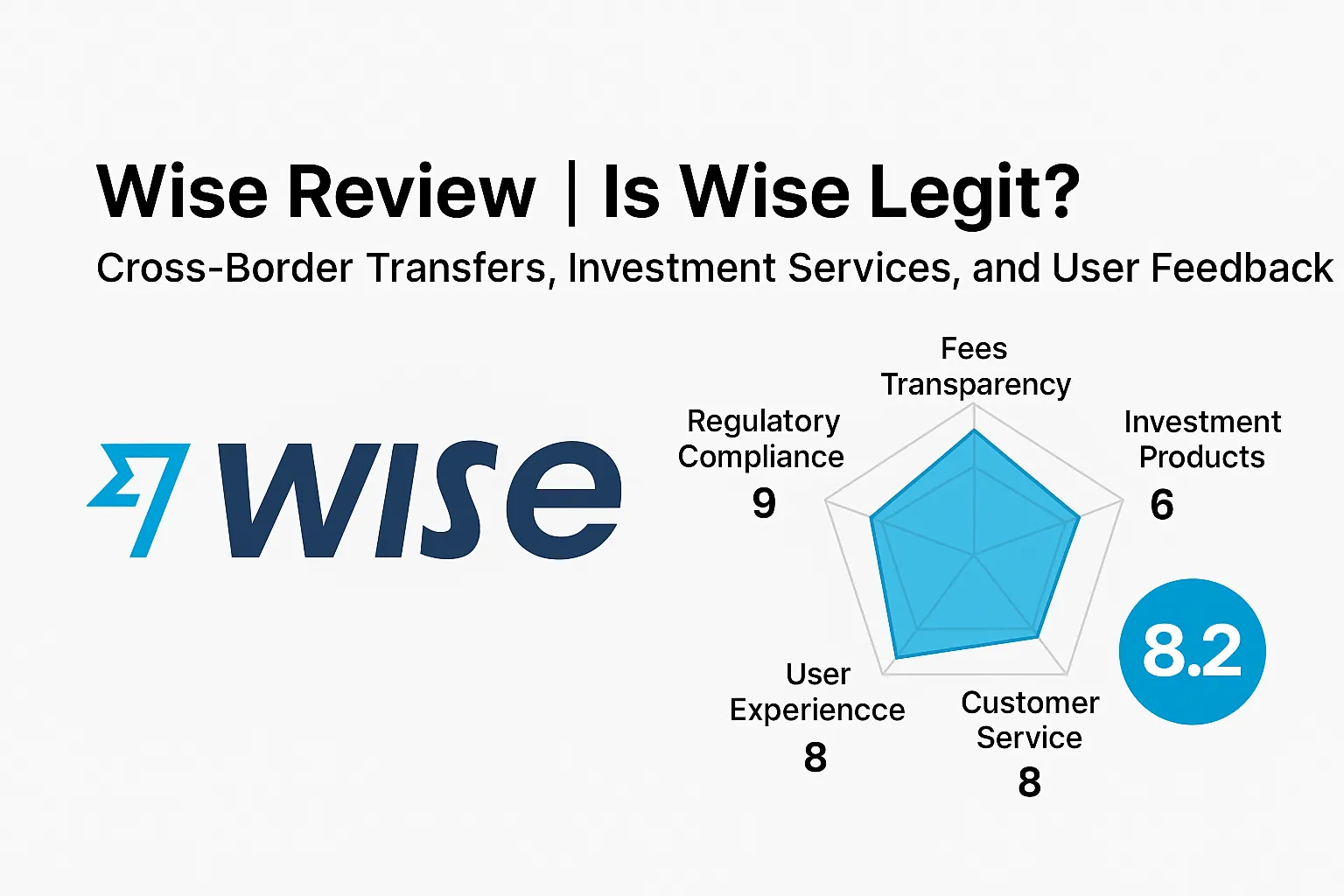

Wise Review | Is Wise Reliable? A Comprehensive Analysis of Cross-Border Transfers, Investment Services, and User Reputation

Summary:Wise (formerly TransferWise) is a leading global cross-border payments platform, regulated by the UK's FCA and multiple countries, and supports low-fee transfers in over 50 currencies. This article comprehensively reviews Wise's fees, regulations, cross-border transfer experience, and user reputation, answering common questions like "Is Wise reliable?", "Is Wise safe?", and "Is Wise a scam?"

