BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Acorns, a US fintech company specializing in "round-ups," is operated by Acorns Grow Inc. It helps beginners and long-term savers easily enter the investment market by automatically investing their daily spare change into a portfolio of ETFs. This article will provide an in-depth analysis of Acorns' regulatory compliance, investment products, fee structure, user experience, and reputation, along with media and third-party reviews, to provide comprehensive reference for investors.

Full company name : Acorns Grow Inc.

Founded : 2012

Headquarters : Irvine, California, USA

Financing and users : Cumulative financing exceeds $200M, and the number of users exceeds 9 million (as of 2024).

Development History :

2014: Acorns officially launched its app and pioneered the Round-Ups investment model.

2017: Launch of the Acorns Later retirement account.

2019: Launch of the Acorns Early Childhood Account.

2021: Total customer investment exceeded $10 billion, making it one of the leading platforms in the micro-investment field in the United States.

📌 For more background, see the Acorns official website .

| Account Type | Minimum deposit | Features | Suitable for people |

|---|---|---|---|

| Acorns Invest | $5 | Fractional investing, automated ETF portfolios | Beginners, investing small amounts of money |

| Acorns Later | $5 | Retirement Account (IRA) | long-term investors |

| Acorns Early | $5 | Children's Education Savings Account | Home users |

| Acorns Checking | $0 | Investment + Banking Integration | Integrated financial needs |

Highlights :

Round-Ups automated investing: round up every purchase and invest the change in ETFs.

Diversified ETF portfolio: Covering US large-cap stocks, bonds, emerging markets, and more.

insufficient :

There is no individual stock trading and investment freedom is limited.

No complex products such as options, cryptocurrencies, foreign exchange, etc.

SEC Registration : Acorns Advisers, LLC is registered with the U.S. SEC as an investment advisor (RIA).

FINRA : Its brokerage firm Acorns Securities, LLC is a FINRA member.

SIPC : User investment accounts enjoy SIPC protection, up to $500,000.

Banking : Acorns Checking is FDIC insured with partner banks.

👉 You can check it through FINRA BrokerCheck .

ETF portfolios : managed by large institutions such as BlackRock and Vanguard.

Combination Type :

Conservative

Robust

Balanced

Growth

Radical

Market coverage : US stocks, bonds, and international emerging markets.

Disadvantages : Limited to ETFs, lacks individual stocks and alternative assets.

Subscription Fee :

$3/month (Individual Plan: Invest + Later + Checking)

$5/month (Family plan: add Early Access)

Trading Commission : Commission-free for ETF investments.

Hidden costs : ETF management fees (0.03%–0.25%).

👉 See Acorns fees page for details.

Deposit method : ACH automatic bank transfer, supports Round-Ups function.

Withdrawal method : Bank transfer, usually arrives in 2-3 business days.

Features : Investments are tied to Checking accounts, allowing users to transfer funds at any time.

Limitations : PayPal, credit cards, and third-party payment channels are not supported.

App features : Minimalist UI, focusing on "savings + investment" automation.

Function :

Round-Ups Automatic Investing

Regular investments (daily/weekly/monthly)

Financial education content (Grow)

Disadvantages : Lack of professional trading tools, technical indicators and real-time quotes.

Contact Information :

Email: [email protected]

Online help: Help Center

Customer Service Hours : Weekdays 9AM – 7PM EST

Language support : English only

User feedback :

Trustpilot : Acorns has a 3.2/5 rating (users complain about slow withdrawals).

App Store : Rating 4.7/5 (users recognize the convenience of investment).

NerdWallet Review: Suitable for beginners, but the fee structure is relatively high compared to the investment amount.

Investopedia gave Acorns 4/5 stars and called it the "Best Automatic Savings and Investment Tool."

Reddit users: Some called it a "forced savings tool," but pointed out that the fees are relatively high.

| platform | product | cost | Features |

|---|---|---|---|

| Acorns | ETF Portfolio | $3–5/month | Fragmented Investment + Automation |

| Stash | Individual stocks + ETFs | $3–9/month | Greater investment freedom |

| Robinhood | Individual Stocks + ETFs + Options | Stock commission-free | More suitable for active trading |

| SoFi Invest | Stocks + ETFs + Crypto | No commissions on stocks, high spreads on cryptocurrencies | Banking and investment integration |

