Axi

15-20Year

Basic Information

Country

St VincentMarket Type

foreign exchangeEnterprise Type

BrokerageService

We offer 6 types of CFD transactions, including foreign exchange, precious metals, commodities, indices, cryptocurrencies and stocks, providing customers with high liquidity and no-dealer trading system. Our business model is straight-through STP.Support Languages

Portuguese, Spanish, Italian, Korean, Thai, Vietnamese, Indonesian, Arabic, Simplified Chinese, Traditional Chinese, English, FrenchDomain Registration Date

1995-12-26Business Status

Normal OperationCompany IntroductionWeb Analytics

Company Introduction

Axi is a global foreign exchange and CFD broker founded in 2007, headquartered in Kingston, St. Vincent and the Grenadines. As one of the most stable brokers in the industry, Axi has long been committed to providing diversified trading products such as foreign exchange, commodities, stocks, indices and cryptocurrencies to global investors, helping different types of investors to achieve flexible trading and asset allocation.

Axi relies on a complete technical support and professional service system to provide customers with efficient trading experience and rich learning resources. The company focuses on risk control and customer fund security. Through long-term compliance operations and technological innovation, it has gradually established a high brand awareness and industry reputation in many major markets around the world.

🌐 Global layout and brand background

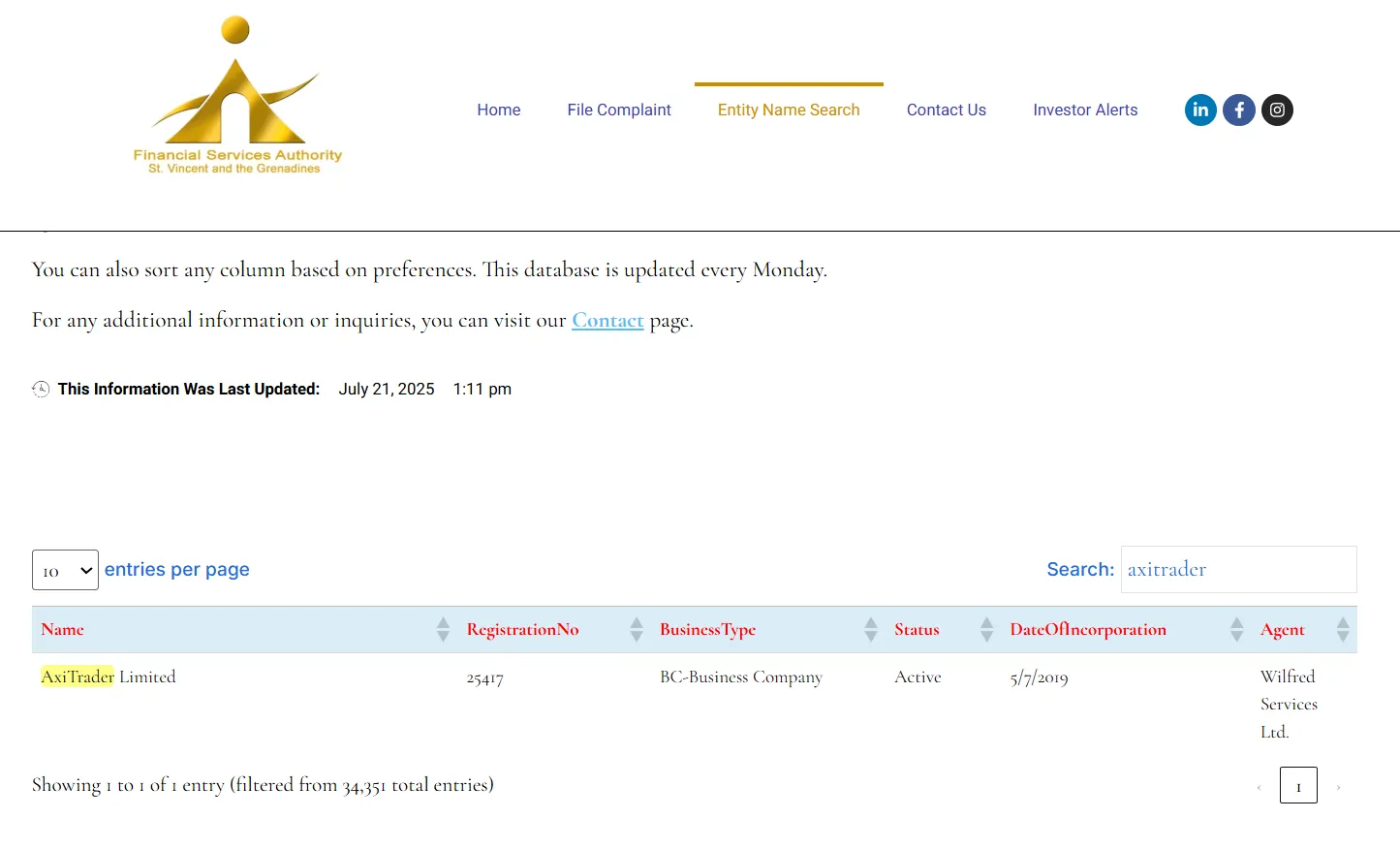

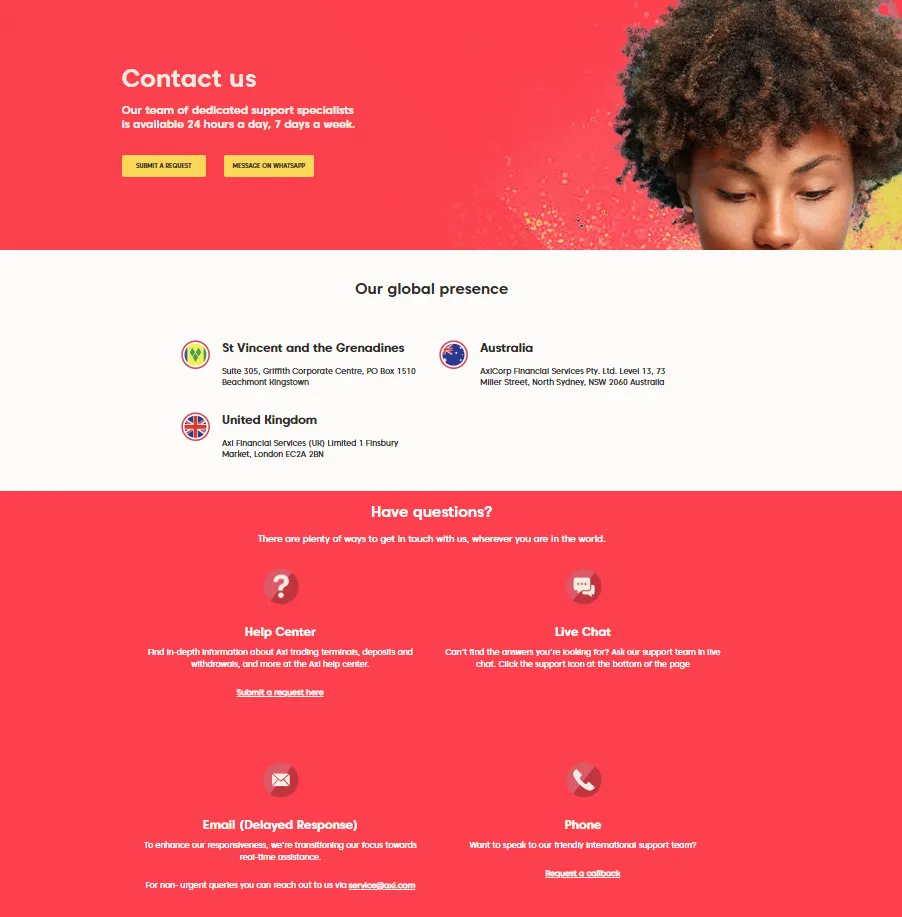

Axi's core operating entity is AxiTrader Limited, which is registered and regulated in major financial markets such as Australia and the United Kingdom through its affiliated company AxiCorp Financial Services Pty Ltd. According to the domain name information, Axi's official website was registered as early as 1995, and has a history of more than 20 years, reflecting its continuous operating capabilities and brand accumulation in the industry.

