BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:OKX Exchange Review: Is OKX safe? This article comprehensively analyzes the company's background, regulatory compliance, trading conditions, fund security, technical performance, user reputation, and potential risks to help investors make informed decisions.

OKX (formerly known as OKEx) was founded in 2017 and is affiliated with OK Group . Its headquarters was originally located in Hong Kong, China, and it is now registered in Seychelles. Its headquarters operations center has been moved to Singapore and Dubai.

Development highlights:

2013 : OKCoin was established, the predecessor of OK Group.

2017 : OKEx brand was launched, focusing on contract trading.

2021 : The brand was upgraded to OKX , emphasizing a diversified ecosystem.

2022 : Launch Web3 wallet, DEX, and NFT market.

2023-2024 : Daily transaction volume will rank among the top three globally, with more than 50 million users.

👉 Official website: https://www.okx.com

OKX is an all-round exchange that covers spot, contracts, options, wealth management, DeFi and other businesses.

| Product Type | Features | Fees/Leverage |

|---|---|---|

| Spot Trading | 400+ currencies, rich trading pairs | Handling Fee: 0.08%–0.1% |

| Contract Trading | Perpetual and delivery contracts | Maximum leverage 1:125 |

| Options Trading | BTC and ETH options | The transaction fee is 0.02% for maker orders and 0.03% for taker orders. |

| Leveraged Trading | Support mainstream currencies | Maximum leverage 1:10 |

| OKX Earn | Fixed deposit, pledge, and dual currency wealth management | 2%–30% annualized |

| Web3 Wallet | Decentralized wallet, supporting DeFi and NFT | No handling fees |

🔑 Features:

The transaction fee is slightly lower than Binance, making it more attractive to large traders.

Rich contract and option products, suitable for professional traders.

It has a self-developed Web3 wallet with a wider ecosystem.

OKX's compliance issues have always been a focus of industry discussion.

| Regulatory Region | state | Entity Name |

|---|---|---|

| Seychelles | Registered Entity | Aux Cayes FinTech Co. Ltd |

| Dubai, UAE | Obtaining a VARA temporary license | OKX Dubai |

| Europe | Lithuania registered as a VASP | OKX Europe |

| USA | ❌ No SEC/CFTC license | - |

🔗 Official compliance page: OKX Regulatory Info

📌 Summary: OKX is compliant in some regions, but does not cover mainstream markets such as the United States and the United Kingdom.

OKX's product ecosystem is very comprehensive:

Spot market : 400+ currencies.

Contract market : perpetual and delivery contracts, supporting over 100 currencies.

Options market : BTC and ETH options are the top two in terms of liquidity globally.

OKX Earn : Fixed deposit, staking, and dual-currency investment.

NFT Marketplace : Supports trading and Launchpad.

Web3 Wallet : Integrated management of DeFi, NFT, and GameFi.

📊 Compared to Binance, OKX has fewer currencies, but is more distinctive in the options and Web3 fields.

Matching engine : supports millions of TPS and has high stability.

Latency : less than 10ms, industry-leading.

Slippage : Mainstream currencies have strong liquidity, while small currencies are slightly less liquid.

APP experience : simple interface and complete functions.

API : Suitable for quantitative trading and popular among professional traders.

Separation of hot and cold wallets : ensuring fund security.

Multi-signature : withdrawals require multiple authorizations.

Proof of Reserves (PoR) : OKX publishes a verifiable reserve report.

Insurance Fund : guarantees compensation for contract trading margin calls.

Deposit : Supports cryptocurrency and fiat currency channels.

Withdrawal : 30 minutes – 2 hours for mainstream cryptocurrencies.

KYC Policy : The withdrawal limit for unverified users is limited.

User feedback: Withdrawals are fast and risk control is strict.

Supported languages : 30+ languages, including Chinese, English, Spanish, etc.

Customer service channels : 24/7 online customer service, work orders, and emails ( [email protected] ).

Educational resources : OKX Academy provides professional tutorials.

Bloomberg: Calls OKX "one of the fastest-growing trading platforms in the world."

CoinDesk: Points out that its Web3 ecosystem layout is leading.

Positive reviews : low fees, strong contract depth, and a complete ecosystem.

Negative review : Insufficient compliance, access to some countries is restricted.

Regulatory risks : Not yet in the US and the UK, there are compliance risks.

Funding risk : Despite PoR, transparency is still not enough to completely eliminate concerns.

Market risk : Highly leveraged products are subject to margin call risks.

