Normal Operation

Normal OperationFXCM

20+Year

Basic Information

Country

BritainMarket Type

foreign exchange|CFDEnterprise Type

BrokerageService

Forex, commodities, indices, stocks, cryptocurrenciesSupport Languages

English, ChineseDomain Registration Date

1999-07-01Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

FXCM is a world-renowned online forex and CFD broker, founded in 1999 and headquartered in New York, USA. As a pioneer in the forex industry, FXCM has long provided global investors with a diverse range of financial products, including forex, commodities, metals, indices, ETF CFDs, stock CFDs, cash stocks, and cryptocurrencies.

FXCM's core business focuses on forex and CFD trading for both retail and institutional clients, leveraging advanced trading technology, low-latency execution, and abundant market liquidity. The company offers clients a stable and efficient trading experience through proprietary trading platforms such as Trading Station and MetaTrader 4, supporting a variety of order types and risk management tools.

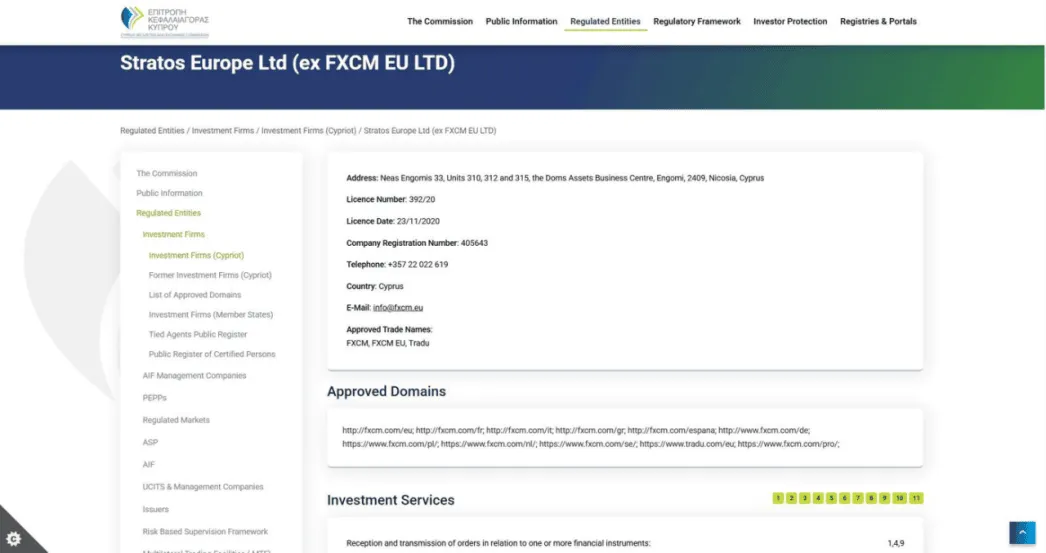

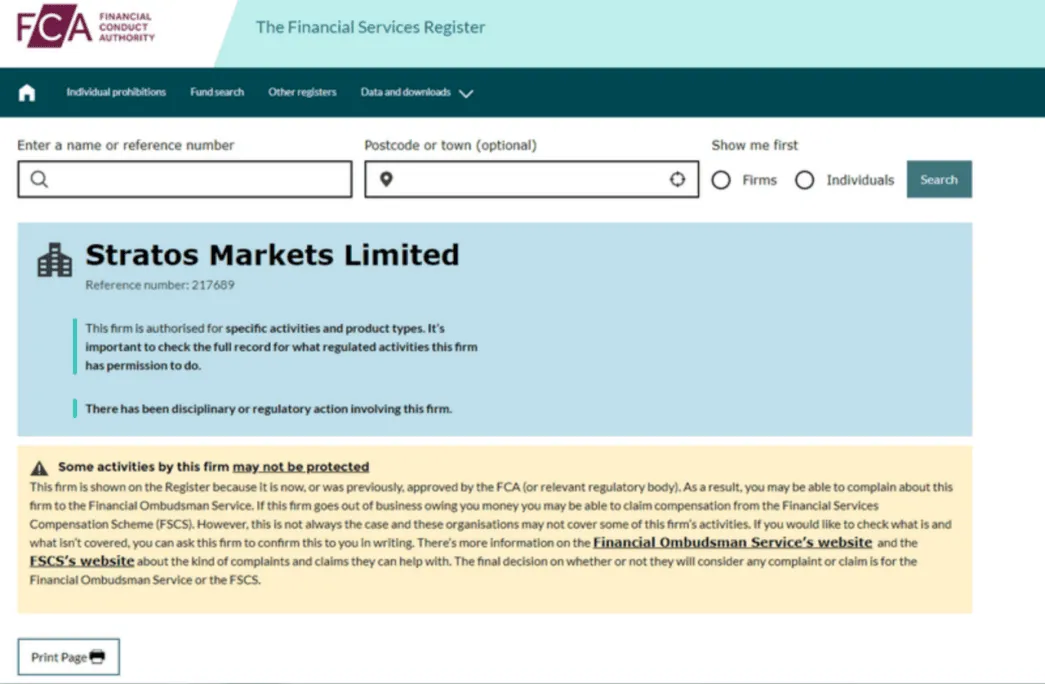

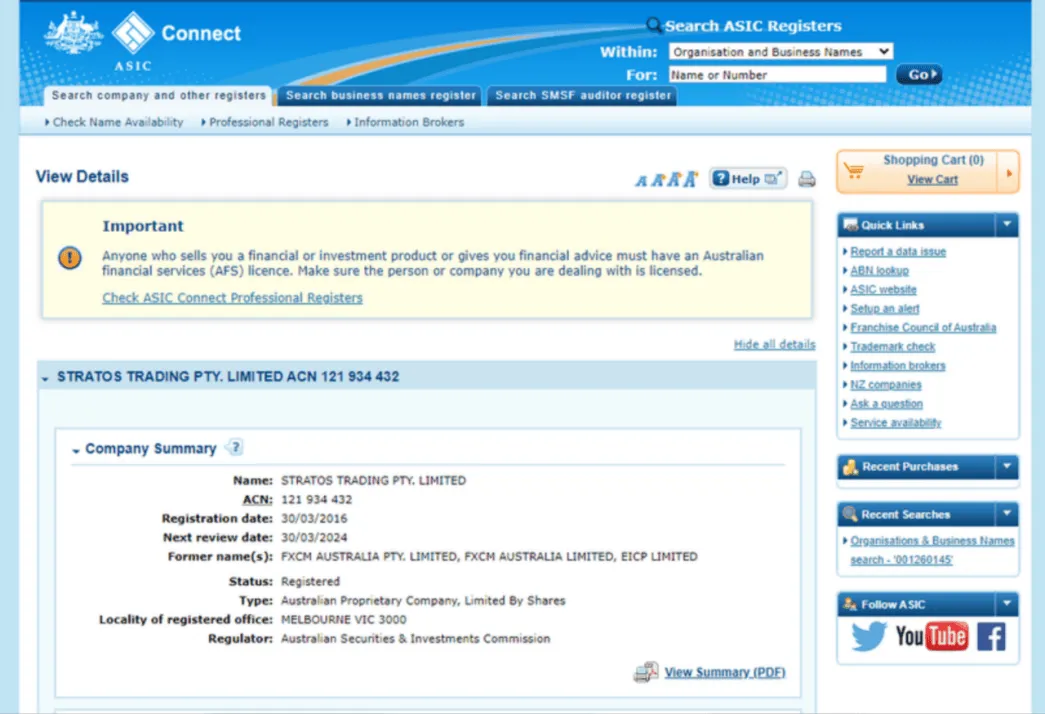

FXCM also prioritizes compliance and client fund security, and is regulated by multiple international financial regulators (such as the UK's FCA and Australia's ASIC), ensuring transparency and reliability in trading. Its educational resources and market analysis services are also highly sought after by investors, helping clients improve their trading skills. Leveraging years of industry experience and technological innovation, FXCM has become one of the leading brands in the global forex and CFD trading space.

🌐Global layout and brand background

FXCM, with its parent company, Leucadia National Corporation (now Jefferies Group), boasts a strong financial backing, providing a solid foundation for its global expansion. Currently, FXCM has offices in several major financial markets, including the UK, Australia, and South Africa, serving a diverse client base across Europe, Asia Pacific, the Middle East, and Africa.

This multi-regional licensing and compliance layout enables FXCM to have strong cross-regional operational capabilities and has become an important guarantee for its long-term attraction to institutional and retail traders.

From a brand perspective, the industry generally believes that FXCM's ability to maintain its brand credibility despite the early volatility of the forex industry demonstrates its resilience and sustainable operations. For novice investors, the established brand of an established broker often signifies a more stable trading environment and more transparent execution.

