BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:This article will focus on the FX Leader platform, providing a comprehensive analysis of its background, compliance, user feedback, and fraudulent methods to help investors identify risks and avoid being scammed.

I. Introduction: The “Double Reality” of the Forex Industry

The foreign exchange (forex) and Contracts for Difference (CFD) markets are the world's largest financial markets, with daily trading volume exceeding $6 trillion . However, behind this vast market, alongside strictly regulated, legal and compliant brokers, there are also numerous shady platforms operating under the guise of forex .

These platforms usually disguise themselves as internationally renowned brands and attract investors through carefully designed marketing methods. However, their ultimate goal is not to provide real trading services, but to illegally make money by manipulating the backend, refusing withdrawals, and falsifying regulatory information .

Platform Name : FX Leader

Place of registration for external publicity : Marshall Islands

Establishment date : No exact registration year. Some websites claim to have launched in 2018, but no business registration records exist.

Company : The official website does not clearly provide the company name, only vaguely mentioning "FX Leader Ltd."

Domain information :

Through WhoIs query, it was found that the domain name changed registrars and servers many times, suspected to be evading tracking.

The domain name registration period is relatively short (less than 3 years), which is seriously inconsistent with the promotion of being a "veteran platform".

Officially claims to provide CFD trading in foreign exchange, precious metals, indices, cryptocurrencies, etc.

The main gimmicks include "zero spread" and "high leverage (up to 1:500)"

Claims to have a "global team of professional instructors"

In essence, FX Leader does not provide real market trading connection, but adopts an internal trading model (B-Book) , that is, all customer transactions are directly controlled by the platform backend.

A legitimate foreign exchange broker must hold one of the following mainstream regulatory licenses:

UK FCA (Financial Conduct Authority)

Australian Securities and Investments Commission (ASIC)

Cyprus CySEC (Securities and Exchange Commission)

U.S. NFA/CFTC (Commodity Futures Trading Commission)

New Zealand FMA, South Africa FSCA, Japan FSA , etc.

These agencies require:

Separation of client funds and company funds

Regular audits and financial disclosures

Strict leverage and risk management

Independent dispute resolution mechanism

Does not appear in any regulatory database : No relevant license information was found in FCA, ASIC, CySEC, or NFA

The Marshall Islands declares that it does not regulate foreign exchange business : it is only an "offshore registration place" and does not provide financial supervision

Fake regulatory number : The regulatory number provided on the FX Leader official website cannot be matched to any real financial institution.

No client funds isolation : Fund flows are opaque and investor account funds are easily misappropriated

Conclusion: FX Leader is not subject to any authoritative financial regulation , and its "regulated" claims are pure falsehood.

Common deceptive marketing tactics used by FX Leader include:

Falsely claiming high returns : Claiming "monthly returns of over 20%" is completely inconsistent with financial common sense.

Zero threshold account opening : Encourage small investors to deposit funds and gradually induce them to increase their investment

Expert guidance : Using "mentor-led trading" to trick investors into frequent trading and create losses

High leverage gimmick : offering 1:500 leverage, far exceeding the level allowed by formal regulations in the EU, UK, Australia, etc.

Fake partners : Displaying the logos of well-known banks and trading software on their official websites, but in reality, they have no partnership with any bank.

📌 These characteristics are highly similar to a large number of exposed forex scams (such as TradeVtech, CryptoIFX, and Royal LotoFX ).

User feedback indicates:

Inflated spreads : The actual spread is much larger than advertised, with the EUR/USD spread reaching 5-8 pips.

Severe slippage : Stop-loss orders are often executed at prices far from the market price

Background intervention : Profitable accounts will be restricted from trading by the system, or even forced to clear.

Fake market data : Some users found that the market data was seriously inconsistent with mainstream data sources such as TradingView.

This means that FX Leader is not truly connected to the international market, but rather manipulates investors' profits and losses at will through internal software.

Mainly supports Bitcoin, USDT, and third-party payment gateways

There are a few bank card channels, but most of them go through overseas intermediaries, which are extremely risky.

Investors generally complain about being unable to withdraw funds

Common routines:

Requires a 20%-30% margin to unfreeze funds

Charge high "taxes" or refuse to withdraw funds

Withdrawal application is "under review" for a long time until it is lost

On third-party platforms such as Trustpilot, WikiFX, and FX110 , FX Leader withdrawal failure cases account for the vast majority.

Case A (European investor) : Deposited $5,000 and earned $2,000 in profit in one month. However, when applying for a withdrawal, they were asked to pay a 25% "withholding tax". They ultimately refused to pay and their account was blocked.

Case B (Southeast Asian investor) : The system freezes multiple times during trading. After the margin call, customer service received no response and the funds disappeared completely.

Case C (Chinese investor) : After joining the "mentor-led trading group", he was induced to increase his position by 10 times leverage, and lost all his money in just three days.

These cases are completely consistent with the typical foreign exchange fraud platform model.

