OctaFX: Fraud Exposed | Is OctaFX a Scam Broker or Legit? Full Review & Warnings

Summary:Is OctaFX a scam? This article, citing India's Enforcement Directorate (ED) investigation, FPA user complaints, and Trustpilot reviews, reveals OctaFX's money laundering investigations, lack of regulation, and withdrawal risks. Is OctaFX a scam broker or legit? A full 2025 review with warnings, evidence, and BrokerHiveX ratings.

1. Platform Background and Current Status of the Official Website

OctaFX was founded in 2011 and is headquartered in Cyprus , operating the official website octafx.com .

Official Website Status : As of August 2025, the official website is accessible, providing account registration and MT4/MT5 trading platforms.

Promotional claims : Millions of customers, low spreads, fast deposits and withdrawals, and global sponsorship cooperation.

However, there are major doubts about its true regulatory background: in most countries and regions, OctaFX does not obtain local regulatory licenses , but provides financial services to local customers.

II. Regulatory and Compliance Issues

1. Registration and regulatory deficiencies

OctaFX is registered in Cyprus as Octa Markets Cyprus Ltd and is regulated by CySEC.

However, its global entity , Octa Markets Incorporated, is registered in Saint Vincent and the Grenadines (SVG) , a typical offshore company . The SVG government does not regulate forex brokers , leaving the security of funds unprotected.

👉 SVG FSA Official Description

2. Indian money laundering investigation

India's Enforcement Directorate (ED) investigated OctaFX in 2022, accusing it of illegal foreign exchange trading and money laundering in India, involving a total amount of 80 billion rupees (about US$160 million) .

👉 Times of India report

3. Regulatory warnings from multiple countries

Malaysia SC : Named OctaFX as operating without a license.

Indonesia's OJK : Banned from providing foreign exchange trading to local customers.

Europe : Only Cyprus clients are regulated by CySEC, while clients in other regions are in an “unregulated” state.

3. Trading Conditions and User Experience

Official website promotion

Spreads as low as 0.6

Fast execution

Instant deposits and withdrawals

User feedback

The actual spread is higher than advertised

Severe platform slippage

Withdrawals are slow and sometimes even rejected 👉 FPA user reviews

Common Complaints

“Customer service keeps urging us to make additional investments”

“I was asked to pay additional fees before my profits were credited to my account.”

"Account frozen for no reason"

IV. Fund Security and Withdrawal Risks

1. FPA User Complaints

“OctaFX froze my withdrawal request without explanation.”

“They blocked my account after I made profit.”

👉 Forex Peace Army Complaint

2. Trustpilot rating

OctaFX has a rating of only 2.2/5 on Trustpilot , and many users have reported difficulty in withdrawing funds.

3. Complaint channel records

WikiFX's low risk rating indicates that most of OctaFX's clients are not protected by CySEC.

5. Media and Third-Party Exposure

Times of India : OctaFX is suspected of money laundering and Indian police are investigating its operations.

WikiFX : Risk rating is "low", indicating failed withdrawal cases.

BrokerChooser : OctaFX is not recommended because “most of its clients are unregulated.”

6. Typical User Cases

Case A (India) : Investors were unable to withdraw funds after making deposits and eventually discovered that the platform was under investigation by the ED.

Case B (Indonesia) : Users traded in an unregulated environment and their profitable accounts were directly blocked.

Case C (Europe) : Despite CySEC regulation, withdrawals were severely delayed, taking over two months to arrive.

7. Summary of Black Platform Routines

OctaFX's behavior conforms to the following typical patterns of fraudulent platforms:

Dual-entity structure : Using a Cyprus company as a "compliance front", most clients actually open accounts with SVG offshore companies.

High-profile publicity : Covering up the lack of regulation through sports sponsorship and advertising.

Withdrawal obstacles : delays, additional fees, and account suspension.

Regional illegal operations : operating without a license in India, Indonesia, etc.

8. Comparison with Compliant Platforms

| platform | Regulatory agencies | Withdrawal speed | User reputation | Risk Level |

|---|---|---|---|---|

| IG | FCA, ASIC | 1–2 days | high | ⭐ |

| OANDA | NFA, ASIC | 2–3 days | high | ⭐ |

| Pepperstone | ASIC, FCA | 1–3 days | high | ⭐ |

| OctaFX | CySEC + SVG | Slow withdrawal/frozen | Difference | ❌ |

IX. Difficulties in Investor Rights Protection

Offshore structure : Most clients are under the jurisdiction of SVG companies and have no channels to protect their rights.

Cross-border complaints are complex : involving the Indian/Indonesian/European judicial systems.

