Charles Schwab Review | Is Charles Schwab Reliable? A Complete Analysis of Regulatory Licenses, Investment Products, Transaction Fees, and User Reputation

Summary:Charles Schwab is one of the largest retail brokerages in the United States, regulated by the SEC and FINRA. Client assets are protected by both SIPC and FDIC regulations. The platform offers commission-free trading of US stocks and ETFs, access to over 4,000 commission-free funds, options, and bonds, and integrates powerful research tools and robo-advisory services. This article will delve into its regulatory compliance, product offerings, fee structure, trade execution, user reputation, and risk warnings to help investors determine whether Charles Schwab is a safe and reliable platform.

1. Brand Background and Development History

Charles Schwab Corporation (full name: The Charles Schwab Corporation ), founded in 1971 and headquartered in Westlake, Texas, is one of the world's largest retail brokerage firms. As a benchmark in the US brokerage market, Schwab has continuously expanded its business scope over half a century and currently serves over 34 million accounts with client assets exceeding US$7.6 trillion .

Schwab positions itself not only as a traditional brokerage firm but also as a comprehensive financial services group, integrating wealth management, investment consulting, retirement planning, and low-cost trading . Its popularity and credibility make "opening an account with Schwab" the preferred choice for many US and international investors.

2. Trading Account and Trading Conditions

Charles Schwab offers a wide variety of account types, covering almost every investor's lifecycle needs, including:

Brokerage Account : Suitable for ordinary investors to trade stocks, ETFs, options and funds.

Retirement Accounts (IRA) : Traditional IRA, Roth IRA, 401(k), etc., to meet the long-term retirement planning needs of American investors.

Custody accounts and education savings accounts : provide support for children's education savings and wealth inheritance.

International Investor Accounts : Investors in some regions can open a Schwab account remotely and invest in US stocks.

Trading conditions:

US stock trading commissions : Zero commission ($0/trade) on stock and ETF trades.

Options trading : USD $0.65 per contract.

Mutual Funds : Over 4,000 commission-free funds available.

Minimum Deposit : There is no minimum deposit requirement for standard brokerage accounts.

This highly competitive commission and fee structure makes Schwab extremely attractive in the context of the low-cost investment trend.

III. Supervision and Compliance

Charles Schwab is a leading authority on regulatory compliance:

U.S. Securities and Exchange Commission (SEC) regulation

Member of the U.S. Financial Industry Regulatory Authority (FINRA)

The U.S. Securities Investor Protection Corporation (SIPC) protects securities up to $500,000 per investor (including a $250,000 cash limit).

Banking services are provided by Schwab Bank , which is FDIC insured and deposits are protected up to $250,000.

This series of regulatory frameworks makes Charles Schwab almost impeccable in terms of security and compliance.

| Regulatory agencies | License number | regulated entities |

|---|---|---|

| SEC | N/A (SEC-registered) | Charles Schwab & Co., Inc. |

| FINRA | CRD# 5393 | Charles Schwab Corporation |

| SIPC | Membership | Charles Schwab & Co., Inc. |

| FDIC | Bank deposit insurance | Charles Schwab Bank |

IV. Trading Products and Market Coverage

Schwab's investment products are rich and cover a wide range of products:

Stocks and ETFs : Comprehensive coverage of the US main board and over-the-counter markets.

Mutual Funds : 4,000+ load-free funds and over 20,000 fund products.

Bonds and fixed income products : government bonds, corporate bonds, municipal bonds.

Options trading : supports multiple strategies (buy, sell, spread, combination, etc.).

Futures and Cryptocurrencies : Futures are offered through subsidiaries, while cryptocurrency exposure can be gained indirectly through partners such as Coinbase.

Financial management and investment advisory services : Schwab Intelligent Portfolios® (robo-advisory, minimum deposit $500), with management fees as low as 0%.

5. Trade Execution and Technical Performance

Schwab's platform portfolio includes:

Schwab.com online trading platform : suitable for novice investors.

StreetSmart Edge® Desktop : Advanced trading software featuring real-time quotes, sophisticated charting, and technical indicators.

Schwab Mobile App : Provides convenient mobile trading and account management functions, and supports fingerprint/face recognition.

API interface : supports strategy access for developers and quantitative investors.

In terms of execution quality, Schwab emphasizes price improvement rate and order execution speed , and has been ranked among the top in the industry in the medium and long term based on independent third-party data comparisons.

