BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Mt.Gox collapse review: The largest Bitcoin exchange in the early days collapsed in 2014 after losing 850,000 BTC due to hacker theft. User funds have not been fully recovered to date, making it a typical case of collapse.

Mt. Gox was once the world's largest Bitcoin exchange, handling approximately 70% of global Bitcoin trading volume . However, in 2014, the platform announced the loss of 850,000 BTC (worth approximately $450 million at the time), leading to its immediate bankruptcy. This incident is considered the most devastating "fleet/collapse" case in the history of the crypto industry.

Founded : 2010, headquartered in Tokyo, Japan;

Market share : once accounted for 70% of global Bitcoin transactions;

Security flaws : long-term management chaos and weak technical protection;

Point of contention : A combination of hacking and internal mismanagement led to the disappearance of funds.

2011–2013 : Multiple small-scale thefts;

February 2014 : Announcement of the loss of 850,000 BTC and closure of the exchange;

April 2014 : Formal filing for bankruptcy protection;

2018–2024 : The liquidation and compensation process was lengthy, with some funds still being recovered.

Large-scale fund loss : user funds are completely lost;

Withdrawal freeze : users cannot withdraw BTC;

Management chaos : internal financial records are extremely opaque;

Long-term unsettled : compensation has not been implemented for a long time.

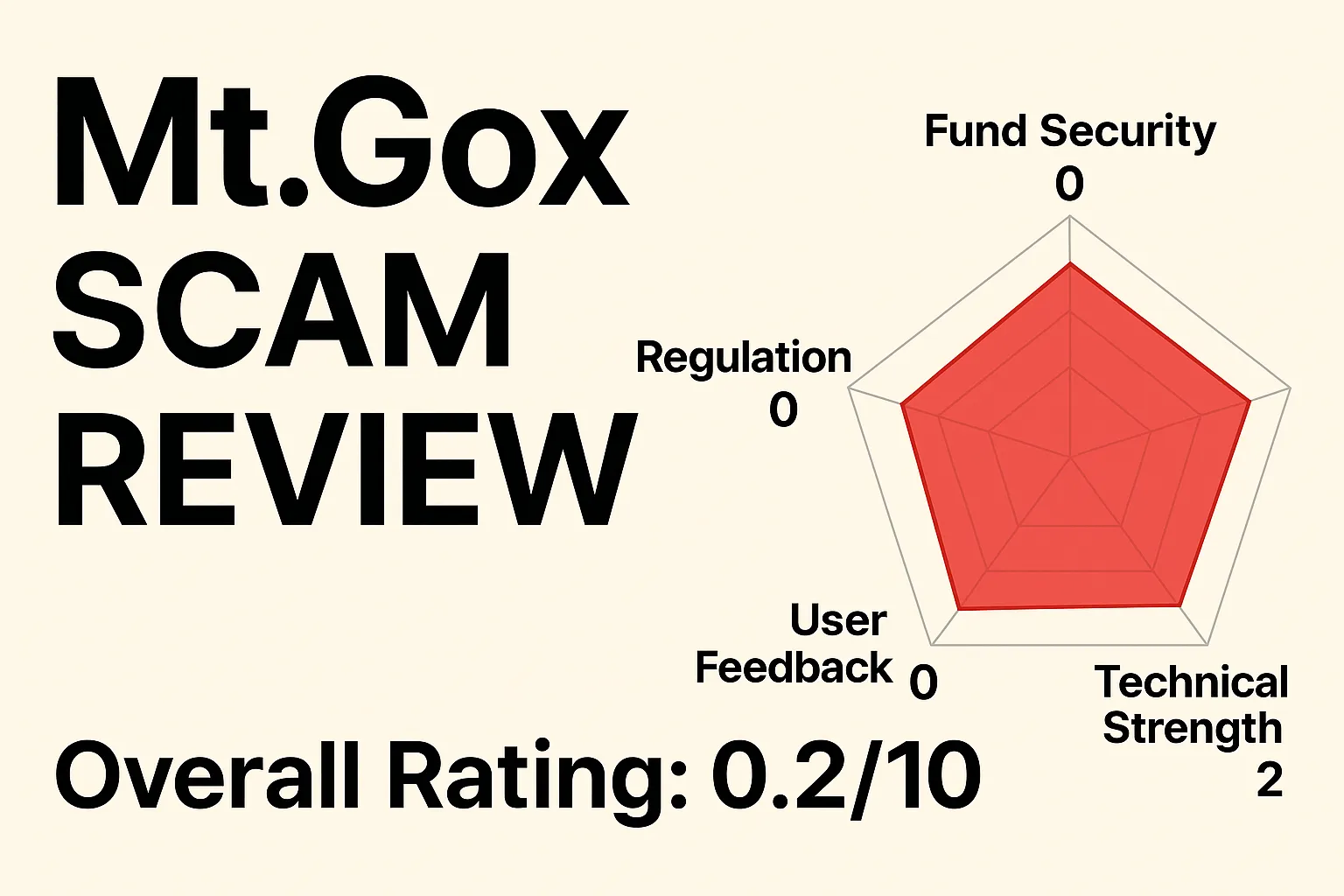

| Dimensions | Rating (0–10) | Comments |

|---|---|---|

| Fund security | 0/10 | 850,000 BTC lost |

| Compliance supervision | 0/10 | Lack of supervision and eventual bankruptcy |

| transparency | 0/10 | Financial opacity and no security audits |

| User reputation | 0/10 | A large number of users lost all their money |

| Technical strength | 2/10 | Outdated technology and chaotic management |

Overall rating: 0.2/10 (the most famous exchange to go bankrupt in crypto history)

BBC/Bloomberg : Called it "crypto's most infamous crash";

Court documents : confirming its bankruptcy and compensation plan;

Community feedback : Mt.Gox has become synonymous with "failed exchange" in the crypto world.

Avoid dependence on a single exchange ;

Choose a regulated platform with high transparency ;

Decentralize asset storage , especially focusing on cold wallets;

Learn from the lessons of Mt. Gox and be wary of single point failures in centralized exchanges.

The collapse of Mt. Gox revolutionized the crypto industry and is considered the most famous case of a scam in crypto history. It serves as a warning to all investors: unregulated, poorly managed platforms are inherently risky.

Final verdict: Mt.Gox = an extremely high-risk, runaway exchange, stay away from it.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.