💹Trading products and services

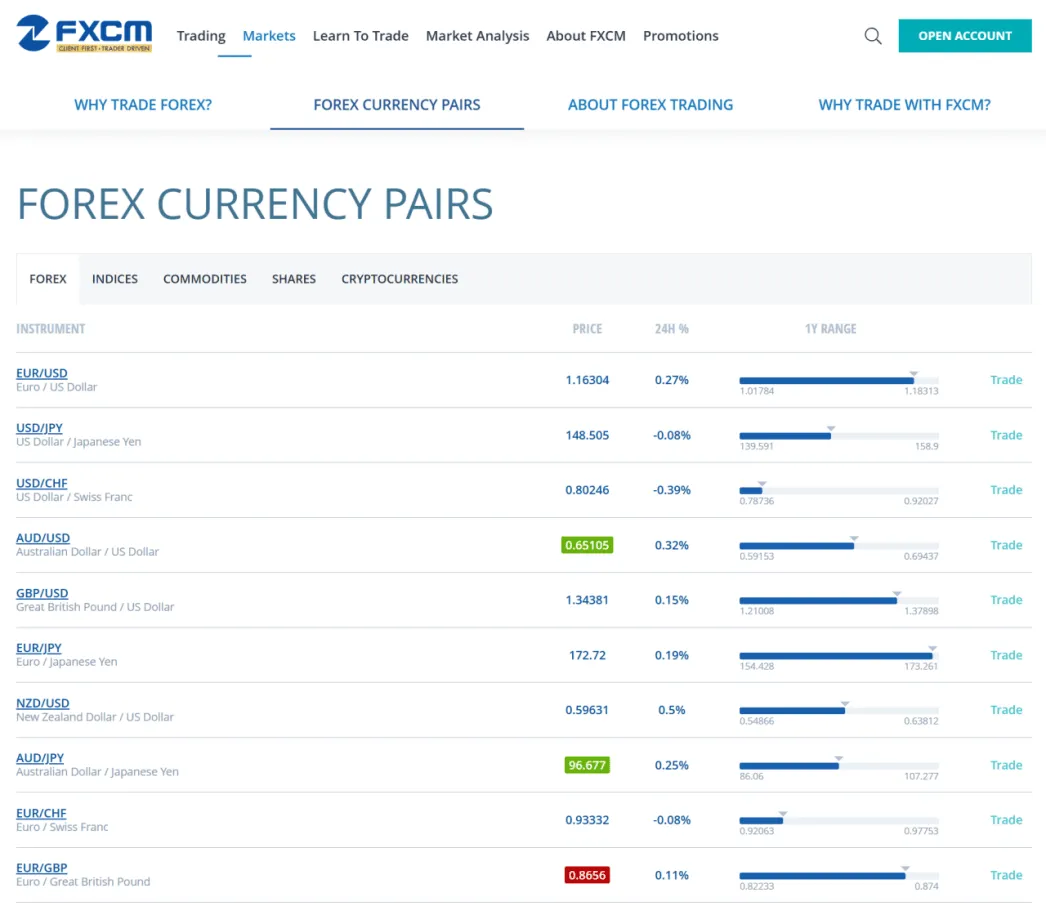

FXCM offers a wide range of trading products, from traditional forex currency pairs to indices, commodities, stock CFDs , and cryptocurrencies. This diverse product line caters to the needs of traders at all levels:

For short-term traders, they can take advantage of the low spreads and high liquidity of the foreign exchange market;

For clients who wish to allocate assets or hedge risks, they can choose precious metals and index CFDs .

For those who are interested in emerging digital assets, the platform also provides CFDs for popular cryptocurrencies such as Bitcoin and Ethereum.

When evaluating FXCM's product line, external analysis platforms generally believe that although its product coverage is wide, it still mainly uses CFDs for innovative assets such as cryptocurrencies, which is suitable for investors with higher risk appetite and less demand for physical delivery.

💻Trading technology and platform experience

In terms of trading technology, FXCM has its own independently developed Trading Station platform, which has a simple interface and high order execution efficiency. It also supports MetaTrader 4 ( MT4 ) and NinjaTrader to meet the needs of users with different trading styles and needs.