6. Fees and Deposit and Withdrawal Methods

Fee advantage is Schwab's core competitiveness:

Stock/ETF trading commissions : $0

Option premium : $0.65 per contract

Mutual Funds : 4000+ No-Load Funds

Account management fee : No minimum deposit, no maintenance fee

Deposit and withdrawal methods : Supports bank wire transfer (Wire), ACH, check deposit, and mobile deposit.

International users : Some countries support international wire transfers.

7. Customer Service and Additional Features

Customer support channels : phone, online chat, email support

Service hours : 7x24 hours customer support

Language : English and Spanish are supported, and some international businesses provide Chinese customer service

Additional features : Investment education center, daily market research, financial management tools (retirement planning calculator, tax optimization advice).

Contact Information:

Official website: https://www.schwab.com

Customer Service: +1 800-435-4000

Email: [email protected]

8. Media and User Reviews

International media coverage

Barron’s : Schwab has been repeatedly ranked as “one of the best brokerages.”

Investopedia : Highly praises Schwab's overall strength, especially its low fees and product breadth .

NerdWallet : Gives it a 5-star review, calling it "the best all-around brokerage for long-term investors."

User feedback

Advantages: Low fees, a wide range of account types, comprehensive educational resources, and cost-effective investment advisory services.

Cons: The account opening process is complex for some international users, and professional traders believe the platform lacks high-frequency trading capabilities.

IX. Risk Warning

Low fees may mask the hidden costs in transaction execution, and investors need to pay attention to the difference between the actual transaction price and the market price.

International users need to confirm whether their country supports account opening and fund transfer.

All investments involve risks, including the risk of loss of principal.

