Normal Operation

Normal OperationXM

15-20Year

Basic Information

Country

BritainMarket Type

foreign exchange|Stock|Futures|OptionEnterprise Type

BrokerageService

Forex, commodities, digital assets, stocks, indices and other CFD trading servicesSupport Languages

28 languages including Chinese, English, Russian, Hindi, Arabic, Portuguese, Thai, Tagalog, etc.Domain Registration Date

2023-08-22Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

XM is an international online foreign exchange and CFD broker founded in 2009, headquartered in Belize, and is affiliated to the world-renowned Trading Point Group. Over the years, XM has been committed to providing diversified financial trading services to global investors, including foreign exchange, cryptocurrency, stock CFDs, Turbo stocks, commodities, securities indices, thematic indices, precious metals and energy and other trading products.

With years of industry experience and service experience, XM continues to improve its trading environment and technical infrastructure to provide a stable, secure and efficient trading experience for traders of different levels, from beginners to professional investors. Its global compliance operations and localized support make it a trusted partner for many investors.

🌐 Global layout and brand background

As an important brand of Trading Point Group, XM has been operating in multiple financial markets with the Group's global strategy and resources, and has been deeply involved in the Asia-Pacific, European, Middle Eastern and African markets. It has core operation centers in Belize and Cyprus, and covers the world through multilingual customer support services.

It is generally believed in the industry that the core of XM's brand lies in the concept of "customer-centricity". Whether it is the transparency of the trading environment, the fairness of order execution, or the sharing of trading education and market information, XM always insists on providing high-quality comprehensive services. With many years of stable operation and continuously optimized product system, XM has gradually established a trustworthy international brand image in the field of foreign exchange and CFD.

💹 Trading Products and Services

XM's product matrix covers a wide range, which not only meets the flexible needs of short-term traders, but also provides convenience for diversified asset allocation.

Foreign exchange trading: providing more than 50 currency pairs, covering mainstream, cross and non-mainstream currency pairs, to meet the needs of different trading strategies;

Crypto CFD: Provide investors with easy access to emerging digital assets with high liquidity and low spreads;

Stocks and Turbo Stocks CFDs: Supports a variety of international stock CFDs, provides flexible leverage options and no additional fees;

Commodities and energy: covering traditional popular categories such as gold, silver, and oil, suitable for allocation or risk-averse investment needs;

Indexes and thematic indexes: allow investors to seize investment opportunities in global market hot spots and industry trends.

This diversified product portfolio provides more options for investors with different experience levels and risk preferences.

💻 Trading technology and platform experience

In terms of trading technology, XM provides investors with two major international mainstream trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which support multi-terminal access such as PC/Mac, smartphones and tablets.

MT4 is famous for its rich technical indicators, stable automated trading environment and user-friendly interface, which is suitable for most investors. On this basis, MT5 further expands the order types and economic calendar functions, which is suitable for users with higher requirements for market research and strategy testing.

External evaluations generally believe that XM's trading platform runs stably, has low server latency, and can provide users with a fast and fair order execution experience, which is particularly suitable for short-term traders and users of automated trading strategies.

🛡️ Regulatory compliance and fund security

XM also maintains high standards in terms of compliance:

