BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:SoFi Invest is a zero-commission investment platform launched by US fintech giant SoFi Technologies, Inc., positioning itself as a "one-stop financial service" for young and beginner investors. It supports stock, ETF, and cryptocurrency trading, and offers automated portfolio management (Robo-Advisor). This article will conduct a comprehensive analysis of regulatory compliance, trading products, fee structure, and user experience, drawing on media and user reviews to help investors assess SoFi Invest's trustworthiness.

Full company name : SoFi Securities LLC & SoFi Digital Assets LLC

Parent company : SoFi Technologies, Inc. (NASDAQ: SOFI)

Establishment date : Investment business launched in 2018

Headquarters : San Francisco, California, USA

Development History :

2011: SoFi is initially founded as a student loan financing platform.

2018: SoFi Invest was launched, offering commission-free trading of stocks and ETFs.

2020: Launch of cryptocurrency investment services.

2021: SoFi successfully listed on the Nasdaq (stock code: SOFI).

2022–2024: The number of users will exceed 6 million, and investment and banking businesses will form a closed loop.

📌 For more information, visit SoFi's official website .

SoFi Invest offers three types of accounts:

| Account Type | Minimum deposit | Features | Suitable for people |

|---|---|---|---|

| Active Investment Accounts | $0 | Commission-free trading of stocks and ETFs | Beginners/Free Investors |

| Automated Investment Accounts | $1 | Robo-Advisor, intelligent portfolio rebalancing | Long-term investors who want peace of mind |

| Cryptocurrency accounts | $10 | Support mainstream cryptocurrency transactions | Users who want to try crypto investment with a small amount |

Highlights :

Stock/ETF fractional share trading, investing in large company stocks with as little as $5.

Automated portfolios are suitable for beginners, as the system will allocate ETFs based on risk preferences.

insufficient :

Lack of advanced trading tools such as options, foreign exchange, and futures.

The number of crypto assets is limited, mainly concentrated in mainstream currencies such as BTC, ETH, and DOGE.

US regulation :

SoFi Securities LLC is registered with the SEC and a member of FINRA .

Investor funds are protected by SIPC (up to $500,000, including $250,000 in cash).

Cryptocurrency Trading : Provided by SoFi Digital Assets LLC, regulated by state licenses (Money Transmitter Licenses).

Banking : SoFi Bank, NA is FDIC insured.

📌 SoFi's compliance framework is relatively transparent, and investors can check it through FINRA BrokerCheck.

Stocks & ETFs : Covers major US exchanges (NASDAQ, NYSE).

Cryptocurrency : Provides 20+ mainstream currencies including BTC, ETH, DOGE, ADA, SOL, etc.

Robo-Advisor : ETF portfolio (covering US stocks, bonds, and emerging market indices).

Missing markets : no Hong Kong stocks, no international stocks, no options/futures.

Stocks & ETFs : Commission-free trading.

Automated investing : 0% advisory fee (compared to 0.25% for Betterment and Wealthfront).

Cryptocurrency : Spread around 1.25% (on the high side).

Account Fees : No account management fees, no minimum fund requirements.

👉 See SoFi Invest official pricing for details.

Deposit methods : ACH free; wire transfer (fee applies).

Withdrawal methods : ACH free; wire transfer $25–45.

Features : Seamless integration with SoFi Checking & Savings bank accounts for fast deposits and withdrawals.

Limitations : PayPal, credit cards, and third-party payments are not supported.

App design : modern UI, integrated investment and banking services.

Trading Tools : Supports real-time quotes and fundamental data, but not as comprehensive as professional platforms (IBKR, TD Ameritrade).

Multi-terminal support : iOS, Android, Web.

Disadvantages : Lack of Level 2 data and advanced technical indicators.

Contact Information :

Phone: 855-456-7634

Email: [email protected]

Online help: Help Center

Language support : Currently mainly English.

User feedback :

Some Trustpilot users have complained about slow withdrawals and high crypto transaction fees.

The overall rating on the App Store and Google Play is 4.5/5, and user satisfaction is high.

NerdWallet rated SoFi Invest as a “beginner-friendly investing starting point.”

Investopedia gave it a 4/5 rating, emphasizing its low fees but criticizing the high crypto transaction fees.

Trustpilot rating 3.3/5.

Pros : Commission-free, free automated investing, integrated banking and investing.

