BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Dodl is a simplified investment app launched by AJ Bell, focusing on low fees and simple operation. This article comprehensively analyzes Dodl's reliability, including FCA regulation, account types, investment products, fee structure, user experience, and risk warnings, to help investors understand its suitability.

Dodl by AJ Bell , launched in 2022, is a subsidiary of AJ Bell plc (AJB.L), a leading UK financial institution. AJ Bell has over 25 years of experience in the UK investment market, managing over £70 billion in assets.

Dodl is positioned as a lightweight, low-fee mobile investment platform , targeting the following customer groups:

New investors

Young generation pursuing low costs

Ordinary investors who want to accumulate wealth through ISAs and pensions

2021 : AJ Bell announces the launch of Dodl, designed to compete with low-fee investing apps like Freetrade and Trading 212.

2022 : Dodl officially launches, supporting Stocks & Shares ISA, GIA and pension accounts.

2023 : The number of users grows rapidly and receives widespread attention from local British media.

2024 : Dodl begins supporting more ETFs and thematic funds, gradually expanding investment options.

Dodl offers the following accounts:

| Account Type | Features | Investment threshold |

|---|---|---|

| Stocks & Shares ISA | UK tax-free investment account, annual limit £20,000 | No minimum investment |

| General Investment Account (GIA) | Ordinary investment account, suitable for users who do not need tax benefits | Starting from £1 |

| Superannuation Account (SIPP) | Enjoy UK pension tax benefits, suitable for long-term savings | Starting from £100 |

📌Features : Dodl's account setup is simplified. Both ISAs and pensions can be opened directly within the app, and the process is faster than with traditional brokerages.

Regulator : Dodl is part of the same company as AJ Bell and is regulated by the FCA (Financial Conduct Authority) .

Fund protection : User funds are segregated from AJ Bell's own funds and protected by the FSCS (Financial Services Compensation Scheme) with a maximum compensation of £85,000.

Transparency : Dodl's investment transactions are provided with custody and clearing services by AJ Bell, and the security is consistent with traditional brokerages.

📌Conclusion : Dodl is consistent with large financial institutions in terms of supervision and fund security, and is safe and secure.

Compared to the main AJ Bell platform, Dodl's investment products are more simplified and are mainly aimed at beginners:

Funds and ETFs :

Low-cost index funds (FTSE 100, S&P 500, etc.)

Thematic investing (ESG, technology, global diversified funds)

Small number of stocks : Only some large-cap stocks from the UK and US are available, which is not as extensive as Freetrade and Trading 212

Pension investment portfolio : provides pension solutions with different risk levels

📌 Suitable for people : Dodl is more suitable for long-term savings investment rather than short-term traders.

Simple interface : Dodl’s UI is geared towards beginners and is simpler to use than the main AJ Bell platform.

Mobile first : fully app-based, supporting iOS and Android.

Convenient operation : account opening, recharging, and investment can almost all be completed on the mobile phone.

Disadvantages : Advanced investors may feel that the product range is too limited and lacks in-depth analytical tools .

📌 Comparison: If you're a beginner, Dodl's simple interface is an advantage; if you're an experienced investor, you might be better off using the AJ Bell main platform.

The biggest highlight of Dodl is its low fees :

Platform fee : 0.15% (much lower than the 0.25% on the main AJ Bell platform)

Fund/ETF fees : 0.2%–0.4% (depending on the product)

Transaction Fees : Dodl does not charge transaction commissions, and buying and selling ETFs/funds is free.

Account fee : No minimum fee threshold, suitable for small investors

📌 Bottom Line : Dodl's fees are very competitive in the UK market, almost comparable to Freetrade and Trading 212.

Customer Service Channels :

In-app online help

Email support: [email protected]

Telephone customer service provided by AJ Bell

Service language : mainly English

User feedback : The response speed is average, and some users think the customer service system is not as complete as the main AJ Bell platform.

Media coverage :

MoneySavingExpert considers Dodl to be a " low-barrier-to-entry investment option for beginners ."

The Financial Times commented that Dodl is AJ Bell's strategic product to capture the young people's market.