1. Brand Background and Development History

Wise was founded in 2011 by Kristo Käärmann and Taavet Hinrikus and is headquartered in London, UK. Its original intention was to address the pain points of high fees and opaque exchange rates in traditional bank cross-border transfers.

As of 2025, Wise has served more than 16 million users , supports 50+ currencies , and processes more than US$100 billion in transfers annually.

Wise was directly listed on the London Stock Exchange (LSE) in 2021, becoming one of the first European fintech companies to enter the capital market through a direct listing, further enhancing its transparency and credibility.

II. Trading Accounts and Service Scope

Wise is not a traditional forex broker, but a multi-functional financial platform that provides the following services:

| Service Type | Main content |

|---|---|

| Cross-border transfers | Support 50+ currencies, real-time exchange rates, no hidden spreads |

| Multi-currency account | Users can hold and manage balances in up to 40+ currencies |

| Wise Card | Debit card, supporting global consumption and ATM withdrawals |

| Investment Services | Offering ETF-based investment options in some European countries |

| Corporate Services | Provide cross-border salary payment, batch payment and API integration |

📌 Advantages: Low fees, high transparency, and global coverage.

📌 Disadvantages: Does not offer high-risk products such as contracts for difference (CFDs) and leveraged trading.

III. Supervision and Compliance

Wise's strong compliance is one of its core competitive advantages:

| Regulatory Region | Regulatory agencies | License status |

|---|---|---|

| U.K. | FCA (Financial Conduct Authority) | Registered and regulated |

| European Union | Bank of Lithuania | Licensed Electronic Money Institution |

| USA | FinCEN + MSB licenses in each state | Compliance Operations |

| Australia | ASIC (Australian Securities and Investments Commission) | Financial license holders |

This means that Wise's client funds enjoy fund isolation and regulatory protection in different regions, and may also enjoy FSCS compensation protection in the UK.

4. Cost and Exchange Rate Advantages

Wise adopts a transparent fee model , which has significant advantages over traditional banks and PayPal:

Transfer fees : Average 0.35%–0.65%, much lower than the 2%–5% charged by banks.

Exchange rate : Use the mid-market real-time exchange rate , no additional spread.

Cash withdrawal fee : Free for the first 200 EUR/GBP per month, 1.75% thereafter.

🔍 Example: Sending €1,000 to Europe would cost around €4–6 with Wise, while a traditional bank could cost over €30.

5. Platform Experience and Technical Performance

Mobile app : Both App Store and Google Play ratings are above 4.5/5 .

Transfer speed : Most currencies can be transferred instantly , while some may take 1-2 business days.

Security : Adopts two-factor authentication, encrypted communication , and complies with financial regulatory standards of various countries.

User experience : simple and intuitive, suitable for personal and corporate users.

6. Customer Service and Support

Wise provides multilingual customer service:

Language support : English, German, Spanish, French, Chinese and more than 20 languages .

Contact information : Online ticket, email, and phone support (available in some regions).

Service evaluation : Overall positive, but some users complain about strict review and delayed payment of large transfers.

7. Media and User Word of Mouth

Trustpilot : Rated 4.3/5, users praise its low fees and transparency .

FXEye/FX110 : Both list Wise as a compliant financial institution and remind it that it is not suitable for high-frequency trading investors.

Common user feedback :

Positive reviews: Fast transfer, low fees, easy operation

Negative reviews: Large amount of funds review is cumbersome, customer service response time needs to be improved

8. Risk Warning

Wise is not a traditional investment platform and does not offer high-risk tools such as leverage and CFDs.

Cross-border regulatory differences may result in service restrictions in some countries.

Large transfers require additional documentation and may result in delayed receipt.

IX. Summary

Wise is suitable for:

✅ Individuals and businesses who need low-cost cross-border transfers ✅ Global users who want to hold multi-currency accounts and debit cards ✅ Seeking transparent and regulated financial services

Not suitable for:

❌ Users who want to trade forex CFDs or high leverage investments ❌ Professional investors who want to access a wide range of investment products

📊Overall rating: 8.2/10

Regulatory compliance: 9/10

Fee transparency: 9/10

Investment products: 6/10

User Experience: 8/10

Customer Service: 7/10

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.