BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX 东方顾问

东方顾问Summary:Is UFX a scam?

Citing FCA warnings , CySEC announcements , CONSOB bans , FPA complaints , and Trustpilot user reviews , this article reveals UFX's transformation from "fake compliance" to "offshore black market," detailing regulatory penalties, user fund risks, and fraudulent schemes. Is UFX a scam broker or legit? A full 2025 review with scam warnings and BrokerHiveX ratings.

UFX was originally registered in Cyprus by Reliantco Investments Ltd. and was authorized by CySEC (Cyprus Securities and Exchange Commission) .

Official website domain name : www.ufx.com (still active as of August 2025)

Historical publicity : A leading global forex broker, offering MT5 and proprietary trading platforms, with tens of millions of registered customers

Actual situation :

From 2017 to 2019, CySEC penalized the company for multiple violations.

Completely lost regulatory license in 2020

Currently, the main body has been transferred to the Marshall Islands , and it has completely become an offshore unregulated platform

UFX has been fined several times by CySEC for “misleading clients, failing to fully disclose risks, and selling highly leveraged products.”

👉 CySEC announcement link

In 2017, the amount of fines reached $750,000 , setting one of the records for that year.

In 2020, Reliantco Investments Ltd. voluntarily relinquished its CySEC license.

From then on, UFX became a completely unregulated platform .

FCA (UK) : UFX promotes financial services to UK investors without authorization.

👉 FCA Warning

CONSOB (Italy) : Blacklisted and banned from providing investment services.

👉 CONSOB Warning List

ASIC (Australia) : Added its website to the investment blacklist.

Conclusion: UFX has completely fallen from being a “once compliant” to being an “offshore black platform”.

Spreads as low as 0.7

Proprietary platform MassInsights™ (market sentiment analysis tool)

Bonuses and Promotions

24/5 customer support

Spreads are inflated : far exceeding the advertised data

Slippage and churn : Orders cannot be executed, especially during news.

Forced liquidation : Some user accounts were manipulated by backend to liquidate 👉 FPA user complaints

This is the area where UFX receives the most complaints.

FPA users :

“They blocked my withdrawal request and forced me to deposit more money.”

“After CySEC license was gone, withdrawals became impossible.”

👉 FPA Complaint

Trustpilot User :

“UFX is a scam. They keep calling me to deposit, but never processed my withdrawal.”

👉 Trustpilot review

Mandatory additional deposit before withdrawal

Charging so-called "handling fees/taxes"

Directly freeze profitable accounts

| platform | Regulatory agencies | Withdrawal efficiency | Risk Level |

|---|---|---|---|

| IG | FCA, ASIC | 1–2 days to arrive | ⭐ |

| OANDA | NFA, ASIC | 2–3 days to arrive | ⭐ |

| UFX | No regulation/multi-national warnings | A large number of withdrawal failures | ❌ |

WikiFX : Very low risk rating, marked as unregulated.

BrokerChooser : Puts it on the "high risk list."

TradersUnion : It pointed out that its regulatory license has been revoked and it is a false advertising platform.

European case (Italy) : The investor discovered that his account was frozen only after being alerted by CONSOB, and the funds of 8,000 euros could not be recovered.

Asian case (Malaysia) : Due to bonus terms and conditions, users were unable to withdraw their account balances.

Middle East case (UAE) : Customer service forced the customer to invest a large sum of money, and the account was blocked after the customer refused.

UFX's tactics are representative:

Fake compliance : CySEC license used as publicity stunt

MassInsights™: A Disinformation Tool with No Value

Aggressive marketing : bombarding customer service calls to induce additional investment

Withdrawal problems : frozen profits, additional fees, withdrawal rejections

Offshore shell companies : Marshall Islands companies conceal the true owners

FCA Complaints: FCA Scam Reporting

CONSOB Complaints: CONSOB Contact

CySEC Complaints (historical): CySEC Complaints

License has been revoked → No regulatory authority

The Marshall Islands has a weak judicial environment, making it difficult to file complaints.