Axi has compliance qualifications in the UK, Australia, the Middle East and Asia. In particular, Axi Financial Services (UK) is regulated by the UK Financial Conduct Authority (FCA) and is authorized to hold and manage client funds, while AxiCorp Financial Services Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC) and the Dubai Financial Services Authority (DFSA). The multi-regional compliance layout provides a guarantee for Axi's cross-regional services and customer funds security.

From the perspective of brand positioning, Axi is committed to providing a safe, transparent and efficient trading environment for global retail and institutional clients. It is generally believed in the industry that Axi's continued investment in product coverage, platform technology and educational resources has given it a good professional image and market reputation in international competition.

💹 Trading Products and Services

Axi's trading product line is relatively comprehensive, covering mainstream categories such as foreign exchange, commodities, indices, stocks, etc., while providing CFD trading services that are connected to the global market. This diversified product portfolio can not only meet the needs of short-term traders for liquidity and low spreads, but is also suitable for investors who are engaged in medium- and long-term asset allocation.

In addition, Axi also provides customers with three different trading accounts: Standard Account, Professional Account and Elite Account to meet the diverse needs of beginners, active traders and high net worth customers. Each account has flexible options in spreads, commissions, minimum transaction units and leverage ratios, helping customers make the best choice based on their own trading strategies and capital scale.

From the perspective of user experience, Axi discloses detailed information on the spreads, trading hours and margin ratios of trading products through its official website, allowing investors to transparently understand transaction costs and conditions and provide support for scientific decision-making.

💻 Trading technology and platform experience

In terms of trading technology, Axi provides the self-developed mobile trading software Axi Trading Platform, and supports the MetaTrader 4 (MT4) platform, which is widely used worldwide, covering desktop version, web version and mobile terminal (iOS/Android). This flexible platform combination allows users to trade conveniently on different devices and scenarios, taking into account stability and operating experience.

Axi also provides VPS hosting services, Autochartist intelligent market analysis tools, and MT4 NexGen plug-ins to help traders improve order execution efficiency and market analysis capabilities. Combined with comprehensive educational resources and copy trading services, Axi is suitable for the different needs of beginners to professional traders.

🛡️ Regulatory compliance and fund security

Supervision is an important criterion for measuring the reliability of brokers. Axi's affiliated companies are regulated or authorized by authoritative institutions such as the UK FCA, Australia ASIC, and Dubai DFSA, and have the qualifications for compliance operations in multiple places. In particular, the official website of the UK FCA shows that Axi Financial Services (UK) is authorized to hold and manage client funds, further protecting the safety of investors' assets.

Axi implements a segregated custody system for customer funds, which strictly separates customer funds from the company's operating funds to ensure that customer funds are protected even in extreme circumstances. This practice complies with the compliance requirements of the international financial market and enhances user trust and fund security.

⚡ Trading conditions and experience

Axi offers flexible trading conditions, including leverage up to 500:1, tight spreads, and a transparent transaction cost structure. For traders seeking fast execution and low latency, Axi's technical infrastructure can effectively ensure order execution efficiency and price stability.

At the same time, Axi provides a convenient process for account registration, supports multi-language interfaces, and covers major regions around the world. Whether it is a demo account experience for beginners or an elite account for professional traders, Axi can provide corresponding customized support.

🎓 Customer Support and Value-added Services

Axi provides 24/5 multilingual customer service and provides investors with value-added resources such as trading tools, educational courses, e-books, video tutorials and online seminars to help users improve their market analysis and trading skills. The platform's copy trading and PAMM account management services also provide convenient asset management options for users who lack time or experience.

Unlike some emerging platforms that focus on social functions, Axi emphasizes the combination of professional trading tools and educational support, providing systematic resources for traders who focus on technical analysis and strategy research.

