AvaTrade

15-20Year

Basic Information

Country

IrelandMarket Type

foreign exchangeEnterprise Type

BrokerageService

Provide foreign exchange, commodities, metals, indices, ETF CFDs, stock CFDs, cash stocks, cryptocurrencies and other trading productsSupport Languages

Thai, Mongolian, Indonesian, Chinese, English, French, Italian, Japanese, etc.Domain Registration Date

2008-07-05Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

AvaTrade (Ava Trade Markets Ltd.) is a global online trading service provider founded in 2006. Headquartered in Dublin, Ireland, it has more than 15 years of industry experience. As an important participant in the global financial derivatives trading market, AvaTrade provides a variety of CFD trading services covering foreign exchange, commodities, stocks, indices and cryptocurrencies to global customers, and supports multi-language and multi-platform operations, with business covering more than 150 countries and regions.

With a robust compliance framework, rich product lines and continuously optimized trading technology, AvaTrade is committed to providing global investors with a convenient, secure and efficient trading experience, and has gradually become a trusted and established brokerage brand in the industry.

🌐Global layout and brand background

AvaTrade's global business layout covers Europe, Asia, the Middle East, Africa and Latin America. Its subsidiaries are legally registered and licensed in Ireland, Japan, Australia, South Africa, the United Arab Emirates, Israel and Cyprus. The compliance operations in various regions effectively meet the localized needs of investors under different regulatory environments.

As one of the earliest FX and CFD service providers to enter the international market, AvaTrade has established a high level of visibility and recognition in multiple global financial markets through years of brand accumulation and service optimization. Its compliant, stable, technically professional and user-friendly platform image has been widely praised.

💹Trading products and services

AvaTrade's product portfolio covers six major trading markets, including foreign exchange currency pairs, global stocks, indices, precious metals, energy commodities and cryptocurrency CFDs. Users can flexibly use a variety of investment strategies for short-term or medium- and long-term transactions, and enjoy flexible leverage options of up to 400:1 (depending on the regulatory region).

The platform supports more than 1,250 tradable financial instruments, covering global mainstream market assets such as U.S. stocks, European stocks, and Hong Kong stocks. With a full range of products, stable spreads, and no transaction commissions, it is suitable for beginners to professional investors.

💻Trading technology and platform experience

AvaTrade supports the industry's leading multi-platform architecture, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, AvaTrade GO and AVA Options, covering desktop, web and mobile devices to meet the flexible needs of users with different trading habits.

In addition, the platform integrates MQL5 signal service, DupliTrade, ZuluTrade and other automated and social trading tools to further improve strategy execution efficiency and investment convenience. Whether it is manual trading or programmatic operation, AvaTrade's technical architecture provides high stability and data synchronization capabilities to ensure a smooth trading experience.

🛡️Regulatory compliance and fund security

AvaTrade is one of the few brokers that is subject to strict financial regulation in multiple regions including the European Union, Australia, Japan, the Middle East and Africa. Its main regulatory entities include the Central Bank of Ireland (CBI), the Australian Securities and Investments Commission (ASIC), the Japan Financial Services Agency (JFSA), the Abu Dhabi Global Market (ADGM), the Cyprus Securities and Exchange Commission (CySEC) and the Israel Securities Authority (ISA).

The platform fully implements the customer fund isolation mechanism to ensure that customer funds are kept separate from the company's own operating funds, and is subject to audits and compliance inspections in multiple locations. The multi-regulatory structure provides users with a higher level of financial security and legal protection.

⚡Trading conditions and experience

AvaTrade provides flexible account types and leverage settings, supporting multiple account currencies such as USD, EUR, GBP, etc., with a minimum deposit of only USD 100. With stable spreads, support for commission-free trading, and fast and reliable order execution, it is suitable for users who pursue low-cost trading.

The platform supports multiple payment methods such as debit cards, credit cards, wire transfers and mainstream e-wallets such as Neteller, Skrill, WebMoney, etc. Deposits are instantly credited to the account, and the average withdrawal processing time is 1-2 working days. The overall deposit and withdrawal efficiency is at the industry-leading level.

