Kabu.com Securities Review | Is Kabu.com Reliable? A Complete Analysis of Japanese FSA Regulation, MUFG Background, and the Trading Experience

Summary:Kabu.com Securities (カブドットコム証券), a subsidiary of Mitsubishi UFJ Financial Group (MUFG), is regulated by the Financial Services Agency (FSA) and is one of Japan's three largest online brokerages. This article provides an in-depth analysis of Kabu.com's regulatory compliance, trading products, platform experience, fee structure, customer feedback, and potential risks, to help investors determine its safety and value.

1. Brand Background and Development History

Kabu.com Securities, founded in 1999 and headquartered in Tokyo, Japan, is a pioneer in Japan's online securities industry and is currently wholly owned by Mitsubishi UFJ Financial Group (MUFG) .

Parent company : MUFG (one of Japan's largest financial groups)

Background : Initially operating as an online securities platform, it was listed on the Tokyo Stock Exchange in 2001 and was later acquired and privatized by MUFG.

Market positioning : Mainly targeting domestic Japanese investors, providing products such as stocks, ETFs, funds, futures, and foreign exchange.

Competitive Position : Ranked as one of Japan's top three online brokerages, along with SBI Securities and Rakuten Securities.

📌 Evidence:

II. Supervision and Compliance

1. Supervision by Japan's Financial Services Agency (FSA)

Kabu.com Securities is a Category 1 financial instruments dealer regulated by the Financial Services Agency (FSA) of Japan .

It is also a member of the Japan Securities Dealers Association (JSDA) .

Customer funds are stored in isolation in compliance with legal requirements.

📌 Evidence:

2. MUFG background guarantee

As a subsidiary of MUFG, one of the world's top ten banking groups, Kabu.com has additional advantages in terms of fund security, compliance operations, and risk management systems.

III. Account Types and Trading Conditions

Kabu.com offers a variety of accounts to meet different investment needs:

| Account Type | Applicable people | Product Range | Features |

|---|---|---|---|

| General Securities Account | retail investors | Stocks, ETFs, and Funds | Standard functions, low threshold |

| Credit trading account | Intermediate Trader | Stock financing and securities lending | Support margin trading |

| Futures/Options Accounts | Professional Trader | Nikkei 225 futures, Nikkei options | High risk, high reward |

| Foreign exchange account | Forex investors | 20+ currency pairs | Limited leverage (up to 1:25) |

| NISA account | long-term investors | Stocks and funds | Enjoy tax exemption policy |

📌 Evidence: Kabu.com products and accounts

IV. Trading Products and Market Coverage

Stocks and ETFs : Tokyo Stock Exchange (TSE) listed companies and ETFs

Funds : Japanese and international fund products

Foreign Exchange (FX) : 20+ major currency pairs, with leverage up to 1:25

Futures and options : Nikkei 225 futures, TOPIX futures, Nikkei options

Bonds : Japanese government bonds and some corporate bonds

📌 Evidence: Kabu.com Products

Kabu.com's market coverage is mainly concentrated in the Japanese domestic market , with limited internationalization.

5. Trading Experience and Platform

1. Trading Platform

Kabustop® : Desktop version, powerful functions, supports real-time market information and order placement

kabu.com Web : web platform, suitable for ordinary users

Mobile application : iOS/Android, suitable for trading at any time

2. Functions and Features

Real-time quotes and research reports

Support multi-screen trading

Linked with MUFG bank account, convenient fund transfer

📌 Evidence: Kabu.com Platforms

6. Deposit and Withdrawal Methods

| aisle | currency | aging | Handling Fees |

|---|---|---|---|

| Bank transfer (MUFG) | JPY | immediate | free |

| Bank transfer (other banks) | JPY | 1 day | Bank standard rate |

| Automatic deduction (seat replacement) | JPY | immediate | free |

| Withdraw funds | JPY | 1–2 days | Free/low rates |

Advantages: MUFG Bank background, fund transfer is extremely convenient.

Disadvantages: Does not support wire transfers or foreign currency deposits commonly used by international customers.

VII. Customer Service and Support

Channels : telephone, online consultation, email

Time : Weekdays 09:00–17:00 (Japan time)

Language : Mainly Japanese, insufficient international support

Educational resources : Investing beginner's guides, webinars, research reports

📌 Evidence: Kabu.com Support

8. Media and User Reviews

1. Media coverage

Nikkei : Calls Kabu.com an online securities platform trusted by Japanese investors.

Japan Economic Weekly : The report said that it relies on the MUFG banking ecosystem and has outstanding advantages in fund security.

2. User word of mouth

front:

MUFG background, high security.

The cost is relatively reasonable.

The platform is rich in functions.

Negative:

Lack of internationalization, almost only serving Japanese customers.

Customer service is only available in Japanese.

The product concentration is high and its appeal to international investors is limited.

