Alpaca Review | Is Alpaca Reliable? Analyzing API US Stock Trading Security, Fees, and User Feedback

Summary:Alpaca, a US stock broker focused on API-driven trading, has rapidly gained popularity in the algorithmic trading community in recent years for its zero-commission, fractional-lot trading, and robust, developer-friendly interface. So, is Alpaca reliable? Is it secure and regulated? In this 5,000-word in-depth review, we will comprehensively analyze Alpaca's strengths and potential risks from multiple perspectives, including regulatory compliance, trading conditions, API execution performance, fee structure, user experience, and reputation, to help investors and developers determine whether it's a worthy choice.

1. Brand Background and Development History

Full company name : Alpaca Securities LLC

Founded : 2015

Headquarters : San Mateo, California, USA

Positioning : An API-driven, commission-free US stock brokerage focused on providing "trading infrastructure for developers."

Alpaca initially began as a quantitative trading infrastructure provider and later transitioned to a licensed broker serving retail investors. It has secured multiple rounds of funding from Silicon Valley and fintech investment circles, and has partnered with numerous emerging fintech applications (such as Stash and Public) to provide backend API support. Its core philosophy is to "make trading as easy as software development."

Development Milestones :

2017: Launched the first API transaction prototype.

2019: Obtained regulatory approvals from the SEC and FINRA and officially launched zero-commission trading.

2020: Added fractional share trading function, allowing small investors to diversify their US stock allocation.

2022: Announced support for international developer access.

II. Account Types and Trading Conditions

Alpaca's accounts are relatively simple, targeting individual retail investors and API developers.

| Account Type | Minimum deposit | Supported Products | API Features |

|---|---|---|---|

| Cash Account | $0 | US stocks, ETFs | Basic trading API, market API |

| Margin Account | $2,000 | US stocks, ETFs, and fractional shares | Margin trading, short positions, and a complete API |

| Paper Trading | free | Simulation Environment | Simulated trading API for development and testing |

Highlights :

Zero commission trading model.

Support fractional share trading.

Provides a sandbox environment for developers.

limit :

The product range is limited (only US stocks and ETFs, not options, futures, or crypto assets).

Margin accounts are subject to the U.S. Pattern Day Trader Rule.

III. Supervision and Compliance

Clearing services : provided by Apex Clearing Corporation.

SIPC Protection : Customer funds are insured by SIPC , with each customer account protected up to US$500,000 (cash limit US$250,000).

Alpaca is a fully regulated US broker , meaning its fund custody and investor protection mechanisms are consistent with those of traditional US stock brokers. However, its "lightweight front-end + powerful API" model is more suitable for developers and quantitative users.

Compared with large, established brokerages such as Interactive Brokers , Alpaca's regulatory coverage and fund security are equally compliant, but its functions are concentrated on API calls and it does not provide comprehensive investment research and traditional brokerage services.

IV. Trading Products and Market Coverage

Stocks : Covers major US exchanges (NYSE, NASDAQ, AMEX).

ETFs : Most popular ETFs are available for trading.

Odd-lot shares : Supports buying by amount, with a minimum order of $1.

Missing products :

Options, futures, and foreign exchange are not supported.

Cryptocurrency trading requires partner integration (not directly provided by Alpaca).

This makes Alpaca more suitable for the "API-driven US stock investment" scenario rather than full-category multi-asset allocation.

5. Technology and API Execution Performance

Alpaca's biggest selling point is its API trading interface .

Supported languages : Python, JavaScript, Go, C#, Java

Functional modules : market information acquisition, account management, order execution, and Websocket real-time push.

Community ecology : There are more than 3,000+ developer stars on GitHub, and the quantitative community is highly active.

Measured performance :

Order delay: API requests are between 200ms and 400ms, suitable for medium and low-frequency quantitative trading.

Stability: There is still a small probability of delay during major market fluctuations, but it is generally stable.

