Normal Operation

Normal OperationTMGM

10-15Year

Basic Information

Country

AustraliaMarket Type

foreign exchange|CFDEnterprise Type

BrokerageService

CFD trading services for foreign exchange, commodities, digital assets, stocks, indices, etc.Support Languages

English, Spanish, FrenchDomain Registration Date

2007-10-28Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

TMGM (TradeMax Global Markets) is a global online foreign exchange and CFD trading service provider founded in 2013, with its headquarters in Sydney, Australia. Since its establishment, TMGM has been operating in multiple markets around the world with its relatively rich trading products and multilingual customer service system, and continues to expand its business coverage in Asia Pacific, Europe and offshore regions. According to its public information, TMGM currently claims to provide services to customers in more than 150 countries and regions.

The company's core business includes derivatives trading such as foreign exchange, commodities, stocks, and cryptocurrencies. It supports a variety of trading platforms and account types, aiming to provide investors at different levels with diversified trading options. Its official website and marketing promotions highlight the technical advantages of "global multi-regulatory licenses" and "instant execution", but the actual operation still needs to be carefully judged in combination with the specific account location and regulatory differences.

🌐 Global layout and brand background

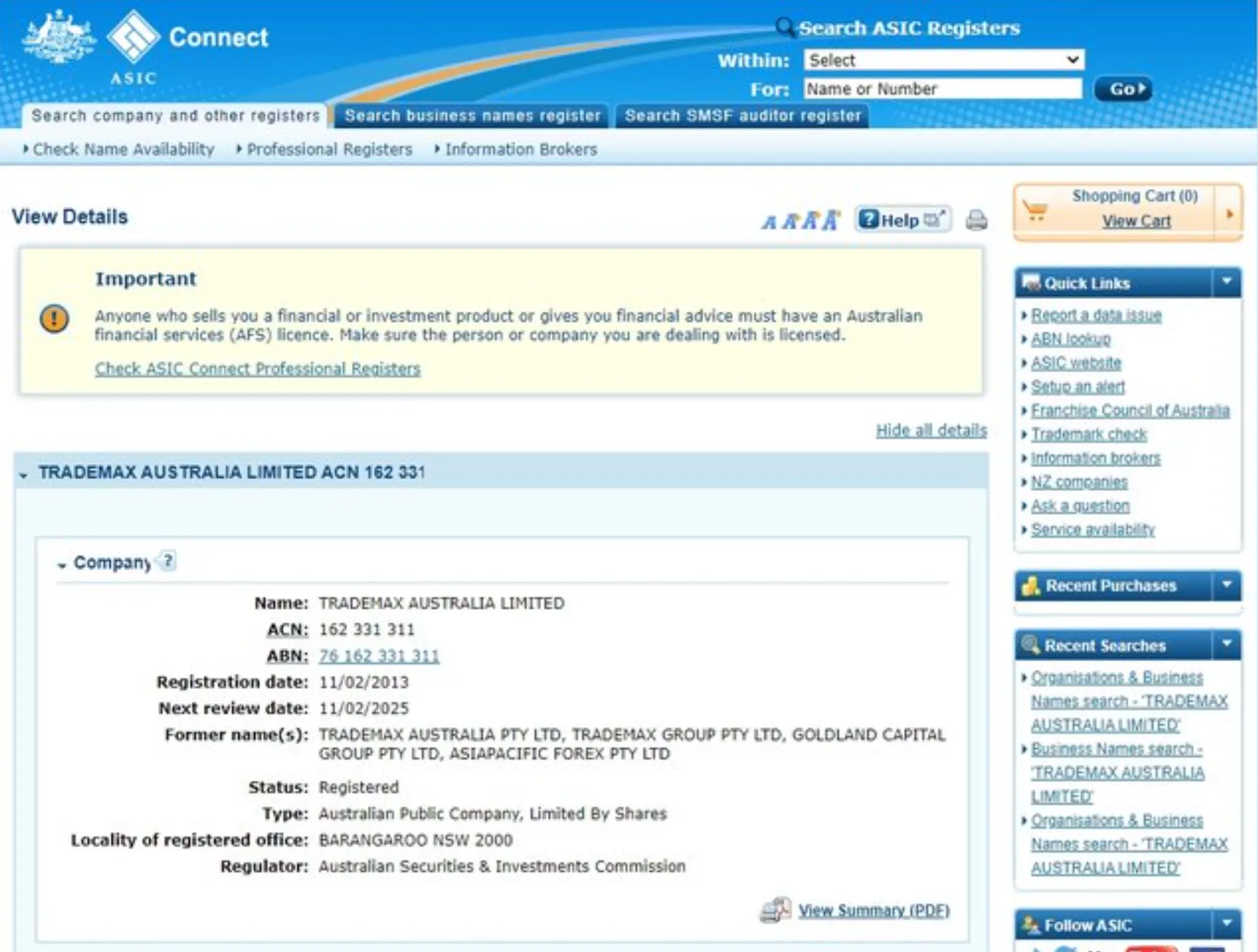

TMGM's parent company, TRADEMAX AUSTRALIA LIMITED, is registered in Australia. The company also has operating locations in New Zealand, Thailand, Cyprus and other places, providing online trading services to global investors. According to its official website, the platform accepts registered customers from many countries and regions around the world and has certain international operation capabilities.

