BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Founded in 1925, Nomura Securities is Japan's largest securities firm, affiliated with Nomura Holdings (listed on the Tokyo Stock Exchange, ticker code 8604). It is regulated by the Financial Services Agency (FSA) of Japan and holds licenses in numerous countries worldwide. This article comprehensively analyzes Nomura's safety and whether it is a worthy choice for investors and institutions, covering regulatory compliance, global operations, product portfolio, trading experience, investment banking and research capabilities, client experience, and risk warnings.

Nomura Securities Co., Ltd. is one of Japan's most representative financial institutions and one of the most well-known investment banks in Asia.

Founded : 1925

Headquarters : Otemachi, Tokyo, Japan

Parent company : Nomura Holdings, Inc. (listed on the Tokyo Stock Exchange, ticker symbol: 8604)

Employee size : Approximately 26,000 (as of 2023)

Market capitalization : approximately 2 trillion yen

Market position : Japan's largest securities company, long ranked alongside Daiwa Securities as one of the "twin giants" of Japan's capital market.

📌 Evidence:

1925 : Nomura Securities is founded in Osaka, starting with bond business.

1938 : Headquarters moved to Tokyo and stock business expanded.

1960s–1980s : Becomes Japan's largest securities firm and expands internationally to the United States and Europe.

1980s–1990s : During Japan's economic bubble, Nomura was the world's largest brokerage firm by market capitalization.

2008 : Acquired Lehman Brothers' Asian and European operations to strengthen its international investment banking business.

After 2020 : Focus on Asian capital markets and strengthen ESG and green finance.

Nomura Securities is a Category 1 financial instruments trader and is regulated by the Financial Services Agency of Japan.

Customer funds are kept in isolation and are subject to capital adequacy and risk review requirements.

Regularly undergo AML (Anti-Money Laundering) and KYC (Know Your Customer) audits.

Nomura Securities is a core member of JSDA and participates in the formulation of industry rules.

United States : Nomura Securities International, Inc., regulated by the SEC and FINRA.

UK : Nomura International plc, regulated by the FCA.

Hong Kong : Nomura Hong Kong Limited, regulated by the SFC.

Singapore : Nomura Singapore Limited, regulated by MAS.

This cross-jurisdictional compliance system provides Nomura Securities with global multi-point compliance endorsement .

Nomura Securities offers a variety of account types for retail, high net worth and institutional clients:

| Account Type | Applicable people | Product Range | Features |

|---|---|---|---|

| General Securities Account | Japanese retail customers | Stocks, ETFs, and Funds | Standard features at a moderate cost |

| Credit trading account | Active Traders | Stock Margin Trading | Financing interest rates are subject to regulatory restrictions |

| Investment Trust Account | Long-term financial management customers | Various funds and pensions | Can enjoy Japan's NISA tax benefits |

| Global Investment Account | international investors | US stocks, Hong Kong stocks, and global ETFs | Covering the international capital market |

| Futures/Options Accounts | Professional Clients | Nikkei 225, TOPIX, and global derivatives | High risk and high leverage |

| Private Banking Account | high net worth clients | Full asset allocation | Customized investment consulting and asset management |

Full coverage of the Tokyo Stock Exchange (TSE).

Products listed on major US and Hong Kong stock exchanges and European exchanges.

ETFs cover global index and thematic investing.

Japanese Government Bond (JGB).

Corporate bonds and international bonds.

Nomura has long held a leading position in the bond underwriting market.

Mutual funds, index funds, pension plans.

ESG and green finance funds.

Nikkei 225, TOPIX futures and options.

Interest rate swaps, foreign exchange swaps, and credit derivatives.

IPO underwriting : long-term ranking first in Japan.

M&A Advisor : We have an important position in both Asia and America.

Debt financing : an important underwriter in the global bond market.

Nomura Online : web version + mobile version.

Professional terminal : Provide FIX API and high-frequency trading support for institutional clients.

