BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

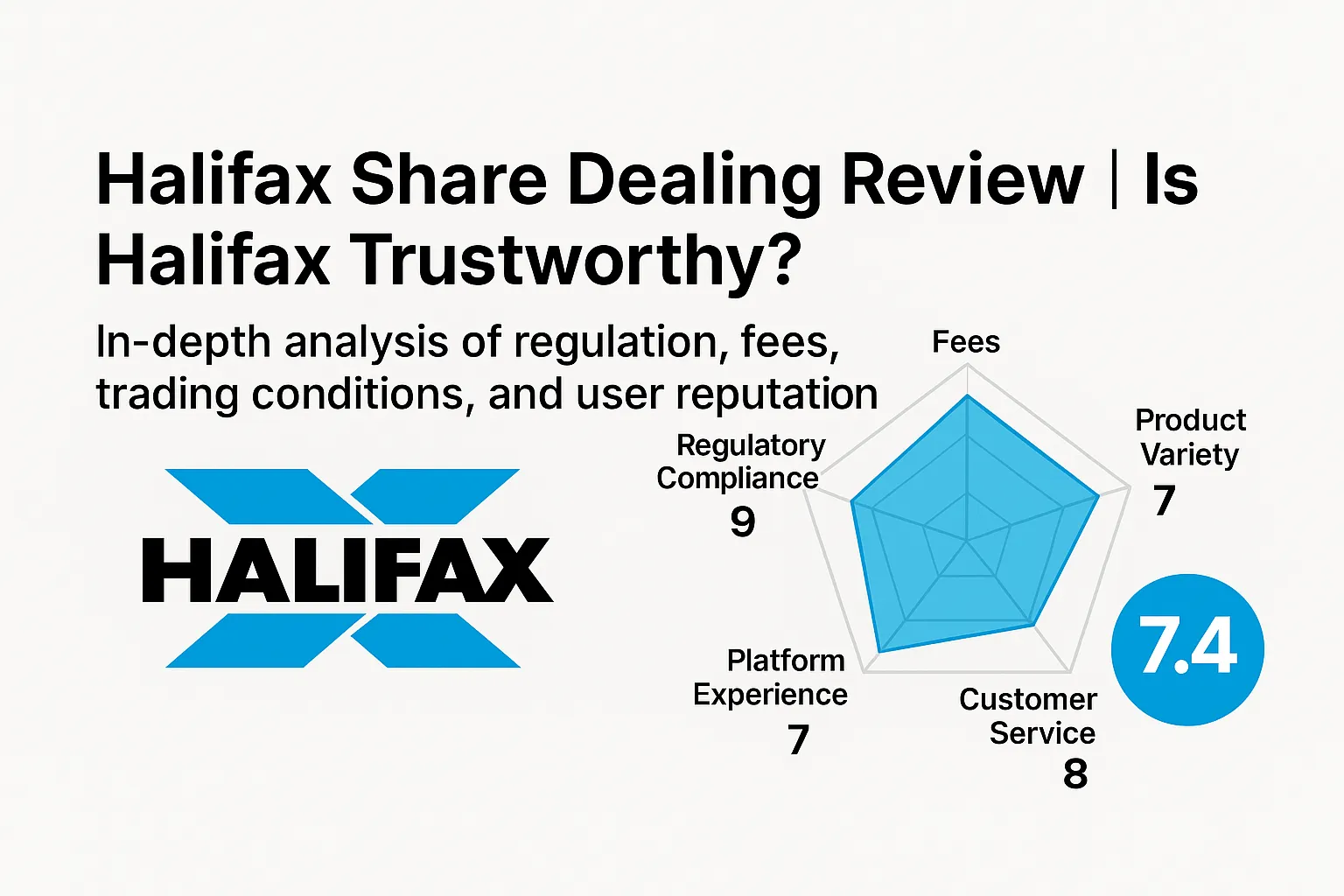

BrokerHiveXSummary:Halifax Share Dealing Review: Is Halifax reliable? This article comprehensively analyzes Halifax's regulatory qualifications, fee structure, trading products, deposit and withdrawal methods, platform experience, and user reputation to help investors determine its trustworthiness.

Halifax Share Dealing is affiliated to Halifax (a subsidiary of Lloyds Banking Group) . As one of the oldest retail banks in the UK, Halifax provides investors with a variety of investment options such as stocks, funds, ETFs, etc. through its trading sub-brand.

