FXTM: A Scam Broker or Legit? Full Review & Warnings

Summary:Is FXTM a scam? This article details FXTM's regulatory loopholes, slippage issues, and withdrawal difficulties.

Citing authoritative sources like FCA warnings , CySEC complaints , Forex Peace Army complaints , and Trustpilot user reviews . Is FXTM a scam broker or legit? A full 2025 review with scam warnings and BrokerHiveX ratings.

1. FXTM Platform Background and Current Status of the Official Website

FXTM (ForexTime) was founded in 2011, with its official website at www.forextime.com , and has claimed that its headquarters is located in Cyprus .

Official website status : As of August 2025, the official website is still active and supports account registration.

Platform promotion : Provides foreign exchange, precious metals, and CFD trading, focusing on low spreads, high leverage and strong educational support .

Regulatory issues :

It has engaged in illegal operations in multiple countries and has been punished and warned many times, especially in the UK and Australia .

The main license comes from Cyprus CySEC , but there are still regulatory loopholes.

2. Company Registration and Legal Entity Analysis

ForexTime Ltd., the company behind FXTM, is registered in Cyprus , a region with lax regulation that allows forex brokers to operate under relatively low compliance standards.

Its FCA and ASIC licenses helped it establish some credibility in the early stages of its business development, but over time, multiple negative feedback and regulatory violations began to emerge.

CySEC (Cyprus Securities and Exchange Commission) is its main regulatory body, but the agency does not fully review all trading activities , and some issues on the platform are not effectively supervised.

3. Regulatory and Compliance Issues

1. Penalties imposed by FCA and ASIC

FCA (UK) : Issued warnings and imposed penalties on FXTM for multiple non-compliant practices (such as misleading advertising).

👉 FCA warningASIC (Australia) : Regulatory action has been taken against FXTM for violations in Australia involving market manipulation, slippage and client funds security issues.

👉 ASIC official announcement

2. CySEC and other regulatory shortcomings

CySEC (Cyprus) : Although FXTM is regulated by CySEC, its supervision has loopholes and fails to adequately regulate the actual operations of the platform .

There are multiple records of violations and penalties , and the current license does not cover the regulation of all foreign exchange products.

3. Regulatory risks

No fund isolation mechanism

No investor compensation fund (such as FSCS, ICF)

Incomplete regulatory coverage

These issues mean that investors have little protection when problems occur on the platform.

4. Trading Conditions and User Feedback

Official website promotion

Spread : as low as 0.1

Leverage : up to 1:1000

Account Type : Standard, ECN, VIP

Other services : automated trading, social trading, MT4/MT5 support

User feedback

According to feedback from multiple users, the actual trading experience with FXTM differs significantly from what is advertised on the official website, particularly in the following aspects:

Inflated spreads : In actual transactions, the spreads are 2–3 times higher than those advertised on the official website.

Severe slippage : Users reported that orders could not be executed during news quotes and slippage was significant.

Withdrawal problems : Withdrawal review takes too long, and withdrawals may even fail.

👉 FPA user reviews

V. Fund Security and Withdrawal

1. FPA Complaints

“FXTM rejected my withdrawal request. They told me to deposit more before I could withdraw any money.”

“My account was blocked for no reason, and my profits were seized.”

👉 FPA Complaint

2. Trustpilot user reviews

On Trustpilot , FXTM has a rating of only 2.2/5 , with most negative reviews focusing on:

Withdrawal declined

Severe slippage

Customer service does not reply to emails

3. Common withdrawal obstacles

Requires additional tax payment when withdrawing cash

After the account was frozen, customer service lost contact

Funds have not been returned yet

VI. Media and Third-Party Exposure

WikiFX : A low risk rating indicates it is not fully regulated, and some users have complained about withdrawal difficulties.

BrokerChooser : Lists it as a "not recommended platform", pointing out that some of its market operations are opaque.

TradersUnion : Warning investors that FXTM is at risk of withdrawal failure and account freezing .

7. Typical User Cases

European investors : Their accounts were frozen by the platform before their withdrawal applications were completed, and they were subsequently unable to contact customer service.

Indian users : Profitable accounts were frozen and required to pay additional "taxes and fees" before withdrawals could be made.

Argentinian user : After recharging, I contacted customer service, but was unable to withdraw the funds smoothly. Ultimately, the funds were frozen and I had no way to complain.

8. Detailed explanation of fraudulent platform tactics

FXTM uses the following typical fraudulent trading tactics:

Falsified compliance documents : Claiming to be regulated by CySEC without providing valid proof.

False propaganda and high leverage inducement : vigorously promote high leverage, but the risks are extremely high, resulting in users' margin calls.

Forced additional investment : After the user's account becomes profitable, they are required to top up more funds, otherwise they will not be able to withdraw cash.

Withdrawal obstacles : freezing accounts and requiring users to pay additional fees.

