BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:eToro is a leading global social trading and investment platform with over 30 million registered users and service in over 100 countries. It specializes in stocks, ETFs, cryptocurrencies, CFDs, forex, and commodities, and offers CopyTrading™, allowing investors to replicate the strategies of professional traders. eToro is regulated by multiple regulators, including the FCA (UK), CySEC (Cyprus), and ASIC (Australia), with some markets also subject to US FINRA/SEC rules, ensuring a solid regulatory compliance foundation. This article will evaluate the platform across six dimensions: regulatory compliance, trading conditions, fee transparency, technology and execution, customer service, and user reputation, and provide a BrokerHiveX rating (out of 10).

Full company name : eToro Group Limited

Founded : 2007

Headquarters : Tel Aviv, Israel, with branches in London, Cyprus, Australia, etc.

User scale : More than 30 million registered accounts

Core Positioning : Social Investment Platform (Social Trading + CopyTrading)

Development Milestones :

2007: eToro is established and launches a visual foreign exchange trading platform

2010: Launched CopyTrading feature

2013–2017: Expanding to include CFDs, cryptocurrencies, and other assets

2019: Entered the US market, offering cryptocurrency and stock trading

2021–2024: Continued expansion into Asia and the Middle East

📌 For more information, visit the eToro website .

Account Type

Retail Account (Standard)

Professional Account (suitable for large capital traders, qualification review required)

Demo account ($100,000 in virtual funds, for practice)

Trading Conditions

Stocks & ETFs : Zero commission (select markets)

Cryptocurrency : Supports 70+ tokens including Bitcoin, Ethereum, Solana, etc.

CFD : Forex, Indices, Commodities (Leverage up to 1:30, varies by region)

Forex : 70+ currency pairs

Minimum deposit : $10 (may be higher depending on the region)

Leverage restrictions : regulated regions follow ESMA/ASIC/FCA regulations

UK FCA : eToro (UK) Ltd., FCA registration number 583263

Cyprus CySEC : eToro (Europe) Ltd., license number 109/10

Australian ASIC : eToro AUS Capital Pty Ltd., AFSL 491139

US FINRA/SEC : eToro USA LLC offers some crypto and stock trading

Others : Comply with ESMA European investor protection rules

Fund security:

SIPC (US) : $500,000 in coverage for eligible accounts

Investor Compensation Fund (Europe) : Up to €20,000

Fund segregation and custody : separation of client funds and company assets

Stocks : Global market stocks (US stocks, European stocks, and some Asian markets)

ETF : covers mainstream indexes and thematic ETFs

Cryptocurrency : 70+ digital assets

CFD : Indices, Forex, Commodities

Forex : 70+ currency pairs

Social Trading : Copy other investors' portfolios

Smart Portfolios : Fund-like portfolio products

📌 Cons: Some markets restrict CFDs and leverage, and compliance varies significantly across regions.

Platform Advantages

eToro App (Mobile + Desktop) : Focuses on social trading

CopyTrading™ : Directly copy the actions of top traders

Smart Portfolios : Preset asset portfolios for long-term investment

Research and Community : Investors can exchange ideas in the community

Execution quality

Orders are transparent, and some products are market maker models

Execution speed is suitable for ordinary investment, but not for high-frequency trading

Deposit methods : credit card, PayPal, bank transfer, wire transfer

Withdrawal method : wire transfer, bank card ($5 withdrawal fee)

Account currency : Only USD is supported (other currencies require conversion)

Fund security : isolated custody, regulated and guaranteed

Customer service channels : Online ticket, App support

Service hours : 24/5 on weekdays

Language support : Supports 20+ languages (including Chinese, English, Spanish, etc.)

User feedback : Customer service response speed is slow

Contact Information:

Help Center: eToro Help Center

Investopedia : eToro Review , calling it "the best social trading and cryptocurrency investment platform"

NerdWallet : eToro Review , rated 3.8/5, strengths lie in its social features and multi-asset coverage, but its disadvantage is its complex fee structure.

Trustpilot : eToro Trustpilot , rated 2.5/5. Users complain about customer service and withdrawals, but approve of the convenience of CopyTrading.

| platform | Regulation | Product Range | cost | Features |

|---|---|---|---|---|

| eToro | FCA/CySEC/ASIC/SEC | Stocks, ETFs, Crypto, CFDs, Forex | No commission for stocks, spread for other products | Social Trading, CopyTrading |

| Robinhood | SEC/FINRA | Stocks, ETFs, Options, Crypto | Zero commission | Young people, crypto trading |

| Interactive Brokers | SEC/CFTC/FINRA + Global | Stocks, ETFs, options, futures, forex, bonds | Ultra-low rates | Professional investors' first choice |

| Moomoo | SEC/FINRA/SIPC + International | US stocks, Hong Kong stocks, A shares, ETFs, options | Commission-free US stock trading | Multi-market coverage + investment community |

Complex fee structure : Crypto and CFD spreads are high

Fund conversion cost : only supports USD accounts

Insufficient customer service : Trustpilot users collectively complain about customer service