⚠️ Risk warning and platform positioning

Foreign exchange and CFD trading are inherently high-leverage, high-risk investment products that may result in the loss of all invested capital. Axi provides clear risk disclosure on its official website and multiple channels, reminding investors to fully understand the product features, leverage mechanism and personal risk tolerance before trading.

From the perspective of positioning, Axi is more suitable for investors who want to conduct multi-category transactions in a compliant, transparent and secure environment. Whether they are learning novice or strategic professional traders, they can find trading models and tool support that suit them.

🔍 Comprehensive analysis and evaluation

Overall, Axi, as an international foreign exchange and CFD broker, has the following advantages:

The brand has a solid history, with domain name registration for more than 20 years and a long-term operating background;

Compliance qualifications in multiple locations, regulated by authoritative organizations such as the UK FCA and Australia ASIC;

The product line covers foreign exchange, commodities, stocks, indices and other fields to meet different trading needs;

The technical platform is flexible, taking into account both independent research and development and mainstream platforms such as MT4;

Provides rich educational resources and value-added services, suitable for traders of different levels.

According to industry reviews, Axi has become a trustworthy international trading platform through continuous optimization of technology and services. For investors who want to balance security, product diversity and trading experience, Axi is a competitive choice.

Selected Enterprise Evaluation

4.60

Total 5 commentsThe mobile app works great; I rarely experience any lag when placing orders.

Reply

Funding via USDT is super convenient, especially for domestic users.

Reply

Chinese-speaking reps are friendly and don’t brush you off.

Reply

Spreads stay reasonable, especially during the Asian and European sessions.

Reply

From sign-up to withdrawal, the flow is seamless.

Reply

~ There's nothing more ~

About Axi's questions

Ask:Is Axi safe? Are my funds secure?

Answer:Axi was founded in 2007 and is headquartered in St. Vincent and the Grenadines. It is registered and operates in compliance with regulations in major financial markets such as the UK, Australia, and the Middle East through its subsidiaries AxiCorp and Axi Financial Services. It is authorized and supervised by authoritative regulatory agencies such as the UK FCA, Australia ASIC, and Dubai DFSA. Customer funds are subject to a segregated custody system in accordance with international standards and are independent of the company's operating accounts to ensure that even if there are operational risks on the platform, customer assets can be protected. With compliance qualifications in many places, a long operating history, and transparent regulatory information, Axi is generally considered to have high security and financial security in the industry. However, foreign exchange and CFDs are high-risk and high-leverage products. Market fluctuations may result in capital losses. Before investing, you should fully assess your personal risk tolerance.

Ask:What trading products and conditions does Axi offer and what types of investors are suitable for?

Answer:Axi's products cover a wide range, including foreign exchange currency pairs, commodities such as gold and crude oil, major global indices and stock CFDs, and also support popular cryptocurrency trading, which can meet the needs of short-term and high-frequency traders as well as investors who make medium- and long-term asset allocations. It provides standard accounts, professional accounts and elite accounts, with flexible options in spreads, commissions and leverage ratios, up to 500:1 leverage, transparent transaction costs, and supports flexible choices for investors with different fund sizes and strategies. Whether it is a beginner who wants to use a demo account to familiarize himself with trading, or a professional user who pursues lower transaction costs and high execution efficiency, Axi can provide corresponding solutions.

Ask:How does Axi perform in terms of trading technology and customer service?

Answer:Axi supports the self-developed Axi Trading Platform, as well as the MetaTrader 4 (MT4) platform widely used in the industry, covering desktop, web and mobile terminals, with a stable trading environment and convenient operation. It also provides users with VPS hosting services, Autochartist intelligent analysis tools, MT4 NexGen plug-ins, etc., to help traders improve order execution efficiency and market analysis capabilities. In terms of customer support, Axi provides 24/5 multilingual services, and is equipped with a wealth of educational courses, video tutorials, e-books and online seminars to help users improve market insight and practical skills. At the same time, it provides copy trading and PAMM account management services to facilitate asset management for users who lack time or experience. Overall, Axi can take into account the needs of both novice and professional traders in terms of technology and services.