Customer service lost contact → chain of evidence difficult to complete

Stay away from unregulated/offshore platforms

Check the validity of the license before depositing

Save all transaction and communication records

| platform | Regulatory status | Complaint Focus | Risk Level |

|---|---|---|---|

| Brokerz | No regulation | Withdrawal freeze | ❌ |

| Umarkets | FCA warning | Mandatory additional investment | ❌ |

| LMFX | CNMV Warning | Slippage and liquidation | ❌ |

| Trade12 | Regulatory warnings from multiple countries | Withdrawal failed | ❌ |

| UFX | License revoked/ FCA & CONSOB warning | Funds frozen | ❌ |

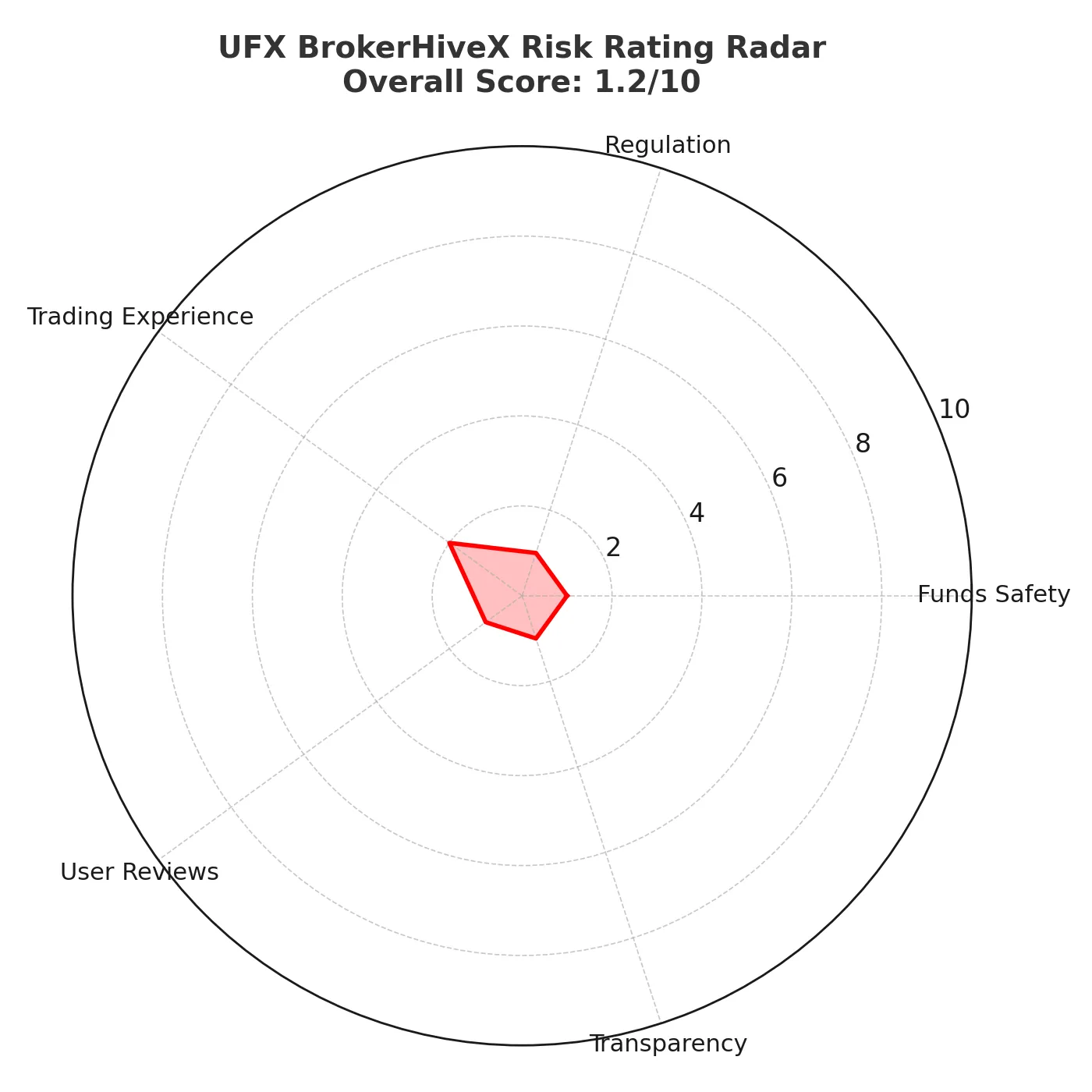

Fund security : 1/10 → Numerous withdrawal failures

Regulatory compliance : 1/10 → License revoked, warnings from multiple countries

Trading Experience : 2/10 → Slippage and Margin Call Complaints

User reputation : 1/10 → Trustpilot/FPA negative reviews concentrated

Transparency : 1/10 → Offshore structure, information opacity

Overall rating: 1.2/10 → Highly risky scam platform🚨

👉 BrokerHiveX Conclusion : UFX has completely fallen from a "compliant" appearance to an "offshore black platform" and has been named by regulators in many countries. Investors are strongly advised to stay away from it.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.