Bithumb Review | Is Bithumb Reliable? A Complete Analysis of Korean Regulation, Trading Depth, Security, and User Feedback

Summary:Is Bithumb reliable? This article comprehensively analyzes Bithumb Korea's regulatory license, trading conditions, market depth, security system, and user reputation. Combining industry media coverage with real-world experiences, we answer the questions "Is Bithumb a scam?" and "Is Bithumb suitable for long-term use?"

1. Brand Background and Development History

Bithumb was founded in Seoul in 2014 and is operated by BTC Korea.com Co. Ltd. It is one of the three major mainstream exchanges in South Korea (along with Upbit and Coinone).

Founded : 2014

Operating entity : BTC Korea.com Co. Ltd.

Place of registration : Seoul, South Korea

Compliance : Regulated by the Financial Services Commission (FSC) of South Korea

Market position : Korean local users account for more than 70%

Development highlights :

2017: It once became the world's largest exchange in terms of trading volume.

2018: Suffered a hacker attack, resulting in a loss of approximately $30 million, but users were fully compensated.

2020: Obtained the Korean ISMS information security certification and became a compliant exchange.

2021: Complete registration with the Financial Services Commission (FSC) of South Korea to ensure compliant operations.

2. Trading Account and Conditions

Bithumb's account system is relatively friendly and is aimed at local Korean investors:

| Account Type | Minimum deposit | Handling Fees | Features |

|---|---|---|---|

| Ordinary account | KRW 1000 | 0.15% | Korean Won Spot Trading |

| PRO Account | KRW 10,000,000 | 0.04%–0.07% | High-frequency traders |

| OTC/Institutional | KRW 100,000,000 | Negotiated price | Institutional Clients |

Differentiated advantages :

Compared with Upbit , Bithumb has a faster listing speed and more currencies (about 200).

The transaction fee is relatively low and the depth is suitable for local users.

III. Supervision and Compliance

Bithumb is a Korean FSC-compliant exchange and one of the first platforms to pass Korea's ISMS information security certification .

| area | Regulatory situation | entity |

|---|---|---|

| South Korea | FSC registered + ISMS certified | BTC Korea.com Ltd. |

| worldwide | No European or American license | — |

👉 Unlike Coinbase and Kraken, Bithumb's compliance scope is limited to South Korea, but it has a great advantage in the domestic market.

IV. Trading Products and Services

Spot Trading : BTC/KRW, ETH/KRW, XRP/KRW and other Korean Won pairs.

Derivatives : High-leverage derivatives are not provided (policy restrictions).

Financial products : pledging and earning interest on deposits.

Bithumb Cash : Built-in payment points that can be used for spending at some merchants in South Korea.

V. Security and Risk Events

Bithumb has two aspects of security:

advantage :

The proportion of cold wallets exceeds 90%

Multi-signature and manual review withdrawals

ISMS Information Security Certification

Risk events :

About $30 million stolen by hackers in 2018

Withdrawal delays reappeared in 2019

However, the platform fully compensates users to maintain its reputation

👉 Compared with Binance and Huobi, Bithumb's security is slightly insufficient, but its compliance strengthens its trustworthiness.

6. Deposit and Withdrawal Experience

Supported fiat currencies : Only KRW (Korean Won) is supported.

Deposit method : Korean bank transfer (real-name account required).

Withdrawal : Usually arrives in 1-2 hours.

👉 It provides excellent experience for local users, but has many restrictions for overseas users.

VII. Customer Support and Service

Language support : Korean, English, Japanese, Chinese.

Contact information : [email protected] ; customer service phone number is only available in South Korea.

evaluate :

Korean users: High satisfaction.

Overseas users: Too many restrictions, not user-friendly enough.

8. Media and Third-Party Reviews

Korea Herald : Calls it one of South Korea's "Crypto Big Three."

CoinDesk Korea : points out its over-reliance on the Korean market and lack of internationalization.

Trustpilot : Rating 2.9/5, with negative reviews mainly concentrated in overseas user experiences.

IX. Risks and Challenges

Single market dependence : Almost entirely dependent on the Korean market.

Historical hacking risk : Despite compensation, reputational damage occurs.

Lack of international influence : Unable to compete with Binance, Coinbase, etc.