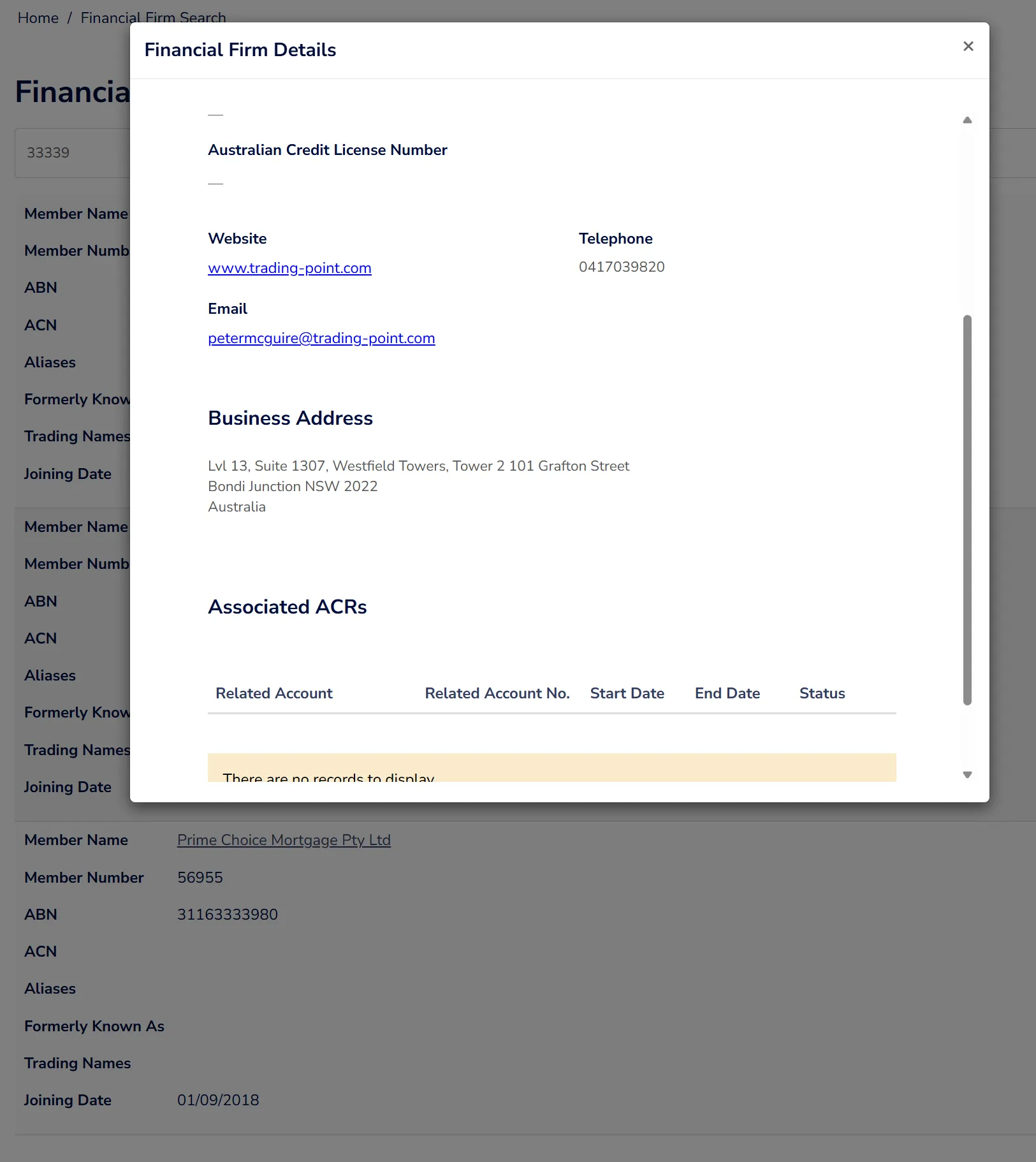

XM Global Limited is authorised and regulated by the Financial Services Commission (FSC) of Belize (licence number: 000261/397).

Trading Point of Financial Instruments Limited is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) (Licence number: 120/10).

Fully licensed and regulated by the Australian Securities and Investments Commission (regulatory license number: 000443670).

This multi-location compliance structure provides stronger protection for investor funds, and the implementation of the segregated custody system for client funds also ensures that client assets can be independently protected even if the platform encounters operational risks.

