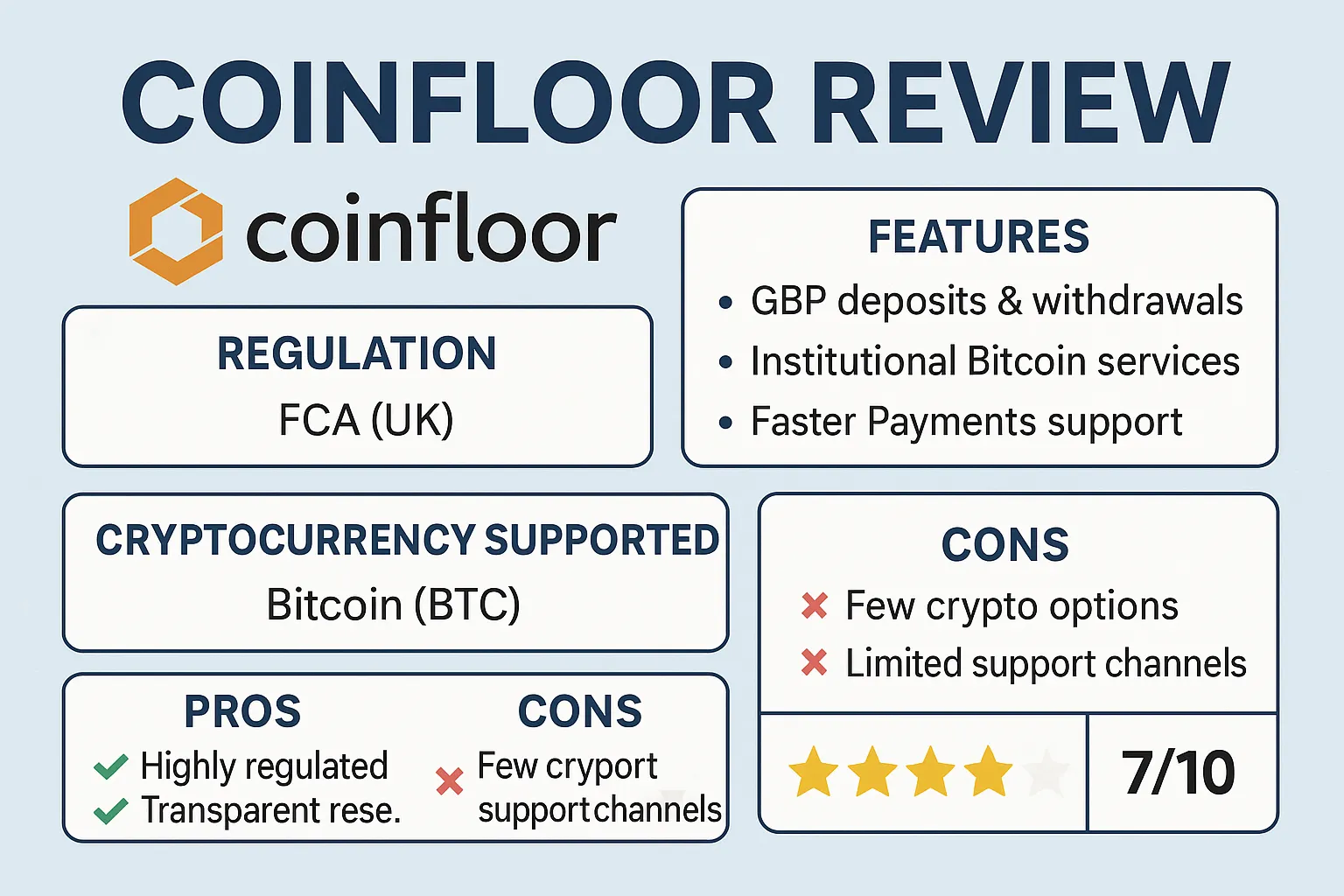

Coinfloor Review | Is Coinfloor Exchange Reliable? A Complete Analysis of the UK's Leading Bitcoin Platform's Regulation, Security, and User Reviews

Summary:This article provides an in-depth review of Coinfloor, a long-established UK Bitcoin exchange, covering its regulatory and compliance background, product positioning, transaction structure, security mechanisms (such as multi-sig + cold storage), auditability (proof of solvency), deposit and withdrawal methods, and user reputation. This article aims to help investors fully understand Coinfloor's legitimacy and trustworthiness, as well as its unique advantages and potential limitations.

1. Brand Background and Development History

Founded in 2013 and headquartered in London, UK, Coinfloor is one of the earliest Bitcoin exchanges. As one of the first licensed cryptocurrency platforms in the UK, Coinfloor specializes in Bitcoin (BTC) trading and custody , and has gradually built a professional user base.

