TradeStation Review | Is TradeStation Reliable? A Complete Analysis of Regulatory Compliance, Trading Conditions, and User Reviews

Summary:Is TradeStation reliable? This 4,000+ word authoritative review comprehensively analyzes TradeStation Group, Inc.'s history, SEC/FINRA/NFA regulatory framework, account fees, execution performance, fund security, and user reputation. It also incorporates media reviews and risk warnings to help you determine whether TradeStation is safe and suitable for investment and quantitative trading.

1. Brand Background and Development History

Full company name : TradeStation Group, Inc.

Founded : 1982

Headquarters : Plantation, Florida, USA

Official website : https://www.tradestation.com

Parent company : Monex Group, Inc. (a publicly listed company in Japan)

TradeStation's history dates back to 1982, when it was founded by the Cruz brothers . Initially, it provided software focused on charting and algorithmic trading. By the 1990s, the TradeStation platform had become a staple among Wall Street traders and fund managers, renowned for its EasyLanguage programming language, which allowed investors to develop and backtest quantitative strategies.

Key development nodes

1980s : Launched charting and strategy software, laying the foundation for quantitative trading.

1990s : TradeStation gradually replaced some of the strategy development functions of the Bloomberg terminal.

2000s : Transformed into a full-license securities broker, providing stock, options, futures, and foreign exchange services.

2011 : Acquired by Japan’s Monex Group , becoming a key part of its global expansion.

2015–2020 : Focus on developing APIs, cloud computing, and quantitative tools, and gradually form a professional trading community.

2021–Present : Expanding crypto asset partnership channels to attract a new generation of retail investors.

Brand Positioning : TradeStation is a brokerage firm with "rigorous compliance + professional quantitative tools" as its core advantages, which distinguishes it from lightweight platforms such as Robinhood.

2. Trading Account and Trading Conditions

TradeStation offers different accounts, covering both casual investors and professional traders.

| Account Type | Minimum deposit | Trading categories | Commission structure | Suitable for people |

|---|---|---|---|---|

| Stocks & ETFs | $0 | US stocks, ETFs | Commission-free | Newbies and long-term investors |

| Options Account | $0 | US stock options | $0.60/contract | Intermediate and advanced traders |

| Futures Account | $500 | CME, ICE, CBOE | $1.50/contract per side | professional investors |

| Foreign exchange account | $2,000 | 80+ currency pairs | Spreads starting from 0.6 | High-frequency and quantitative trading |

| IRA/Retirement Accounts | $0 | Stocks/ETFs/Options | Discount structure | Long-term savings investors |

Cost breakdown

Stocks & ETFs : Zero commission, on par with Robinhood and Charles Schwab.

Options : $0.60/contract, slightly lower than Schwab ($0.65).

Futures : $1.50 per side, lower than IBKR ($1.85), with obvious cost advantage.

Forex : Spreads start from 0.6, which is lower than OANDA (1.0) and close to IC Markets.

User scenario analysis

Newbies : Zero commission stock account + platform with a steep learning curve and a threshold for experience.

Quantitative traders : ECN forex accounts, low futures commissions + powerful API.

Long-term investors : IRA accounts are friendly with educational support.

III. Supervision and Compliance

| Regulatory agencies | License number | Entity Name |

|---|---|---|

| SEC (U.S. Securities and Exchange Commission) | CRD# 39473 | TradeStation Securities, Inc. |

| FINRA (Financial Industry Regulatory Authority) | CRD# 39473 | Membership Holders |

| NFA (National Futures Association) | ID: 0339826 | TradeStation Futures & Forex |

Regulatory advantages

SEC/FINRA dual supervision : mandatory compliance with best execution, capital adequacy, anti-money laundering and other provisions.

NFA/CFTC : Ensure fair trading of futures and foreign exchange.

Investor Protection : Securities accounts are protected by SIPC (up to $500,000, including $250,000 in cash) .

Risk Reminder

International customers are not eligible for SIPC protection.

Leverage is limited (capped at 1:50 in forex), so beginners may find it unattractive.