Founded : 1990s

Service scope : Mainly covers UK investors, while some services are open to EU clients

Parent company : Lloyds Banking Group (listed on the London Stock Exchange, ticker symbol LLOY)

Customer base : Millions of UK retail users, particularly in savings, mortgages, and investment services

Halifax is known for its one-stop "banking + investment" solution and is often chosen by UK users as the first choice for long-term investment and pension accounts .

Halifax offers a variety of account types to suit different investment needs:

| Account Type | Minimum deposit | Average commission | Suitable for people |

|---|---|---|---|

| Share Dealing Account | £1 | £9.50 per transaction | Ordinary stock investors |

| ISA Account | £20/month (fixed fee) | £9.50 per transaction | Tax-advantaged investors |

| SIPP Account | £100/month (management fee) | Transaction fees are charged separately | Pensions/long-term investments |

Fixed fee model , transparent and no hidden fees

Provide DRIP (Dividend Reinvestment Plan) , suitable for long-term investment

Can be directly connected to Halifax bank account to achieve instant deposit

The shortcomings are:

The commission for a single transaction is £9.50, which is significantly higher than that of emerging low-fee brokers such as Freetrade and Trading 212.

Lack of active trader preferential model, not suitable for high-frequency trading

Halifax Share Dealing has a very strong compliance background:

| Regulatory agencies | License number | Entity Name |

|---|---|---|

| UK FCA (Financial Conduct Authority) | FRN 183332 | Halifax Share Dealing Limited |

FCA regulation : ensures segregated custody of client funds (Client Money Rules), and investors are protected by FSCS (UK Financial Services Compensation Scheme) with compensation of up to £85,000.

The parent company, Lloyds Banking Group, is one of the top 50 banks in the world with a huge market capitalization, which reduces the risk of the platform running away.

Conclusion: Halifax is a typical bank with strong regulation and large banking background , and its security is almost impeccable.

The main investment products offered by Halifax include:

Stocks : UK and international listed companies

Funds : OEICs and Unit Trusts

ETFs and investment trusts : covering index-based and thematic investing

Bonds and Treasury Bonds : Provide fixed income products

However, compared to competitors such as Interactive Brokers or Saxo Bank, Halifax falls short in the following areas:

Foreign exchange (FX) and contract for difference (CFD) trading is not supported

Product coverage is relatively "traditional" and lacks cryptocurrency and emerging market derivatives

Suitable for investors: conservative/long-term holding type .

Halifax provides a web-based Share Dealing Platform :

User experience : simple interface, intuitive operation, suitable for novice investors

Order type : market order, limit order, regular investment

Speed : Stable execution, but not a high-speed trading platform

Disadvantages:

No separate desktop or mobile advanced trading software

Technical analysis tools are limited, and charting functionality is relatively basic

Compared to IG or CMC Markets, Halifax is more suitable as an investment vehicle rather than an active trading platform.

The fee structure is transparent, but generally high:

Transaction fee : £9.50/transaction

Management fee : ISA account £20/month, SIPP account £100/month

Deposits and withdrawals : Free (instant transfers when linked to a Halifax bank account)

Advantages: Excellent fund liquidity , especially suitable for customers who already have Halifax bank accounts.

Disadvantages: High transaction fees are not friendly to active users.

Halifax customer service channels include:

Telephone support (8:00-17:00 weekdays in the UK)

Online email support

Branch counter service (an advantage over online brokerages)

shortcoming:

No live chat

Slow response time (usually 1-2 working days)

The Financial Times said Halifax is "known for its stability and tradition, but lacks technological innovation."

MoneySavingExpert believes Halifax is “better suited to long-term ISA investors rather than short-term traders”.

Positive feedback : Fund security, suitable for pensions and long-term investments, high brand credibility

Negative Feedback : High fees, outdated trading tools, lack of flexibility

Although Halifax is almost risk-free in terms of regulation and fund security, investors still need to pay attention to the following:

Investing in stocks/funds involves market risks and the principal may be lost

High fee model is not conducive to short-term trading

Lack of diversified derivatives may lead to missed market opportunities

Halifax Share Dealing is a traditional platform for highly secure, long-term investments in the UK market.

Suitable for: Conservative investors, pension account holders

Not suitable for: High-frequency traders, cryptocurrency/forex enthusiasts

BrokerHiveX Overall Rating: 7.4/10

Regulatory Compliance: 9/10 ✅

Fee transparency: 6/10 ❌

Product diversity: 7/10

Platform experience: 7/10

Customer Service: 8/10

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.