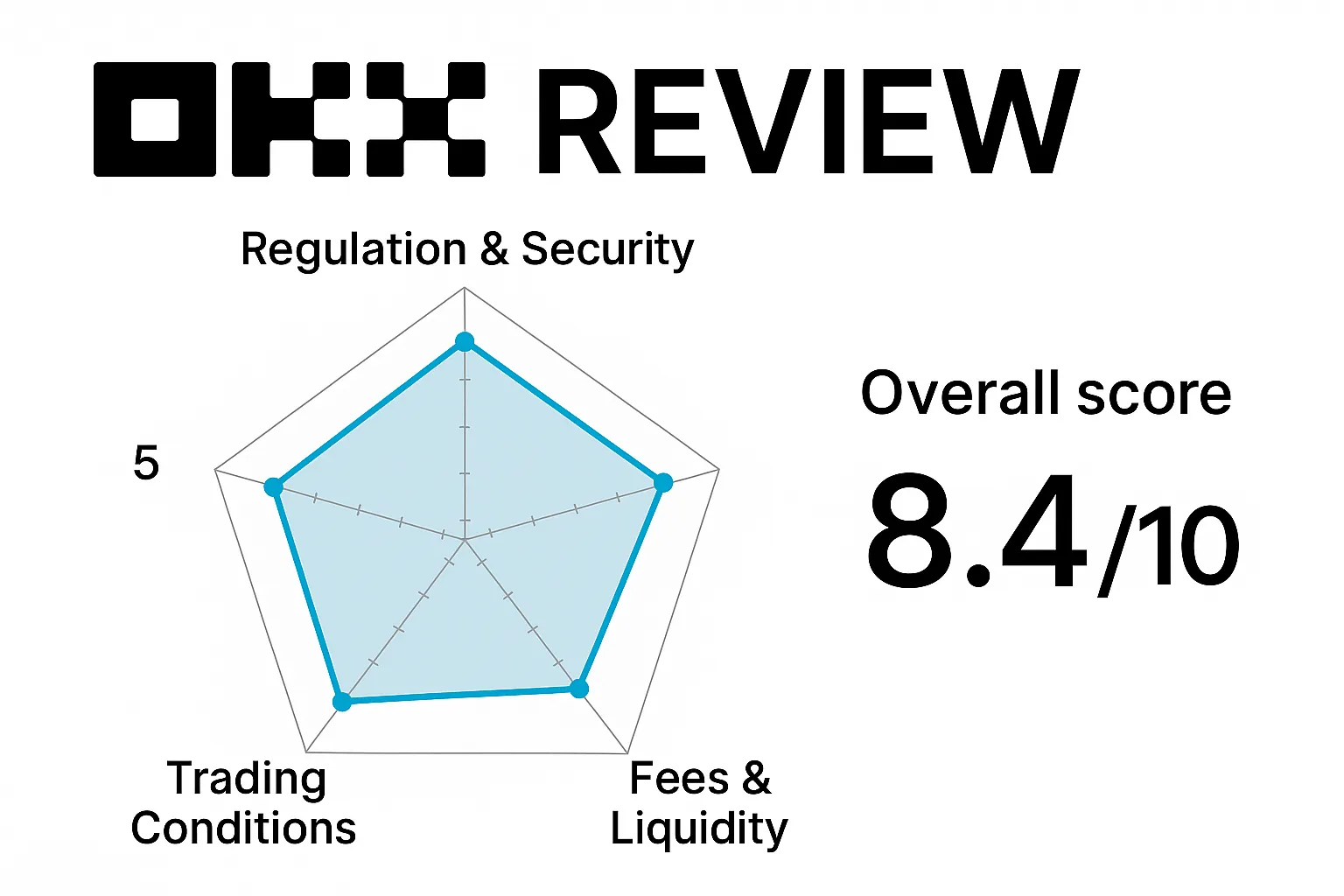

Regulation and Security : 7/10 — Compliance in some areas, but limited coverage.

Trading Conditions : 9/10 — Low fees and flexible leverage.

Product Richness : 9/10 — Comprehensive product offerings, covering Web3.

Technology and Liquidity : 9/10 — Globally leading in stability and depth.

Customer Service and Service : 8/10 – Multilingual customer service and prompt responses.

📊Overall rating: 8.4/10

OKX is one of the world's top exchanges, suitable for mid- to high-end users, but compliance coverage remains the biggest challenge.

As one of the world's leading exchanges, OKX has established itself as a leader beyond Binance with its low transaction fees, powerful contract and options markets, and leading Web3 layout .

Advantages : excellent trading conditions, strong technical performance, and complete ecosystem.

Disadvantages : Lack of top global regulation and restrictions in some countries.

👉 Official website: https://www.okx.com

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.