IV. Trading Products and Market Coverage

Stocks & ETFs : Nasdaq, NYSE, AMEX full coverage

Options : US stock options full market

Futures : Covering all contracts of CME, CBOT, NYMEX, and ICE

Forex : 80+ currency pairs, liquidity directly from tier-one banks

Cryptocurrency : Cooperate with third parties to provide BTC/ETH trading channels

Features

Stocks and futures are core strengths, with depth and liquidity comparable to Interactive Brokers.

Foreign exchange is slightly inferior to OANDA and IG markets, but the spreads are reasonable.

The accessibility of cryptocurrency is lower than Binance.US, but it meets basic needs.

5. Trade Execution and Technical Performance

Platform support : TradeStation desktop, WebTrader, mobile, API

Technical highlights :

EasyLanguage : A dedicated programming language that supports strategy development, backtesting, and optimization.

API interface : supports Python, C++, and third-party quantitative frameworks.

Execution latency : <100 ms.

Transaction rate : 97%+, stable during peak periods.

contrast

Compared to Robinhood : It has much more powerful functions, but it is not suitable for complete beginners.

Compared to IBKR : Slightly more expensive, but more user-friendly.

Compared to eToro : quantitative and strategic tools are far superior.

6. Fund Deposit and Withdrawal Methods and Experience

Deposit method : ACH, wire transfer, check

Withdrawal method : mainly wire transfer

Arrival time :

ACH: 1–2 days

Wire transfer: 1–3 days

Fees : Free for ACH, $25 for wire transfers

User feedback

US customers : Funds flow smoothly, and the free ACH service has a clear advantage.

International customers : Channels are limited and withdrawal fees are relatively high.

7. Customer Service and Additional Features

Customer service channels : phone, email, online chat

Supported languages : English, Spanish

Time : US Eastern Time, not 24/7

Additional features :

Education Academy : Trader Academy Video Courses

Demo account : full function support

Strategy Market : Share or buy automated trading systems

8. Media and User Reviews

Media reviews

Investopedia : Rated as the "Best Professional Trading Platform" for many consecutive years.

Barron’s : Awarded the title of “Top Quantitative Trading Platform”.

NerdWallet : Claims to be “suitable for experienced investors.”

WikiFX : Reminder of international account opening restrictions.

BrokerHiveX : It scores relatively high and is considered to be the "first choice for technical traders."

User reputation

Positive reviews : The platform is comprehensive, quantitative-friendly, and has stable execution.

Negative reviews : High learning cost and lack of international customer service.

Case : American professional traders say "API interfaces are extremely advantageous"; Asian customers complain about the complicated account opening process.

9. Typical User Group Profile

Professional quantitative traders : benefit the most and use EasyLanguage and API to automate trading.

Ordinary retail investors : The cost advantage is obvious, but the learning curve is steep.

International investors : Account opening is restricted and the cost of capital inflow and outflow is high.

