BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Is FXDD reliable? This article provides a comprehensive analysis of FXDirectDealer LLC (FXDD), including its background, regulatory status (MFSA), account types and spreads, execution models, deposit and withdrawal methods, customer service, user reviews, and media coverage. This article also includes competitive comparisons and risk warnings to help investors determine whether FXDD is safe and suitable for trading.

1. Brand Background and Development History

Full company name : FXDirectDealer LLC (operating under the brand FXDD)

Founded : 2002

Headquarters : Originally founded in New York, USA, and currently operates primarily in Malta

Regulation : Malta Financial Services Authority (MFSA)

Positioning : Initially a foreign exchange retailer focused on the US market, later transitioning to the European market

2002 : FXDD was founded in New York and obtained US NFA registration.

2006–2010 : Expanded into the Asian market and accumulated a large number of retail customers.

2011 : Due to stricter regulations in the United States, it gradually shifted to Europe and obtained the Malta MFSA license.

2014–2018 : In addition to the MT4/MT5 platforms, we launched our own WebTrader.

After 2020 : Strengthen European compliance and multilingual customer service, focusing on the Eurasian market.

It was once a major player in the US retail foreign exchange market , alongside Gain Capital and OANDA.

Now it is more inclined towards the European market and positioned as a medium-sized licensed broker .

FXDD offers two core account types:

| Account Type | Minimum deposit | Spread | commission | Platform support | Applicable people |

|---|---|---|---|---|---|

| Standard Account | $200 | From 1.5 pips | No commission | MT4 / MT5 / WebTrader | New users |

| ECN Account | $2,000 | From 0.0 pips | $6/standard lot (double-sided) | MT4 / MT5 | Professional, high-frequency traders |

Trading conditions :

Leverage : Up to 1:500 (1:30 for EU clients).

Minimum lot size : 0.01 lot.

Product coverage : foreign exchange, precious metals, index CFDs, commodity CFDs, and cryptocurrency CFDs.

Summary : The accounts are clearly differentiated, and both novice and professional users can find suitable options.

| entity | Place of registration | Regulatory agencies | License plate number |

|---|---|---|---|

| FXDirectDealer LLC | malta | MFSA (Malta Financial Services Authority) | IS/48817 |

MFSA regulation falls under the EU system (MiFID II framework), and client funds enjoy segregation protection.

The Investor Compensation Fund (ICF) is capped at €20,000.

However, compared with FCA and ASIC, the MFSA's regulatory intensity is still slightly weaker.

Forex : 50+ currency pairs

Metals : gold, silver

Index CFDs : S&P 500, Nasdaq 100, Dow Jones, DAX40

Commodity CFD : Crude oil, natural gas

Cryptocurrency CFDs : BTC, ETH, LTC, etc.

The coverage is moderate, with a good selection of index and crypto CFDs in particular.

Platforms supported : MT4, MT5, WebTrader

Execution mode : STP/ECN, no market maker model

Delay performance : 100–150ms, relatively stable

Slippage control : Slippage is controllable in stable market, and there is a certain negative slippage in turbulent market

Technical support : EA, API trading available, VPS service provided

Comparative advantages : It is better than some small brokers in terms of multi-platform selection , but its execution speed is slightly lower than that of top liquidity platforms.

Deposit methods : Wire transfer, Visa/MasterCard, Skrill, Neteller, cryptocurrency

Withdrawal methods : Wire transfer, e-wallet, cryptocurrency

Time to Funds : 1–3 days for wire transfers, instant for e-wallets, and several hours for cryptocurrencies

Fees : No internal handling fee, payer may charge a fee

Fund security : Deposited in segregated accounts, protected by MFSA client funds rules

Case :

A European customer deposited $500 via Visa and the money was credited to his account within minutes; he withdrew the money via wire transfer and the money was credited to his account within 2 days (the bank deducted a $15 fee).

Service hours : 5×24 hours

Channels : Email, Live Chat, Phone

Language : English, Chinese, Arabic, Spanish, Russian, etc.

