Huobi (HTX) Review | Is Huobi a Scam? A Complete Analysis of Its Global Layout, Regulatory Challenges, Security, and User Reputation

Summary:Is Huobi (HTX) reliable? This article deeply analyzes Huobi Global (now HTX), its development history, global compliance, trading conditions, security performance, and user reputation. Drawing on media coverage and real-world examples, this article answers questions like "Is Huobi a scam?" and "Can HTX still be used safely?"

1. Brand Background and Development History

Huobi was founded in 2013 by Leon Li and was originally headquartered in Beijing, China. It is one of the earliest cryptocurrency trading platforms in China.

Founded : 2013

Original headquarters : Beijing, China (later moved to Singapore and then expanded to Dubai)

Parent company : Huobi Global, now branded as HTX

Core markets : Asia, Europe, Middle East

User scale : more than 10 million registered users

Important development nodes :

2017: Huobi relocates its headquarters to Singapore following China’s blanket ban.

2019: Obtained compliance qualifications in Japan, South Korea and other places.

2020: Expansion into the Middle East and Europe.

2022: Actual acquisition by Justin Sun (founder of Tron) , brand adjustment.

2023: The brand is officially changed to HTX , targeting Binance.

2. Trading Account and Conditions

Huobi provides a multi-level trading experience:

| Account Type | Minimum deposit | Fee Structure | Applicable people |

|---|---|---|---|

| Ordinary account | $50 | Maker 0.2% / Taker 0.2% | Ordinary users |

| VIP Account | $1000 | Maker 0.07% / Taker 0.07% | High-frequency traders |

| Institutional Account | $100,000 | Negotiated price | Institutions and large investors |

Differentiated features :

Supports more than 500 currencies and 1000+ trading pairs , which is far more than Coinbase and Kraken.

Leveraged trading : Up to 125x leverage (much higher than Coinbase/Kraken).

Derivative products : futures, perpetual contracts, options, with wide coverage.

Innovative features : Huobi Earn, staking and investment management, and mining pool services.

III. Supervision and Compliance

Huobi’s compliance path is complex:

| area | Regulatory situation | Entity Name |

|---|---|---|

| Japan | FSA License | Huobi Japan |

| South Korea | FIU License | Huobi Korea |

| Dubai | VARA temporary license plate | Huobi Middle East |

| Europe | Partial Registration | Huobi Europe |

| USA | Stop service | No US license |

👉 Compared to Coinbase and Kraken, Huobi's compliance disadvantages are obvious, especially due to its forced withdrawal from the US market. However, in the Asian market, it forms a "three-legged race" with OKX and Binance.

IV. Trading Products and Services

Huobi's product matrix is very rich:

Spot trading : 500+ currencies, maintaining long-term activity in the Asian market.

Contract trading : With a maximum leverage of 125 times, it is the main choice for derivatives users.

Financial products : staking, lending, and income-generating products to attract long-term holders.

Mining pool business : Huobi Pool, once one of the top five BTC mining pools in the world.

NFT market : in the exploratory stage, not yet scaled up.

5. Security and Technical Architecture

Huobi once enjoyed a strong reputation for security, but this has been questioned in recent years.

Safety measures :

98% of funds are stored in cold wallets

Multi-signature withdrawal mechanism

Anti-money laundering and risk control system

Security incidents :

2015: Small-scale theft, but compensation was paid to users.

After 2021: There will be no large-scale public hacking incidents, but the security and transparency of funds will be questioned by the outside world.

Comparative advantages : Compared with Binance and OKX, Huobi places more emphasis on cold wallet security, but the disclosure of Proof of Reserve (PoR) is not frequent enough.

6. Deposit and Withdrawal Experience

Supported fiat currencies : CNY (disabled), USD, EUR, VND, TRY, etc.

Deposit methods : bank card, third-party payment, P2P over-the-counter transaction.

Withdrawal experience : Withdrawals in the Asian market are relatively fast, while users in Europe and the United States report delayed withdrawals.

VII. Customer Support and Service

Language support : Chinese, English, Korean, Japanese, Vietnamese, etc.

Contact : [email protected] + Online Ticket.

evaluate :

Advantages: Multi-language coverage, good user experience for Asian users.

Disadvantages: Customer service processing speed is slow, especially during peak hours.

8. Media and Third-Party Reviews

Cointelegraph : Points out that Huobi faces dual challenges of regulation and market after its transformation into HTX.

Bloomberg : Reports indicate that its relationship with Justin Sun is complicated and may affect the stability of the brand.

Trustpilot : 2.8/5, users have obvious differences in their withdrawal experience.