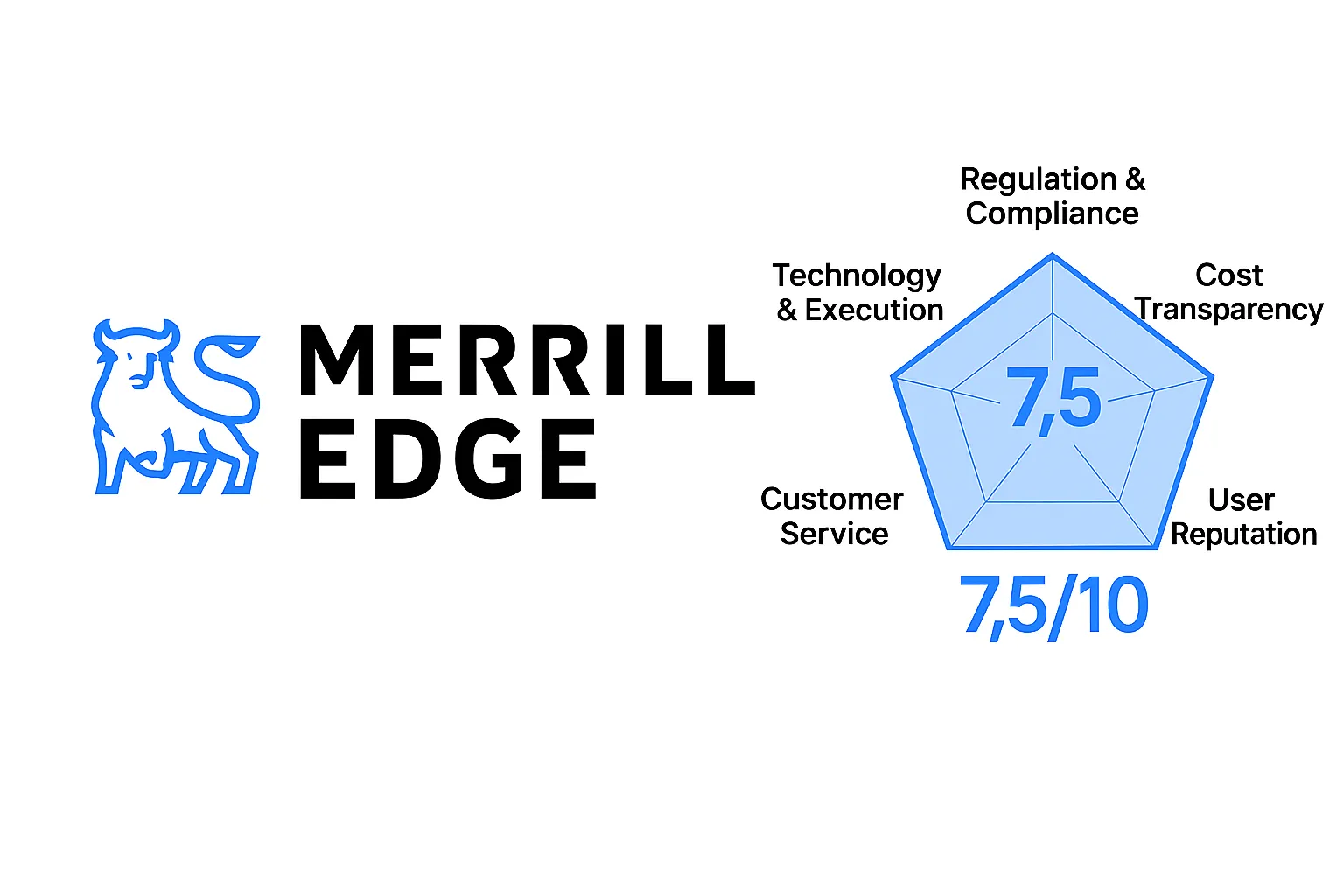

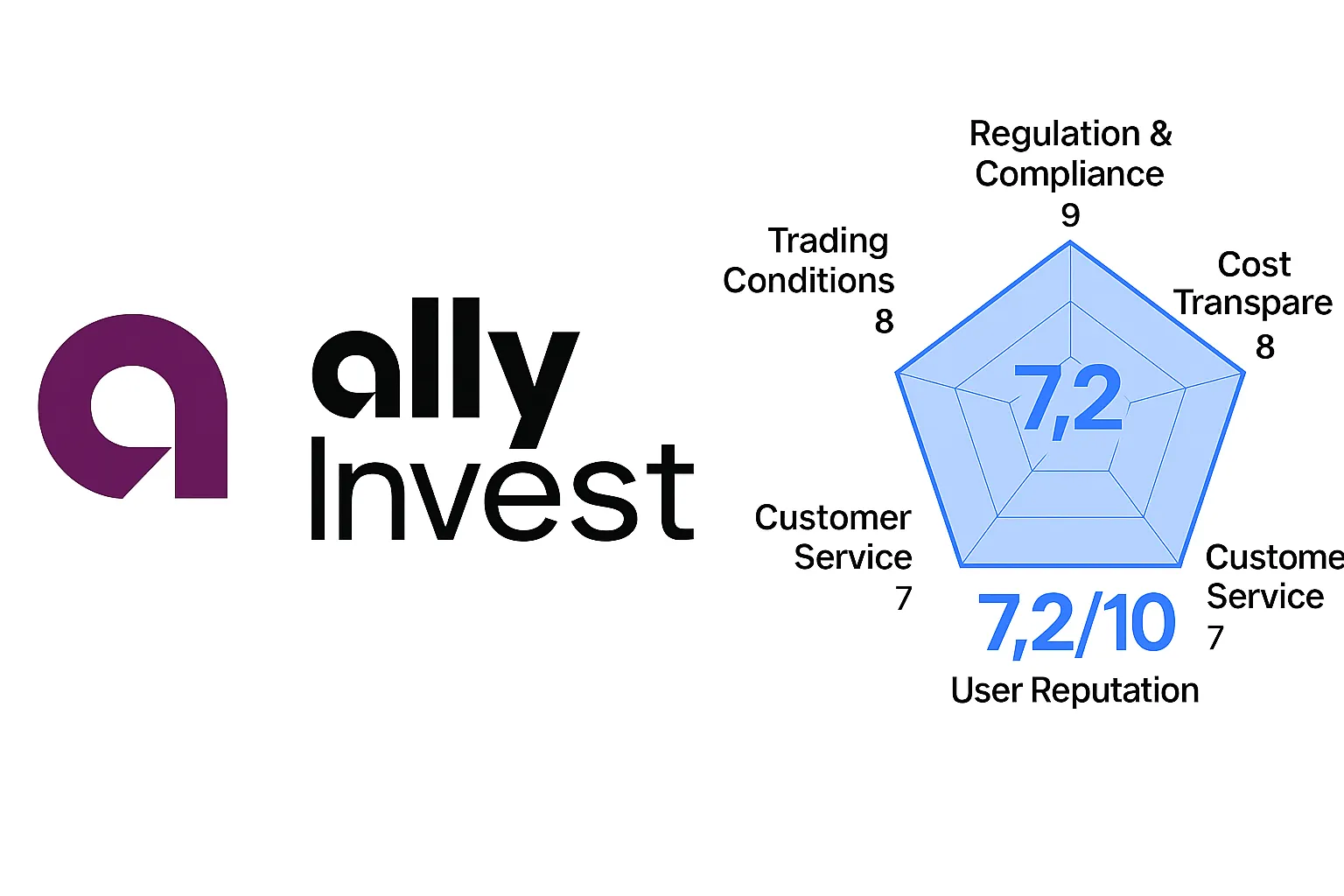

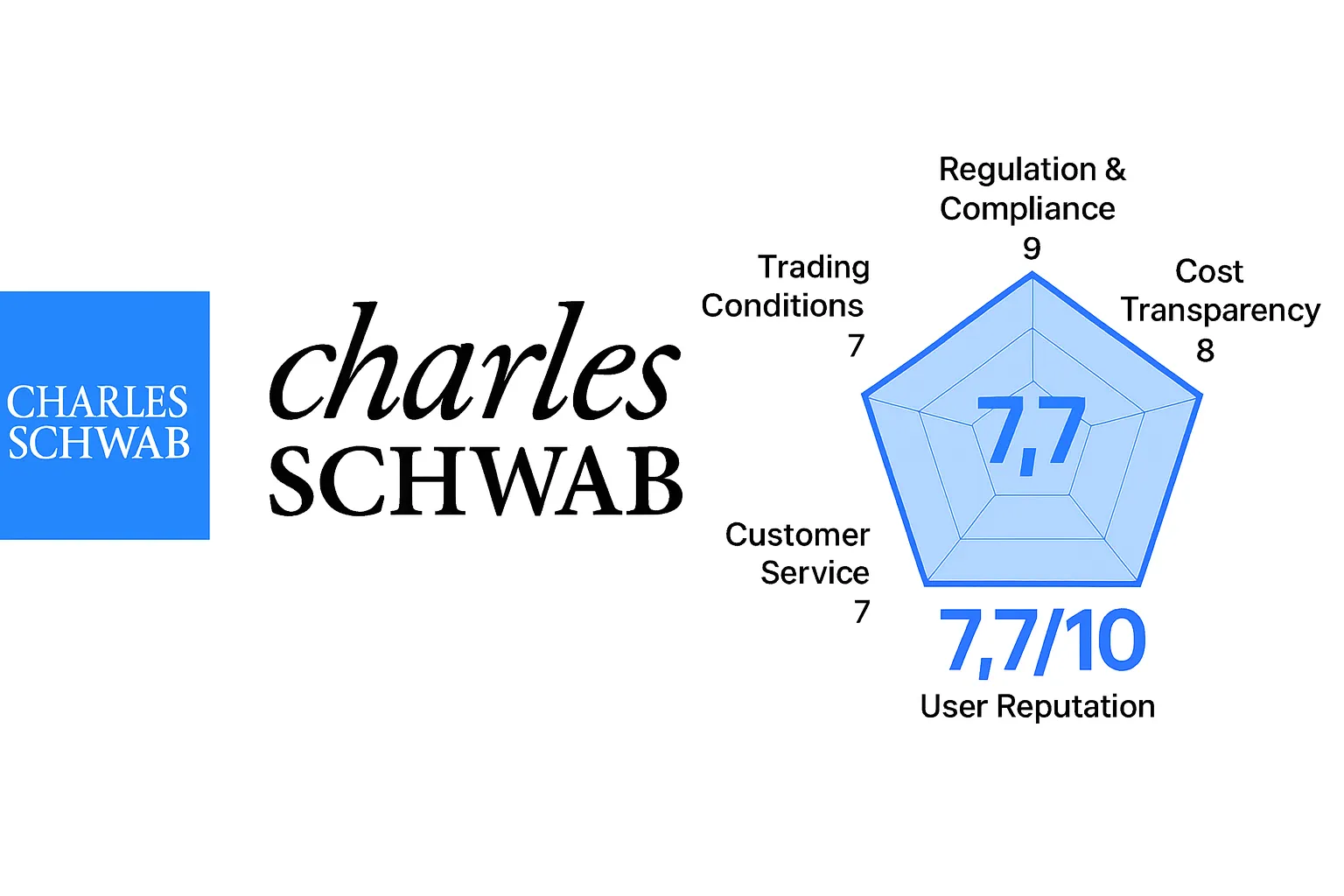

🔹 Multi-dimensional rating (BrokerHiveX standard, full score 10)

Regulatory Compliance: 9/10 — Multiple regulations, safe and reliable

Trading Conditions: 7/10 — Very low fees, but slightly higher options

Fee transparency: 8/10 — Zero commission model is transparent

Technology and Execution: 7/10 — The platform is stable, but not as good as professional trading software

Customer Service: 7/10 – 24/7 customer service, limited international support

User reputation: 8/10 — Positive reviews from mainstream media and investors

📊Overall rating: 7.7/10

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.