BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Bitpanda is a leading European multi-asset trading platform, regulated by the Austrian Financial Market Authority (FMA) and operating in multiple EU countries. This article comprehensively analyzes Bitpanda's regulatory compliance, product features, deposit and withdrawal methods, user experience, and market reputation, helping investors determine whether Bitpanda is a safe and reliable platform.

Founded in 2014 and headquartered in Vienna, Austria, Bitpanda is one of the most well-known compliant fintech platforms in Europe.

Founders : Eric Demuth, Paul Klanschek, Christian Trummer

Positioning : Multi-asset investment platform, not limited to cryptocurrencies, but also including stocks, ETFs and precious metals

Number of users : More than 4 million registered users

Expansion process : Establishing compliant subsidiaries in EU countries such as Germany, Spain, France, and Italy

📌 Evidence:

Bitpanda is regulated by the FMA (Austrian Financial Market Authority) and holds an investment services license under the EU MiFID II framework.

Obtained BaFin license in Germany

Registered as a Virtual Asset Service Provider (VASP) in France, Italy, and Spain

Client funds isolation, regular audits, and compliance with Anti-Money Laundering/Counter-Terrorism Financing (AML/CFT) regulations

Bitpanda is known as the "European version of Coinbase" and is one of the few trading platforms that is truly regulated by multiple countries.

📌 Evidence:

| Account Type | Applicable people | Minimum deposit | Handling Fees | Features |

|---|---|---|---|---|

| Retail Accounts | Ordinary users | €25 | Starting from 1.49% | Multi-asset investment, simple interface |

| Professional Account | High-frequency traders | €10,000 | Negotiated rates | API transactions, institutional support |

| Business Account | Corporate Clients | €50,000 | Customization | Custody services, compliance account management |

Bitpanda’s biggest differentiator is its multi-asset coverage :

Cryptocurrency : BTC, ETH, ADA, SOL, DOT, etc. 200+

Stocks and ETFs : Support fractional share investment, covering EU and US stock markets

Precious metals : digital investments such as gold, silver, and platinum

Stablecoins and fiat currencies : Support EUR, CHF, GBP, USD

📌 Evidence: Bitpanda Supported Assets

Platform experience : The interface is simple and suitable for beginners; there is also a professional mode.

Mobile apps : iOS and Android ratings are generally higher than 4.5.

Order Execution : Sufficient depth and low latency.

Security :

Cold wallet storage >95%

Multi-signature

Compliance insurance coverage

📌 Evidence: Bitpanda App

| aisle | Supported Currencies | aging | Handling Fees |

|---|---|---|---|

| Bank SEPA transfer | EUR | 1–2 days | Free/low rates |

| Credit/Debit Card | EUR/USD | immediate | 1.5–2% |

| Skrill/Neteller | EUR | immediate | 1.5% |

| PayPal | EUR | immediate | 1.5–2% |

| Crypto transfers | BTC, ETH, USDT | 30 minutes | On-chain fees |

📌 Evidence: Bitpanda Payment Method

Channels : Tickets, Online Help Center

Language : Support German, English, French, Spanish, Italian

Time : 5x24, VIP customers provide priority support

Bloomberg : Bitpanda is seen as "an important bridge between crypto and multi-asset investing in Europe."

CoinDesk : Reports on its compliance progress as it expands into France and Germany.

front:

Strong compliance and financial security.

Multi-asset support and rich investment options.

Fiat currency deposits and withdrawals are convenient.

Negative:

The fees are higher than some competitors.

Professional trading features are limited.

Fee issue : The transaction fee is relatively high and is not suitable for high-frequency traders.

Market positioning : Focused on retail, with limited institutional capabilities.

Competitive pressure : from large platforms such as Coinbase and eToro.

