Trading 212 Review | Is Trading 212 Reliable? A Comprehensive Analysis of Regulation, Commission-Free Trading, and User Reputation

Summary:Trading 212 Review | Is Trading 212 reliable? This article comprehensively analyzes its FCA regulation, commission-free trading advantages, account types, fee structure, and user feedback. Learn whether Trading 212 is safe, suitable for beginners, and its reputation in the European and UK markets.

1. Brand Background and Development History

Founded in 2004 and headquartered in London, UK, Trading 212 is a popular online trading platform for European and UK investors. The brand's core selling point is zero-commission stock trading , while also offering a variety of financial products, including ETFs, forex, and contracts for difference (CFDs).

Initially focused on CFD clients, the platform has gradually shifted its focus to commission-free stock investing since 2018, attracting a large number of young investors and beginners. Currently, Trading 212 has over 2 million registered users in over 100 countries.

Founded: 2004

Headquarters: London, UK

Service scope: UK, EU and some international markets

User scale: 2 million+

Trading 212 has a relatively high reputation in Europe, especially for its attractive zero-commission trading and fractional share investments . However, there is some controversy in user feedback regarding customer service and platform stability.

2. Trading Account and Conditions

| Account Type | Minimum deposit | Main Features |

|---|---|---|

| Invest Account | £1 | Zero commission on stocks and ETFs, including fractional shares |

| ISA Account | £1 | UK-specific Stocks & Shares ISA account |

| CFD Account | £10 | Leveraged trading, CFDs, Forex, Commodities |

Spreads : Almost no spreads on stock trading, medium spreads on CFD trading

Leverage : Compliant with ESMA/FCA regulations (up to 1:30 for retail clients)

Trading software : Self-developed Trading 212 App and web version

Overall, Trading 212 accounts have simple settings and extremely low minimum deposit thresholds, making them particularly suitable for novices and small investors.

III. Supervision and Compliance

| Regulatory agencies | License number | Entity Name |

|---|---|---|

| FCA (UK) | 609146 | Trading 212 UK Ltd |

| FSC (Bulgaria) | RG-03-146 | Trading 212 Ltd (EU) |

UK client funds are regulated by the FCA and enjoy FSCS £85,000 investor protection

European customers are regulated by the Bulgarian FSC and their funds are kept in segregated storage.

The platform adopts negative balance protection to prevent users from incurring unbearable losses due to market fluctuations

The regulatory qualifications are relatively robust, but as some clients switch to EU licenses, there are certain differences in the service experience.

IV. Trading Products and Market Coverage

Stocks : 7000+ global stocks (covering US stocks, UK stocks, and European stocks)

ETFs : 1,800+ funds

Forex : 180+ currency pairs

Contracts for Difference (CFD) : Indices, Commodities, Cryptocurrencies

The highlight of Trading 212 is the commission-free stock + ETF . In comparison, the CFD section is more suitable for experienced traders.

5. Trade Execution and Technical Performance

Trading 212 utilizes a proprietary platform with an intuitive interface and smooth operation, particularly on mobile devices, which outperforms some established brokers. However, during periods of significant market activity (such as the US stock market opening hours), some users have reported order delays or lagging price updates .

Order types : market order, limit order, stop-loss order

Execution speed : average 0.2~0.4 seconds

Platform advantages : simple, user-friendly, suitable for entry-level investors

Disadvantages : Lack of advanced trading tools (such as API interfaces, algorithmic trading)

6. Deposit and Withdrawal Methods and Time Limits

Deposit : Bank card, bank transfer, Apple Pay, Google Pay

Withdrawal : Bank card, bank transfer

Timeliness : Deposits are credited instantly, withdrawals take 1-3 business days

Fees : Free deposits, small fees for some withdrawals

The payment method is relatively convenient, but it lacks more abundant channels such as PayPal.

7. Customer Service and Additional Features

Customer service channels : Live chat, email ( [email protected] )

Service language : Supports 10+ languages, including English, German, and Spanish

Educational resources : Provide investment classes and simulated accounts

Additional features : fractional share investing, automated portfolio management

The customer service response speed is average, and some users reported long waiting times , which is its weakness.

8. Media and User Reviews

Trustpilot

Average rating: 3.6/5

Advantages: Commission-free, user-friendly interface

Disadvantages: Withdrawal speed, customer service response

TraderKnows

FXEye: Rated B, emphasizing its FCA regulatory advantages

TraderKnows: CFDs are riskier, but stock investments are safer

Comprehensive conclusion

Trading 212 is a popular commission-free trading platform in Europe and the UK, particularly suitable for beginners and small investors . However, if you are a professional trader or a heavy CFD user, you may find its tools lacking in comprehensiveness.

