BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Is Revolut reliable? This article comprehensively analyzes Revolut's regulatory qualifications, fee transparency, trading and investment features, user reputation, and risk warnings. It covers its UK FCA and EU licenses, and compares it with platforms like Wise to help investors determine whether Revolut is worth using long-term.

Revolut Ltd. was founded in 2015 and is headquartered in London, UK. Initially known for its zero-fee cross-border payments, it has since expanded into foreign exchange, multi-currency accounts, cryptocurrency trading, stock and ETF investing, insurance, and wealth management tools .

Currently, Revolut has become a global fintech unicorn with more than 30 million users and covering more than 200 countries and regions.

2015: Launched a multi-currency prepaid card, focusing on cross-border low-fee rates

2017: Entering the cryptocurrency market

2018: Obtained EU electronic money license

2020: Valuation exceeds US$5.5 billion, becoming a leading European fintech company

2023: Business expansion to Asia Pacific and Americas markets

Revolut is positioned not only as a payment tool, but also as a "super financial application" that attempts to replace traditional banks and securities firms.

Revolut offers multiple account tiers, including Standard (free), Plus, Premium, and Metal . Different tiers correspond to different functions and cost advantages.

| Account Type | Monthly Fee | Foreign exchange quota | Investment function | Additional Benefits |

|---|---|---|---|---|

| Standard | free | No fees for up to €1,000 per month | Stocks & ETFs have restrictions | Basic functions |

| Plus | €2.99 | €3,000 credit limit | More flexible stock trading | Customer service priority |

| Premium | €7.99 | Unlimited redemption | Support cryptocurrency transactions | Travel Insurance |

| Metal | €13.99 | Unlimited redemption | All investment features | Metal Card + Cash Back |

In terms of investment functions, Revolut offers fractional share trading, ETF investment, cryptocurrencies (Bitcoin, Ethereum, etc.) and commodities (gold, silver) , but its transaction fees and spreads are still slightly higher than those of professional brokerages.

Revolut is gradually improving its compliance:

| Regulatory agencies | License number | Applicable areas |

|---|---|---|

| UK Financial Conduct Authority (FCA) | 900562 | U.K. |

| Central Bank of Lithuania (Electronic Money License) | 304580906 | European Union |

| U.S. financial regulatory license (pending) | - | US market |

| Australian ASIC Authorization | - | Australian market |

Compared to Wise, which focuses more on cross-border payment compliance, Revolut emphasizes multi-market expansion and strives to obtain licenses in major economic zones.

Revolut's services go far beyond a single payment app, covering the following areas:

Cross-border payments : support 30+ fiat currencies, real-time exchange rates, no hidden fees

Investing : Fractional stocks, ETFs, crypto assets, commodities

Payment : Virtual card, metal card, Apple Pay/Google Pay full coverage

Insurance : travel insurance, medical insurance, equipment insurance

Financial management tools : budgets, savings vaults, and automatic crypto investments

This diversified ecosystem brings Revolut closer to its positioning as a “financial supermarket” .

Revolut's app features a clean design and a smooth user experience. Key highlights include:

Interface : intuitive operation, supports one-click exchange and one-click investment

Technology : Real-time push of transaction records and support for transaction reminders

Payment experience : Global consumption and withdrawal performance is stable

Disadvantages : Customer service response is slow and waiting time is long during peak hours

Overall, Revolut performs well in terms of technology , but still needs to improve in customer service .

Financial Times: Calls Revolut "European fintech disruptor."

CNBC: Pointed out that it still needs more regulatory clarity on its encryption and investment business.

Positives : Low exchange rates, good app experience, and multi-functional integration

Negatives : Long customer service wait times and relatively high investment fees compared to brokerage firms

On Trustpilot, Revolut has a 4.3/5 star rating , which is better than most emerging financial platforms overall.

Different regulatory coverage : Different regions have different regulations, so you need to pay attention to the scope of account application.

Investment risks : Cryptocurrencies and commodities are highly volatile

Insufficient customer service : If your account is frozen, it may take a long time to unlock it

When using Revolut, investors should be aware of its non-traditional banking attributes and reasonably diversify risks.