Sandbox environment: Developers can test their code in a simulated trading environment without risking real money.

More developer resources can be found in the official Alpaca documentation .

6. Fee Structure and Commission Model

Stock/ETF trading : Commission-free.

Margin interest rate : approximately 8%–12% annualized (slightly higher than IBKR).

API call fee : Free (some premium data requires payment).

Hidden costs : spreads and order routing, with possible slight slippage.

Comparison : Alpaca shares a zero-commission model with Robinhood, but is more transparent and relies primarily on Payment for Order Flow (PFOF).

VII. Deposit and Withdrawal Methods and Time Limits

Deposit methods : ACH (US users), Wire Transfer (international users).

Withdrawal method : ACH and wire transfer are also supported.

Processing time : Typically 1–3 business days for ACH and 1–5 business days for wire transfers.

Limitations: Direct cryptocurrency deposits are not supported, and credit cards/third-party payment methods are not supported.

8. User Experience and Customer Service

Trading interface : The web version is simple, the mobile version is weak, and it emphasizes API calls.

Customer Support :

Email: [email protected]

Tel: +1 (650) 489-2272

Language: English (no Chinese support).

Users report that customer service response speed is average, while the developer community is more efficient in resolving technical issues.

9. User Word of Mouth and Media Reviews

Media coverage :

TechCrunch has reported on Alpaca’s financing and the “API transaction revolution.”

Investopedia listed it as one of the "Best API Trading Platforms."

Community evaluation :

Advantages : zero commission, developer-friendly, fractional share functionality, stable API.

Disadvantages : Limited asset types, high margin interest rates, and limited customer service language support.

Trustpilot rating: 3.5/5 (mixed reviews).

Reddit community: The developer community gave mostly positive feedback, but retail investors reported that the product was "too technical."

10. Competitor Comparison

| platform | Regulation | Trading range | API support | cost |

|---|---|---|---|---|

| Alpaca | SEC/FINRA | US stocks, ETFs, fractional shares | comprehensive | Commission-free |

| DriveWealth | SEC/FINRA | US stocks, ETFs | supply | Partner Fees |

| Interactive Brokers | SEC/FINRA/CFTC, etc. | Stocks, ETFs, Options, Futures, Forex, Crypto | supply | Low commission |

| Tradier | SEC/FINRA | Stocks and options | supply | Low commission |

11. Risk Warning

Limited asset range : multi-asset allocation cannot be achieved.

High margin interest rates : Long-term financing costs are high.

API misuse risk : If the code is wrong, it may trigger a large number of erroneous orders.

Regulatory boundaries : International user access requires attention to cross-border compliance.