IX. Risks and Challenges

Regulatory risk : Absence of strict markets in the United States and Europe.

Competition risk : Squeezed out by OKX and Binance in Asia.

Reputational risk : The connection with Justin Sun has caused concern among some investors.

10. Future Outlook

The key to Huobi (HTX)'s future lies in:

Whether it can obtain a formal license in the Middle East market ;

whether it can enhance reserve transparency ;

Whether it can form differentiated competition with Binance and OKX.

👉 It may still maintain its important position in the Asian market, but it will find it difficult to expand in the European and American markets.

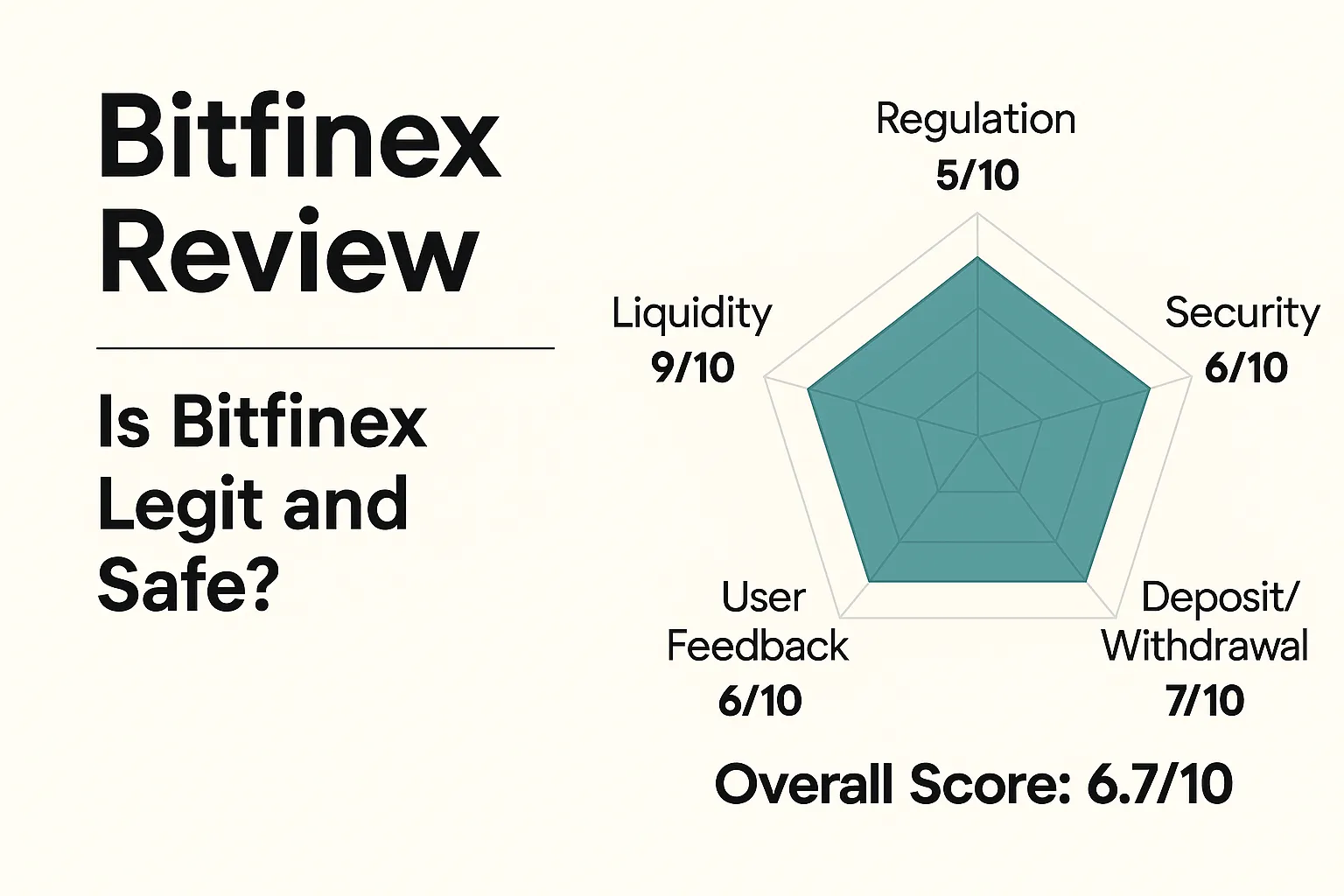

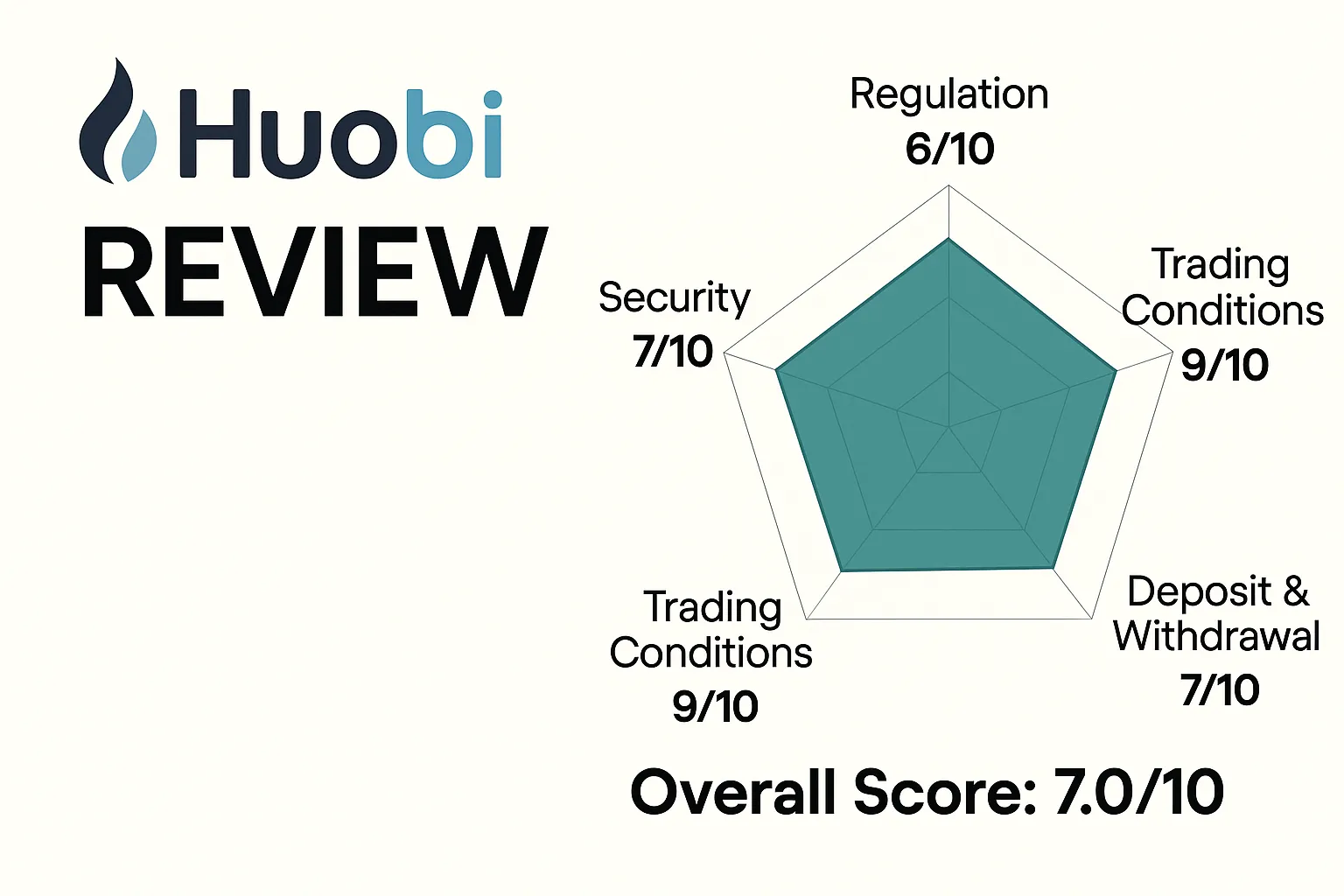

Multi-dimensional comprehensive scoring

Regulatory compliance: 6/10 — Some Asian licenses, but no European or American ones.

Trading Conditions: 9/10 — Wide range of currencies and very high leverage.

Security: 7/10 — Strong cold wallet mechanism, but lacks transparency.

Deposit and Withdrawal Experience: 7/10 — Faster in Asia, slower in Europe and the United States.

User reputation: 6/10 —— Severe polarization.

Market strategy: 7/10 — Transformation to HTX remains to be seen.

👉 Overall score: 7.0/10

in conclusion

Huobi (HTX) is not a scam and is a top-ten cryptocurrency exchange globally. However, its compliance procedures are inferior to those of Coinbase and Kraken, and its security and transparency have been questioned. It is more suitable for high-risk traders in Asian and Middle Eastern markets , rather than for European and American users seeking long-term stability.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.