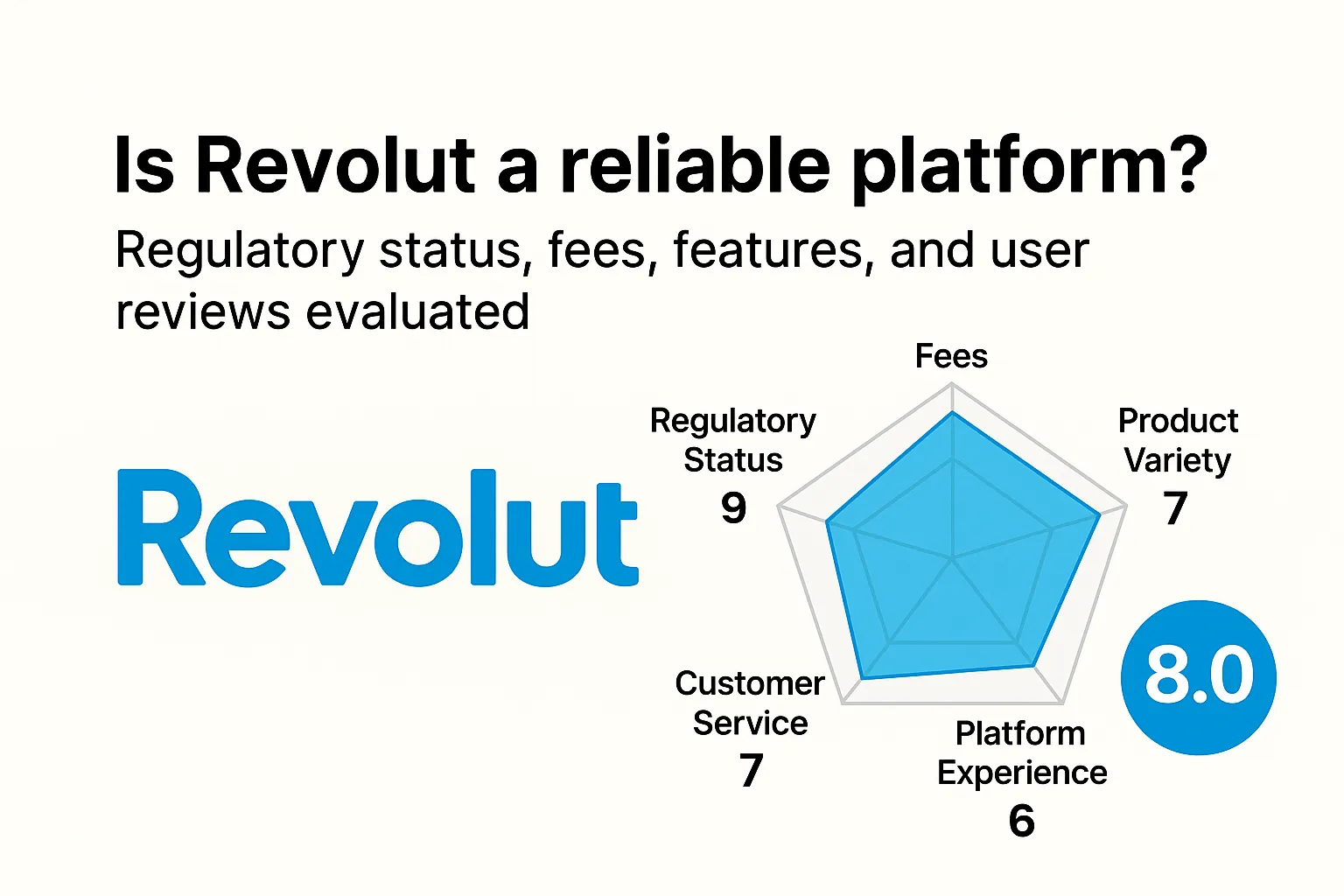

According to Brokerhivex evaluation criteria (0-10 points):

Regulatory compliance : 8 points (UK + EU licenses, international expansion in progress)

Fee structure : 9 points (significant advantage in cross-border payments)

Product diversity : 7 points (rich in investment functions, but not as good as professional brokerages)

User experience : 8 points (Excellent app design, smooth transactions)

Customer Service : 6 (Insufficient customer service)

👉 Overall score: 8.0/10

Conclusion : Revolut is suitable for users seeking cross-border consumption, low-fee payments, and light investments , especially those who require multi-currency accounts. However, for heavy investors , it is still recommended to combine it with a traditional brokerage.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.