Disadvantages : Lack of diversified products and average customer service efficiency.

| platform | Regulation | Product Range | Fee Model | Features |

|---|---|---|---|---|

| SoFi Invest | SEC/FINRA/SIPC | US stocks, ETFs, cryptocurrencies, Robo | No commissions on stocks, high spreads on cryptocurrencies | Investment + Banking Integration |

| Webull | SEC/FINRA/MAS | US stocks, ETFs, options, and cryptocurrencies | Commission-free stocks and low options fees | For active traders |

| Robinhood | SEC/FINRA | US stocks, ETFs, options, and cryptocurrencies | Stock commission-free | The originator of zero commission in the United States |

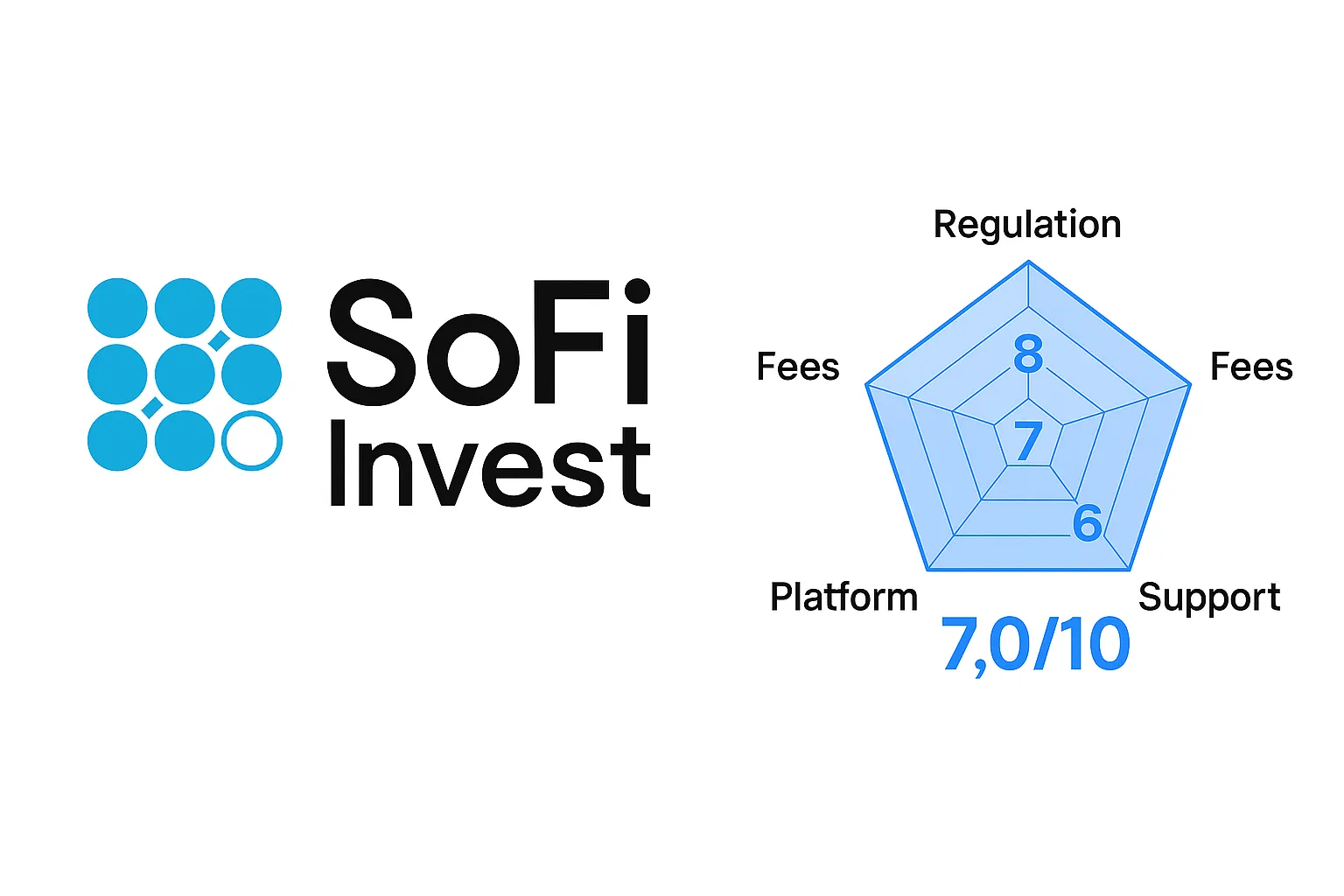

Regulatory Compliance : 8/10 – SEC & FINRA regulated, SIPC insured.

Trading Conditions : 7/10 – Covers stocks, ETFs, crypto, but lacks derivatives.

Fee Transparency : 8/10 – Commission-free for stocks, higher fees for crypto.

Technology & Execution : 7/10 – The app is modern, but lacks professionalism.

Customer Service : 6/10 – Customer service was generally responsive.

User reputation : 6/10 – Average rating on Trustpilot, good reputation on the App Store.

Overall score: 42/60 (7.0/10)

SoFi Invest is a platform suitable for novice investors . Its commission-free, free automated investing, and seamless integration with bank accounts have attracted a large number of young users. However, its features are still insufficient for investors who need diversified asset allocation or professional trading tools.

Best for : Beginners and those who want to manage their banking and investments in an integrated way.

Not suitable for : Professional investors such as options/foreign exchange/futures.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.