DriveWealth Review | Is DriveWealth Safe? A Detailed Look at Regulation, Partners, and API Transactions

Summary:DriveWealth is a US-licensed brokerage known for its business-to-business-to-consumer (B2B2C) model. By providing APIs and back-end clearing services to global fintech applications (such as Stash and Revolut), it provides millions of users with indirect access to the US stock market. So, is DriveWealth reliable? Is it safe and regulated? In this 5,000-word in-depth review, we will thoroughly analyze its regulatory compliance, API model, partner ecosystem, fee structure, and user reputation, helping investors and developers assess its value and risks.

1. Brand Background and Development History

Full company name : DriveWealth, LLC

Founded : 2012

Headquarters : New Jersey, USA

Positioning : API-driven US stock clearing and trading infrastructure, focusing on serving global fintech applications.

DriveWealth's vision is to enable global users to invest in US stocks through fractional shares. Rather than primarily targeting retail end users, DriveWealth provides backend support to investors through partners such as fintech apps and brokerages.

Development Milestones :

2012: Founded, focusing on US stock liquidation and fractional share trading.

2015: Became the first company to implement fractional share trading technology in the United States.

2018: Collaborated with financial technology applications Stash and MoneyLion.

2020: Partnered with European upstart Revolut to become its US stock clearing backend.

2021: Completed Series D financing with a valuation of over US$2 billion.

II. Account Types and Trading Conditions

DriveWealth itself does not directly target large-scale individual investors, but rather serves as a clearing and brokerage backend . Its account structure relies on partner platforms:

| Cooperation Platform | Minimum deposit | Supported Products | Features |

|---|---|---|---|

| Stash | $1 | US stocks, ETFs | Fractional share investing, educational content |

| Revolut | No explicit requirements | US stocks | Global users can invest in US stocks |

| MoneyLion | $1 | US stocks | Integration with financial services |

Highlights :

An industry pioneer in fractional share trading.

Cooperate with global fintech to lower the investment threshold.

limit :

Users cannot open an account directly on the DriveWealth official website and must go through a partner.

The product range is limited to US stocks and ETFs, and options, futures, and foreign exchange are not available.

III. Supervision and Compliance

Clearing services : self-clearing, and cooperation with Apex Clearing and others.

SIPC Protection : Customer funds are protected by SIPC insurance, up to $500,000 per customer ($250,000 in cash).

DriveWealth is a fully compliant US broker , licensed by the SEC and FINRA, ensuring the security of funds. However, because it primarily serves as a "B2B2C backend," retail investors have a low awareness of its transparency.

IV. Trading Products and Market Coverage

Stocks : Full coverage of the U.S. stock market (NYSE, NASDAQ, AMEX).

ETF : All mainstream ETFs are tradable.

Fractional share investment : Invest as little as $1.

Missing products :

No options, no futures, no cryptocurrencies.

Only supports the U.S. stock market and does not cover securities in other countries.

5. Technology and API Execution Performance

DriveWealth's advantage lies in its B2B API :

Functions : account opening, KYC, transaction execution, clearing, and reporting interface.

Advantages : Allows fintech platforms to quickly integrate U.S. stock investment functions.

Latency performance : The measured API call latency is between 200ms and 500ms, which is suitable for low- to medium-frequency transactions.

Compliance integration : API automatically connects to SEC/FINRA compliance processes.

Similar to Alpaca , DriveWealth provides a developer-friendly interface, but is positioned more towards back-end clearing rather than retail tools.

6. Fee Structure and Commission Model

DriveWealth adopts a B2B fee model:

Partners need to pay API integration fees and transaction clearing fees.

For end users, in most cases the fee policy is determined by the partner platform (e.g. Stash charges a $1/month subscription fee).

DriveWealth itself supports a commission-free model and maintains operations through order flow payment.

VII. Deposit and Withdrawal Methods and Time Limits

DriveWealth's deposits and withdrawals depend on the partner platform:

Deposit methods : ACH, wire transfer.

Withdrawal method : same as above.

Time limit : 1–5 business days, depending on partner policy.

For users, the security of funds is doubly guaranteed by the partner platform and DriveWealth.

8. User Experience and Customer Service

DriveWealth itself is not directly aimed at retail investors, and the user experience is mainly reflected in the cooperative platform.

Stash/Revolut : User-friendly front-end interface and available globally.

Customer Service : DriveWealth offers support in English, but retail investors typically connect with customer service through partner apps.

Contact Information:

Email: [email protected]

Tel: +1 (800) 461-2680

Language: English.

9. User Word of Mouth and Media Reviews

Media coverage :

TechCrunch has reported on DriveWealth’s financing and global expansion many times.

Forbes calls it "the infrastructure provider for global fractional investing."

Community evaluation :

Advantages : Global coverage, flexible API, and strong partnerships.

Disadvantages : Low transparency on the retail side and fees depend on partner policies.

Trustpilot does not have a unified rating yet, and most user experiences come from partner apps (such as Revolut and Stash), and the overall reputation is positive.

10. Competitor Comparison

| platform | Regulation | position | API support | Covered Market |

|---|---|---|---|---|

| DriveWealth | SEC/FINRA | B2B US stock liquidation | powerful | US stocks + ETFs |

| Alpaca | SEC/FINRA | B2C+Developer API | powerful | US stocks + ETFs |

| Interactive Brokers | Global multi-regulatory | All-round brokerage firm | powerful | Global Multi-Asset |

| Tradier | SEC/FINRA | API+Options Broker | middle | US stocks + options |

11. Risk Warning

Insufficient retail transparency : Users actually interact with partner platforms, and DriveWealth’s brand exposure is low.

