BitConnect's Debacle: A Ponzi Scheme Collapse and Investors Lost All Their Money

Summary:BitConnect: One of the most notorious Ponzi schemes in the history of cryptocurrencies, it collapsed in 2018, leaving investors penniless. It is a typical case of a platform that ran away.

1. Summary of Evaluation Conclusions

BitConnect once billed itself as a "crypto lending and investment platform," offering annualized returns of up to 120% . In reality, its funding relied entirely on new user deposits, making it a classic Ponzi scheme. In early 2018, the platform closed after being targeted by regulators in multiple US states. The token price plummeted from $400 to less than $1 , leaving hundreds of thousands of investors with heavy losses.

2. Platform Background Review

Founded : 2016

Token issuance : launch of BCC (BitConnect Coin);

Slogan : Promise high and stable returns;

Core issue : The profit model is completely dependent on the capital flow from recruiting people.

3. Timeline of the Thunderbolt Incident

2017 : BitConnect Coin (BCC) market capitalization once entered the top 20 in the world;

January 2018 : Regulators in Texas and North Carolina issued cease-and-desist orders;

January 2018 : BitConnect announced the closure of its trading and lending businesses;

February 2018 : BCC plummeted from $400 to less than $1;

2022 : A US court convicts core members of fraud.

4. Signs of a scam/runaway model

Promises of unrealistic returns : 120% annualized returns are typical of Ponzi schemes;

Dependence on new funds : The profit model is completely dependent on subsequent investors’ top-ups;

Crash liquidation : The market is quickly closed after regulatory action, and the price drops to zero in an instant;

Judicial characterization : The US court confirmed it as a fraudulent platform.

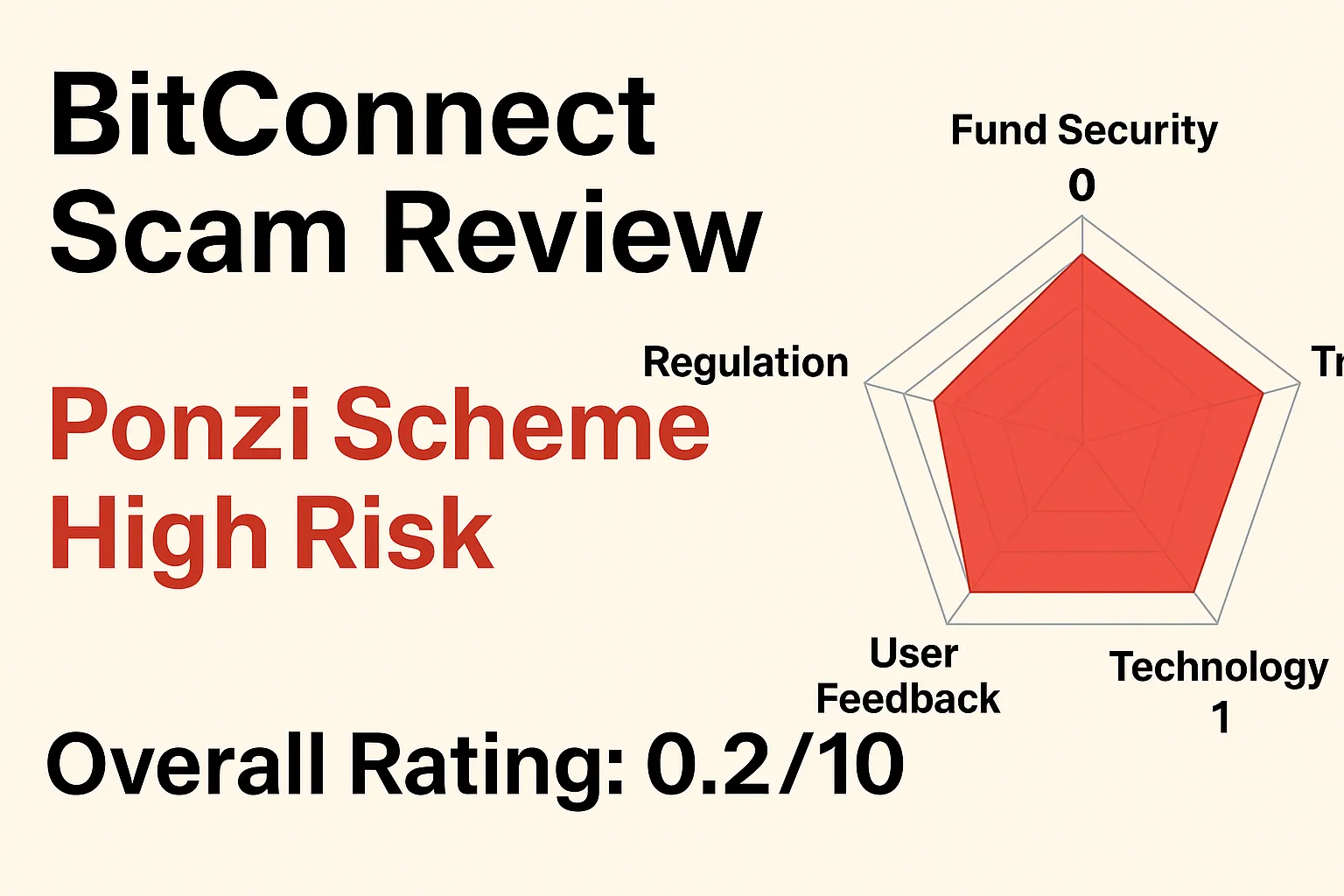

5. Risk Rating (BrokerHiveX Standard)

| Dimensions | Rating (0–10) | Comments |

|---|---|---|

| Fund security | 0/10 | Investors' funds are completely lost |

| Compliance supervision | 0/10 | No license, clearly illegal |

| transparency | 0/10 | No real profit model |

| User reputation | 0/10 | A large number of investors lost all their money |

| Technical strength | 1/10 | Technical shell, actually a scam |

Overall rating: 0.2/10 (typical scam)

VI. Media and Community Evaluation

BBC & CNN : Called it one of the most notorious Ponzi schemes in the history of cryptocurrencies;

The U.S. Department of Justice (DOJ ) confirmed that its founder was imprisoned for fraud;

Community feedback : BitConnect has become a "scam" in the crypto world.

7. Investor Precautions

Stay away from any platform that promises fixed high returns ;

Choose a compliant and licensed exchange ;

Diversify assets and avoid investing in a single high-risk project;

Enhance risk control awareness and be wary of "high-yield traps."

8. Conclusion

The collapse of BitConnect has become a classic case of scam and extortion in the history of cryptocurrencies. It proves that "promises of unrealistically high returns are inevitably scams."

Final verdict: BitConnect = a typical scam that runs away and should be avoided completely.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.