In terms of regulation and regional distribution, TMGM holds multiple regulatory licenses including the Australian Securities and Investments Commission (ASIC), the New Zealand Financial Markets Authority (FMA) and the Vanuatu Financial Services Commission (VFSC). It should be noted that different customer accounts may belong to different legal entities. Investors should learn in detail whether the company they are opening an account with is affiliated with a mainstream regulatory agency before choosing to open an account.

In terms of brand, TMGM has been actively promoting its business in the Asian and Southeast Asian markets in recent years, and has appeared in many sports and financial events to increase brand exposure. The market is still in the process of building its brand awareness.

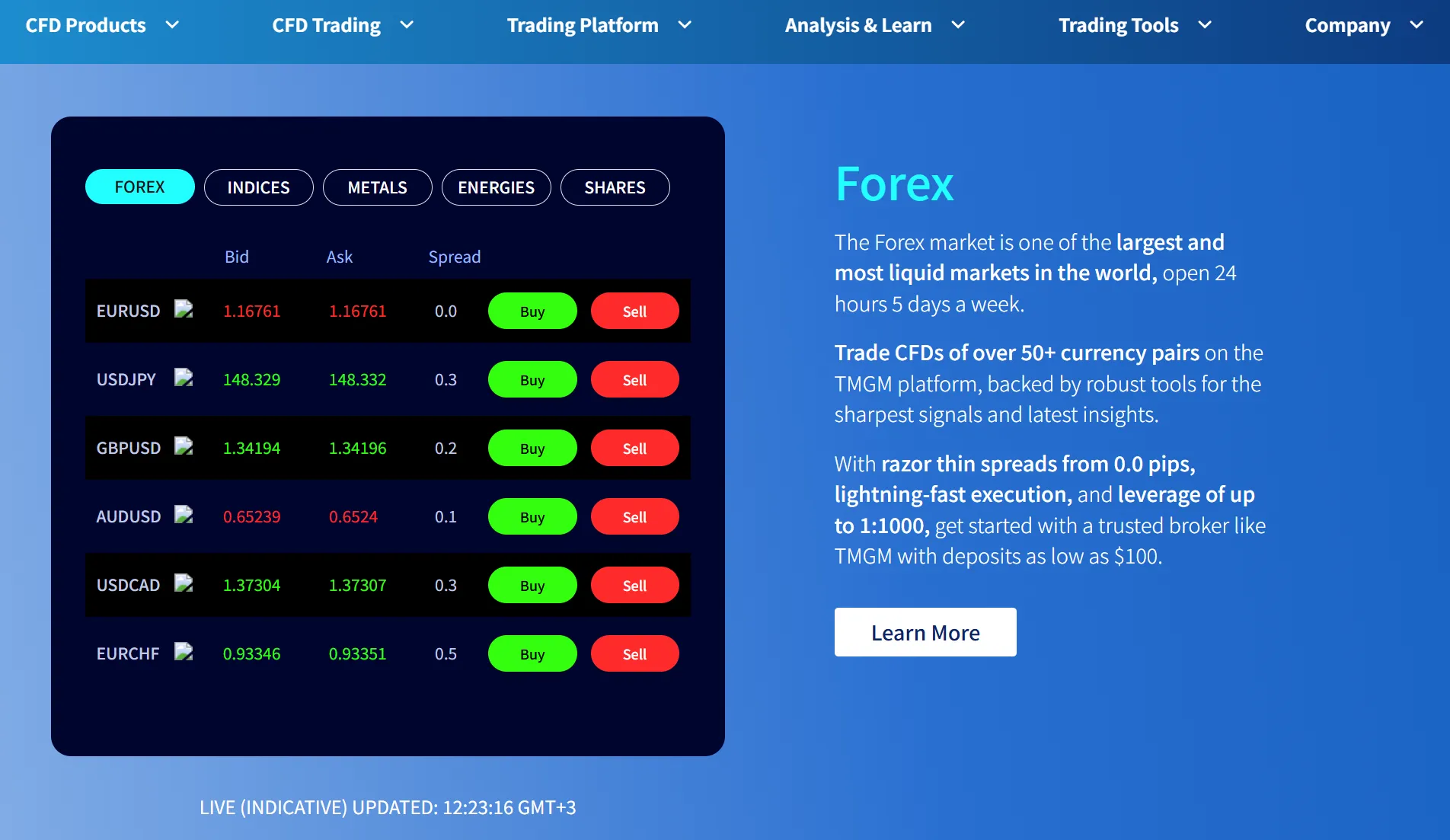

💹 Trading Products and Services

TMGM's trading products cover foreign exchange, precious metals, energy, indexes, stocks and cryptocurrency CFDs, providing a relatively complete market coverage. Users can trade mainstream currency pairs (such as EUR/USD, GBP/USD), gold, crude oil, global popular indices (such as S&P 500, Nasdaq) and cryptocurrencies such as Bitcoin and Ethereum through its platform.

In terms of account structure, TMGM provides two main account types, EDGE and CLASSIC, corresponding to the "low spread + handling fee" and "no handling fee + fixed spread" modes respectively. The minimum deposit requirement is $100, which is suitable for traders with different strategy preferences. The maximum leverage is 1:30, which meets the retail trading restrictions under mainstream regulatory requirements.

From a functional perspective, the product types and account flexibility can cover the basic needs of beginner to intermediate and advanced trading users, but the specific spreads and transaction costs still require investors to compare and verify based on real-time platform data.

💻 Trading technology and platform experience

TMGM supports the mainstream trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and also provides the Iress platform, which is suitable for higher-frequency stock and derivatives trading users. MT4/MT5 are accepted and used by the majority of investors due to their maturity and automated trading capabilities, while Iress mainly serves professional investors and accounts with larger funds.

From the perspective of platform performance, TMGM emphasizes "low latency" and "high-speed execution", but according to user feedback, some high-volatility periods have problems such as increased slippage and slightly slow server response. It supports EA program trading, chart analysis, multi-language terminals and other functions, which provides certain conveniences for traders who are accustomed to quantitative strategies and technical analysis.

In terms of terminal usage experience, TMGM's mobile, web and desktop platforms all support access, meeting users' multi-scenario trading needs. The platform interface is relatively clear, and the overall operation fluency is above average.

🛡️ Regulatory compliance and fund security

TMGM shows on its official website that it is regulated by multiple regulatory agencies, including Australia's ASIC, New Zealand's FMA and Vanuatu's VFSC. It should be noted that the legal entities to which user registered accounts belong in different regions may be different, and some accounts may not be subject to strong regulatory protection mechanisms.