User feedback :

Trustpilot rating of approximately 4.1/5

Advantages: low cost, user-friendly interface

Disadvantages: Too few investment options, not suitable for advanced investors

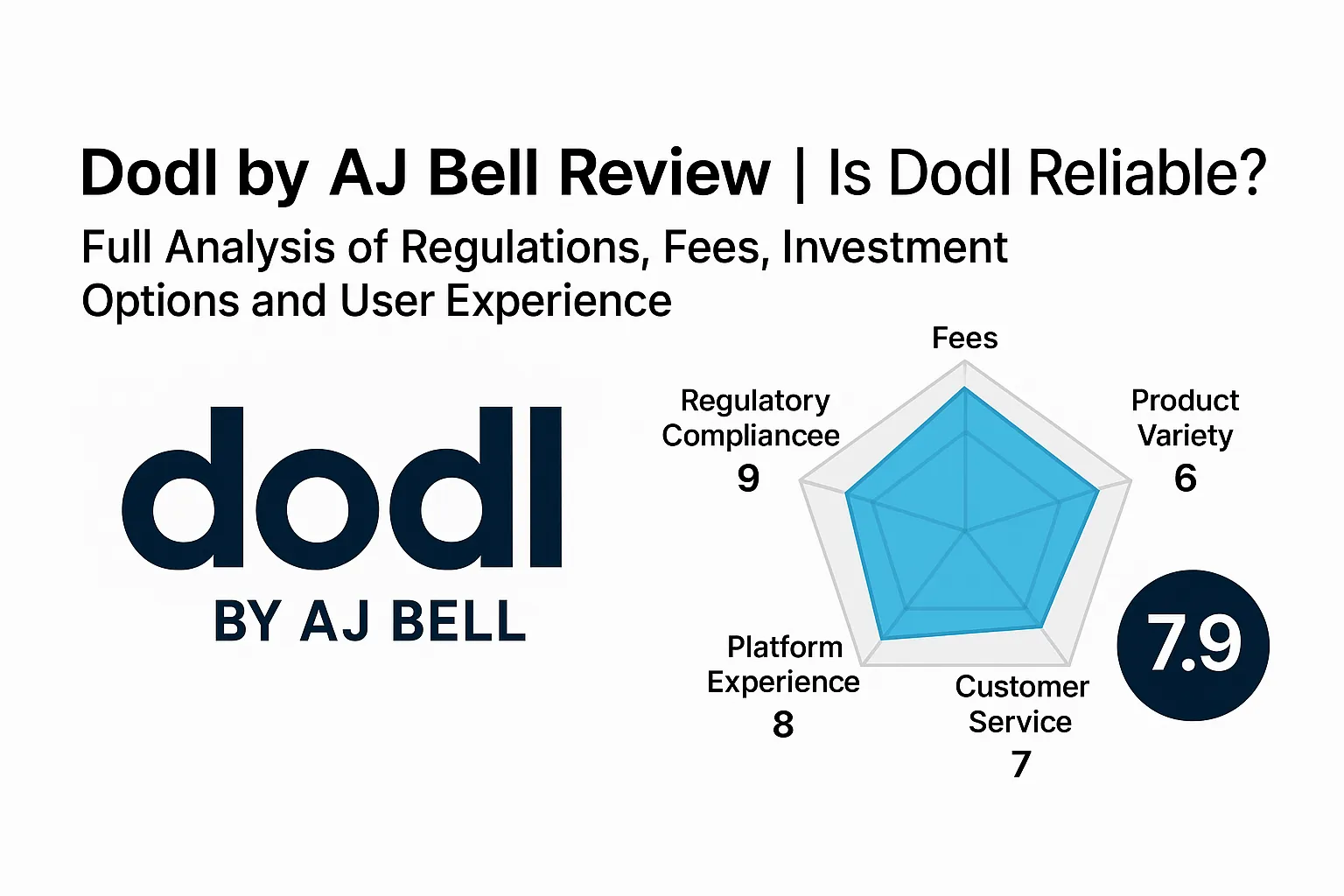

Regulatory compliance : 9/10 ✅ Backed by AJ Bell and regulated by the FCA

Fee level : 9/10 ✅ One of the lowest in the industry

Investment product diversity : 6/10 ⚠ Few products, more entry-level

Platform experience : 8/10 ✅ Friendly interface and easy operation

Customer Service : 7/10 ⚠ Average customer service response

📊Overall rating: 7.9/10

Dodl is a low-fee, compliant, secure, and user-friendly investment app, perfect for both financial novices and long-term savers .

Limited portfolio, not suitable for investors seeking diversification

Does not support complex trading tools and is not suitable for professional traders

Long-term pension investments are still affected by market fluctuations

Dodl by AJ Bell is a secure, low-cost, and streamlined investment app. With AJ Bell's regulatory backing, Dodl is ideal for both novice investors and those seeking long-term ISA/pension funding. However, if you require a wider range of investment options or professional trading capabilities, you may be better suited to the AJ Bell platform or another brokerage.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.