Moneyfarm UK Review | Is Moneyfarm Reliable? A Complete Analysis of Regulatory Licenses, Fee Transparency, and User Experience

Summary:Moneyfarm UK Review | This FCA-regulated robo-advisory platform offers ISA and pension investments, with fees that decrease with asset size. It's suitable for long-term investing and retirement planning, but doesn't support individual stocks or high-frequency trading.

1. Brand Background and Development History

Moneyfarm Ltd. was founded in 2011 in Milan, Italy, by Giovanni Daprà and Paolo Galvani. Initially focused on the European retail investment market, the company quickly expanded to the UK, establishing its headquarters in London and becoming one of Europe's leading Robo-Advisor platforms.

Currently, Moneyfarm has an important position in both the UK and Italian markets , with cumulative assets under management exceeding £3 billion and providing services to more than 250,000 investors .

Moneyfarm is positioned as a mid-to-high-end robo-advisory platform , similar to Nutmeg, but with greater diversity in customer positioning, fee plans, and portfolio selection.

📌Milestone

2016: Entered the UK market and obtained FCA regulatory authorization

2018: Established strategic cooperation with Allianz Group and Poste Italiane

2022: Acquisition of Profile Pensions to expand UK pensions client base

2024: AUM (Assets Under Management) exceeds €4.5B, becoming one of the top three Robo-Advisors in the European market

II. Account Types and Investment Products

Moneyfarm offers accounts covering investing, retirement, and tax optimization:

| Account Type | Minimum deposit | Features | Suitable for people |

|---|---|---|---|

| General Investment Account (GIA) | £500 | Automated Portfolios | ordinary investors |

| Stocks & Shares ISA | £500 | UK tax-free investment account, annual limit £20,000 | Long-term savings investors |

| Junior ISA | £500 | Minor Children's Investment Accounts | Household savings |

| Self-Invested Personal Pension (SIPP) | £500 | Tax-deductible pension investments | Retirement Planning |

| Profile Pensions (acquired) | N/A | Personalized pension transfer and management | UK residents with pension accounts |

Compared with Nutmeg, Moneyfarm focuses more on the pension market, especially SIPP and pension transfer services , which is one of its differentiating advantages.

Investment products:

ETF (Exchange Traded Fund) as the core

Covering stocks, bonds, commodities, ESG/sustainable investing

No single stock or CFD forex available

📌Conclusion : Moneyfarm is a pure long-term financial management platform suitable for "buy and hold" investment rather than short-term trading.

III. Investment Strategy and Portfolio Construction

Moneyfarm offers seven risk level portfolios , ranging from low-risk bonds to high-risk stocks .

Investment Approach : Core-Satellite Model

Core component: low-cost ETFs to ensure diversification

Satellite segment: Thematic investment or active allocation

Investment style :

Mainly passive investment to reduce fees

Some proactive adjustments and rebalancing based on market conditions

ESG Portfolios : Focusing on Responsible Investing

Automation features :

Automatic rebalancing

Monthly Plans

Retirement Goal Planning Tools

📊Compared to Nutmeg :

Nutmeg highlights ISA + Smart Alpha (partnership with JPMorgan)

Moneyfarm places more emphasis on pensions and risk-stratified portfolios

IV. Fees and Charging Model

Moneyfarm's fee structure is relatively transparent, mainly consisting of management fees + fund fees :

Management fees (decreasing with asset size)

£500 – £10,000: 0.75%

£10,001 – £50,000: 0.60%

£50,001 – £100,000: 0.50%

£100,001+: 0.35%

Fund expenses (ETF costs)

Average 0.20%–0.30%

transaction costs

Average 0.05%–0.10%

📌Example : Invest £50,000, management fee is approximately £300 + fund fee is £100, totaling £400/year.

📌Comparison : Slightly cheaper than Nutmeg, especially advantageous for large sums of money.

V. Supervision and Fund Security

Moneyfarm is regulated by the Financial Conduct Authority (FCA) in the UK with registration number 562754 .

Fund security : Customer funds are stored separately from the company's own funds

FSCS protection : up to £85,000

Partners : Cooperate with Allianz and China Post Group to ensure more secure fund custody

✅Safety Rating: High

6. Platform Experience and User Interface

Web & Mobile App : Intuitive and easy to use

Investment planning tools : provide retirement goals and risk preference assessment

Educational content : Basic investing education, but not as extensive as Nutmeg

shortcoming :

No real-time trading support

Lack of advanced technical analysis tools

📌Summary : Very suitable for long-term investment + pension users , not suitable for short-term traders.