Features : Provide rebate support for IBs and customized liquidity solutions for institutional clients

Educational resources : FXDD offers introductory forex articles and tutorial videos.

Market analysis : daily briefings and fundamental research reports

Disadvantages : Lack of research depth, more retail-oriented

WikiFX : Rated around 6.8/10, it emphasizes its MFSA compliance but reminds users to be cautious with offshore accounts.

FX110 : Comment: "As an established broker, its execution is transparent, but the number of users is declining."

Forex Community : Customer support is generally positive, but withdrawals can sometimes be slow.

Finance Magnates : Reported on its progress in business compliance in the Maltese market.

Test Account: ECN Account + MT5

EUR/USD Spread : 0.2–0.3 pips

Gold spread : 0.25–0.30 USD/oz

Execution speed : average 120ms

Slippage : Negative slippage of 0.4 pips during non-farm payroll data release

Withdrawal experience : Wire transfer arrives in 2 days

Conclusion : The performance is average and the stability is good.

| platform | Regulation | Spread/Commission | Platform support | Minimum deposit | Features |

|---|---|---|---|---|---|

| FXDD | MFSA | Spread from 0.0 + $6/lot | MT4/MT5/WebTrader | $200 | Old brand, long-lasting and stable |

| IC Markets | ASIC + CySEC | Spread from 0.0 + $3.5/lot | MT4/5, cTrader | $200 | Leading global liquidity |

| Pepperstone | ASIC + FCA | Spread from 0.0 + $3.5/lot | MT4/5, cTrader, TradingView | $200 | Strong supervision and excellent execution |

| Exness | FCA + CySEC | Spread from 0.0 + $3.5/lot | MT4/5 | $1 | Flexible leverage, fast withdrawal |

Conclusion: FXDD performs well in terms of compliance and stability, but is not as competitive as the top global platforms.

Regulatory differences : Only regulated by the MFSA, which is less stringent than the FCA/ASIC.

Withdrawal issues : Some users reported that the speed of wire transfers was unstable.

Market risk : Highly leveraged transactions carry higher risks.

FXDD, a long-established forex broker with over 20 years of experience, has an average overall performance:

Strengths : Long history, MFSA compliance, platform diversity (MT4/MT5/WebTrader)

Disadvantages : Limited regulatory intensity, average execution speed, superficial research content

Suitable for :

Traders who want to choose a compliant and established broker

Users who prefer MT4/MT5 platforms

Not suitable for people :

