Ally Invest Review | Is Ally Invest Reliable? A Complete Analysis of Regulatory Licenses, Investment Products, Transaction Fees, and User Reputation

Summary:Ally Invest is a US-based online investment platform operated by Ally Financial Inc. (NYSE: ALLY). As a compliant brokerage regulated by the SEC and FINRA, and a member of SIPC, Ally Invest offers commission-free stock and ETF trading, low-cost options, mutual funds, bonds, and robo-advisory services. Leveraging Ally Bank's integration, Ally Invest has become a popular wealth management and trading platform for US investors. This article will conduct a detailed evaluation across six dimensions: regulatory compliance, trading conditions, fee transparency, technology and execution, customer service, and user reputation, and provide a BrokerHiveX rating (out of 10).

1. Brand Background and Development History

Full company name : Ally Invest Securities LLC / Ally Invest Advisors Inc.

Parent company : Ally Financial Inc. (NYSE: ALLY, a US-listed financial group)

Founded : 2005 (formerly TradeKing, renamed Ally Invest after acquisition)

Headquarters : Charlotte, North Carolina, USA

Positioning : A low-cost online brokerage for mass investors, featuring zero-commission trading, robo-advisory, and bank integration.

Development History :

2005: TradeKing launched, focusing on low-commission US stock and options trading.

2016: Acquired by Ally Financial.

2017: Officially changed its name to Ally Invest .

2020–2024: Expanding robo-advisory (Robo Portfolio), ETF investment and retirement accounts.

📌 For more information, visit Ally Invest's official website .

2. Trading Account and Trading Conditions

Account Type

Self-Directed Trading : Stocks, ETFs, Options, Funds, Bonds

Robo Portfolios : Minimum deposit of $100, automatically configured ETF portfolio by algorithm

IRAs : Traditional IRA, Roth IRA, SEP IRA

Custody Account : For Education and Wealth Inheritance

Trading Conditions

Stocks & ETFs : Zero Commission

Options : $0 base commission + $0.50 per contract (lower than most competitors' $0.65)

Mutual funds : Some are commission-free, but others may charge transaction fees.

Bonds/CDs : Spread model, cost embedded in quotes

Minimum deposit : No minimum deposit requirement (robo-advisor starts at $100)

III. Supervision and Compliance

SEC : Ally Invest Securities LLC is registered with the U.S. Securities and Exchange Commission

FINRA : Member of the Financial Industry Regulatory Authority (FINRA), available for inquiry via FINRA BrokerCheck

SIPC : Customer securities accounts enjoy SIPC protection up to $500,000 (cash limit $250,000)

Parent company : Ally Financial Inc. is a US listed financial group (NYSE: ALLY) and is subject to multiple regulatory oversight by the SEC and OCC.

Conclusion: Robust compliance and high transparency.

IV. Investment Products and Market Coverage

Stocks & ETFs : Covering major US exchanges (NYSE, NASDAQ)

Options Trading : Multiple Strategies for Active Traders

Mutual Funds : No-Load Funds + Thousands of Tradeable Funds

Bonds/CDs : U.S. Treasury bonds, corporate bonds, CDs

Robo-advisory : Algorithms automatically allocate ETF portfolios and support ESG strategies

Disadvantages : Does not offer foreign exchange, futures, or cryptocurrency trading.

5. Trade Execution and Technical Performance

Trading Platform :

Web page : simple interface, suitable for beginners

Mobile App (iOS/Android): Provides stock, ETF, and options trading

Ally Invest LIVE : Professional-grade web-based trading tool with real-time quotes, technical charts, and filters

Execution speed : industry average, transparent order routing

Research tools : Built-in third-party research reports such as Morningstar and CFRA

6. Deposits and Withdrawals and Fund Management

Deposits : ACH (free), wire transfer, check deposit

Withdrawal : ACH is free, wire transfers require a fee of around $30

Integration Advantages : Seamless integration with Ally Bank, allowing users to instantly transfer funds between bank accounts and investment accounts

7. Customer Service and Multilingual Support

Customer service channels : phone, online chat, email

Service hours : Monday to Friday 7AM – 10PM (EST)

Language support : Mainly English, no Chinese customer service support yet

Comment : Customer service response is generally fast, but there are delays during peak hours.

Contact Information:

Phone: 1-855-880-2559

Help Center: Ally Invest Help Center

8. Third-party media and user reviews

NerdWallet : Ally Invest Review rated 4.3/5, with advantages in low fees and bank integration.

Investopedia : Ally Invest Review says it is "suitable for active investors and low-cost traders."

Trustpilot : Ally has an overall Trustpilot score of 2.5/5. Users complain about customer service and app stability, but positive reviews focus on low fees and convenient transfers.