Dependence on partners : If the cooperative platform is not well operated, the user experience will be affected.

Product limitations : Only supports US stocks and ETFs, and cannot achieve multi-asset investment.

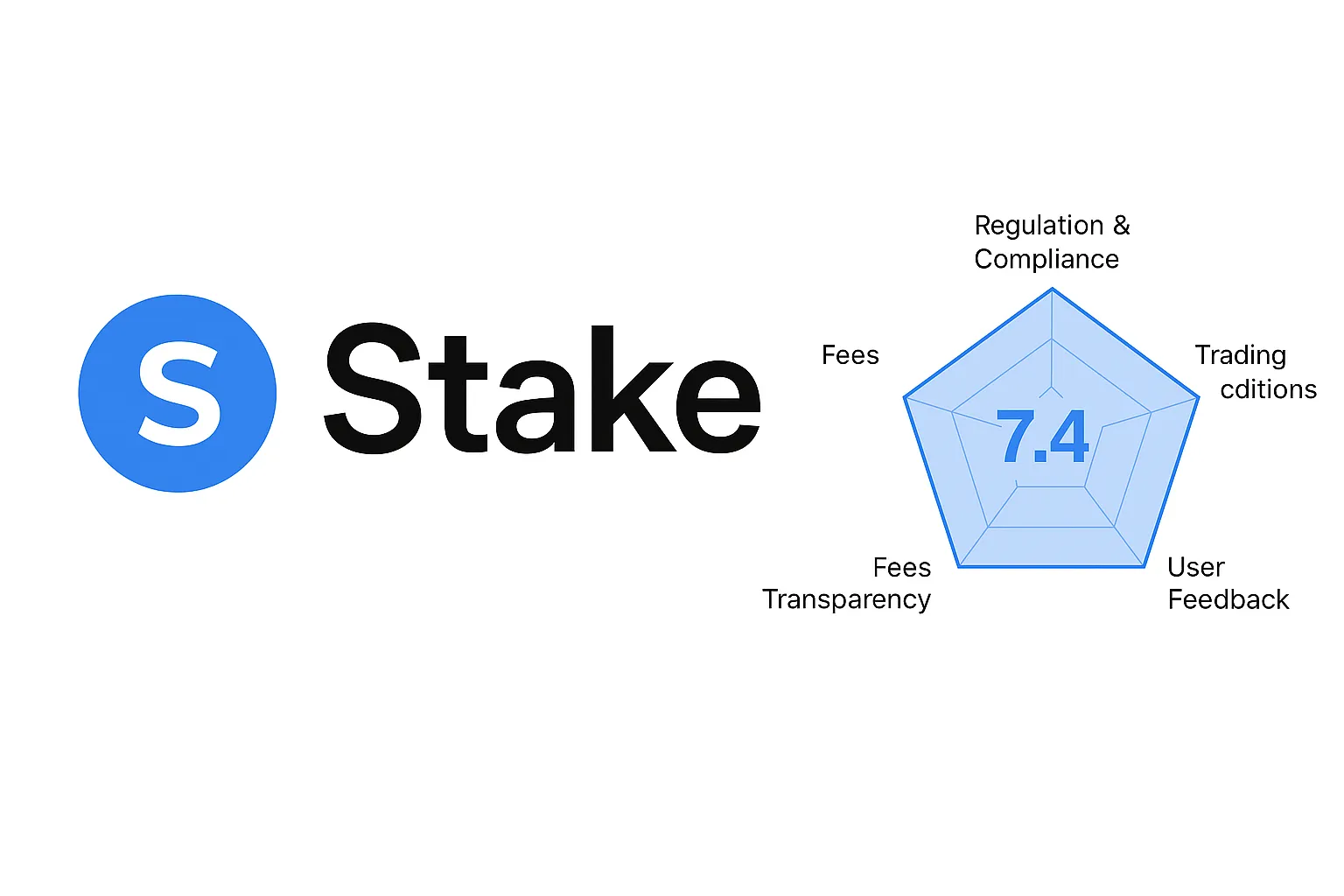

12. Multi-dimensional Rating (1-10 point scale, including comments)

Regulatory Compliance : 9/10 – Regulated by the SEC and FINRA, ensuring high fund security.

Trading Conditions : 7/10 – Friendly for fractional share investing, but limited product offerings.

Technology and Execution : 8/10 – API is mature and suitable for B2B model.

Customer Service : 6/10 – Retail investors rely on partner platforms’ customer service, with limited direct support from DriveWealth.

User Reputation : 7/10 – The partner platform has a good reputation, but DriveWealth brand awareness is low.

13. Conclusion and Investor Recommendations

DriveWealth is a global infrastructure provider for fractional share investing . By partnering with fintech applications, it provides global users with low-barrier access to the US stock market. While its regulatory compliance and fund security are commendable, its more back-end nature means it's less directly accessible to average investors.

Suitable for :

Fintech startups/brokerage firms (B2B cooperation).

Retail investors who wish to invest in U.S. stocks with low barriers to entry through cooperative platforms (such as Revolut and Stash).

Not suitable for people :

Investors who want to open an account directly (DriveWealth does not provide retail direct services).

Users who need multi-asset allocation or in-depth research tools.

Overall Recommendation : DriveWealth is a hidden gem. If your app is used for clearing, your funds are generally secure and compliant. However, if you're looking for a full-featured, terminal-oriented brokerage, Interactive Brokers or Alpaca may be more suitable.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.