ETRADE Review | Is ETRADE Reliable? A Complete Analysis of Regulatory Licenses, Investment Products, Transaction Fees, and User Reputation

Summary:E*TRADE is one of the oldest online brokerages in the United States, founded in 1982 and acquired by Morgan Stanley (NYSE: MS) in 2020, becoming the core platform for its retail brokerage business. E*TRADE offers a full range of investment products, including stocks, ETFs, options, funds, bonds, and futures. Its transparent fees and powerful trading tools make it particularly popular among active traders and professional investors. As an SEC-registered, FINRA-regulated, and SIPC-insured brokerage, it offers a solid foundation for security and compliance. This article will evaluate E*TRADE across six dimensions: regulatory compliance, trading conditions, fee transparency, technology and execution, customer service, and user reputation, and provide a BrokerHiveX score (out of 10).

1. Brand Background and Development History

Full company name : E*TRADE Financial Holdings, LLC (a subsidiary of Morgan Stanley)

Founded : 1982

Headquarters : Arlington, Virginia, USA

Parent company : Morgan Stanley (a leading global investment bank with a market capitalization of approximately US$150 billion)

Development History :

1983: Becomes one of the first brokerages to offer online stock trading

1996: Listed on NASDAQ, driving online retail investment

2000s: Expanding investment products such as options, futures, and funds

2020: Acquired by Morgan Stanley and integrated into its retail and wealth management brands

📌 For more information, visit the E*TRADE official website .

2. Trading Account and Trading Conditions

Account Type

Brokerage Account (Standard Brokerage Account) : Stocks, ETFs, Options, Funds, Bonds, Futures

Retirement Accounts : IRA, Roth IRA, SEP IRA

Custody Accounts : Education Savings and Wealth Inheritance

Futures account : Apply separately and meet risk disclosure and margin requirements

Trading Conditions

Stocks & ETFs : Zero Commission Trading

Options : $0 base commission + $0.65/contract ($0.50/contract for active traders)

Mutual Funds : Over 4,000 No-Load Funds

Bonds & CDs : Secondary market trading, fees embedded in the spread

Futures : $1.50/contract/side (relatively cheap)

Minimum deposit : No minimum deposit requirement (futures accounts require margin)

III. Supervision and Compliance

SEC : E*TRADE Securities LLC is registered with the U.S. Securities and Exchange Commission

FINRA : Member of the Financial Industry Regulatory Authority (FINRA), available for inquiry via FINRA BrokerCheck

SIPC : Customer securities accounts enjoy SIPC protection up to $500,000 (cash limit $250,000)

Parent company endorsement : Affiliated with Morgan Stanley , enhancing financial and brand strength

Conclusion: E*TRADE's regulatory and compliance assurances are at the top of the industry.

IV. Investment Products and Market Coverage

Stocks & ETFs : Coverage of all US exchanges (NYSE, NASDAQ, AMEX)

Options trading : supports single-leg, multi-leg, spread and complex combination strategies

Mutual Funds : 4,000+ commission-free funds covering all asset classes

Bonds & Fixed Income : U.S. Treasury bonds, corporate bonds, local bonds, municipal bonds

Futures : covering stock indices, interest rates, energy, and commodities

Not supported : Forex, spot cryptocurrencies

5. Trade Execution and Technical Performance

Platforms and Tools

E*TRADE Web Platform : A web-based platform with comprehensive functions suitable for general investors

Power E*TRADE : Designed for active and professional traders, with advanced charting, option chain analysis, and real-time market depth

Mobile App : Supports stock, options, funds, and futures trading with rich functions

Research and Education : Provides third-party research from Morningstar, Credit Suisse, Thomson Reuters, etc.

Execution Performance

Smart order routing to ensure price improvement and execution speed

Provides Level II market depth and advanced analytical tools suitable for day trading and options strategies

6. Deposits and Withdrawals and Fund Management

Deposits : ACH transfer (free), wire transfer, check deposit, mobile check deposit

Withdrawal : ACH free, wire transfer $25-$30

Fund security : Investment accounts are protected by SIPC, and cash deposits are FDIC-insured (through the Sweep mechanism)

7. Customer Service and Multilingual Support

Customer service channels : phone, online chat, email

Service time : 7x24 hours customer service

Language support : English is the main language, some customers can apply for Spanish support

Evaluation : Professional customer service team, but waiting time is long during peak hours

Contact Information:

Phone: 1-800-387-2331

Help Center: E*TRADE Customer Service

8. Third-party media and user reviews

Investopedia : E*TRADE Review , rated as "one of the best brokers for options and active traders"

NerdWallet : NerdWallet E*TRADE Review , rated 4.5/5, emphasizing low fees and powerful options tools

Trustpilot : E*TRADE Trustpilot , user rating 2.6/5, mainly complaining about customer service and app stability, but praising the powerful trading tools

9. Competitor Comparison

| platform | Regulation | Product Range | cost | Features |

|---|---|---|---|---|

| E*TRADE | SEC/FINRA/SIPC | Stocks, ETFs, options, funds, bonds, futures | Stock commission-free, options $0.65/contract | Powerful trading tools for active traders |

| Charles Schwab | SEC/FINRA/SIPC | Stocks, ETFs, Funds, Bonds, Options | Stock commission-free | Comprehensive all-round brokerage firm |

| Fidelity | SEC/FINRA/SIPC | All-category investment | Stock commission-free | Strong research and retirement account services |

| Robinhood | SEC/FINRA/SIPC | Stocks, ETFs, Options, Crypto | Stock commission-free, options commission $0.65 | Easy to use, preferred by young investors |