IX. Risk Warning

Geographical limitations : Almost limited to domestic Japanese investors.

Language limitation : Difficult to use for non-Japanese speaking investors.

Leverage restrictions : Forex and futures leverage is strictly restricted by the FSA.

10. Overall Rating (0–10 points)

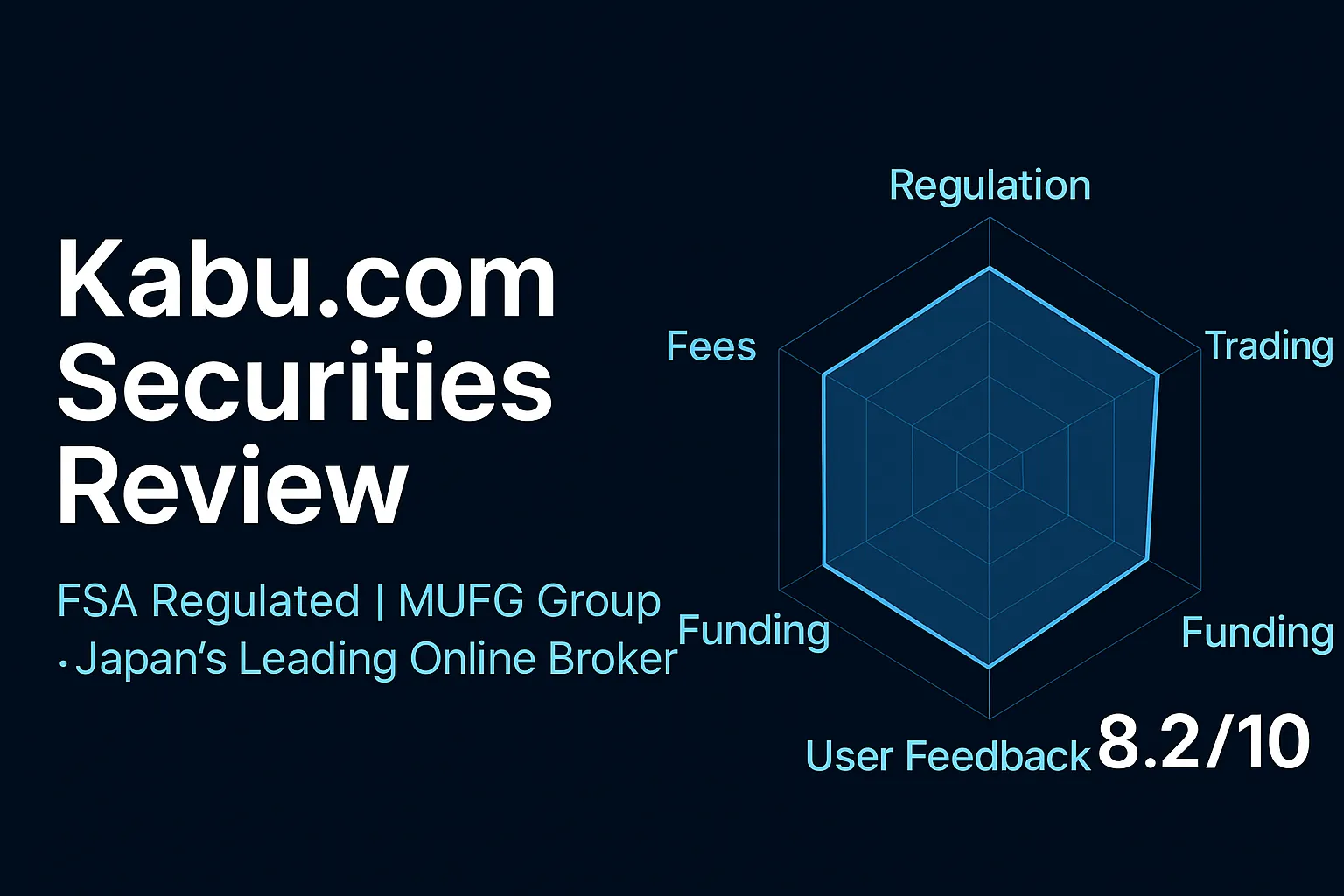

Regulatory Compliance: 9/10 — FSA Regulated, MUFG Background

Trading Experience: 8/10 — Professional platform, but limited language support

Fund Management: 9/10 — Bank linkage, fund security

Fee level: 8/10 – Reasonable but not the lowest

User reputation: 7/10 — High local recognition, insufficient internationalization

Overall Score: 8.2/10 – A good choice for Japanese investors, limited for international users.

in conclusion

As a subsidiary of MUFG, Kabu.com Securities enjoys a high level of trust among Japanese investors thanks to its banking background, FSA regulation, and local market advantages . While its internationalization and multilingual support may be limited, it remains a compliant, secure, and robust securities trading platform for local Japanese investors.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.