Bithumb Review | Is Bithumb Reliable? A Complete Analysis of South Korea's Largest Exchange's Regulatory License, Security, Trading Depth, and User Feedback

Summary:Is Bithumb reliable? This article comprehensively analyzes the Bithumb exchange's regulatory compliance, security performance, trading volume, user reputation, and risk warnings. Combining third-party data and media reports, this article provides investors with a comprehensive answer to the question, "Is Bithumb a scam?"

1. Brand Background and Development

Bithumb is one of South Korea's most iconic cryptocurrency exchanges, founded in Seoul in 2014. Over the past decade, Bithumb has grown alongside the ups and downs of the Korean crypto market, evolving from a local exchange into a globally influential trading platform.

Key development milestones :

2014–2016 : Focused on the BTC/KRW trading pair and quickly captured the Korean market.

2017–2018 : During the crypto bull market, Bithumb once became one of the top three exchanges in the world in terms of trading volume.

2018–2019 : Multiple security incidents triggered a crisis of trust, but its market share remained strong.

2020–2023 : Compliance upgrade and approval by the Financial Intelligence Unit (FIU) of South Korea.

2024–2025 : Continue to advance overseas compliance exploration, while increasing support for NFT and DeFi.

👉Positioning Summary : Bithumb's advantage lies in its deep local presence, but its global influence remains insufficient.

II. Compliance and Supervision

| area | Regulatory status | Regulatory agencies | Entity Name |

|---|---|---|---|

| South Korea | Licensed | Financial Intelligence Unit (FIU) | Bithumb Korea Co., Ltd. |

| USA | Not open | — | — |

| Europe | Restrictions in some countries | — | — |

| Other regions | Provide limited services | — | — |

Compliance comments :

Bithumb is compliant in the Korean market and recognized by the government.

The lack of licenses in developed markets such as Europe and the United States has limited international expansion.

Compared with Coinbase (which holds a US license) and Kraken (regulated in multiple countries), Bithumb's compliance is more "localized".

3. Trading Conditions and Product Coverage

Bithumb provides spot trading and some contract products , and is also expanding into the DeFi and NFT fields.

Spot Market :

Supports 200+ currencies.

BTC/KRW, ETH/KRW, and XRP/KRW trading pairs are extremely deep.

Other currencies have limited liquidity and rely on market heat.

Derivatives Market :

Its scale is far smaller than Bybit and Binance.

Offers limited leverage and is primarily targeted at professional users.

Handling Fee :

Ordinary users: Maker 0.15% / Taker 0.15%.

VIP users: enjoy rate discounts.

👉 Compared to Binance (0.1%) and Bybit (0.06%), Bithumb's transaction fees are relatively high.

IV. Security and Historical Risks

Security Incident Review

2017 : Hackers stole 3,000 BTC.

2018 : $30 million stolen.

2019–2020 : Continue to optimize security architecture.

2021–2024 : No major accidents occurred and overall safety was improved.

Current safety measures

98% cold wallet reserves

Two-factor authentication (2FA)

Multi-signature mechanism

Real-time risk control system

Security Review : Bithumb did have security issues in the past, but has made significant improvements in recent years. However, investors should remain aware of the risks and avoid concentrating all their assets on the exchange .

V. Deposits and Withdrawals and User Experience

Deposit : Supports direct deposit in Korean Won (KRW), real-name registration required.

Withdrawals : Cryptocurrency withdrawals typically take 5–15 minutes.

International users : Direct deposits from local fiat currencies are not supported, and can only rely on transfers such as USDT.

👉Comment : It is very friendly to Korean users, but not convenient enough for overseas investors.

6. User reputation and feedback

Positive reviews

The Korean Won Channel experience is excellent.

The platform interface is intuitive and friendly to newbies.

A local compliant exchange with high user trust.

Negative reviews

Historical security incidents affect the image.

The handling fee is relatively high.

Customer service falls short on international support.

Third-party data :

Trustpilot : 2.8/5

Korean forum : Highly active, Bithumb remains a "long-standing symbol of trust."

VII. Media and Industry Reviews

CoinDesk Korea : Bithumb is “the first choice for local Korean users.”

Bloomberg : Reports on its listing plans and regulatory pressure.

FX110 : Classified as a high-risk platform, but points out its local compliance.

8. Competitiveness and Positioning

Advantages

Monopoly position in the Korean market.

The uniqueness of the Korean won channel.

Government compliance certification.

Disadvantages

Global expansion is weak.

The transaction fees are higher than those of mainstream competitors.

There was once a shadow of hacking incident.

👉Positioning summary : In the Korean market, its competitiveness is higher than Upbit, but in the global market, it is lower than Binance, Bybit, and OKX.