7. Deposits and Withdrawals

Minimum investment : £500

Deposit method : Bank transfer, debit card (credit cards and e-wallets are not supported)

Withdrawal : 3–7 working days to arrive

Account currency : GBP

8. Customer Service and Research

Customer service methods : phone, email, online chat

Support hours : Monday to Friday 9:00–18:00 (UK time)

Research Services :

Portfolio Description

Market Commentary (Regular)

Pension Report

IX. Media and User Reviews

Trustpilot

Rating: ⭐ 4.3/5

Positive reviews :

Simple interface and clear fees

Excellent pension planning function

Bad reviews :

Withdrawal speed is slow

Does not support complex transactions

Media coverage

Financial Times: Called "an innovator in the digitalization of UK pensions"

The Guardian: Points out that Moneyfarm is "Nutmeg's main competitor in the UK market"

10. Risk Warning

Investment is limited to ETFs, individual stocks and alternative investments are not supported

Fees are low, but not as high as ultra-low-cost platforms like Vanguard Investor

Pensions have strong functions but lack flexibility

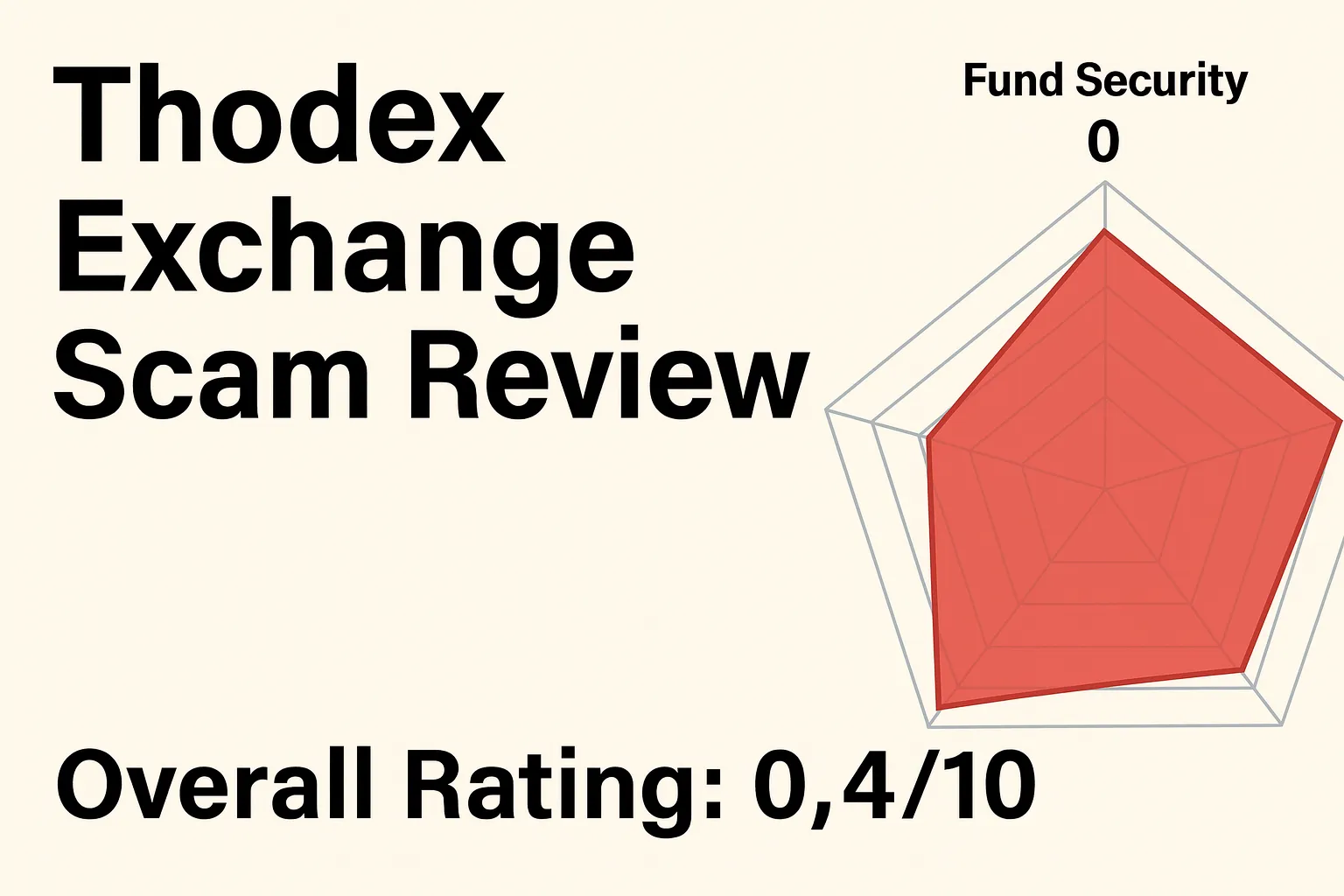

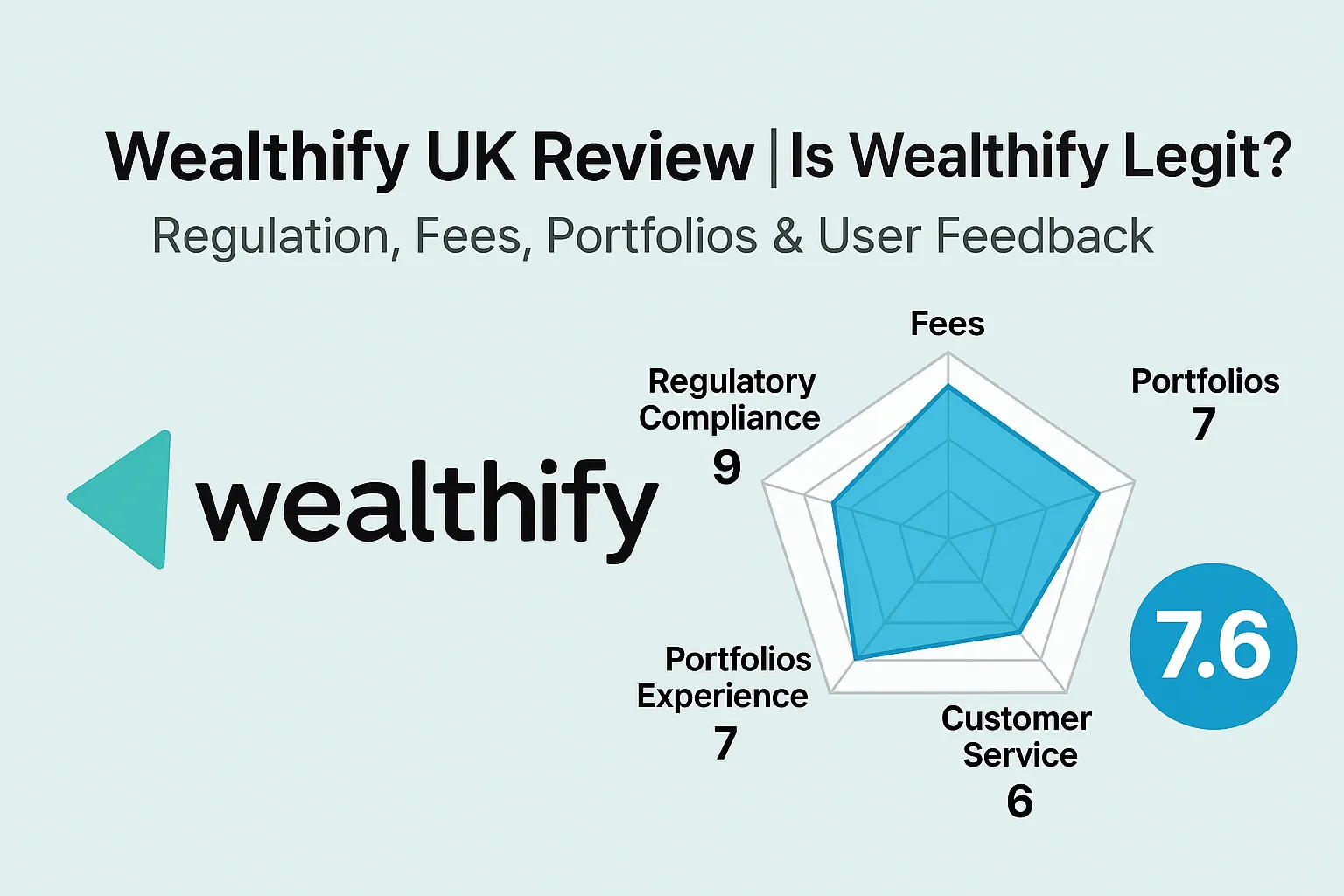

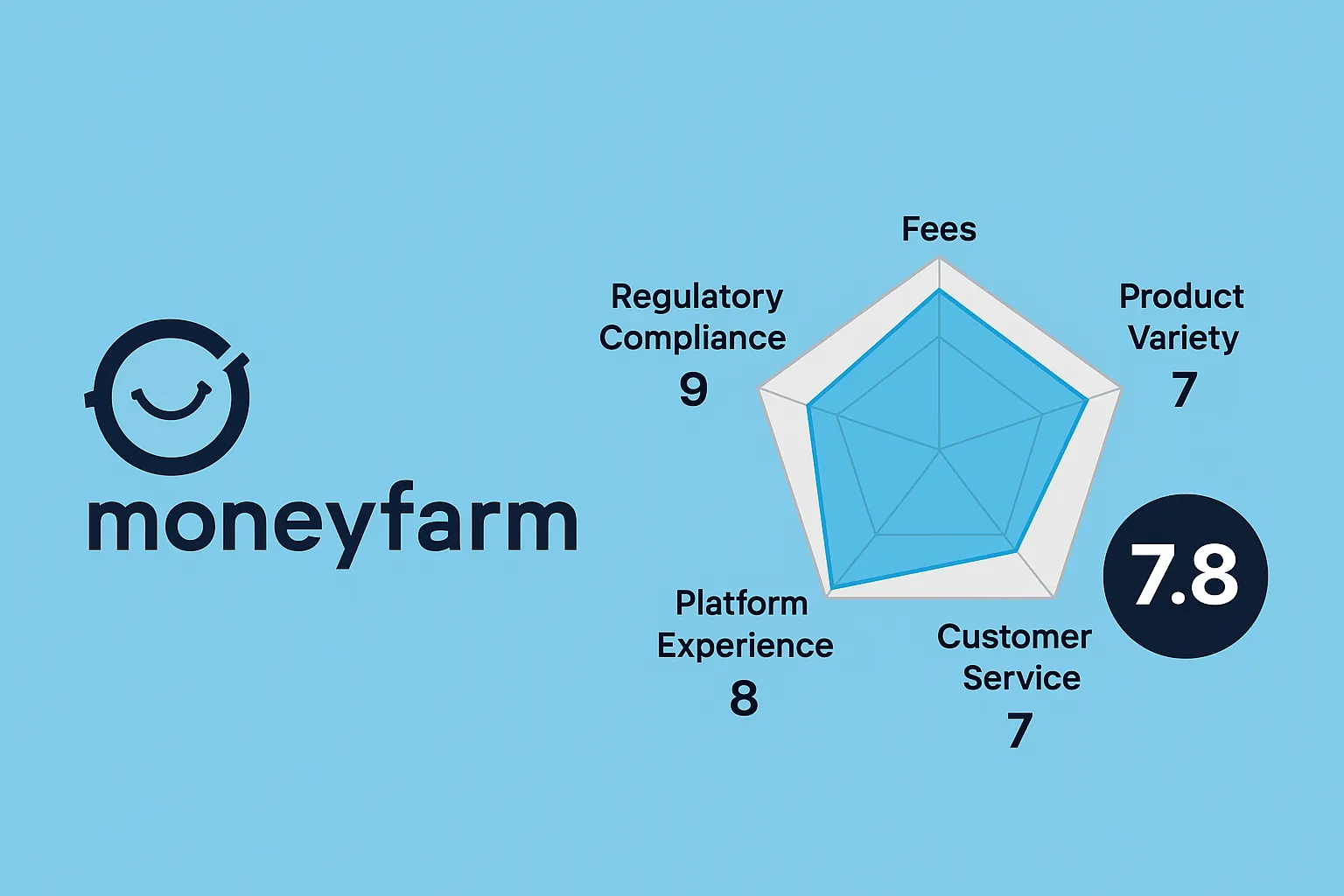

11. Overall rating (10 points + brief comments)

Regulatory Compliance: 9/10 — FCA regulated, funds segregated and secure

Fee structure: 8/10 — Decreases with assets, with clear long-term advantages

Product Diversity: 7/10 — ETFs + ESG, but lacks individual stocks

Platform Experience: 8/10 — Clear interface, but not suitable for professional trading

Customer Service: 7/10 — Averagely responsive

Overall score: 7.8/10

👉 Moneyfarm is a great choice for UK pension investment and long-term financial management , especially for users who seek automated and worry-free investing.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.