Fidelity Review | Is Fidelity Investments reliable? A complete analysis of regulatory licenses, investment products, transaction fees, and user reputation.

Summary:Fidelity Investments is one of the world's largest asset managers, managing over $4.5 trillion in assets. It has long been a leading brokerage firm in the US, offering a comprehensive range of investments, including stocks, ETFs, mutual funds, bonds, options, and retirement accounts. As an SEC-registered, FINRA-regulated, and SIPC-insured brokerage, Fidelity is considered an industry benchmark for security and service. This article will evaluate the firm across six dimensions: regulatory compliance, trading conditions, fee transparency, technology and execution, customer service, and user reputation, and provide a BrokerHiveX score (out of 10).

1. Brand Background and Development History

Full company name : FMR LLC (Fidelity Management and Research), which operates Fidelity Investments

Founded : 1946

Headquarters : Boston, Massachusetts, USA

Positioning : A leading global retail brokerage and asset management company

Development History

1946: Fidelity is founded, starting with mutual funds

1970s: Individual Retirement Accounts (IRAs) introduced

1990s: Pioneered in online trading

2010s–2020s: Expansion into ETFs, mobile trading, and digital wealth management

📌 For more information, visit Fidelity's official website .

2. Trading Account and Trading Conditions

Account Type

Brokerage Account : Stocks, ETFs, Funds, Bonds, Options

Retirement Accounts (IRA/401k)

Custody Accounts & Education Accounts (529 Plan)

Margin Account

Trading Conditions

Stocks & ETFs : Zero Commission

Options : $0 base fee + $0.65/contract

Mutual Funds : Over 3,700 no-load funds

Bonds : U.S. Treasuries, corporate bonds, municipal bonds

Minimum deposit : No minimum requirement

III. Supervision and Compliance

SEC : Registered Broker

FINRA : Member regulated, available on BrokerCheck

SIPC : Customer assets are protected by SIPC , up to $500,000 ($250,000 for cash)

Additional insurance : Some customers enjoy additional excess insurance coverage

Conclusion: Supervision is transparent and compliance is top-notch in the industry.

IV. Investment Products and Market Coverage

Stocks : All US stocks + some international stocks

ETFs : Commission-free, covering index and thematic investments

Funds : Fidelity's own funds + third-party funds

Bonds : government bonds, corporate bonds, municipal bonds

Options : Multi-strategy support

Retirement products : 401k, IRA full coverage

Not supported : Cryptocurrency spot trading (only some Bitcoin funds are supported)

5. Trade Execution and Technical Performance

Platforms and Tools

Active Trader Pro : Professional-grade trading platform

Web & Mobile App : Suitable for general investors

Research resources : Fidelity self-research + third-party research reports (Morningstar, CFRA)

Execution quality

Fast order execution

Provide smart order routing to ensure price transparency

6. Deposits and Withdrawals and Fund Management

Deposit methods : ACH, bank transfer, wire transfer, check

Withdrawal method : ACH, wire transfer

Fund security : SIPC protection + excess insurance

Integration services : Deep integration with 401k and retirement accounts

7. Customer Service and Multilingual Support

Customer service channels : telephone, online customer service, branch consultant

Service hours : 7x24 hours

Language support : English, Spanish, some Chinese services

User evaluation : Customer service quality is top-notch in the industry, and branch network support is strong

Contact Information:

Phone: 1-800-343-3548

Help Center: Fidelity Support

8. Third-party media and user reviews

Investopedia : Fidelity Review , called it "the best brokerage for comprehensive investors"

NerdWallet : Fidelity Review , rated 4.8/5, almost perfect

Trustpilot : Fidelity Trustpilot , rated 1.7/5. Negative reviews mainly focus on technical support and customer service wait times, but overall reputation is still strong.

9. Competitor Comparison

| platform | Regulation | Product Range | cost | Features |

|---|---|---|---|---|

| Fidelity | SEC/FINRA/SIPC | Stocks, ETFs, Funds, Bonds, Options, Retirement Accounts | Stock commission-free | All-round brokerage firm with strong research capabilities |

| Charles Schwab | SEC/FINRA/SIPC | Stocks, ETFs, funds, bonds, options, futures | Stock commission-free | Comprehensive coverage and excellent customer service |

| TD Ameritrade | SEC/FINRA/SIPC + CFTC/NFA | Stocks, ETFs, funds, options, futures, foreign exchange | Stock commission-free | Professional-grade thinkorswim platform |

| Robinhood | SEC/FINRA/SIPC | Stocks, ETFs, Options, Crypto | No commission required | Easy to use, suitable for young user groups |

10. Risk Warning

Missing crypto assets : Direct cryptocurrency investment is not supported

Trustpilot ratings are low : users mainly complain about customer service wait times and platform glitches.