Nomura Research Institute (NRI) is one of the largest independent research institutions in Japan.

Covers macroeconomics, industry trends, and individual stock research.

It has a strong influence in the Asian research market.

The interface is traditional and comprehensive.

Language: Mainly Japanese, international branches support English and Chinese.

| aisle | currency | aging | Handling Fees |

|---|---|---|---|

| Bank transfer (within Japan) | JPY | Immediate/1 day | free |

| International Wire Transfer | JPY, USD | 2–3 days | Bank standard rate |

| Automatic deduction (seat replacement) | JPY | immediate | free |

| Withdraw funds | JPY/USD | 1–2 days | Free/low rates |

Advantages: Backed by large banks such as MUFG and SMBC, it is extremely safe.

Disadvantages: Transfer costs for international customers are relatively high.

Asia : Key markets, including Japan, China, Hong Kong, Singapore, and India.

Europe : London is the European headquarters, focusing on investment banking and trading business.

Americas : New York is the Americas headquarters, focusing on investment banking, bonds and derivatives.

Strategic direction : Focus on emerging markets in Asia and expand ESG financial layout.

| Comparison Dimension | Nomura Securities | Daiwa Securities | Rakuten Securities | SBI Securities |

|---|---|---|---|---|

| Market position | No. 1 in Japan | Japan second | Top two online brokerage firms | No. 1 Internet brokerage |

| Establishment | 1925 | 1902 | 1999 | 1999 |

| Customer Group | High net worth, institutional, retail | High net worth, institutional, retail | Mainly retail | Mainly retail |

| Degree of internationalization | high | medium | medium | medium |

| Investment Banking | Very strong | powerful | weak | weak |

| Research Strength | Very strong | Very strong | medium | medium |

| Cost Level | medium to high | medium to high | Low | Low |

Conclusion: Nomura Securities leads in internationalization, investment banking business, and research capabilities .

Account opening process

Japanese residents: Open an account online. MyNumber and ID required.

International customers: need to open an account through an overseas branch, which is a more complicated process.

Transaction speed

Local latency in Japan is extremely low.

International users need to go through the Hong Kong/London/New York branches, which results in higher latency.

Deposit and Withdrawal Experience

For users in Japan: MUFG/SMBC bank transfers are almost instant.

International customers: Wire transfers take 2–3 business days.

Compliance record : Nomura Securities has been penalized by the FSA for insider trading and mis-selling in the past (2012).

Corrective measures : Strengthen internal compliance training and establish an independent risk control department.

Risk control system : The capital adequacy ratio has been higher than the regulatory requirements for a long time, and liquidity risk is controllable.

This demonstrates the ability of large investment banks to improve and self-repair under regulatory pressure.

Higher fees : Commissions and service fees are higher than those of online brokerages.

Internationalization threshold : It is complicated to open accounts for overseas retail customers.

Language issue : Domestic business in Japan is still mainly conducted in Japanese.

Compliance risk : There has been a history of compliance penalties.