10. Risk Warning

Technology dependency : App may experience delays during peak hours

International limitations : Open only to US residents, not suitable for international investors

Customer service issue : Some users report long waiting times

Missing products : Cryptocurrency and Forex are not supported

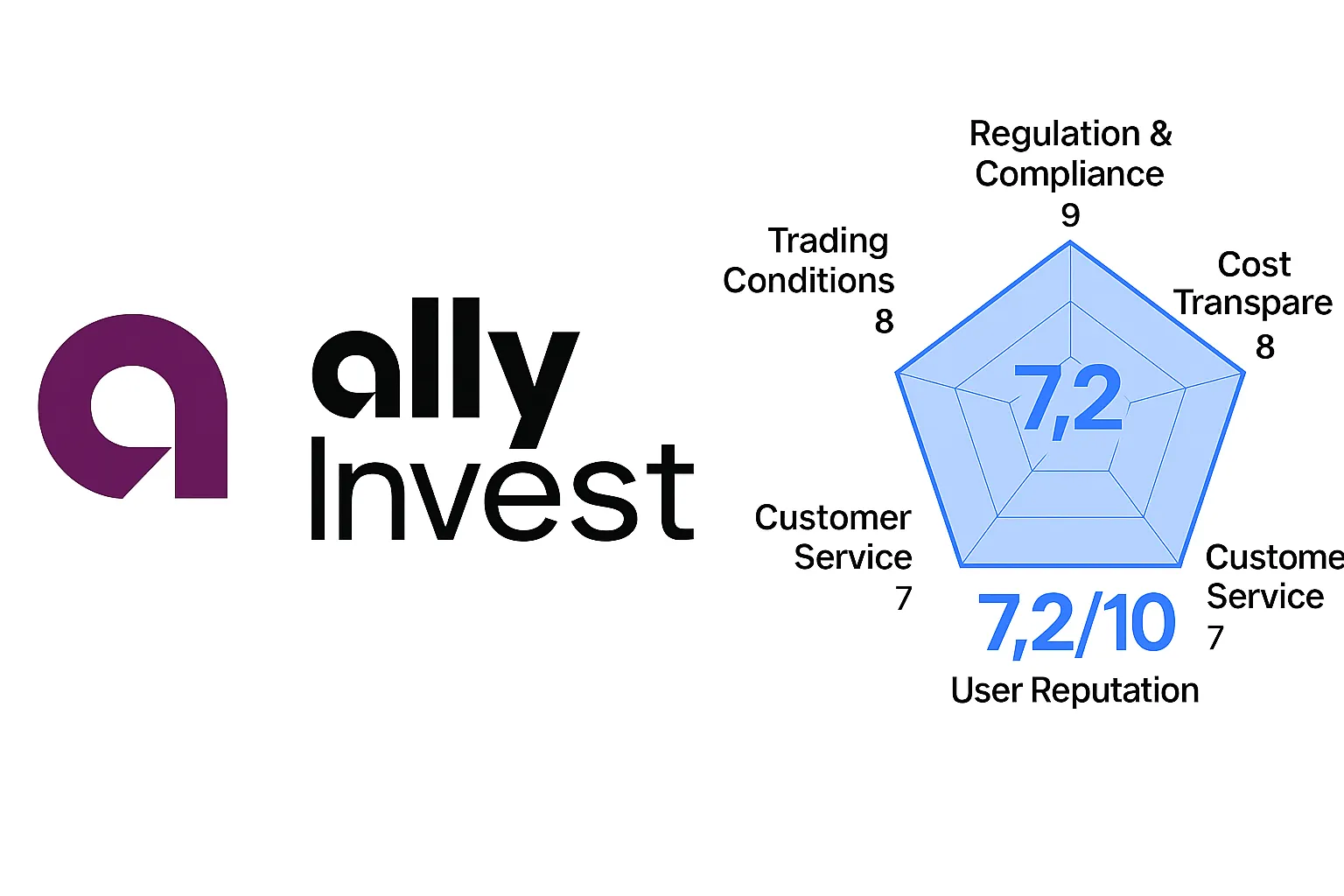

11. BrokerHiveX Six-Dimensional Rating (10-point scale)

Regulatory Compliance : 9/10 — SEC/FINRA regulated, SIPC insured, and backed by parent company Morgan Stanley

Trading Conditions : 8/10 – Comprehensive product range, especially options and futures.

Fee Transparency : 8/10 — Commission-free for stocks, reasonable options/futures rates

Technology and Execution : 8/10 — The Power E*TRADE platform is powerful and suitable for active traders

Customer Service : 6/10 — Professional but not very responsive

User reputation : 6/10 — Highly praised by professional media, but low on Trustpilot users

📊 Overall score: 45/60 (7.5/10)

12. Conclusion and Investment Recommendations

Suitable for people

US Residents

Active traders, option strategy investors

Users who want to use professional platforms and research tools

Not suitable for everyone

Users who want to trade Forex or cryptocurrencies

international investors

Overall evaluation

As a long-established US brokerage and subsidiary of Morgan Stanley , E*TRADE excels in security, trading tools, product coverage, and fee transparency, making it particularly suitable for active trading and options investing. While its customer service and user reputation have been somewhat controversial, it remains one of the most trustworthy brokerages in the US market.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.