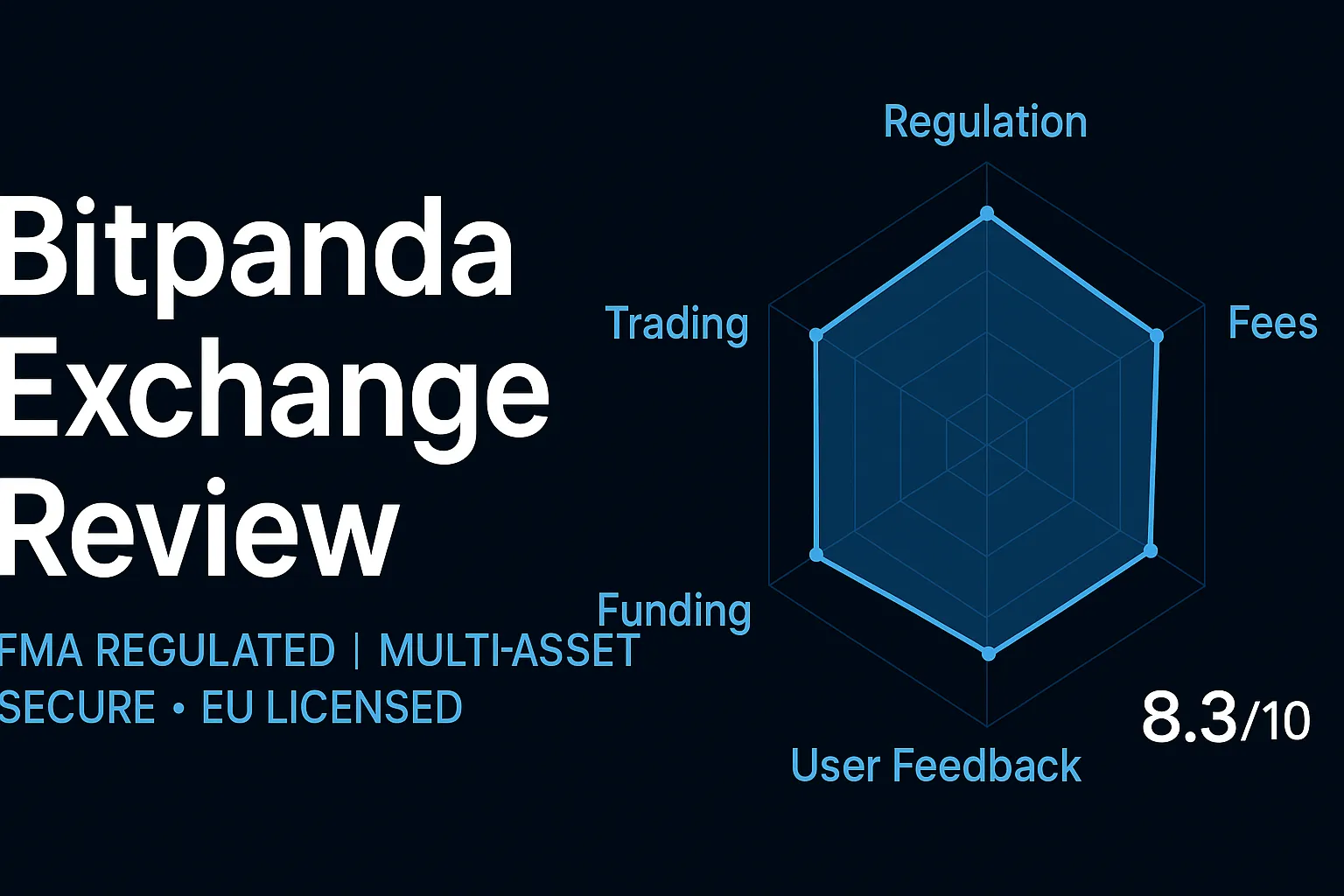

Regulatory Compliance: 9/10 — Multi-national Regulator, EU License

Trading Experience: 8/10 — User-friendly interface, multi-asset support

Deposits and Withdrawals: 9/10 — Wide range of payment methods, including PayPal

Fee level: 7/10 — slightly higher fees

User reputation: 8/10 — Good reputation in Europe

Overall Score: 8.3/10 – A compliant multi-asset investment platform suitable for European retail users.

📌Conclusion

Bitpanda is a compliant, secure, and multi-asset European trading platform, particularly suitable for retail users looking to invest in cryptocurrencies, stocks, and precious metals. While fees are relatively high, Bitpanda's regulatory backing from the Financial Conduct Authority (FMA) and multiple EU jurisdictions ensures its long-term competitiveness in the European market.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.