Third-party evaluations rank FXCM 's order execution speed and server stability above average in the industry, making it particularly suitable for short-term traders seeking fast execution. MT4 support is also a significant advantage for users of automated trading strategies. However, it's important to note that account leverage limits and trading conditions vary by region due to regulatory requirements, so investors should clarify local regulations before opening an account.

🛡️Regulatory compliance and fund security

Regulation is a crucial indicator of a broker's credibility. FXCM is currently regulated by several authoritative regulators, including the UK FCA , Australia's ASIC , and South Africa's FSCA . FXCM also implements a segregated custody system for client funds. This means that even if the company encounters operational risks, client funds are protected by law and regulations.

In risk ratings on platforms like BrokerHiver, FXCM is considered a relatively low-risk, established broker due to its multi-regional regulatory compliance and long-standing operational track record. However, investors are reminded that even regulated brokers still carry financial risks associated with market volatility and high leverage trading, and they should carefully assess their risk tolerance.

⚡Trading conditions and experience

FXCM offers flexible trading conditions, including tight spreads, leverage up to 1:400 (subject to regulatory changes in different regions), and fast order matching technology. For users seeking low-cost trading, these conditions are competitive among similar brokers.

It's important to note that while high leverage can magnify returns, it also magnifies risks. Professional analysis agencies recommend that investors fully understand margin mechanisms and risk management strategies before using high leverage to avoid unnecessary financial losses.

🎓Customer support and value-added services

FXCM offers 24/5 multilingual customer service, highly regarded in the industry for its responsiveness and professionalism. It also provides market analysis reports, webinars, and educational courses to help traders quickly understand the market and trading strategies. These are particularly helpful additional services for novice investors.

Judging from external evaluations, FXCM has maintained a good tradition in customer education and value-added services. However, compared with some emerging platforms focusing on social trading or intelligent investment research, its innovation is slightly lacking and it is suitable for users who like to learn and research the market independently.

⚠️Risk Warning and Platform Positioning

Forex and CFD trading are inherently high-risk, highly leveraged products that can result in the loss of all invested capital. FXCM provides clear risk disclosures on its official website and third-party platforms, emphasizing the importance of fully understanding trading mechanics and allocating funds appropriately. FXCM's platform positioning suggests it is more suitable for users who have a basic understanding of trading mechanics and prioritize security and stability, rather than short-term speculators seeking high returns.

🔍Comprehensive analysis and evaluation

From a comprehensive perspective, FXCM , as a long-established international broker, possesses the following characteristics:

The brand has a long history, a sound regulatory system, and high financial security;

The trading product line covers a wide range, but tends to be conservative in the field of crypto assets;

The platform technology is stable and suitable for short-term and automated trading users;

Suitable for investors who focus on compliance, capital security and traditional trading products.

As a long-standing international broker, FXCM 's greatest value lies in compliance, security, and technological stability, rather than the pursuit of extreme leverage or innovative products.

Therefore, for users who want to conduct multi-category transactions in a safe and compliant environment, FXCM is still a platform option worth considering.

Selected Enterprise Evaluation

4.41

Total 16 commentsStable funding process, smooth order execution, and responsive late-night support. A trustworthy platform.

Reply

be***h2

be***h2"Be careful out there—scams are everywhere these days." I got tricked by a fake investment platform. They made everything look professional until it came time to withdraw my funds. That's when the red flags started. Thankfully, I found Mrs. Nora online. She was responsive, professional, and helped me recover my funds quickly. I recommend her to anyone trying to get their money back. Contact: [email protected] | Website TRAZEVAULT.ORG

Reply

There are many platforms out there, but this one stands out with low costs, stable charts, and fast deposits/withdrawals.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

Opened an account to test—good trading conditions. Easy registration, plus a lottery bonus. Fast funding too.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

Withdrawals are quick, deposits arrive instantly, and customer support solves problems efficiently.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

Customer support replies quickly. I’ve always been happy with their service.

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

I unfortunately fell victim to a scam, and it turned out to be an incredibly challenging experience. I invested thousands of dollars, could not withdraw money in my account and they kept asking for tax when I attempted to request a payout. Despite my efforts involving the police, I faced significant obstacles. Fortunately, until I reported my case to a Cybercrime Units on their website( Cybertecx net ) and their lead investigator was able to trace and recoup my scammed funds without any upfront fees..,

Reply

Warning: Do not trust this broker — it’s a scam! I was scammed out of €22,000. My account was suddenly frozen, and I was accused of suspicious activity. They kept demanding more money from me, claiming it was necessary to release my deposit. It was a complete trap. Thankfully, I found a review about Mrs. Morris Meihua, and she turned things around. She helped me recover my lost funds. If you’ve fallen victim to a similar scam, I highly recommend contacting her through the details below: Email: m o r r i s m e i h u a 5 @ g m a i l . c o m WhatsApp💬+1 (262) 672-0690 Don't lose hope — help is out there.