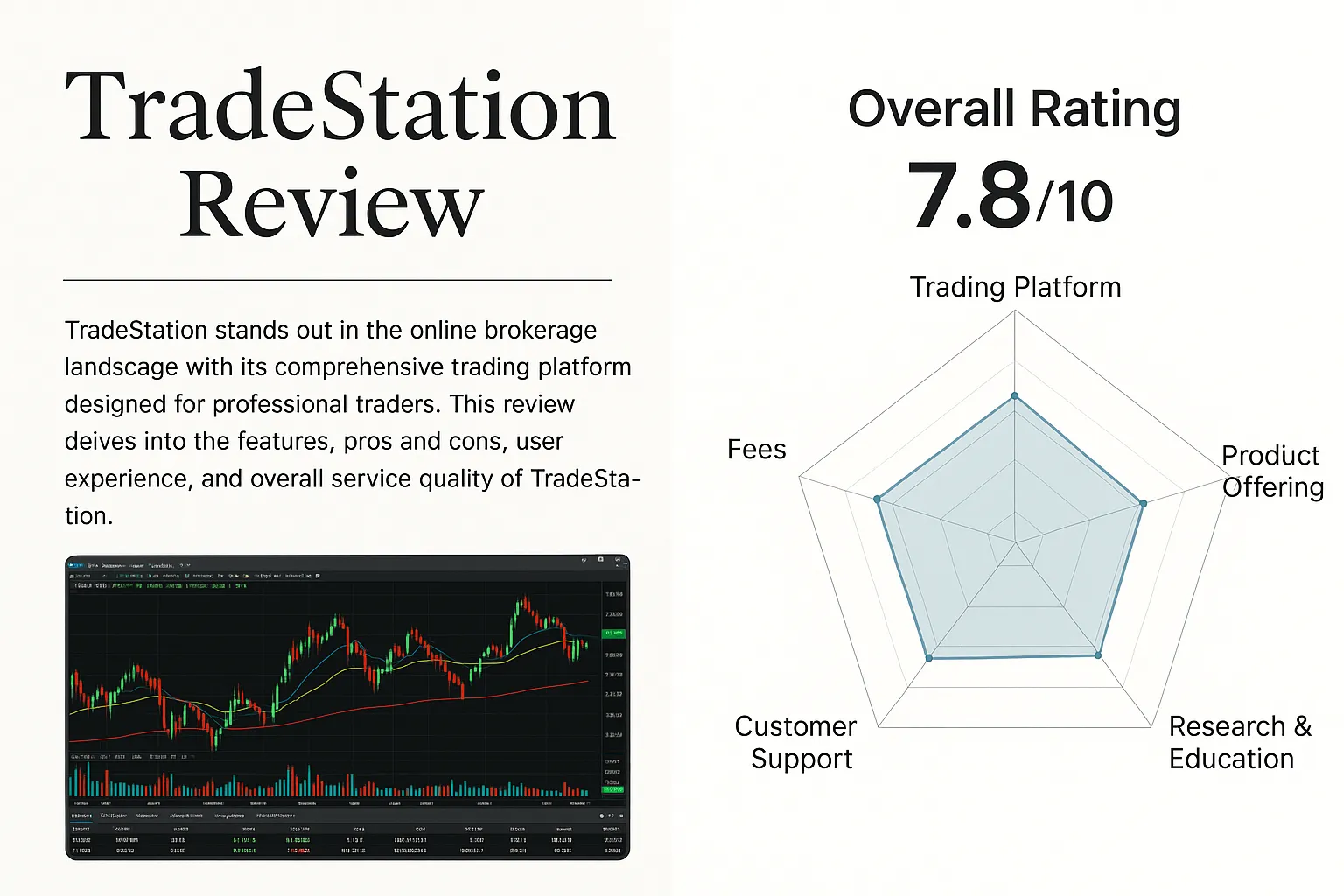

🔟 Multi-dimensional rating (out of 10, including comments)

Regulation : 9/10 - Top-level regulation in the United States, compliant and transparent.

Pricing : 7/10 — No commissions on stocks, reasonable costs on futures/forex, high withdrawal fees.

Execution : 9/10 — Very low latency and a powerful quantitative interface.

Funding : 7/10 — Smooth for US clients, limited for international clients.

Support: 7/10 — English/Spanish customer service , insufficient coverage.

Overall score: 7.8/10 — Ideal platform for professional quantitative trading, but lacks internationalization.

11. Risk and Compliance Reminders

Limited leverage : Not suitable for extremely high leverage speculation.

International customers : Account opening is restricted and deposits and withdrawals are inconvenient.

Novice users : The learning cost is high and they may be discouraged by complex functions.

12. Conclusion

TradeStation is a long-established, strictly regulated, US online brokerage focused on professional traders :

Advantages : top-level supervision, commission-free stock trading, and leading quantitative tools.

Disadvantages : Inconvenience for international customers, no 24/7 customer service, high learning curve.

Suitable:

Professional quantitative developer and long-term investor in US stocks .

Not suitable for:Completely new, non-US investors .

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.