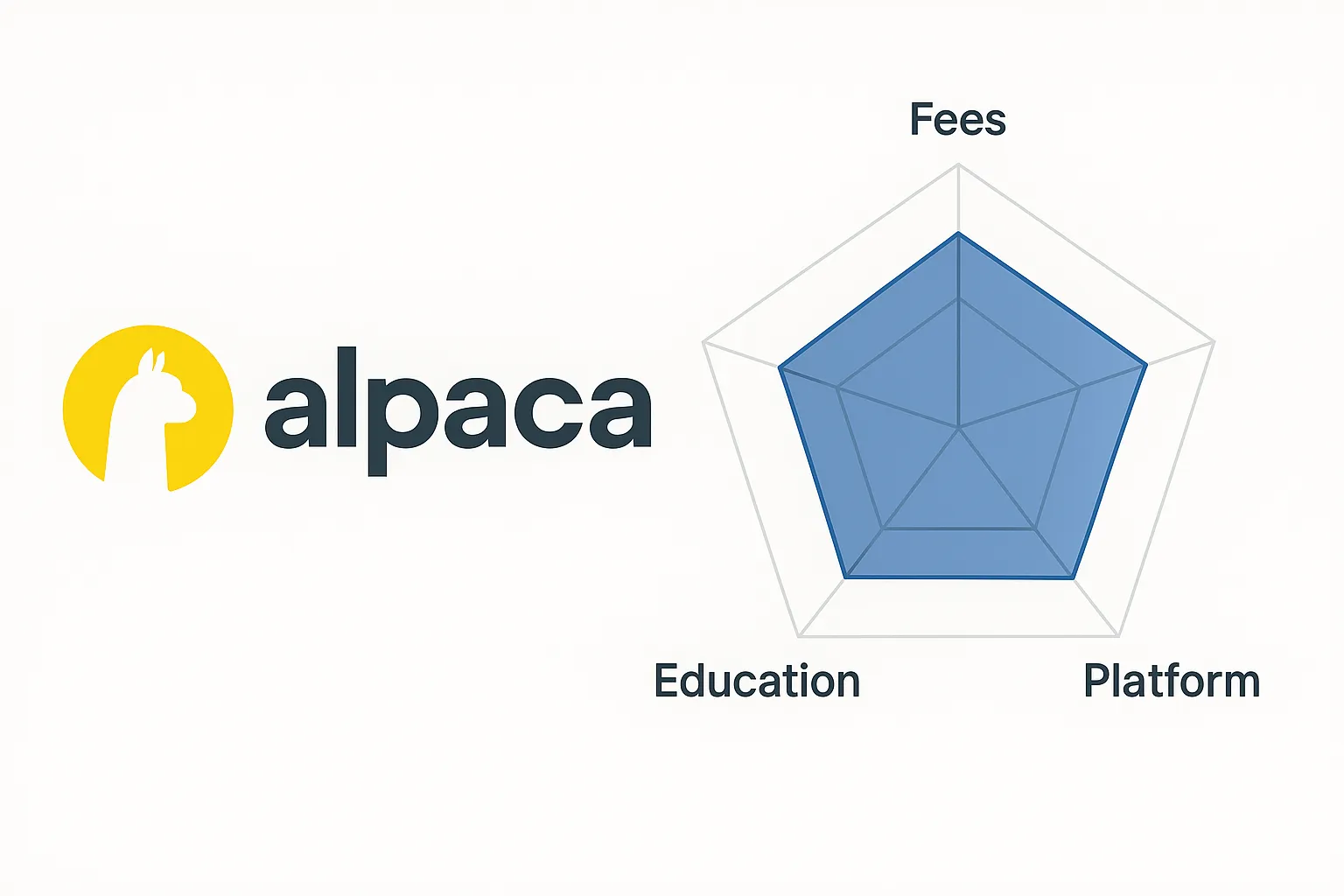

12. Multi-dimensional Rating (1-10 point system, including comments)

Regulatory Compliance : 8/10 – Regulated by the SEC and FINRA, providing a high level of security.

Trading Conditions : 7/10 – The zero commission and fractional share options are impressive, but the product range is limited.

Technology and Execution : 9/10 – The API is robust and stable, making it suitable for programmatic trading.

Customer Service : 6/10 – Lacks multilingual support and average customer service response speed.

User reputation : 7/10 – Positive reviews from developers, mixed reviews from retail investors.

13. Conclusion and Investor Recommendations

Alpaca is a clearly positioned API-driven brokerage firm , offering advantages such as zero commissions, fractional share trading, and a developer-friendly API. For algorithmic traders, quantitative teams, and developers looking to manage investments through code, Alpaca is undoubtedly a worthy option.

However, for investors seeking comprehensive asset allocation, requiring multilingual customer support, or relying on traditional brokerage research tools, Alpaca’s functionality may be insufficient.

Overall Recommendation : Alpaca is suitable for investors who understand code, but not for beginners who rely entirely on manual operations. If you're a developer, Alpaca's API ecosystem will be a huge convenience. However, if you're a retail investor, you might find the tools too rigid and the experience less user-friendly.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.