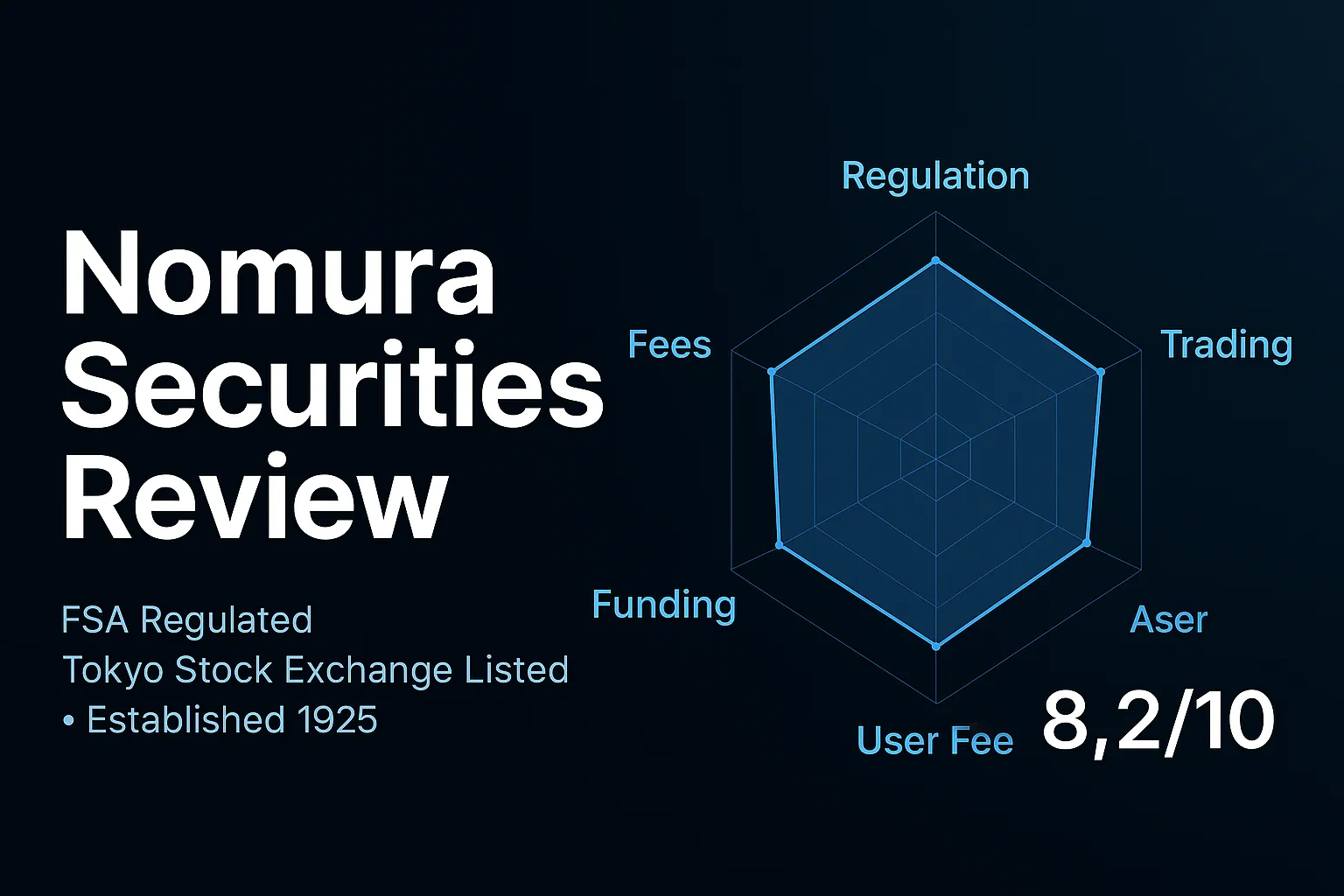

Regulatory Compliance: 9/10 — Multi-national regulated, Tokyo-listed company.

Trading Experience: 8/10 — The platform is stable, but the interface is traditional.

Fund Management: 9/10 - Bank background, fund security.

Cost level: 7/10 – Cost is on the high side.

User reputation: 8/10 — Strong research and investment banking credentials, limited international retail experience.

Overall Score: 8.2/10 – Japan's largest securities firm, suitable for institutions and high-net-worth clients.

As a leading financial institution in Japan's capital markets, Nomura Securities, leveraging its century-long history, global regulatory oversight, Tokyo listing, and strong research and investment banking capabilities , holds a significant influence in both Asian and global capital markets. It is suitable for high-net-worth individuals, institutional investors, and research-focused, long-term investors . However, for retail clients, particularly international users, fees and account opening requirements may be higher.

Overall, Nomura Securities is a compliant, secure, and professional global investment-grade securities firm.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.