Regulatory restrictions : Inconsistent product offerings in different countries

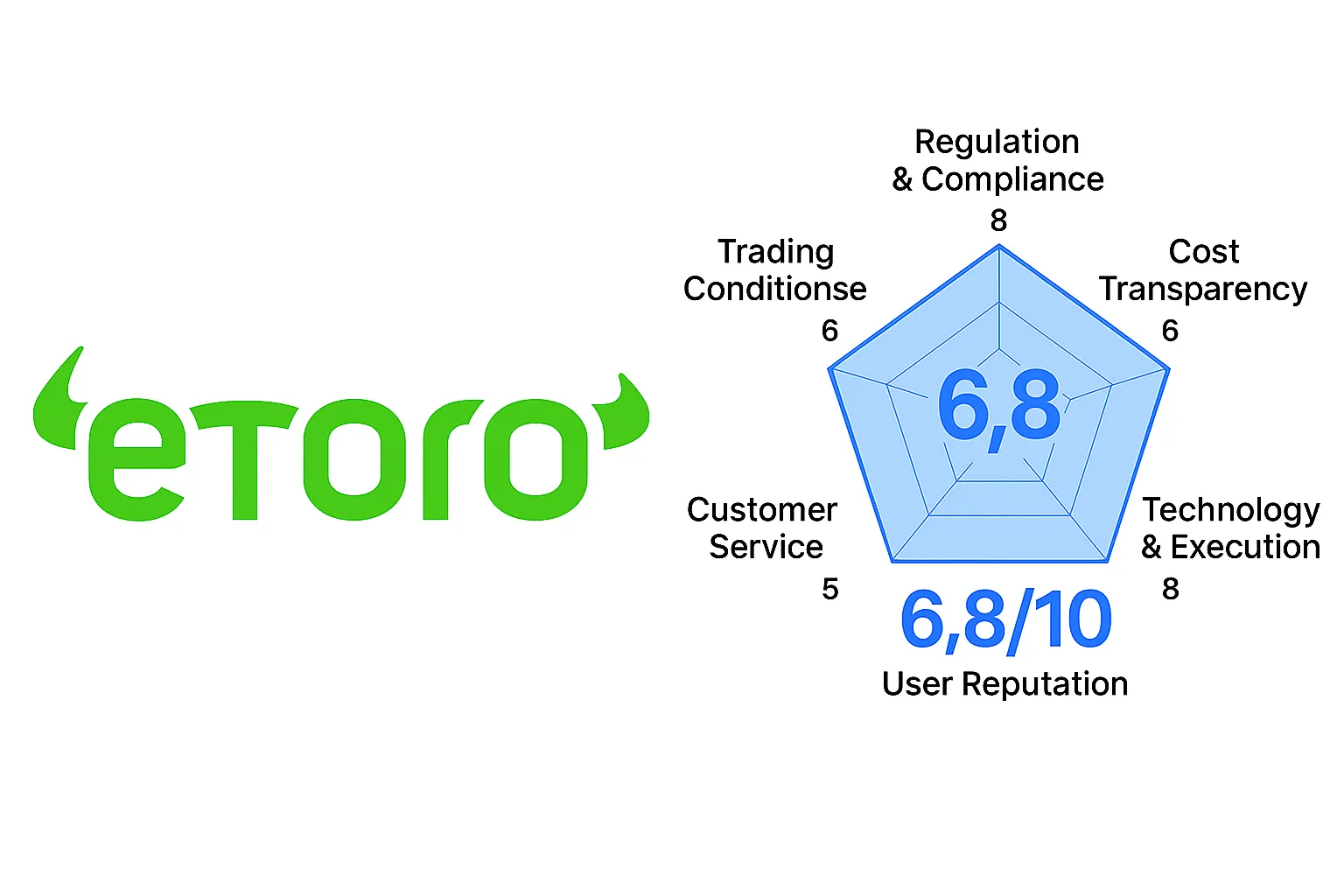

Regulatory Compliance : 8/10 — Multi-national regulation, segregated funds custody

Trading conditions : 8/10 — Wide product coverage, including social features

Fee Transparency : 6/10 — Commission-free for stocks, but high spreads and withdrawal fees

Technology and Execution : 8/10 — Platform is powerful, CopyTrading is unique

Customer Service : 5/10 – Slow responses and lack of immediate support

User Reputation : 6/10 — Positive media reviews, but average user feedback

📊 Overall score: (6.8/10)

Suitable for people

Investors who like social trading and want to follow the masters

Pursue diversified asset allocation (stocks + ETFs + crypto + forex)

Medium- and long-term investors

Not suitable for everyone

High-frequency traders

Users who are extremely sensitive to costs

Investors who want high-quality customer support

Overall evaluation

eToro is a legally compliant, global social investment platform known for its CopyTrading™ and diversified assets , making it particularly suitable for novice investors and users who want to tap into the wisdom of the community. Despite controversy over fees and customer service, it remains one of the most influential investment platforms in the world.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.