Public.com Review | Is Public.com Safe? Analyzing Social Investments, Fees, and User Complaints

Summary:Public.com is a New York-based online investment platform positioned as a "social investment platform," allowing users to buy and sell stocks, ETFs, and crypto assets in a community environment while also viewing other investors' portfolios and perspectives. This article will explore regulatory compliance, product features, fee structure, and user reputation, drawing on real media coverage and user reviews to help investors comprehensively assess the security and risks of Public.com.

1. Brand Background and Development History

Full company name : Public Holdings, Inc.

Founded : 2019

Headquarters : New York, USA

Financing background : Received support from well-known investment institutions such as Accel, Greycroft, and Tiger Global, with a total financing amount exceeding US$300 million.

Development History :

2019: Launched a commission-free trading app, targeting the young investor market.

2020: Introducing social investing functionality, allowing users to share their portfolios publicly or privately.

2021: Add support for cryptocurrency transactions.

2023: Treasury accounts are launched, allowing users to invest in U.S. Treasury bonds.

More background information can be found on the official Public website .

II. Account Types and Trading Conditions

Public.com offers the following accounts:

| Account Type | Minimum deposit | Supported Products | Features |

|---|---|---|---|

| Standard Investment Account | $0 | Stocks, ETFs, Cryptocurrencies | Zero commission, social functions |

| Treasury Account | $0 | U.S. Treasury Bonds | Stable returns and low risk |

| Public Premium | $10/month | Stocks, ETFs, Crypto, Bonds | Advanced analytical tools |

Advantages :

Fractional share trading has a low threshold.

Social community function allows users to learn other people’s investment logic.

limit :

The product range is limited and does not support foreign exchange and futures.

Premium features require a paid subscription.

III. Supervision and Compliance

United States : Public.com operates through its subsidiary Public Investing Inc., which is registered with the SEC and is a member of FINRA .

Fund Security : Client funds are held in custody by our partner clearing firm, Apex Clearing, and are protected by SIPC insurance (up to $500,000).

Regulatory information can be found through the SEC official website and FINRA BrokerCheck .

IV. Trading Products and Market Coverage

US stocks : covers NYSE and NASDAQ stocks.

ETF : All mainstream ETFs are tradable.

Cryptocurrency : Provides mainstream currencies such as Bitcoin and Ethereum.

U.S. Treasury Bonds : Users can directly invest in short-term Treasury.

Missing products : No forex, no commodity futures, no contracts for difference (CFDs).

5. Fee Structure and Commission Model

Public.com advertises "zero commission," but there are still some hidden fees:

Stock/ETF trading : Commission-free.

Cryptocurrency trading : Spread model, actual cost is about 0.5%–1%.

Subscription service : Public Premium $10/month.

Withdrawal Fees : Bank wire transfers may incur additional fees.

See Public.com Fees for details.

6. Deposit and Withdrawal Methods and Time Limits

Deposit : Bank transfer, ACH, Debit card.

Withdrawal : Cash withdrawal from bank account.

Time limit : ACH 1–3 business days, wire transfer 1–5 business days.

Limitations: PayPal and cryptocurrency deposits are not currently supported.

7. User Experience and Customer Service

Trading interface : simple and easy to use, good App experience.

Customer Service Contact Information :

Email: [email protected]

Online Help Center: Help Center

Language support : Currently only English is supported.

Overall, the customer service response speed is average, and some users on Trustpilot reported that the customer service was not efficient enough in solving problems.

8. User Word of Mouth and Media Reviews

Media coverage :

TechCrunch called Public "one of the most challenging emerging investment platforms since Robinhood."

CNBC mentioned that Public is different from traditional brokerages because of its social investment function.

User reputation :

Trustpilot rating is around 3.5/5.

Advantages : no commission, user-friendly interface, strong community learning function.

Disadvantages : High crypto spreads, poor customer service experience, and some complaints about slow withdrawals.

9. Competitor Comparison

| platform | Regulation | Product Range | Fee Model | Features |

|---|---|---|---|---|

| Public.com | SEC/FINRA | Stocks, ETFs, Crypto, Treasury Bonds | No commission on stocks, crypto spreads | Social Investment Community |

| Robinhood | SEC/FINRA | Stocks, ETFs, Options, Crypto | Commission-free | Mainstream platforms for retail investors in the US stock market |

| eToro | FCA/CySEC/ASIC | Stocks, ETFs, Crypto, Forex | No commission + spread | The originator of social trading |

| Interactive Brokers | Global multi-regulatory | Multi-asset | Low commission | The first choice for professional traders |

10. Risk Warning

Withdrawal delay risk : Some users complain about slow withdrawal speeds.

Hidden Fee Risk : Cryptocurrency trading spreads are high.

Community content risk : Social investing may lead to me-too trading.