9. Competitor Comparison

| platform | Regulation | Product Range | cost | Features |

|---|---|---|---|---|

| Ally Invest | SEC/FINRA/SIPC | US stocks, ETFs, options, funds, bonds | Stock ETF commission-free, options $0.50/contract | Bank integration, smart investment advisory |

| Robinhood | SEC/FINRA/SIPC | Stocks, ETFs, Options, Crypto | Stock commission-free, options $0.65/contract | Young groups, encrypted products |

| Fidelity | SEC/FINRA/SIPC | All-category investment | No commission on stocks and wide coverage of funds | Rich research resources |

| Charles Schwab | SEC/FINRA/SIPC | Stocks, ETFs, Funds, Bonds, Options | Stock commission-free | All-round comprehensive securities firm |

10. Risk Warning

Lack of diversified products : no support for foreign exchange, cryptocurrency, and futures

Technical stability : Some users report that the app experiences delays during peak hours.

Customer service fluctuates : Trustpilot repeatedly mentions unresponsiveness.

Investment risk : Market investment carries the risk of capital loss.

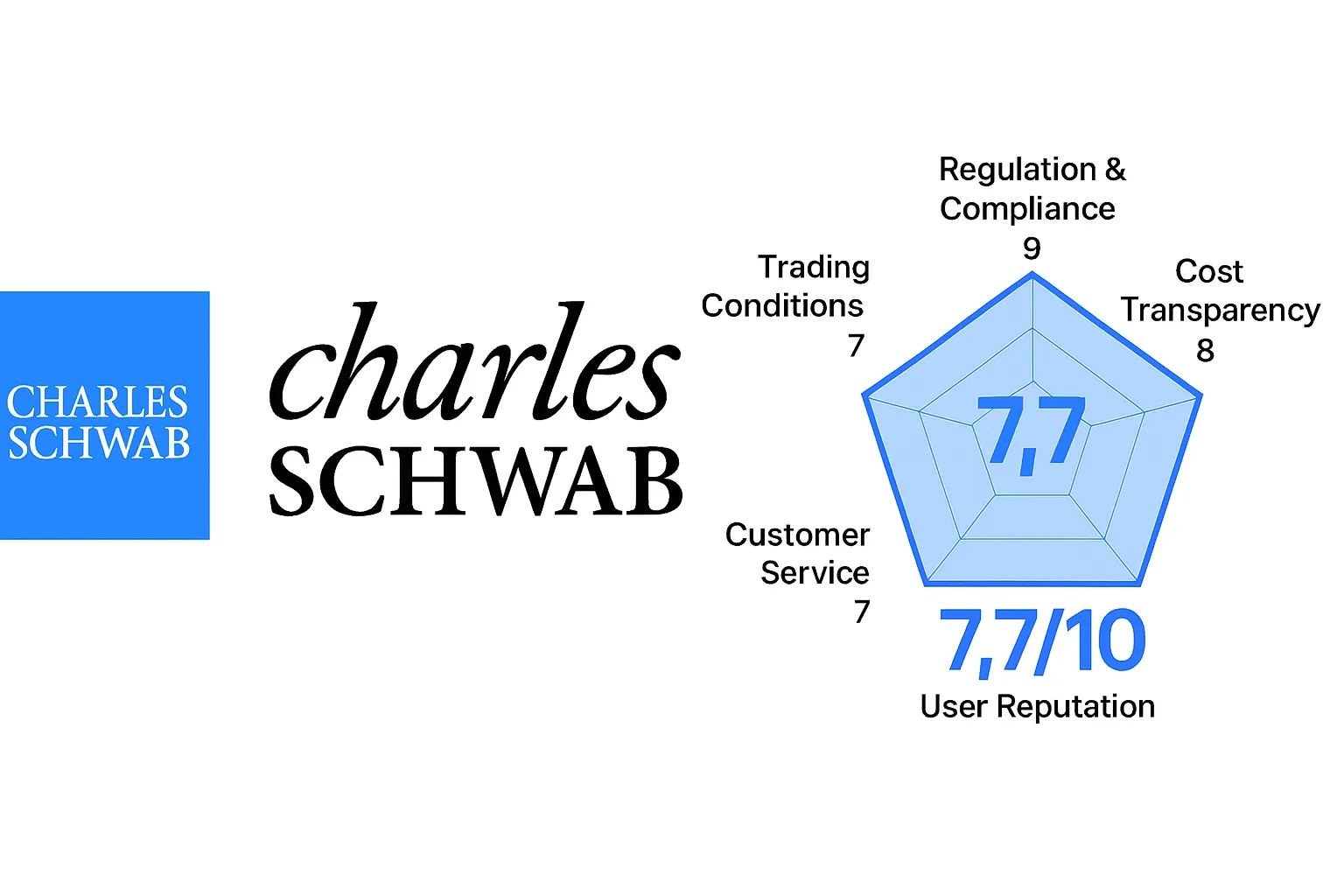

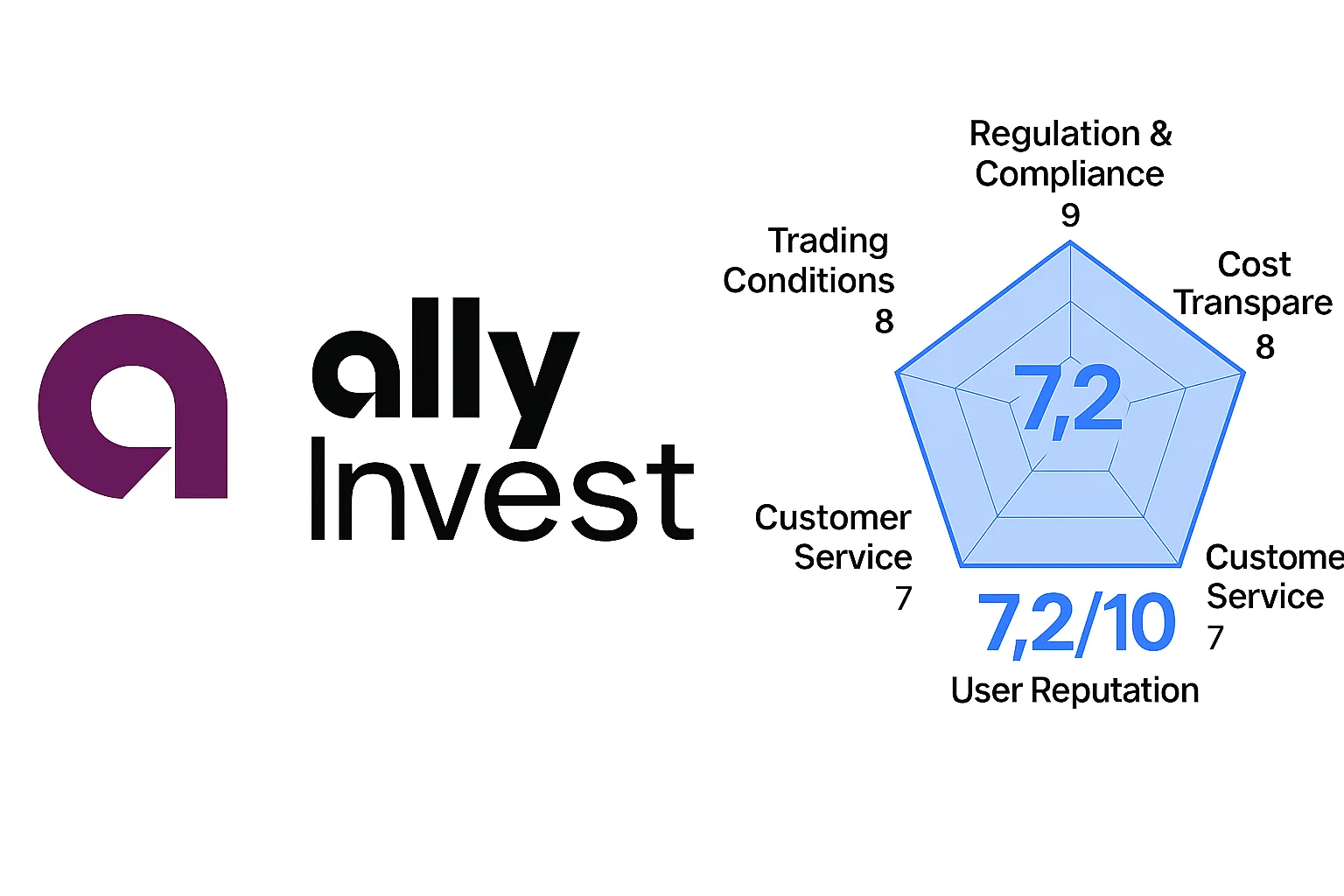

11. BrokerHiveX Six-Dimensional Rating (10-point scale)

Regulatory Compliance : 9/10 — SEC + FINRA + SIPC, multiple compliance guarantees

Trading Conditions : 7/10 — Stocks/ETFs/options covered, but no crypto/futures

Fee transparency : 8/10 — Zero commission on stocks, and lower option contract rates than peers

Technology and Execution : 7/10 — The platform is simple and easy to use, but the app lacks stability

Customer Service : 6/10 – Average response time, lacks multilingual support

User reputation : 6/10 — Low on Trustpilot, but high on professional review sites

📊 Overall score: 43/60 (7.2/10)

12. Conclusion and Investment Recommendations

Suitable for :

US Residents

Investors who prefer low-cost US stock/ETF/option trading

Users who want to manage funds integrated with Ally bank accounts

Financial management users interested in Robo Advisors

Not suitable for people :

Users who want to trade cryptocurrencies, futures, or forex

High-frequency or professional quantitative traders

Overall evaluation :

Ally Invest is a mainstream US brokerage firm offering security, compliance, low fees, and convenient bank integration , making it suitable for small and medium-sized investors and long-term financial management users. While its regulatory framework is robust, it still has room for improvement in product diversity, technical performance, and customer service.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.