The platform claims to have adopted a segregated custody system for customer funds, which means that customer funds are separately deposited in designated bank accounts, and theoretically will not be misappropriated when risks occur in the company's operations. Although this is a standard practice in the industry, due to regulatory differences and limited transparency of custodian banks, investors are advised to find out the entity to which the account belongs when opening an account, and understand whether it is applicable to the mainstream regulatory fund protection mechanism.

In terms of market risks, TMGM, as a CFD trading platform, has set up a risk disclosure page on its official website, providing basic explanations of leverage, price fluctuations and account loss risks.

⚡ Trading conditions and experience

TMGM's trading conditions are generally flexible, with a minimum deposit threshold of $100 and an account leverage limit of 1:30, which meets the risk limit requirements of mainstream regulators for retail traders. Spreads and fees vary depending on the account type. The EDGE account offers tighter spreads with fixed fees, which is suitable for high-frequency trading users; while the CLASSIC account saves fees but has a higher spread.

The platform's transaction execution speed and slippage control capabilities are average. Some users reported order delays or quote deviations when the market fluctuated violently. It is recommended that highly sensitive strategy users use a demo account for preliminary testing. In terms of deposits and withdrawals, it supports UnionPay, wire transfers, Skrill, SticPay, credit cards and other methods. Most channels can deposit funds instantly, while withdrawals take 1-3 working days depending on the method.

🎓 Customer Support and Value-added Services

TMGM supports multilingual customer service including Chinese, English, French, Spanish, Thai, Vietnamese, etc. The official website provides three main contact methods: online chat, email and phone, and supports 24/5 online service. User feedback shows that ordinary problems are handled quickly, but when encountering account funding issues, the customer service response is slightly delayed.

The platform provides educational resources and market analysis content, including online trading tutorials, strategy lectures, daily market analysis, etc. The content is biased towards beginners and mid-range users. Compared with emerging platforms that focus on in-depth strategy research and social trading, TMGM's content is biased towards basic education and is suitable for daily use by entry-level users.

⚠️ Risk warning and platform positioning

As an international platform that provides leveraged CFD trading services, TMGM's trading products are characterized by high volatility and high risk, which may lead to the loss of all investors' funds. Although the platform claims that it has taken measures such as fund isolation, risk control and negative balance protection, investors should still fully assess their risk tolerance before trading and understand the relevant financial product mechanisms.