Newcomers to strong regulatory reliance

High-frequency trading and large-amount capital clients

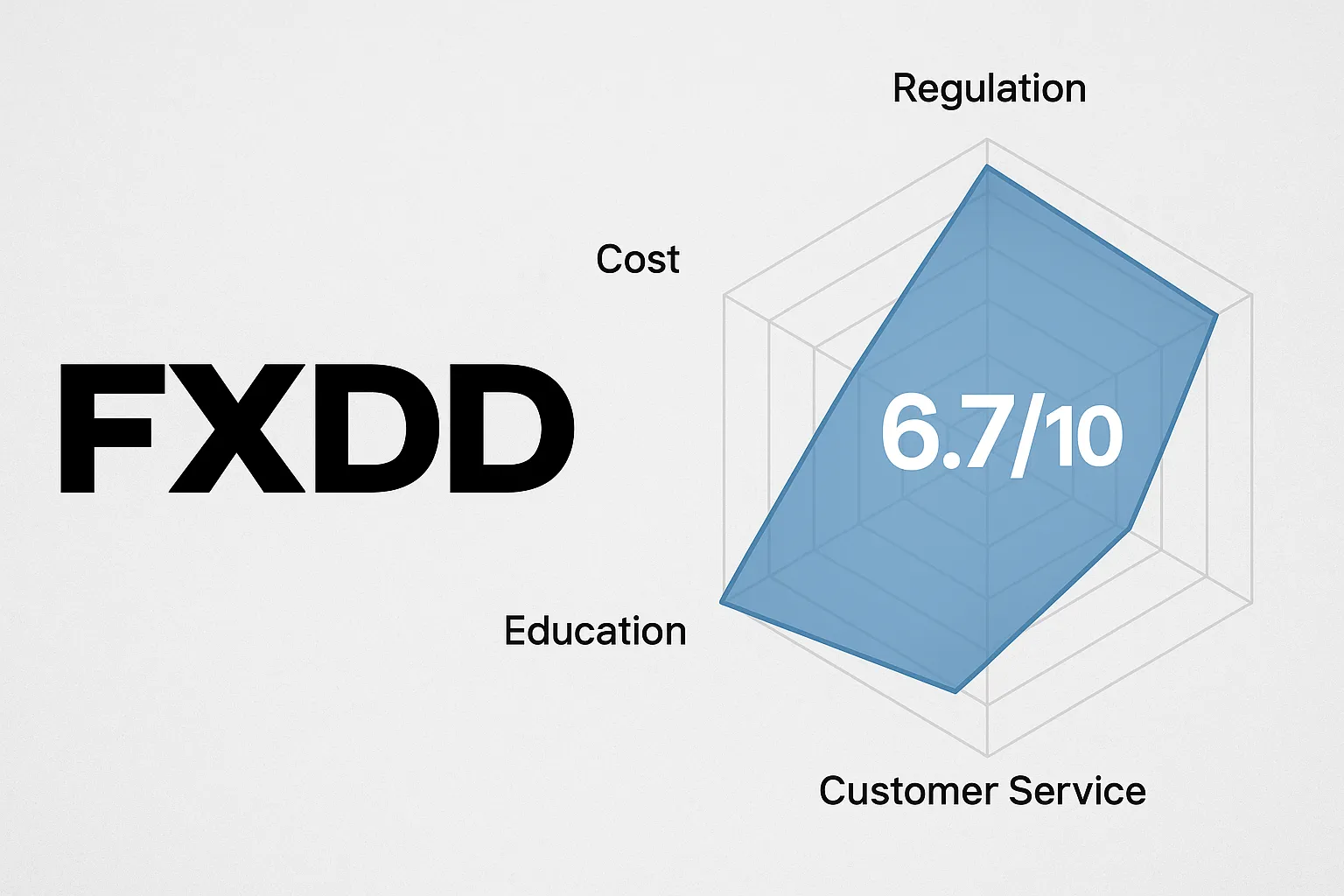

Regulation : 6/10 — regulated by the MFSA, with a medium level of compliance.

Pricing : 7/10 — ECN offers low spreads but slightly higher commissions.

Execution : 7/10 — Decent stability, average speed.

Funding : 7/10 — Deposits are fast, but withdrawals can be delayed occasionally.

Support : 7/10 — Multi-language support, normal responses.

Education : 6/10 - Limited basic information.

Product Range : 7/10 – Forex + Indices + Crypto, medium coverage.

Overall score : 47 / 70 ≈ 6.7 / 10 —— An old and stable brand, but with limited competitiveness.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.

I invested in what I believed was a legitimate trading platform, only to have the company vanish with my funds and cut all lines of communication. The sense of betrayal and helplessness was overwhelming. I had nearly given up hope when someone recommended Mrs. Bruce Nora, a specialist in financial fraud recovery. She not only took on my case but remained in constant contact, updating me on every development. With her help, I successfully reclaimed the full amount I had lost. Her commitment to justice and client support is beyond commendable. Anyone facing a similar nightmare should definitely reach out to her. Email: bruce nora2 54(@)gmail. com | .web, trazevault.org

I invested in what I believed was a legitimate trading platform, only to have the company vanish with my funds and cut all lines of communication. The sense of betrayal and helplessness was overwhelming. I had nearly given up hope when someone recommended Mrs. Bruce Nora, a specialist in financial fraud recovery. She not only took on my case but remained in constant contact, updating me on every development. With her help, I successfully reclaimed the full amount I had lost. Her commitment to justice and client support is beyond commendable. Anyone facing a similar nightmare should definitely reach out to her. Email: bruce nora2 54(@)gmail. com | .web, trazevault.org