No compensation fund : Client funds are not segregated and are not protected by a guarantee fund.

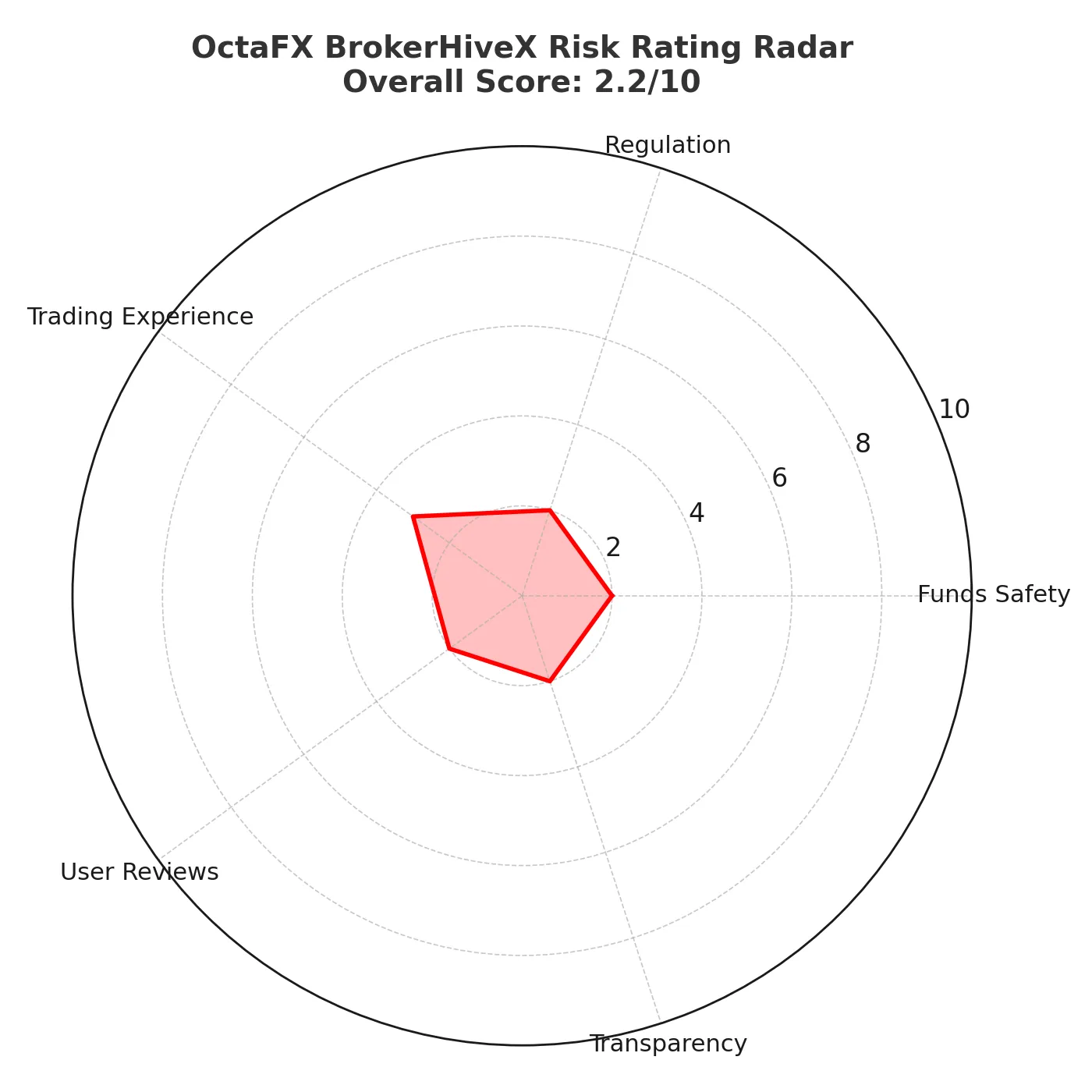

10. BrokerHiveX Style Score

Fund security : 2/10 (withdrawal freeze cases are serious)

Regulatory Compliance : 2/10 (CySEC only covers a small number of clients, most are unregulated)

Trading experience : 3/10 (slippage, latency)

User reputation : 2/10 (Trustpilot/FPA has a lot of negative reviews)

Transparency : 2/10 (dual-entity structure, unclear information)

Overall Rating: 2.2/10 → High-risk scam platform ⚠️

👉 BrokerHiveX Conclusion : Although OctaFX actively promotes itself on its official website and has a regulated entity in Cyprus, most clients actually open accounts with unregulated offshore companies. Withdrawal risks are enormous and some clients may even be involved in money laundering investigations. We strongly recommend staying away from OctaFX.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.