From the perspective of positioning, TMGM is suitable for retail clients who want to try standard trading products such as foreign exchange and precious metals. For institutional users who pay attention to brand history, regulatory transparency or fund custody details, further careful evaluation is still needed.

🔍 Comprehensive analysis and evaluation

In summary, TMGM has the following characteristics:

The trading product line covers a wide range, and the account threshold is low, which is suitable for beginners and intermediate users;

The platform supports mainstream MT4/MT5 and Iress trading terminals with complete functions;

The multilingual service coverage is good, but there is still room for improvement in the efficiency of customer service in handling complex issues;

Many of the regulatory licenses held include offshore ones, and users need to pay attention to the actual ownership of the account opening entity.

As a broker in the midstream development stage of the industry, TMGM has certain competitiveness in terms of product richness and platform functionality, but there is still room for improvement in regulatory compliance and long-term trust building. Investors are advised to carefully check the actual regulatory ownership of the account before opening an account and rationally evaluate the platform's adaptability.

Selected Enterprise Evaluation

4.63

Total 4 commentsMost brokers restrict crypto trading on weekends. This one lets me trade BTC and ETH 24/7.

Reply

My so-called “profits” vanished the moment I was locked out of my trading account. Desperate for answers, I found MRS SELETINA DE-ALAGRENS. They didn’t waste time — just reviewed the facts and got to work. Less than two days later, my funds were back. It was the first real relief I’d felt in weeks. Get in contact with her if scammed ([email protected])

Reply

I once had a pending order issue, but their team explained it with screenshots and fixed it. Respect.

Reply

ch***nn

ch***nnI never imagined I’d see my money again after being scammed. The whole situation felt hopeless until a friend recommended [MRS SELETINA DE-ALAGRENS]. I reached out to her, shared my case, and carefully followed her guidance. To my surprise, everything was recovered within just three days. It still feels surreal, but I’m beyond grateful. If you’ve ever been in my shoes, don’t give up—Mrs. Nora is someone you can truly trust. 📧 Email:([email protected])

Reply

The market depth tool they provide helps me decide when to enter larger positions.

Reply

Please do not fall prey to their sweetly spoken Customer Executives. I lost US$18,700 just because of greed, thinking it would multiply and I could get attractive returns. Anyhow, I managed to get their Head Office address and Phone No. (mentioned on their website) physically verified at Seychelles and found that there is nothing related to Capitalix at that address. Even if you invest, initially everything will look very smooth and fine. After a few days, all your investment will start going negative and will never recover. Now you have lost all your money. Don’t believe the good reviews about them on different websites, it’s all managed by them. I am mentioning what I personally faced. Thankfully, I was later able to recover my money with the help of [MRS SELETINA DE-ALAGRENS], whom I came across through the internet (and was also recommended by a friend). Without that support, I would have lost everything. don’t give up—Mrs. Nora is someone you can truly trust. Email: ([email protected])

Reply

~ There's nothing more ~

About TMGM's questions

Ask:Is TMGM a regulated and formal platform? How is the security of funds guaranteed?

Answer:TMGM claims to hold regulatory licenses from multiple countries or regions, including the Australian Securities and Investments Commission (ASIC), the New Zealand Financial Markets Authority (FMA) and the Vanuatu Financial Services Commission (VFSC). However, it is worth noting that the company entity to which the user actually opens an account may not be regulated by ASIC or FMA, but by the VFSC entity with looser supervision. Although the platform claims to implement a customer fund segregation and custody system, it does not clearly disclose the third-party custodian bank and specific guarantee mechanism. Investors are advised to confirm the regulatory entity to which their account belongs before opening an account and carefully evaluate the security of their funds.

Ask:Does TMGM have a wide variety of trading products? Is it suitable for diversified investment strategies?

Answer:The trading products provided by TMGM include CFD contracts for foreign exchange, stocks, precious metals, crude oil, stock indexes and cryptocurrencies, supporting a variety of market targets, and basically meeting the asset allocation needs of investors with different investment preferences. In particular, the two account types EDGE and CLASSIC correspond to low spreads and no handling fees, respectively, which have a certain degree of flexibility. However, since all are in the form of CFDs and do not support spot delivery, investors are more suitable for short-term and medium-term swing trading rather than long-term holding.

Ask:Is the account opening process complicated? Is the transaction execution smooth?

Answer:TMGM supports online account opening process, with a simple operation interface. The account opening process includes filling in basic information, identity authentication and fund deposit, which is relatively convenient overall. The trading platform supports MT4, MT5 and Iress to meet the different needs of automated and manual trading. However, according to feedback from some users, the platform may experience delays and increased slippage during periods of volatile market conditions. It is recommended that new users test the platform execution quality in advance through a demo account before deciding whether to invest in real trading.