10. Future Outlook

Bithumb's future strategic priorities are:

Continue to strengthen regulatory compliance in the Korean market ;

May seek to expand into Southeast Asian markets;

Relying on the local payment ecosystem (Bithumb Cash).

👉 It works well for Korean users, but has limited appeal to overseas users.

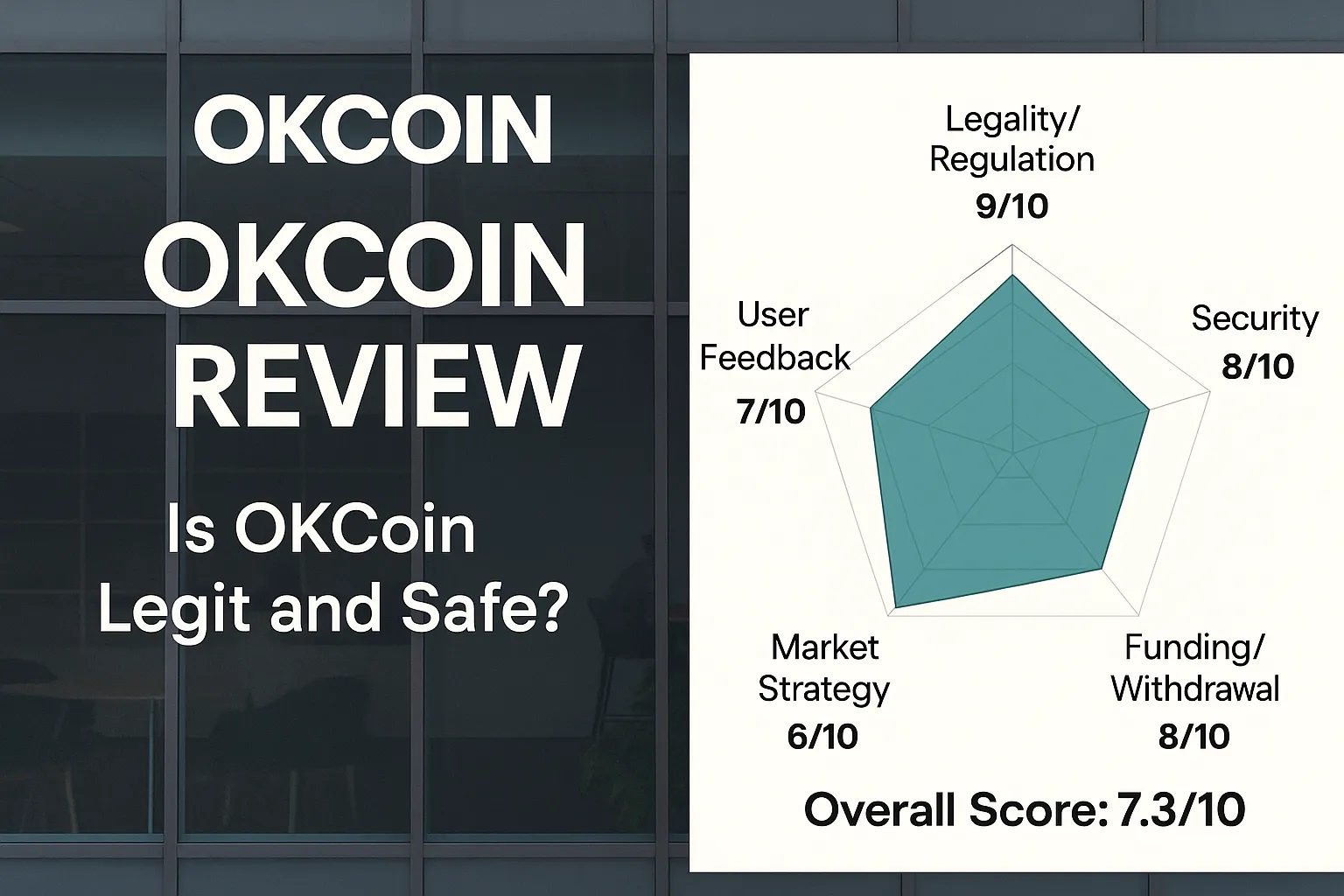

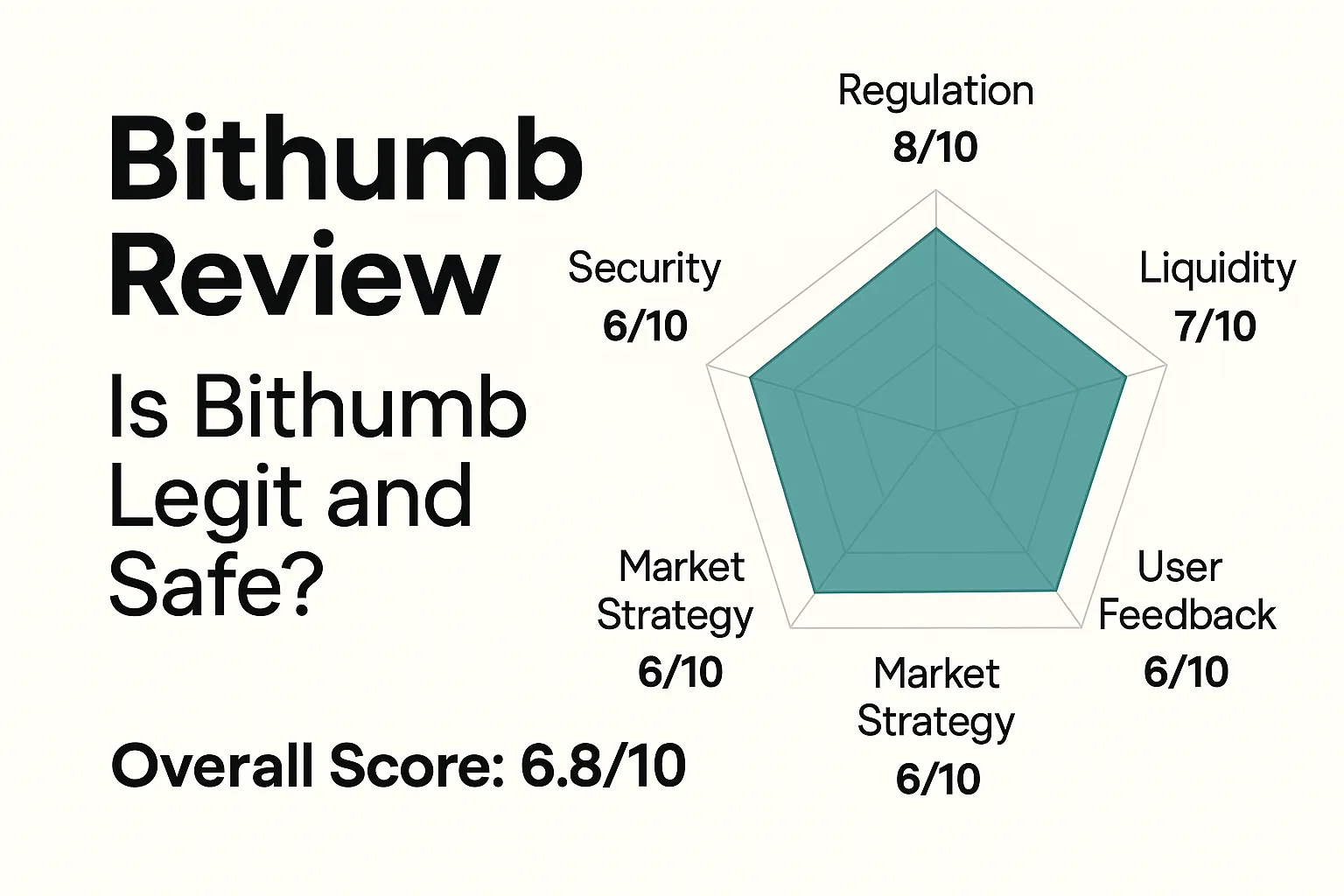

Multi-dimensional comprehensive scoring

Regulatory Compliance: 8/10 — FSC registered in South Korea, high compliance.

Trading conditions: 7/10 — Many currencies, but lack of derivatives.

Security: 6/10 — There have been hacking incidents.

Deposit and Withdrawal Experience: 8/10 — Friendly Korean Won Support.

User reputation: 6/10 ——Recognized by Korean users, average reputation overseas.

Market strategy: 6/10 — Insufficient internationalization.

👉 Overall score: 6.8/10

in conclusion

Bithumb is not a scam, but rather one of South Korea's most influential and compliant cryptocurrency exchanges. While it's suitable for Korean investors , it has significant limitations for international users. However, for local users, it remains a reliable option.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.