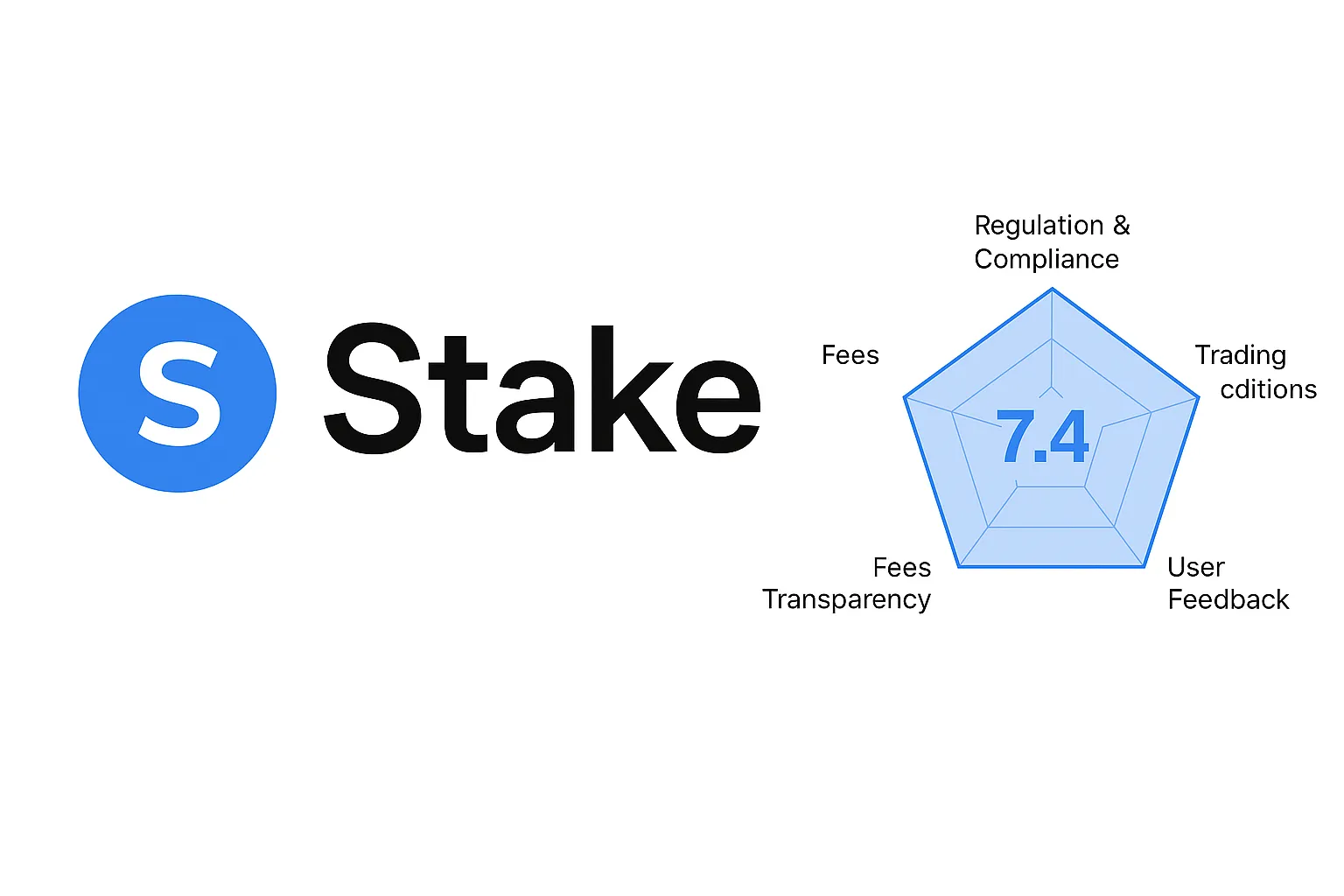

11. Multi-dimensional scoring (10-point scale)

Regulatory Compliance : 8/10 – Dual SEC and FINRA regulation ensures reliable compliance.

Trading Conditions : 7/10 – Supports US stocks, ETFs, and crypto, but lacks futures and forex.

Fee Transparency : 6/10 – Commission-free for stocks, but high spreads for crypto.

Customer Service : 6/10 – Slow customer service responses and lack of multilingual support.

User Reputation : 7/10 – Community features are popular, but withdrawals and fees are controversial.

12. Conclusion and Investor Recommendations

Public.com, a social investment platform , offers a low-barrier entry point for new and young investors into the US stock and crypto markets. While its advantages lie in its commission-free nature and community learning platform, its disadvantages include hidden fees and insufficient customer service.

Recommended for : Investors who want to enter the U.S. stock and crypto markets through social learning and low barriers to entry.

Not suitable for people who need multi-asset allocation and professional investors with high requirements for transaction speed and customer service.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.