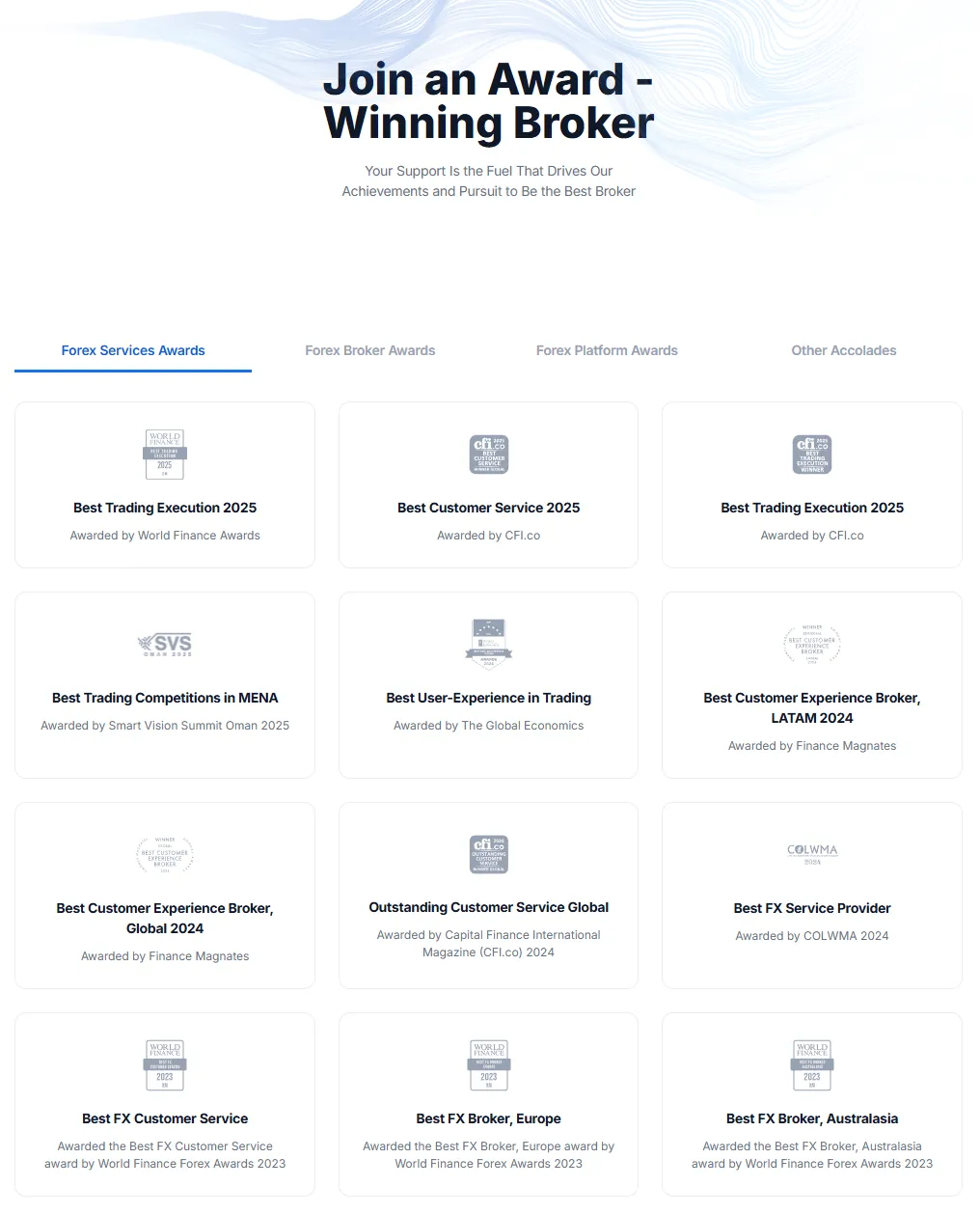

Among multiple independent rating agencies, XM has received a relatively positive risk assessment due to its ongoing compliance record and transparency, making it suitable for investors who value financial security and fair transactions.