Reply

They showed a remarkable level of commitment in understanding my needs and offering assistance. This made me confident in their work. The result was a smooth resolution to a situation. Based on my experience, I'm happy to suggest Resoxit .cc to others seeking support. They have proven to be reliable and capable. I am thankful for their help.

Reply

I invested in what I believed was a legitimate trading platform, only to have the company vanish with my funds and cut all lines of communication. The sense of betrayal and helplessness was overwhelming. I had nearly given up hope when someone recommended Mrs. Bruce Nora, a specialist in financial fraud recovery. She not only took on my case but remained in constant contact, updating me on every development. With her help, I successfully reclaimed the full amount I had lost. Her commitment to justice and client support is beyond commendable. Anyone facing a similar nightmare should definitely reach out to her. Email: bruce nora2 54(@)gmail. com | .web, trazevault.org

Reply

scam platform. I made my legal claim with the help of gavinray78 @ gmail .com , who help me recover my money from this fake platform. I Highly recommend reaching out to him

Reply

When the platform froze my withdrawals, I initially hoped it was just a technical issue—but soon realised I had fallen victim to a scam. Mrs. Doris Ashley came highly recommended, and from our first interaction, she was transparent, professional, and responsive. Within 72 hours, she successfully recovered my funds—delivering exactly what she promised, with no false assurances. Email: (dorisashley71 (@) gmail. c 0 m ) WhatsApps:+1 (404) .-721 . -56 .-08 She’s the only one I personally trust when it comes to financial recovery. Stay safe and protect your money

Reply

Load More

About FXCM's questions

Ask:Is FXCM safe and reliable? Can it guarantee the safety of my funds?

Answer:FXCM is a well-established international brokerage firm founded in 1999. Its parent company is Jefferies Group (formerly Leucadia National Corporation), with strong capital backing. The platform is regulated by several leading financial regulators, including the UK FCA, Australia's ASIC, and South Africa's FSCA (Source: Company Profile), and implements a segregated custody system for client funds. This means that even if the platform itself faces operational risks, client funds are protected by the regulatory framework and laws. In BrokerHivex's risk rating, FXCM is considered a relatively low-risk, established brokerage due to its multi-regional regulatory compliance and long-standing operational track record. However, investors should note that forex and CFD trading are inherently highly leveraged products, and they must independently assess the risks associated with market volatility.

Ask:What are the advantages of FXCM's trading categories and conditions, and which type of investors are they suitable for?

Answer:FXCM offers a wide range of trading products, including foreign exchange currency pairs, precious metals, commodities, index CFDs, stock CFDs, ETF CFDs, and popular cryptocurrency CFDs such as Bitcoin and Ethereum (Source: Company Introduction). Trading conditions have advantages such as low spreads, up to 1:400 leverage (regulatory requirements may vary in different regions), and fast execution technology. They are especially suitable for short-term traders or automated trading users who pursue low transaction costs and high execution efficiency. At the same time, the platform is equipped with multiple platform support such as Trading Station, MT4 and NinjaTrader, which is more friendly to intermediate and advanced investors who learn market analysis independently. For short-term speculators who are purely pursuing high returns, they need to understand the risks of high leverage and configure reasonable risk management strategies.

Ask:Does FXCM have any plans for emerging innovative fields such as AI trading and social trading?

Answer:From the perspective of external evaluation, FXCM tends to be a stable and compliant platform in terms of products and technology. Its main advantages lie in the depth of traditional trading products and the stability of the platform, rather than the pursuit of emerging functions such as social trading or AI investment research. Although FXCM performs well in value-added services such as customer education, market analysis reports, and online seminars, its innovation is slightly conservative compared to some new platforms that focus on AI investment research and social copy trading, and is more suitable for users who focus on compliance and a stable trading environment. For investors who prefer cutting-edge innovative functions, FXCM may not be the first choice, but for users who want to conduct multi-category transactions in a safe and compliant environment for a long time, it is still a platform worth considering.