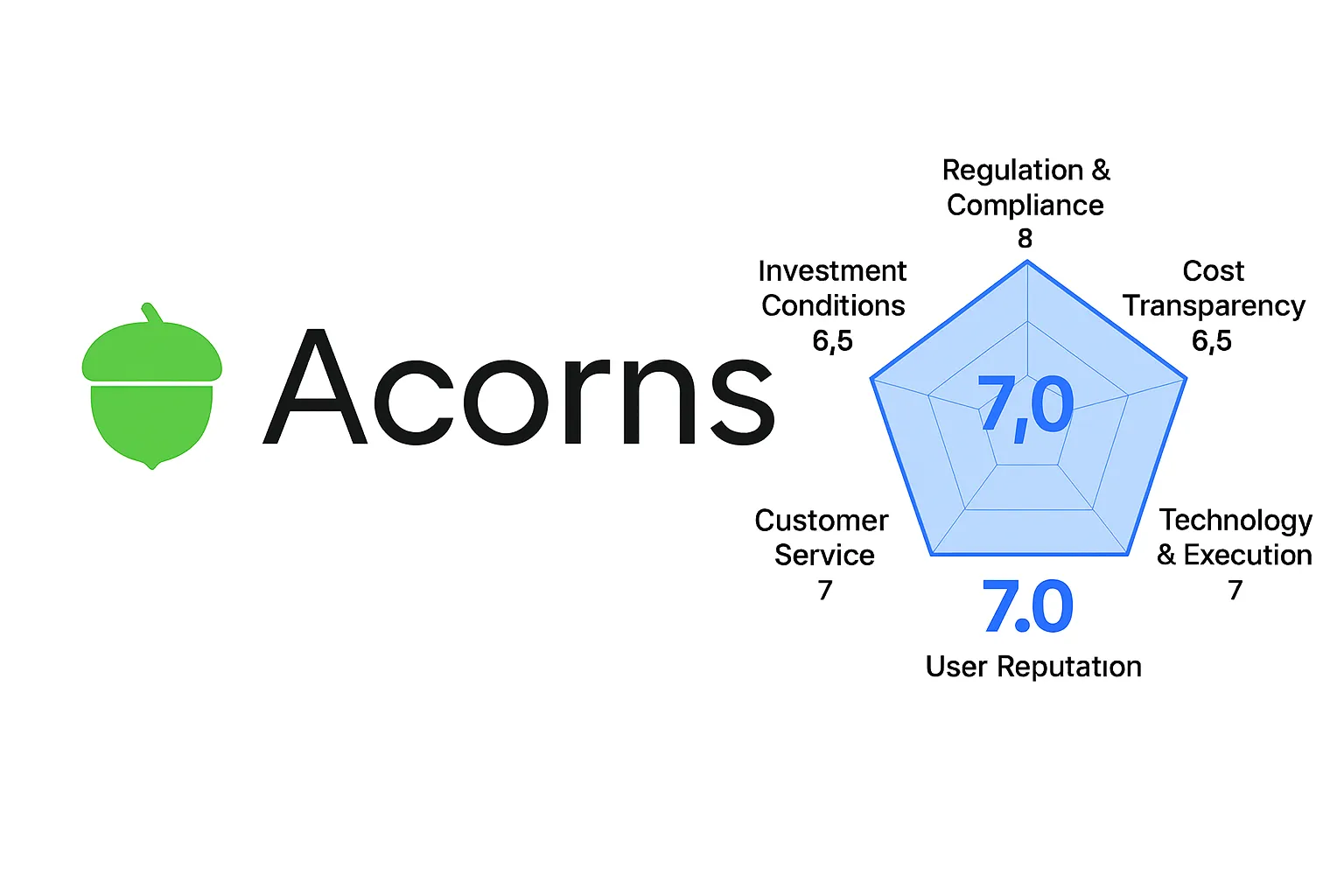

Regulatory Compliance : 9/10 – SEC/FINRA/SIPC covered.

Investment Conditions : 6/10 – ETFs only, lack of diversification.

Fee Transparency : 7/10 – Simple fees, but a bit high for smaller investors.

Technology & Execution : 7/10 – The app is clean, but lacks professional features.

Customer Service : 6/10 – Slow responses and single language support.

User Rating : 7/10 – Highly rated on the App Store, average on Trustpilot.

Overall score: 42/60 (7.0/10)

Acorns' core value lies in making investing incredibly simple and automated . It's a great tool for beginners with no investment experience and those with a long-term savings commitment. However, for those seeking diversified asset allocation or professional trading, Acorns can be overly simplistic.

Suitable for : Beginners, small investors, and those who want to save automatically.

Not suitable for : Professional investors, those who need a diversified portfolio.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.