⚡ Trading conditions and experience

XM provides flexible and competitive trading conditions for global investors:

Low spreads and low transaction costs help users optimize transaction returns;

Flexible leverage up to 500:1 (adjusted according to regional regulatory requirements), providing diversified options for different strategies;

Transparent margin and risk management mechanism helps users effectively control risks.

Combined with advanced matching technology, XM's order execution efficiency and trading experience are at a relatively high level among similar brokers, and are especially suitable for users who pursue high liquidity and low costs.

🎓 Customer Support and Value-added Services

XM provides 24/5 multilingual customer support services, which are timely and professional, and support multi-channel communication via email, phone and online customer service. At the same time, the platform provides investors with systematic market analysis reports, online education courses and seminars to help novices get started quickly, and also provide in-depth market insights for professional investors.

Its education and value-added services have gained a good reputation in the industry and are considered to be "a comprehensive service provider that is suitable for both beginners and can provide reference for advanced traders."

⚠️ Risk warning and platform positioning

Foreign exchange and CFD trading are inherently high-risk investments that may result in partial or total loss of investment funds. XM has clear risk disclosures on its official website and platform, reminding investors to fully understand the market mechanism before trading and to plan their personal risk tolerance appropriately.

From the perspective of platform positioning, XM is suitable for both advanced investors who want to diversify their transactions, and novice users who want to gradually accumulate experience through education and demo accounts.

🔍 Comprehensive analysis and evaluation

In general, XM, as a broker that has been established for many years and has a certain influence in the global market, has the following advantages:

Compliance supervision in multiple places, perfect fund isolation system and high security;

Rich trading product lines to meet the needs of different investment strategies;

The platform technology is mature and stable, and the execution is fair and efficient;

The educational resources are complete and the customer support is professional and in place.

Third-party analysts generally believe that XM has long-term operational capabilities in terms of compliance, security, and technology, and is a comprehensive international broker that takes into account both trading experience and capital security.

For users who are looking for a safe and compliant, multi-category trading environment and want to operate flexibly in a transparent and efficient market, XM is a good choice worth considering.

Selected Enterprise Evaluation

4.18

Total 14 commentsI’ve made multiple deposits without any issues. No hidden fees either.

Reply

ai***88

ai***88After being scammed by a platform that blocked all withdrawals, I had almost given up hope. Then I found Mrs. Nora. She guided me step by step, and within 72 hours, every cent was back in my account. Fast, reliable, and trustworthy—she’s the real deal. 📧 Email: bruce.nora254@gmail. com | 📱 WhatsApp: +1 (8 7 0) 810 54 42

Reply

Slippage is well-controlled—even during volatile events like NFP.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

The reps are polite and patient, unlike many other platforms I’ve used.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

Clean, intuitive UI that’s easy to navigate, even for first-timers.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

Transparent system. You can see everything you need in the backend.

Reply

ch***nn

ch***nnI had a deeply frustrating encounter with a deceptive trading platform that abruptly blocked my access after I made a substantial deposit. Despite multiple attempts to resolve the issue through their so-called support team, I received no response. That’s when I was fortunate enough to find Mrs. Bruce Nora, a seasoned professional in the field of asset recovery. She approached my case methodically, requested all necessary documentation, and handled the situation with impressive competence. Within a short time, she was able to retrieve my lost funds. Her service exceeded my expectations, and I can confidently vouch for her credibility and skill in tackling financial fraud cases.brucenora254 [@]gmail. com or WhatsApp +1 (8 7 0) 8 1 0 54 4 2

Reply

test

Reply

FX***00

FX***00test1

Reply

I’m so grateful for the excellent assistance I received in recovering my lost item. I had almost given up hope, but thanks to their quick response, professionalism, and attention to detail, I was able to get my belongings back safely. Their communication was clear throughout the process, and I truly appreciate the effort they put in to help me. Highly recommended! Mail: olivetraderecover 5 5 A t g mail.c0m Website: https://iconicrecovery.org