🎓Customer support and value-added services

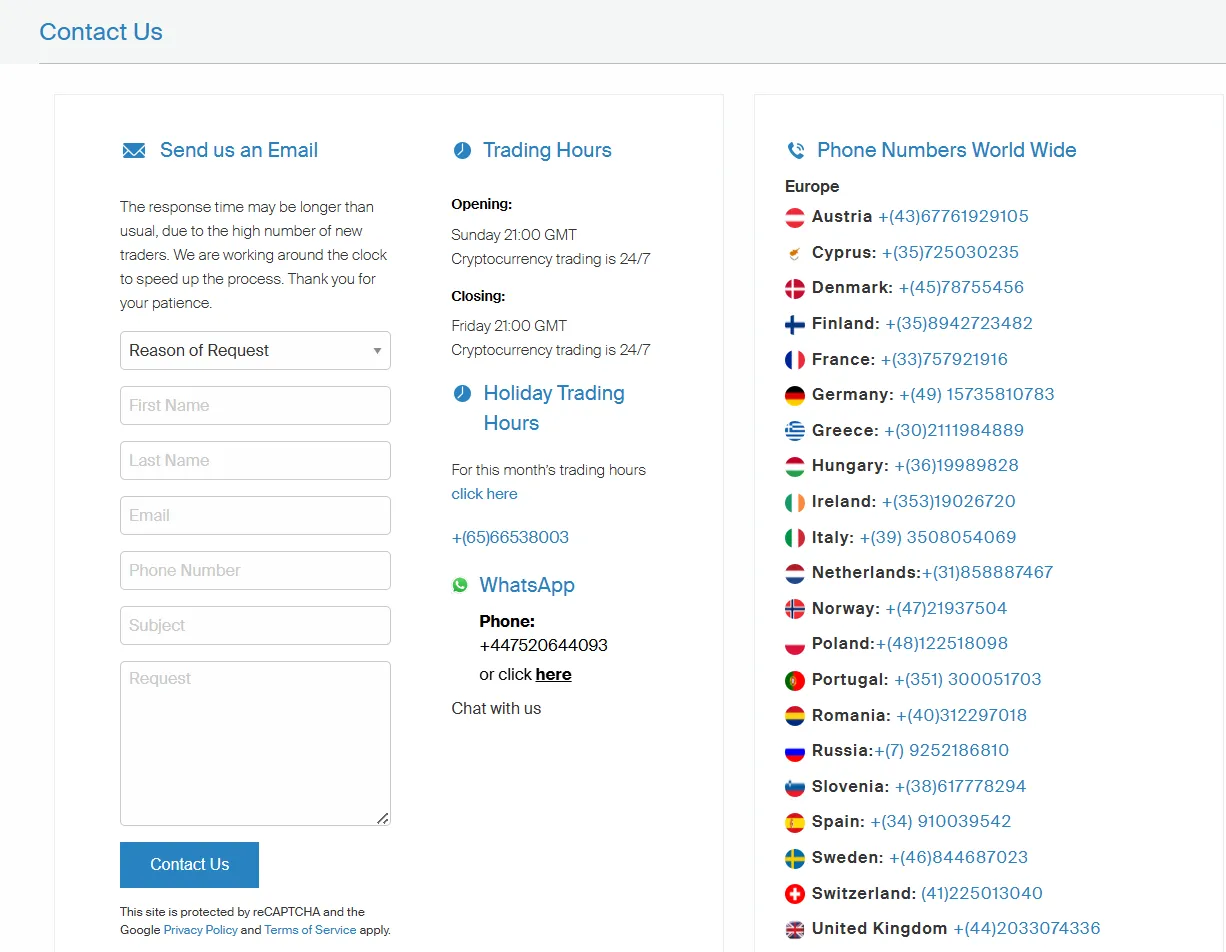

AvaTrade provides a professional customer service team in more than 30 languages for global customers, covering telephone, email and online chat channels to ensure that users in different regions receive efficient support. At the same time, the platform also provides a large number of trading teaching resources, video courses, daily market analysis and automatic trading strategy guidance, which are suitable for investors at all stages to learn and grow.

