BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Is Kraken reliable? This article comprehensively analyzes Payward Inc. (Kraken Exchange)'s history, regulatory compliance, trading conditions, security measures, deposit and withdrawal channels, and user reputation. Combining third-party data and media reviews, this article helps investors determine whether Kraken is safe and whether it's a scam.

Founded in 2011 and headquartered in San Francisco, California, Kraken is one of the world's earliest cryptocurrency exchanges, founded by Jesse Powell . It positions itself as a compliant, secure, and established platform suitable for professional investors .

Registered entity : Payward Inc.

Founded : 2011

Headquarters : California, USA

User scale : More than 9 million registered users, with business covering 190+ countries.

Positioning : One of the most regulated crypto exchanges in the United States, alongside Coinbase.

Key Milestones :

2013: BTC/USD, LTC/EUR and other trading pairs were launched.

2014: Becomes one of the first exchanges to display crypto data via the Bloomberg terminal.

2020: Obtained a banking license in Wyoming, USA, becoming the first crypto bank.

2022: Earn products were taken offline due to SEC review, indicating that it chose a conservative approach under compliance pressure.

Kraken offers three main trading interfaces: Kraken Simple, Kraken Pro, and Kraken Futures .

| Platform version | Minimum deposit | Fee Structure | Applicable people |

|---|---|---|---|

| Kraken Simple | $10 | 0.9%–1.5% | Novice investors, simple interface |

| Kraken Pro | $20 | Maker 0.16% / Taker 0.26% | High-frequency and professional traders |

| Kraken Futures | $50 | Handling fee 0.02%–0.05% | Derivatives traders |

Differentiated features :

Kraken is a leader in fiat currency support , supporting more than 8 major fiat currencies (USD, EUR, GBP, JPY, CAD, CHF, AUD, etc.).

Leverage : The maximum leverage for spot trading is 5 times, and the maximum leverage for futures trading is 50 times.

Liquidity : Mainstream trading pairs have good liquidity depth and are suitable for large capital inflows and outflows.

Kraken is a model in the industry in terms of compliance:

| area | Regulatory agencies | Entity Name |

|---|---|---|

| USA | FinCEN MSB Registration | Payward Inc. |

| Canada | FINTRAC Registration | Payward Canada |

| Europe | BaFin (Germany), AMF (France), etc. | Kraken Europe Ltd. |

| U.K. | FCA registered | Payward Ltd. |

| Australia | AUSTRAC registration | Kraken Australia Pty Ltd. |

👉 Kraken is on par with Coinbase in the United States, and its compliance status is much higher than overseas platforms such as Binance/OKX.

Kraken's product matrix is relatively robust. It doesn't pursue "all-round" functionality, but rather emphasizes professional trading and security :

Spot trading : supports 200+ currencies.

Futures contracts : 50x leverage, covering BTC, ETH, XRP, and LTC.

OTC block trading : suitable for institutional users.

Staking service : provides annualized returns of 3%–12% for ETH, DOT, ADA, etc., but was forced to go offline in the US market.

NFT Marketplace : Beta version launched in 2022.

Comparison with competitors :

Binance: More product types, but significant compliance disadvantages.

Kraken: Relatively few products, but with strong regulation and a high reputation for security.

Kraken’s biggest selling point is security , and it is considered one of the safest exchanges in the world.

Cold wallet reserves : 95% of assets are stored in cold storage.

Two-factor authentication (2FA) : Supports Google Authenticator and YubiKey.

Bug bounty program : long-term operation, attracting white hat hackers to participate.

Audit system : Proof of Reserves (PoR) is published regularly.

Historical security record : Kraken has never experienced a major hacking incident .

Comparative advantage : This is Kraken’s biggest brand trust point compared to Binance and Crypto.com.

Deposit : Support bank wire transfer, SEPA, SWIFT, ACH .

Withdrawal : Fiat currency arrives quickly, usually within 1–3 days.

Transaction Fees : Different fiat currencies have different withdrawal fees, which are generally lower than Coinbase.

Supported languages : English, French, Spanish, German, Japanese.

Contact us : [email protected] + 24/7 online customer service.

evaluate :

Advantages: fast processing speed and high professionalism.

Disadvantages: Delayed customer service response during the peak of the bull market.

Forbes : Calls Kraken “one of the most trusted crypto exchanges.”

CoinDesk : Emphasizes its stability and compliance in the US market.

Trustpilot : 3.8/5. Users praise its security and withdrawal experience, but criticize its interface as not as flexible as Binance.

Regulatory challenges : The US SEC has strict restrictions on pledge services and derivatives.

Competitive challenges : Striving to capture the US compliance market simultaneously with Coinbase, and insufficient marketing efforts.

Market risk : A conservative strategy may result in user growth being lower than that of emerging exchanges.

Kraken's future development direction is compliance-first + institutional users while maintaining security advantages.