Reply

ai***88

ai***88so real just yesterday 😄😅, ah still unbelievable, thanks you thank you MRS Bruce Nora""""😊🙏🏻🙏🏻🙏🏻 and also thanks to the reviews that really helped thanks for the support, after all my years of hardship of not able to get access to my funds

Reply

FX***00

FX***00nice

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

I was unfortunately targeted by an online investment scam after investing more than $2M based on promised high returns. When I attempted to withdraw funds, my account was frozen, and the platform demanded additional “verification” payments—an immediate red flag I later worked with an asset-recovery professional who helped me recover a portion of the lost funds (about $450,000). While experiences and outcomes differ, I appreciated the support throughout the process. This incident highlights the importance of strong cybersecurity awareness: Email: (dorisashley71 (@) gmail. com ) or via WhatsApp at +1 .- (404) 721 56 08.) always verify platform legitimacy, conduct independent research before investing, and be cautious of platforms requiring unexpected payments for withdrawals. Staying informed is crucial to protecting your financial assets in the digital space.

Reply

I had a deeply frustrating encounter with a deceptive trading platform that abruptly blocked my access after I made a substantial deposit. Despite multiple attempts to resolve the issue through their so-called support team, I received no response. That’s when I was fortunate enough to find Mrs. Bruce Nora, a seasoned professional in the field of asset recovery. She approached my case methodically, requested all necessary documentation, and handled the situation with impressive competence. Within a short time, she was able to retrieve my lost funds. Her service exceeded my expectations, and I can confidently vouch for her credibility and skill in tackling financial fraud cases.brucenora254 [@]gmail. com or WhatsApp +1 (8 7 0) 8 1 0 54 4 2

Reply

Load More

About XM's questions

Ask:Is XM safe and reliable? Are my funds secure?

Answer:XM is affiliated with the world-renowned Trading Point Group. It was founded in 2009 and has been operating in compliance with regulations in the international market for a long time. It holds regulatory licenses from multiple countries, including the Financial Services Commission (FSC) of Belize, the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC), and implements a customer fund segregation and custody system to ensure that user funds are independent of the company's operating funds and can be protected even if risks arise on the platform. External rating agencies give high ratings to its compliance and transparency, so it is suitable for investors who focus on fund security and fair trading. However, it should be noted that foreign exchange and CFDs are essentially high-leverage and high-risk products. Market fluctuations may result in capital losses. Personal risk tolerance should be fully assessed before trading.

Ask:What trading products and conditions does XM offer and what types of investors are suitable for it?

Answer:XM's trading products cover foreign exchange, cryptocurrency, stock CFDs, Turbo stocks, commodities, energy, securities indices and thematic indices, etc., which can meet the strategic needs of short-term traders and are also suitable for asset diversification. The platform provides low spreads and low transaction costs, flexible leverage up to 500:1 (depending on regional regulatory requirements), and adopts transparent margin and risk management mechanisms to help investors better control risks. For investors who need high liquidity, low costs and a diversified product portfolio, XM is a well-balanced choice, which is suitable for novices to learn through demo accounts and can also meet the needs of advanced traders for multi-market layout.

Ask:How does XM perform in terms of trading technology and customer service?

Answer:XM provides investors with two major international trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which support desktop, web and mobile access. The platform runs stably and has low server latency, making it suitable for short-term traders and users of automated strategies. MT4 is simple and practical, suitable for most investors; MT5 has expanded order types and market analysis functions, suitable for users with higher requirements for strategy testing and research. In terms of customer support, XM provides 24/5 multilingual services, professional and timely responses, and is equipped with market analysis reports, online education courses and seminars to help novices get started quickly, while providing professional traders with deeper market insights. Overall, XM maintains a high level of technology and service experience, suitable for users who pursue a stable execution environment and complete value-added services.