International Restrictions : Some services are only available to U.S. residents

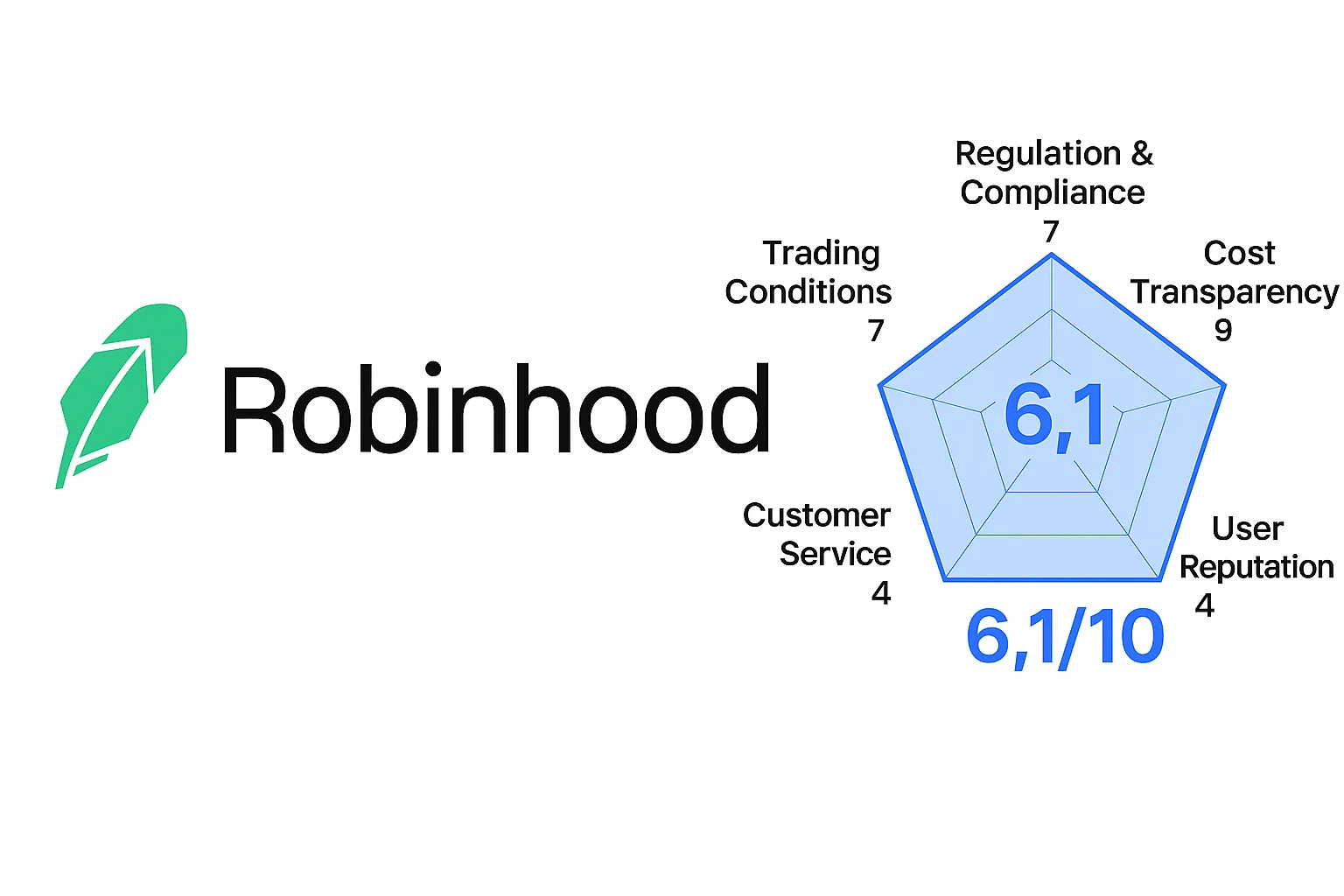

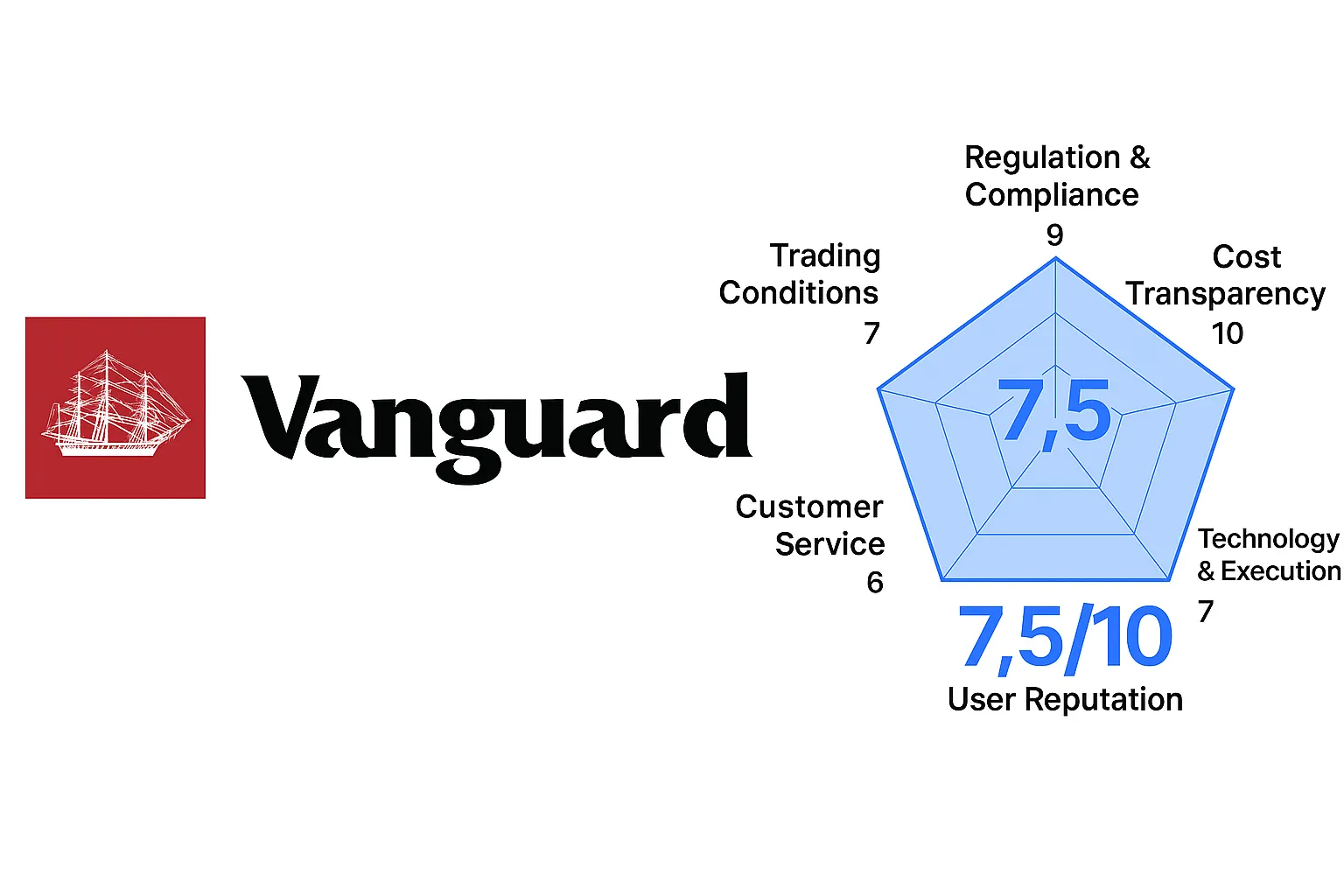

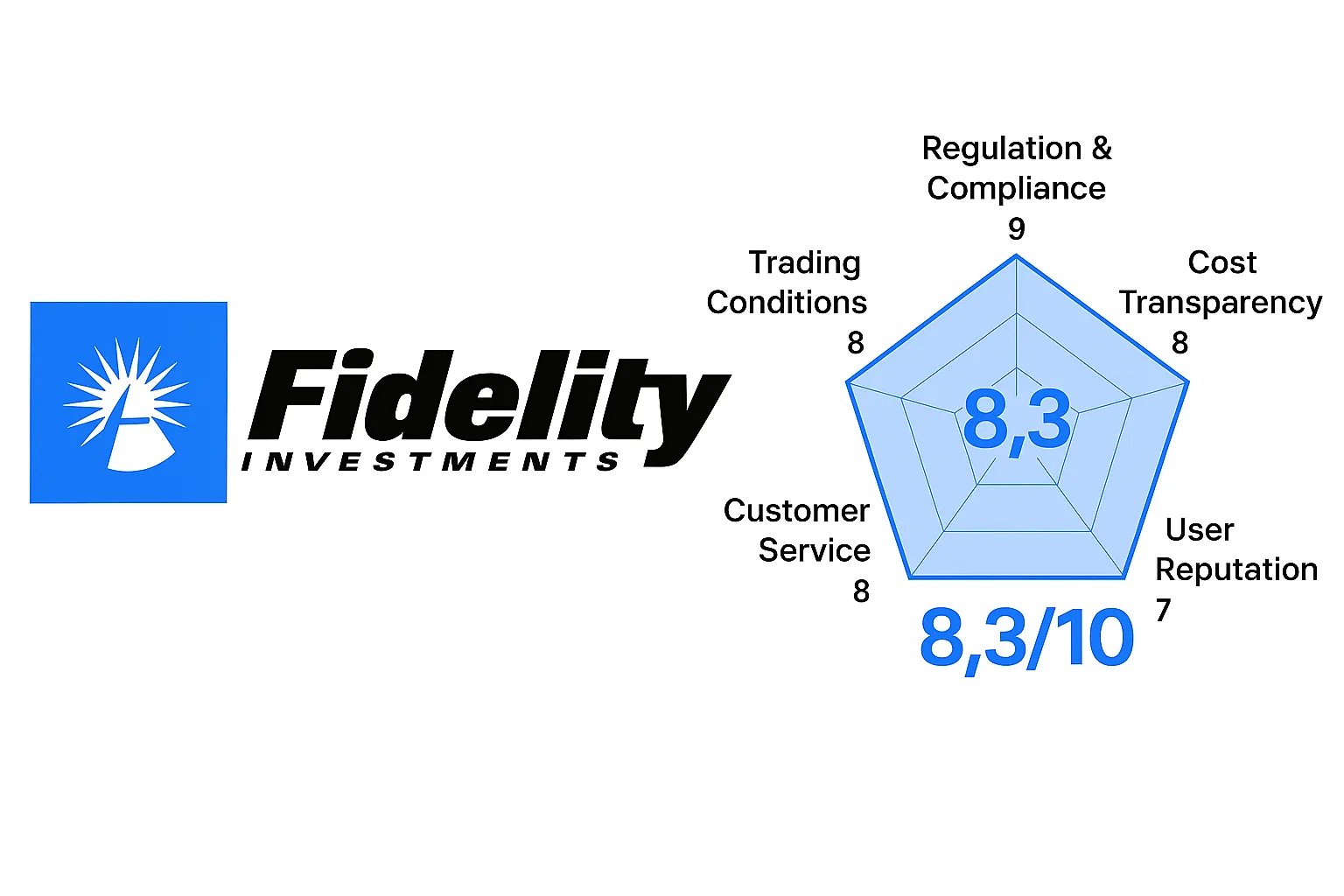

11. BrokerHiveX Six-Dimensional Rating (10-point scale)

Regulatory Compliance : 9/10 — SEC/FINRA/SIPC, top of the industry

Trading conditions : 9/10 - Full category investment coverage

Fee Transparency : 8/10 — No commissions on stocks, but some funds/bonds have higher fees

Technology and Execution : 8/10 — Active Trader Pro is powerful, but a bit complex for beginners

Customer Service : 9/10 – Industry-leading, strong branch support

User reputation : 7/10 — High media ratings, average user reviews

📊 Overall score: (8.3/10)

12. Conclusion and Investment Recommendations

Suitable for people

Long-term investors, especially those investing for retirement

Investors who value research and advisory resources

Middle and high net worth users who need full-category investment

Not suitable for everyone

Users who want to invest in cryptocurrency

Beginners who prefer a minimalist trading platform

Overall evaluation

Fidelity is a top-tier, compliant, and comprehensive global brokerage firm , ideally suited for long-term investors and retirement planners. Fidelity maintains a leading position in the industry through its research resources, customer service, and investment coverage .

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.