For beginners, the AvaTrade GO application integrates charts, risk management tools and demo account functions, making it an ideal entry point for novices to quickly get started. For advanced users, MT4/MT5 combined with EA and copy trading tools can also flexibly expand the depth of investment strategies.

⚠️Risk warning and platform positioning

As a financial service platform that provides leveraged CFD trading, AvaTrade always emphasizes that investors need to fully understand the nature and risks of the product before trading. The platform has set up a detailed risk disclosure and education mechanism to help users achieve rational trading in a compliant environment.

From the overall positioning, AvaTrade is more suitable for retail or light institutional users who want to flexibly participate in multi-market asset trading under a stable regulatory framework. Especially for users who focus on platform compliance, fund security, trading convenience and global market participation, AvaTrade is an optional platform with both experience and credibility.

🔍Comprehensive analysis and evaluation

In summary, AvaTrade has the following advantages:

Licensed and regulated in many places around the world, with a solid compliance foundation;

The product line covers a wide range to meet diverse investment needs;

Support multi-platform transactions and perfect technical foundation;

Customer support is responsive and educational resources are plentiful;

There are various deposit and withdrawal methods, and the processing cycle is reasonable.

As an international broker with nearly 20 years of history, AvaTrade has gradually established a high industry status and user base with its diversified compliance structure and stable operation capabilities. Whether it is a novice or a veteran strategy expansion, AvaTrade can provide a trustworthy trading environment and service support.

Selected Enterprise Evaluation

4.40

Total 5 comments FX***00

FX***00不错不错

Reply

FX***00

FX***00我的图片呢

Reply

One of the rare brokers that doesn’t spam you with phone calls after sign-up.

Reply

The economic calendar and news feed in the platform are surprisingly useful.

Reply

I got a small welcome bonus, but the best part is I could withdraw profits after trading, no tricks involved.

Reply

~ There's nothing more ~

About AvaTrade's questions

Ask:Is AvaTrade a regulated company? Is my money safe?

Answer:Yes, AvaTrade is an international financial derivatives broker with multiple regulatory licenses. Its parent company is regulated by the following regulatory agencies: Central Bank of Ireland (CBI) Australian Securities and Investments Commission (ASIC) Japan Financial Services Agency (JFSA) Abu Dhabi Global Market (ADGM) Cyprus Securities and Exchange Commission (CySEC) South African Financial Conduct Authority (FSCA) Israel Securities Authority (ISA), etc. In addition, AvaTrade implements a client funds segregation system, that is, client funds are kept separate from the company's own operating funds to enhance fund security. Although being regulated in multiple places does enhance the compliance of the platform, investors should still pay attention to the specific regulatory agency corresponding to the entity where they open an account, because the fund protection mechanism in different regions may be different.

Ask:What trading products does AvaTrade offer? Is it suitable for diversified investment strategies?

Answer:AvaTrade offers more than 1,250 financial derivatives (CFDs) covering the following market areas: Foreign exchange currency pairs Global major stock indices (such as S&P 500, German DAX, Nikkei 225, etc.) Commodities (such as crude oil, gold, natural gas, etc.) Global stocks (such as Apple, Tesla, Google, etc.) Cryptocurrencies (such as BTC, ETH, LTC, etc.) Investors can use different leverage and spread strategies for short-term trading, trend speculation or asset allocation, which is suitable for diversified investor needs. The platform also supports commission-free trading and flexible leverage (up to 400:1) to increase operating space.

Ask:What trading platforms does AvaTrade offer? What types of traders are they suitable for?

Answer:AvaTrade supports a variety of mainstream trading platforms in the industry, covering various trading habits such as manual trading, automatic trading, mobile trading and options trading: MetaTrader 4 & 5 (MT4/MT5): suitable for manual, automated and EA trading users AvaTrade GO: suitable for mobile users, integrated charts and market updates WebTrader: no need to download, suitable for novice users to get started quickly AVA Options: specially designed for options trading, suitable for strategic trading users ZuluTrade / DupliTrade: supports social trading and copy trading In addition, the platform supports MAM accounts, API access and automatic trading signals (such as MQL5), which is suitable for experienced professional traders to expand their strategy execution capabilities.