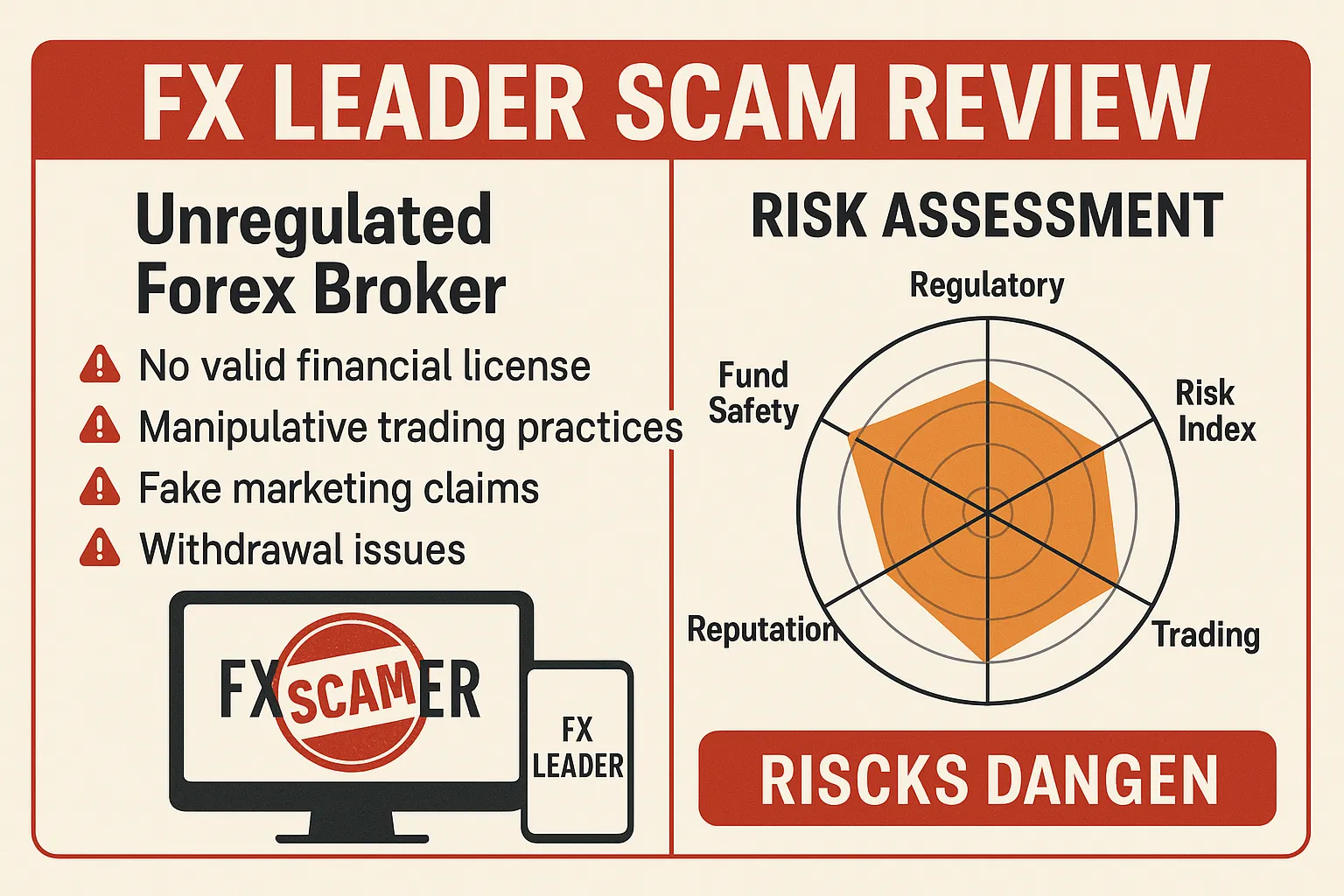

Combining multi-dimensional data, FX Leader's risk score is as follows:

| Dimensions | Fraction | Comments |

|---|---|---|

| Regulatory compliance | 0/10 | No regulation, false information |

| Fund security | 1/10 | Difficulty in withdrawing funds, funds cannot be guaranteed |

| Transaction transparency | 2/10 | Market fraud and serious backend manipulation |

| User feedback | 1/10 | A large number of negative complaints |

| Customer Service and Compliance Support | 1/10 | Customer service attitude is bad and refuses to explain |

| Comprehensive risk index | 9/10 | Extremely dangerous, stay away immediately |

Verify regulatory license : Be sure to check on the FCA/ASIC/NFA official website

Avoid offshore registered companies : SVG, Marshall Islands, and Seychelles are largely unregulated

Be wary of excessive leverage promises : Be cautious if it exceeds 1:50

Pay attention to third-party reviews : User complaints from WikiFX, TraderKnows, and FX110 are important references

Transparency of funding channels : Legitimate platforms support bank cards and wire transfers, while black platforms often require USDT/Bitcoin

FX Leader is not a legitimate forex broker, but a typical scam . Its main issues include:

No effective supervision

Difficulty withdrawing funds and retrieving them

Backstage manipulation of transactions, false market conditions

High number of user complaints

📌 Recommendations for investors:

Stay away from unregulated platforms such as FX Leader

If you have been deceived, you should immediately preserve evidence and report it to local regulators, the police or international human rights organizations.

Choose a platform with authoritative licenses such as FCA, ASIC, NFA , etc. to trade

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.