IX. Risk Warning

Although stock and ETF investments are commission-free, they are still subject to market risks.

CFD products have high leverage and there is a risk of principal loss

Users should clarify their own risk tolerance before investing

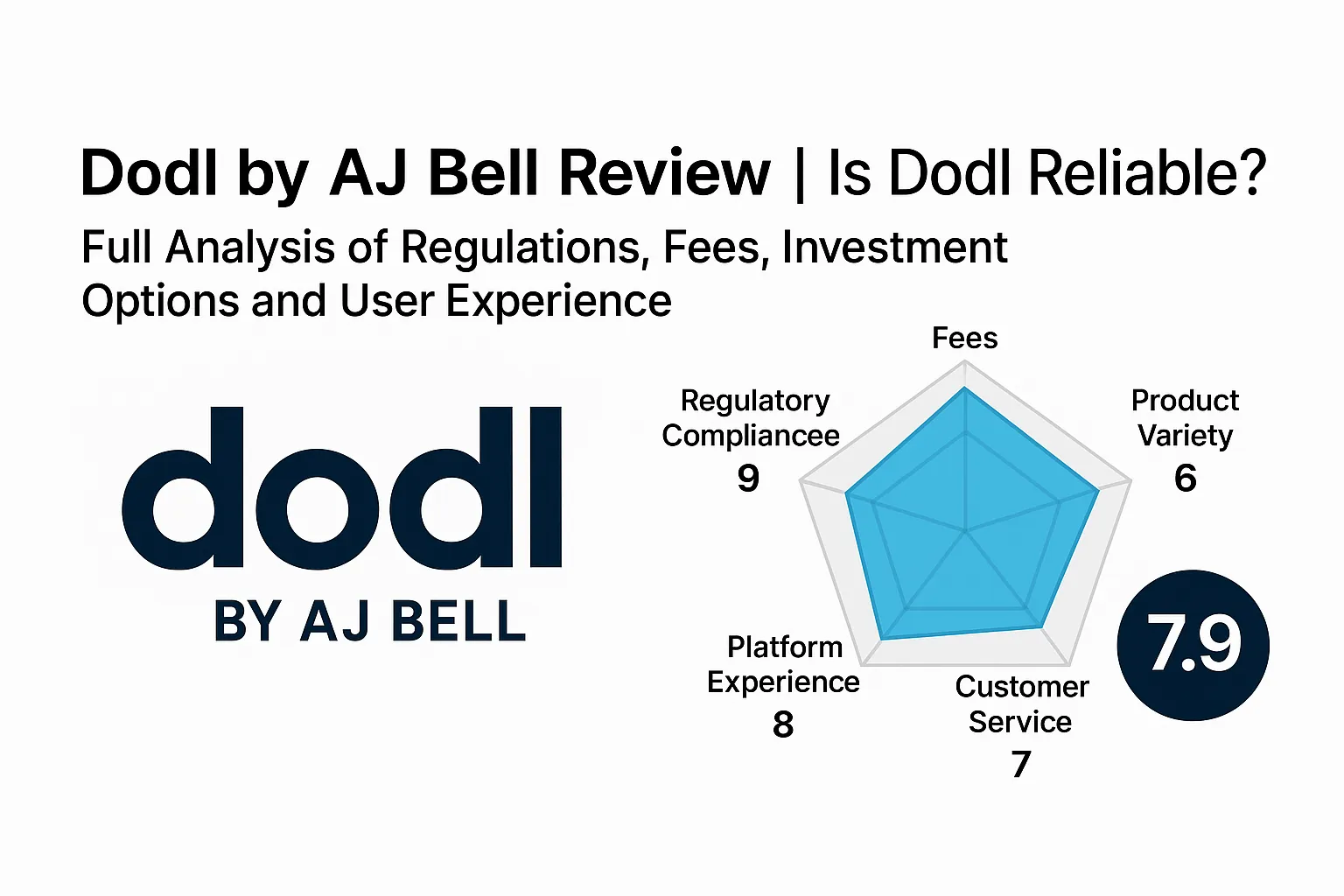

Comprehensive score (10 points)

Regulatory Compliance : 8/10 — FCA regulated, high fund security

Fee Level : 9/10 — Commission-free, low-cost advantage

Investment Products : 7/10 — Rich in stocks, but limited in derivatives

User Experience : 8/10 — User-friendly interface, suitable for beginners

Customer Service : 6/10 – Slow to respond

👉 Overall score: 7.8/10

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.