cTrader | $100 | Liquidity + retail dual model |

| IC Markets | ASIC + CySEC | Raw: Spread from 0.0 + $3.5 | MT4/5, cTrader | $200 | Leading global liquidity |

| Pepperstone | ASIC + FCA | Raw: Spread from 0.0 + $3.5 | MT4/5, cTrader, TradingView | $200 | Strong supervision, multiple platforms |

| LMAX | FCA | Matching spread starts from 0.1 + commission | MTF+FIX | $1,000 | Institutional-level matching |

Conclusion: TopFX is suitable for the middle tier of users between retail and institutional.

Regulatory differences : CySEC and FSA branches have different regulatory levels.

Withdrawal risk : Some users reported that withdrawals were a bit slow.

Market risk : Highly leveraged transactions carry significant risks.

TopFX's dual positioning as a liquidity provider and retail forex broker gives it certain differentiated advantages in the industry:

Advantages : Dual regulation, low spreads on Raw accounts, cTrader support, and multilingual support.

Disadvantages : Withdrawal speed needs to be improved and research content is limited.

Suitable for :

High-frequency traders

cTrader users

Connect with IB/liquidity clients

Not suitable for people :

Newbies who rely entirely on front-line regulatory protection

Regulation : 7/10 — CySEC + FSA regulated, acceptable compliance.

Pricing : 8/10 — Raw accounts offer low spreads and reasonable commissions.

Execution : 8/10 — Low latency and stable execution.

Funding : 7/10 — Deposits are fast, but withdrawals can be delayed occasionally.

Support : 7/10 — Multi-language support, average response speed.

Education : 6/10 — Limited educational resources and lack of depth.

Product Range : 8/10 — Forex + Commodities + Crypto, comprehensive coverage.

Overall score : 51 / 70 ≈ 7.3 / 10 — Suitable for experienced retail and institutional traders, with overall stable performance.

Company Name:TopFX

Website:

https://topfx.com.sc/cn

7.42

Business Rating

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.