BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:JuBi Exchange Scam Review: AJE tokens plummeted, over 100,000 investors lost their funds, withdrawals were blocked, there was no regulatory guarantee, and it was suspected that the fund had run away. Please stay away from this high-risk platform.

JuCoin Exchange is currently embroiled in a public outcry over the collapse of its funding pool, the loss of investor funds, and its use as a pyramid scheme . Based on public information and user feedback, the platform is highly suspected of being a scam and investors should stay away immediately.

Complex predecessor : JuBi has changed its name and restarted many times. Its predecessors include Bitcoin Exchange, Baobi.com, and BiDan, all of which have been accused of launching unrealized coins, manipulating transaction depth, and even running away.

The latest packaging : After 2023, it will return under the name of "JuCoin Butterfly Ecosystem", calling itself DeFi 3.0, with a flagship public chain, cross-border payment, and risk control system.

However, upon verification, the so-called public chain showed no signs of mainnet operation and was more of an open source template for shell companies.

AJE token fund pool plummeted : In the early morning of August 6, 2025, the AJE fund pool fell by as much as 98.7% in 10 minutes, and the market value evaporated by about 1.6 billion yuan .

Number of victims : According to media statistics, more than 110,000 investors lost their funds overnight and were unable to withdraw cash.

Typical victim statements : Many users publicly stated on social media that their accounts were frozen and customer service was out of touch, and official channels only issued vague reassurance announcements without any substantive resolution.

By comparing the characteristics of typical Ponzi schemes, JuBi's operation conforms to the logic of a Ponzi scheme:

High-yield promise : Claiming that “node staking” can generate high annualized returns.

Attracting new funds : Using rebate system and referral rewards to induce investors to continuously recruit new people to join the game.

Withdrawal restrictions : Withdrawal delays and account freezes frequently occurred before the crash.

Concept packaging : Disguised as "DeFi ecology and public chain technology", but lacking the transparency of open source code and technical white papers.

It claims to have obtained exemption from operating rights in Singapore , but no valid license has been disclosed by any authoritative financial regulatory agency.

Third-party financial media generally believe that the so-called "compliance" is merely marketing propaganda and fails to provide real license registration.

Conclusion : This platform has no effective supervision and is a high-risk "black exchange".

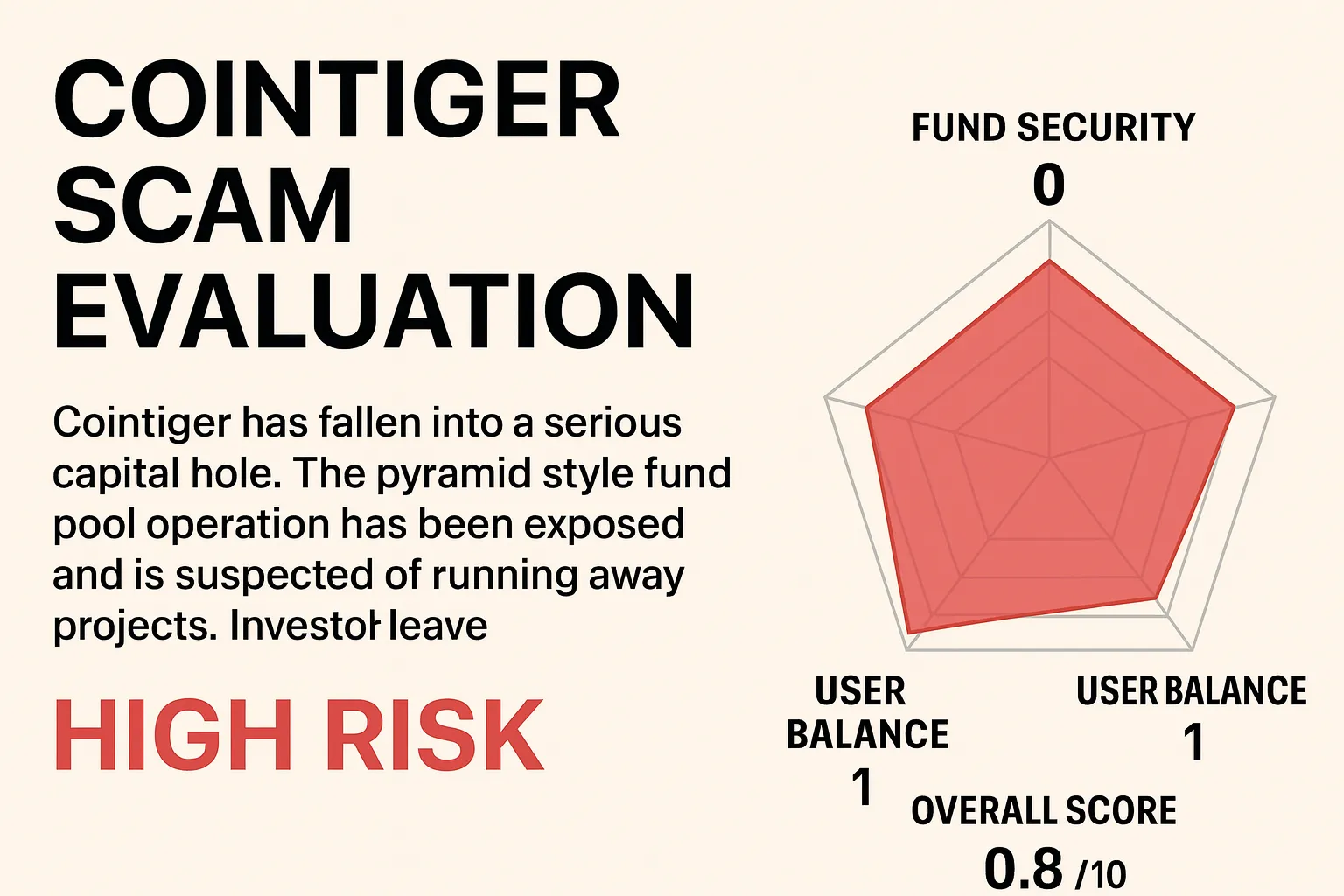

| Dimensions | Rating (0-10) | Comments |

|---|---|---|

| Fund security | 0/10 | User funds have been largely reduced to zero, and withdrawals have failed. |

| Compliance supervision | 0/10 | No real regulatory license |

| transparency | 1/10 | Public chain and ecology have no open source transparent verification |

| User reputation | 1/10 | A large number of victims complained and public opinion collapsed |

| Technical strength | 2/10 | Only a shell system, no independent research and development |

Overall rating: 0.8/10 (high risk of scam)

Sohu Finance : Directly pointing out that the Butterfly ecosystem is the "revival of an old-fashioned capital pool", and the technology depends entirely on packaging.

Zhihu Column : Investors’ real accounts say “1.6 billion market value was wiped out, and tens of thousands of people lost all their money.”

Cryptocurrency circle self-media : It is generally recommended to stay away from JuCoin to avoid becoming the "next batch of buyers."

Immediately stop any deposits and investments .

Save transaction receipts , including deposit and withdrawal records and chat screenshots.

Protect your rights with caution : those who have suffered large amounts of damage can jointly take legal action.

Give priority to regulated exchanges : such as Binance, OKX, Kraken, etc., which all have clear licenses and transparency.

Jubi Exchange has been proven to be a scam , with Ponzi schemes collapsing, massive investor losses, and false compliance packaging . Its highly opaque operating model, lacking regulatory protection, is highly likely to lead to a complete collapse in the future.

Recommendation: Stay away from JuBi Exchange to avoid becoming the last buyer.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.