It is expected to further expand into the European and Asian markets , but will not pursue an “all-round super application” like Binance.

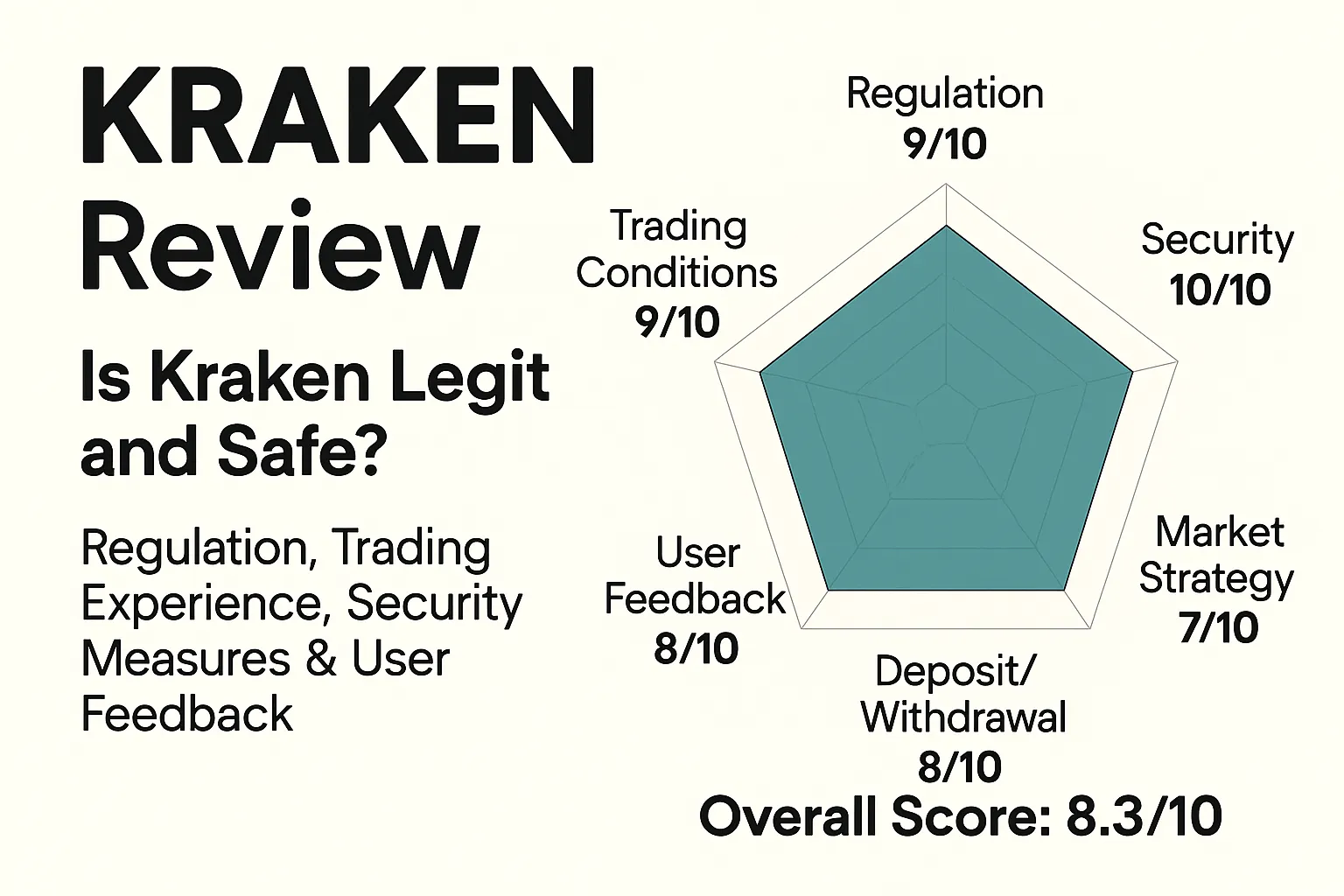

Regulatory Compliance: 9/10 — Fully compliant with US/Europe, solid position.

Trading Conditions: 8/10 — Fiat currency support is comprehensive, but the range of currencies is less than Binance.

Security: 10/10 — No major hacking incidents in history.

Deposit and Withdrawal Experience: 8/10 — Smooth fiat access and reasonable fees.

User reputation: 8/10 - Security is good, and the interface experience is average.

Marketing strategy: 7/10 — Robust but conservative, with insufficient brand exposure.

👉 Overall score: 8.3/10

Kraken is one of the world's most secure and compliant exchanges, particularly well-suited for institutional investors and long-term holders who prioritize security and compliance . It's not a scam, but rather one of the industry's oldest and most trusted platforms. While its shortcomings include a lack of innovation and a somewhat conservative interface , its overall performance far surpasses most overseas exchanges.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.