IX. Comparison with Compliant Platforms

| platform | Regulatory agencies | Withdrawal efficiency | User reputation | Risk Level |

|---|---|---|---|---|

| IG | FCA, ASIC | 1–2 days to arrive | high | ⭐ |

| OANDA | NFA, ASIC | 2–3 days to arrive | high | ⭐ |

| FXTM | No regulation/multi-national warnings | Withdrawal failed | Difference | ❌ |

10. Investor Rights Protection and Legal Recourse

1. Complaint channels

FCA Complaints: FCA Scam Reporting

CONSOB Complaints: CONSOB Contact

CySEC Complaints

2. Difficulties in protecting rights

Since the platform is registered offshore, it is difficult for users to protect their rights

Customer service is out of contact, and there is no way to complain

Limited judicial channels and high difficulty in cross-border rights protection

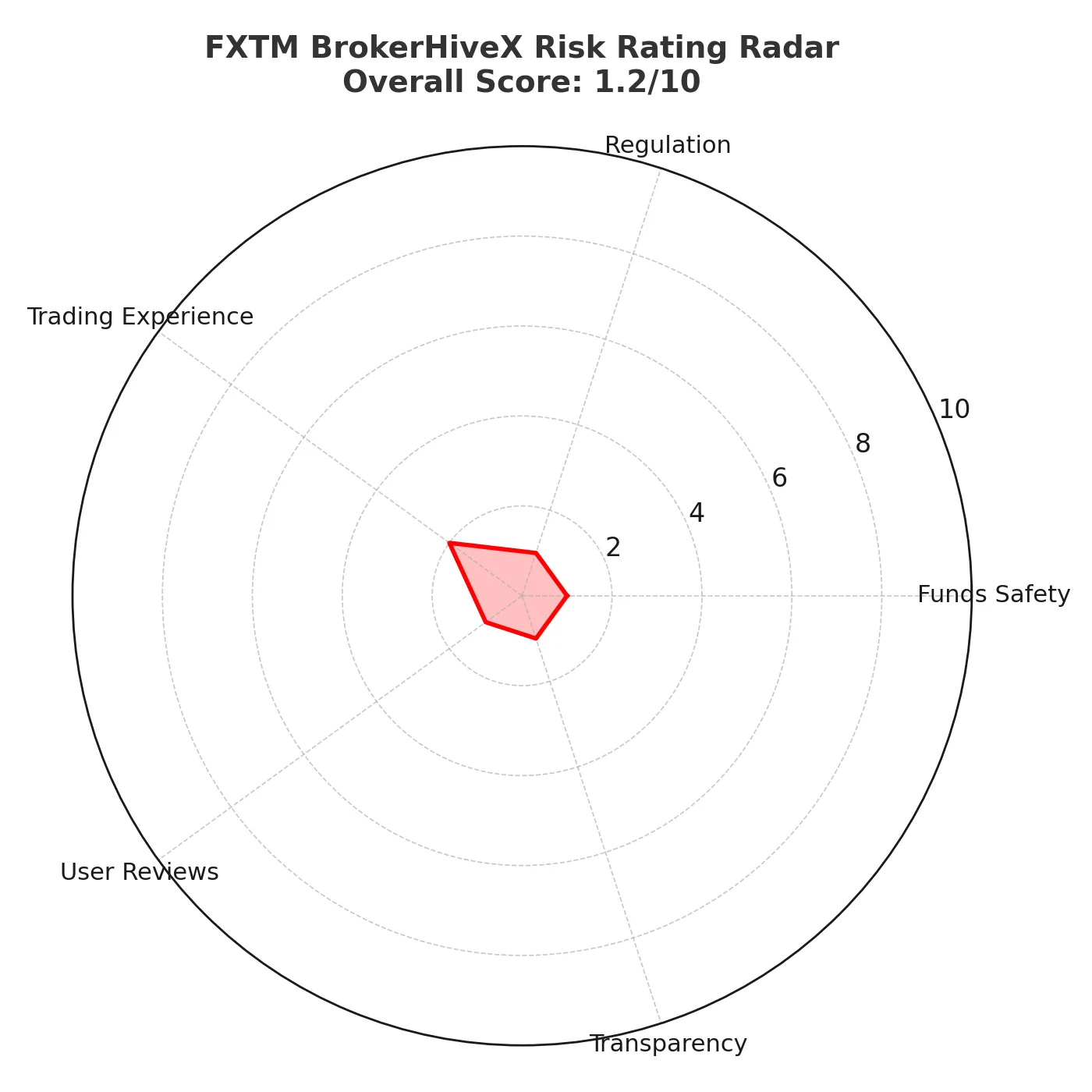

11. BrokerHiveX Rating

Fund security : 1/10 → A large number of withdrawals failed and accounts were frozen

Regulatory Compliance : 1/10 → No effective regulation, history of CySEC penalties

Trading Experience : 2/10 → Severe slippage and inflated spreads

User reputation : 1/10 → Trustpilot/FPA negative reviews concentrated

Transparency : 1/10 → Offshore registration, serious lack of transparency

Overall rating: 1.2/10 → Highly risky scam platform🚨

👉 BrokerHiveX Conclusion : FXTM is a typical offshore black platform that has been warned by multiple regulators and has frequent withdrawal problems. Investors are strongly advised to stay away from it.

FXTM

Company Name:Forextime Ltd

Website:

https://www.futuo-fx.biz/zh-CN/

9.19

Business Rating

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.