IX. Risk Reminder

Investors need to pay attention when using Bithumb:

Geographical restrictions : Overseas users may face service restrictions.

Security concerns : Although there have been no major incidents in recent years, historical hacking incidents remind investors not to store long-term assets in exchanges.

Market volatility : The depth of the Korean Won-based market may become disconnected during periods of significant volatility in international markets.

High fee issue : Compared with international peers, the fee disadvantage will erode the profits of frequent traders.

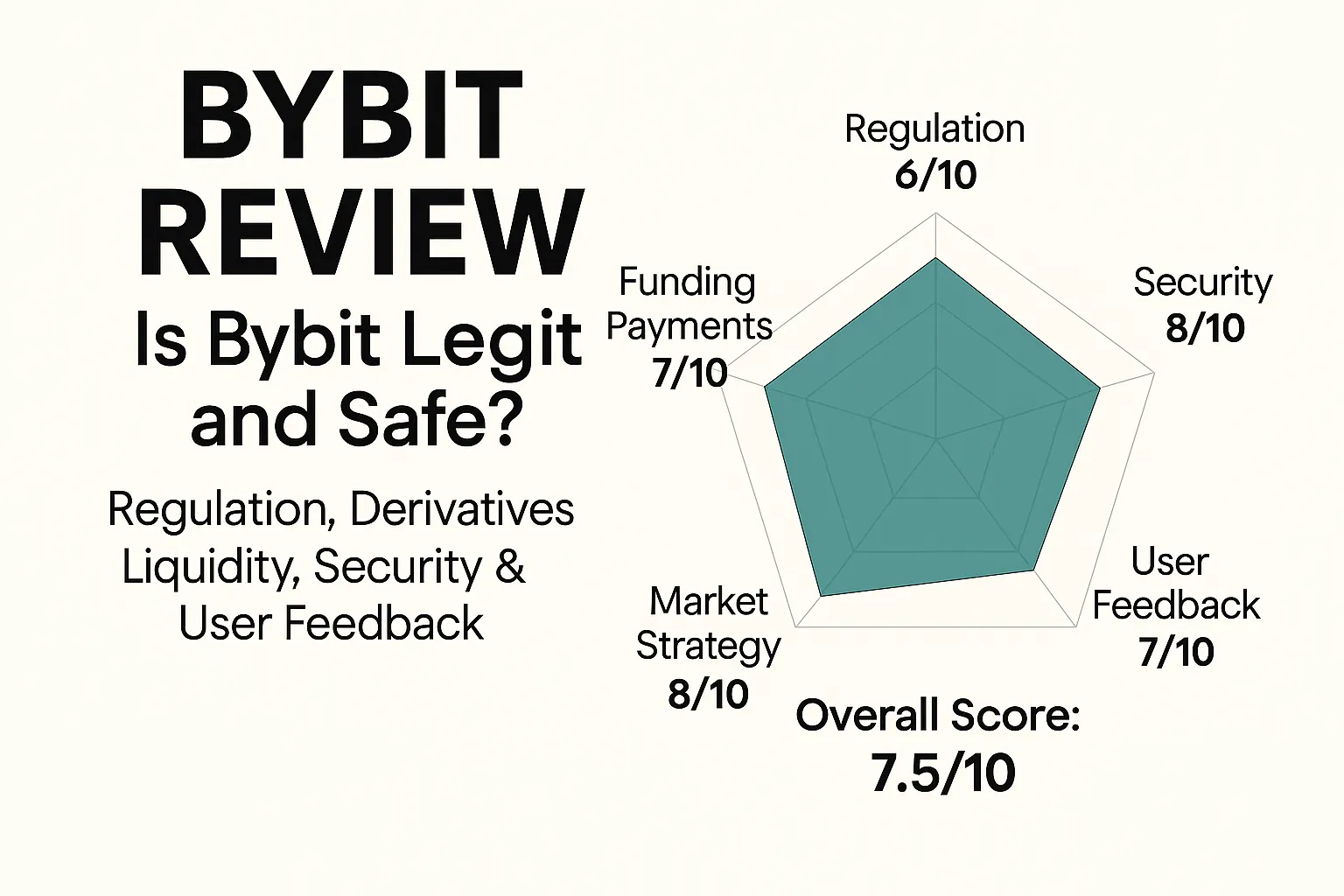

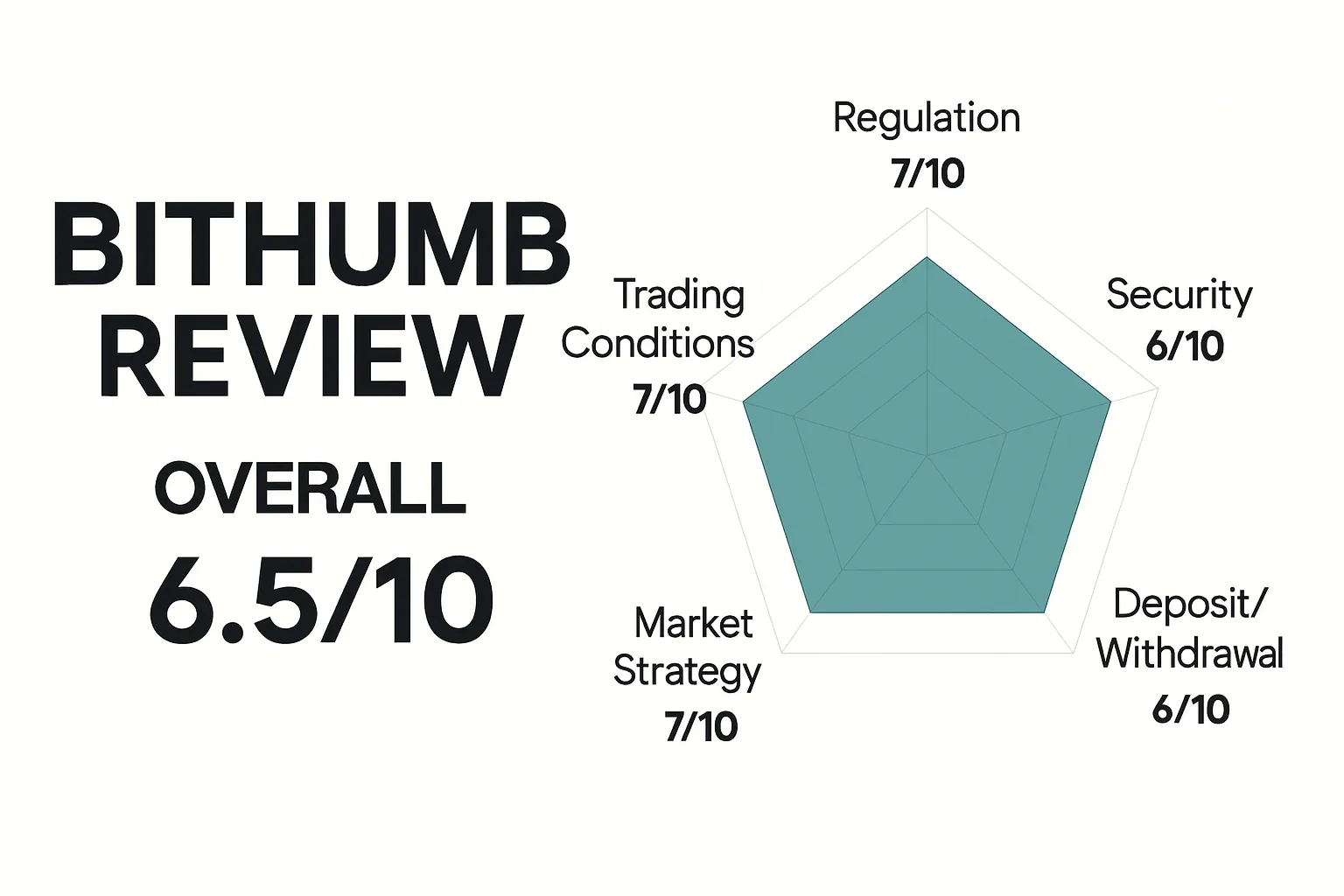

10. Comprehensive Rating (with explanation)

Regulatory compliance: 7/10 — Locally licensed, strong regulation, but lacks internationalization.

Trading conditions: 7/10 — The Korean won market has excellent liquidity, but high fees and weak international presence.

Safety: 6/10 — Historical risks were significant, but improvements have been significant.

Deposit and Withdrawal Experience: 6/10 — Smooth for Korean users, limited for overseas users.

User reputation: 6/10 - High local recognition, average international reputation.

Market Strategy: 7/10 — Focused on the Korean market, but lacks global competitiveness.

Overall score: 6.5/10 — Suitable for Korean users, not recommended for long-term reliance by global investors.

11. Conclusion

Bithumb is one of the most important exchanges in South Korea and is not a scam, but its compliance and security tend to be localized .

Suitable for : Korean investors and those who need to trade in Korean won.

Not suitable for people who : International institutional users, those who pursue low fees and global services.

Risk Warning : Any cryptocurrency exchange is subject to security and market risks. Investors should adhere to the principle that "an exchange is not equal to a wallet" and store long-term assets in cold wallets.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.