The platform's historical positioning is quite unique: unlike comprehensive exchanges such as Binance and Coinbase, Coinfloor has chosen a differentiated path of "focusing on Bitcoin and institutional services" during its development.

The main development process includes:

2013 : Coinfloor is established in London and launches Bitcoin trading services.

2015 : Became one of the first crypto trading platforms in the UK to pass FCA audit.

2017 : CoinfloorEX (derivatives platform) was launched, but was later merged into the new business.

After 2018 : Gradually withdraw from the retail user market and transform into an institutional Bitcoin trading and custody platform .

2021 : Coinfloor was acquired by CoinCorner (another UK-based crypto payment and trading company) to continue maintaining its institutional business.

📌 Overall, Coinfloor has a long history and has local advantages in the UK market, but due to its conservative development direction, it has gradually transformed into a niche market.

2. Trading Account and Trading Conditions

Coinfloor does not offer a wide range of currencies like Binance or OKX, but instead focuses on Bitcoin spot and fiat currency channels .

| Account Type | Minimum deposit | Trading instruments | Main handling fees |

|---|---|---|---|

| Personal Account | From £100 | BTC/GBP | 0.1% - 0.3% |

| Institutional/OTC Accounts | From £5000 | Large BTC transactions | Negotiated pricing |

Key transaction features:

Fiat currency support : Only British Pounds (GBP) are supported. Deposits must be made through a UK bank account.

Spreads and fees : Fees for retail users are relatively high, especially for small transactions.

Professional Client Channel : Provides OTC large-value Bitcoin services for hedge funds and family offices.

III. Supervision and Compliance

Coinfloor is one of the oldest compliant crypto exchanges in the UK .

| Regulatory agencies | License/Status | Entity Company Name |

|---|---|---|

| FCA UK Financial Conduct Authority | Registered as a Cryptoasset Firm | Coinfloor Ltd. |

Compliance points:

The platform was once approved by the FCA to operate crypto-related businesses.

Comply with UK Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations .

After the acquisition, its client business was merged into CoinCorner and supervision continued.

📌 Unlike many offshore exchanges, Coinfloor has always taken a "compliance first" path.

IV. Trading Products and Market Coverage

Coinfloor’s positioning is very simple:

Supported currencies : Only BTC (Bitcoin) is supported.

Trading pair : BTC/GBP.

Not provided : Altcoin, DeFi, NFT related services.

This means that its market coverage is very limited and is more suitable for local UK Bitcoin investors .

5. Trade Execution and Technical Performance

Matching system : supports professional-level matching engine, suitable for large Bitcoin orders.

OTC Desk : Provides low slippage block trades to institutional clients.

API interface : Provides REST API/FIX API to facilitate programmatic trading.

Liquidity : Liquidity is not as good as Binance and Coinbase, but it has a certain depth in the UK market.

6. Deposit and Withdrawal Methods and Time Limits

| Deposit method | Supported Currencies | aging | Handling Fees |

|---|---|---|---|

| Bank transfer | GBP | 1-2 business days | free |

| Withdraw to bank | GBP | 1-2 business days | £10 fixed |

Features:

No card required for deposits , completely dependent on UK Faster Payments.

The withdrawal fees are high , which is especially unfriendly to small-amount users.

7. Customer Service and Additional Features

Support channels : Email ( [email protected] ), no 24/7 online customer service.

Available languages : English only.

Additional features : Provide custody and proof of reserve reports for professional investors.

8. Media and User Reviews

International media citations

CoinDesk previously reported that Coinfloor is the UK’s “most conservative yet compliant” exchange.

The Financial Times noted that it "lacks innovation but has outstanding compliance advantages."

Community Reviews

Advantages: Compliance, security, and no risk of running away.

Disadvantages: Too few currencies, high transaction fees, and slow customer service response.

IX. Risk Warning

Market risk : Only supports Bitcoin and cannot diversify risks.

Compliance changes : UK regulations are becoming stricter, which may further restrict retail investors’ entry in the future.

Competitive Disadvantages : Compared with Binance, Kraken, etc., its functionality is seriously insufficient.

10. Overall Rating (BrokerHiveX 10-point system)

Compliance: 8/10 — UK regulated, but partially incorporated into CoinCorner.

Security: 8/10 — Transparent Custody and Proof of Reserves.

Trading Conditions: 6/10 — High fees, limited options.

User Experience: 6/10 — The interface is simple but too basic.

Market reputation: 7/10 — Medium community recognition, niche positioning.

📊 Overall score: 7/10

👉 Bottom Line: Coinfloor is suitable for professional Bitcoin investors in the UK , but isn't recommended for those looking for multi-currency trading or low fees.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.